Online Form 944

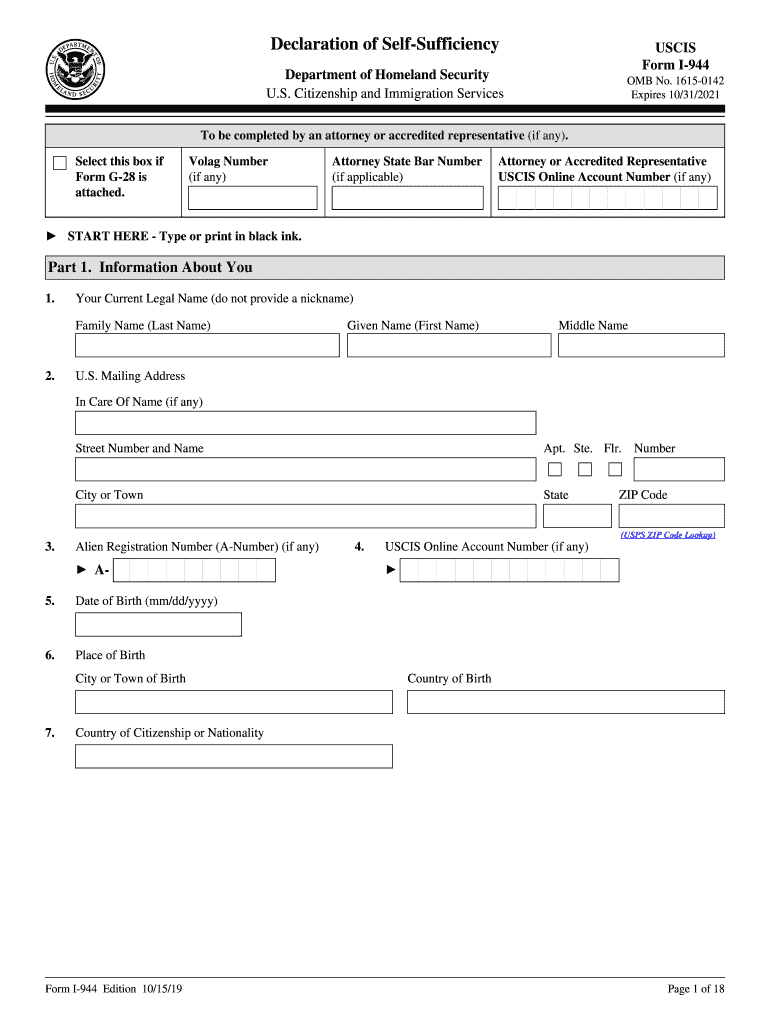

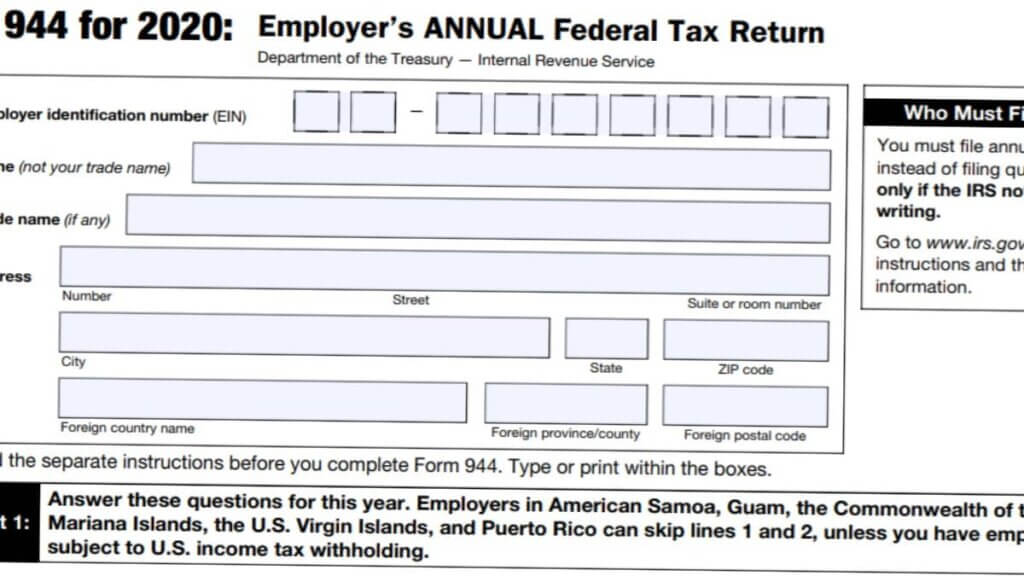

Online Form 944 - Web what is irs form 944? Web irs form 941 is due on the last day of the month following the end of the quarter. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. Quarter 1 ( january, february, march) may 1st,. Web your form 944 can be mailed to your states irs office. Irs form 944 is used to report annual. Web simply follow the steps below to file your form 944: Get ready for tax season deadlines by completing any required tax forms today. Select form 943 & enter. Complete, edit or print tax forms instantly.

940, 941, 943, 944 and 945. Web irs form 941 is due on the last day of the month following the end of the quarter. Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. Select form 943 & enter. Get ready for tax season deadlines by completing any required tax forms today. Irs form 944 is used to report annual. Complete, edit or print tax forms instantly. Web only employees, or their preparer and/or translator, may correct errors or omissions made in section 1. Web simply follow the steps below to file your form 944: Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve.

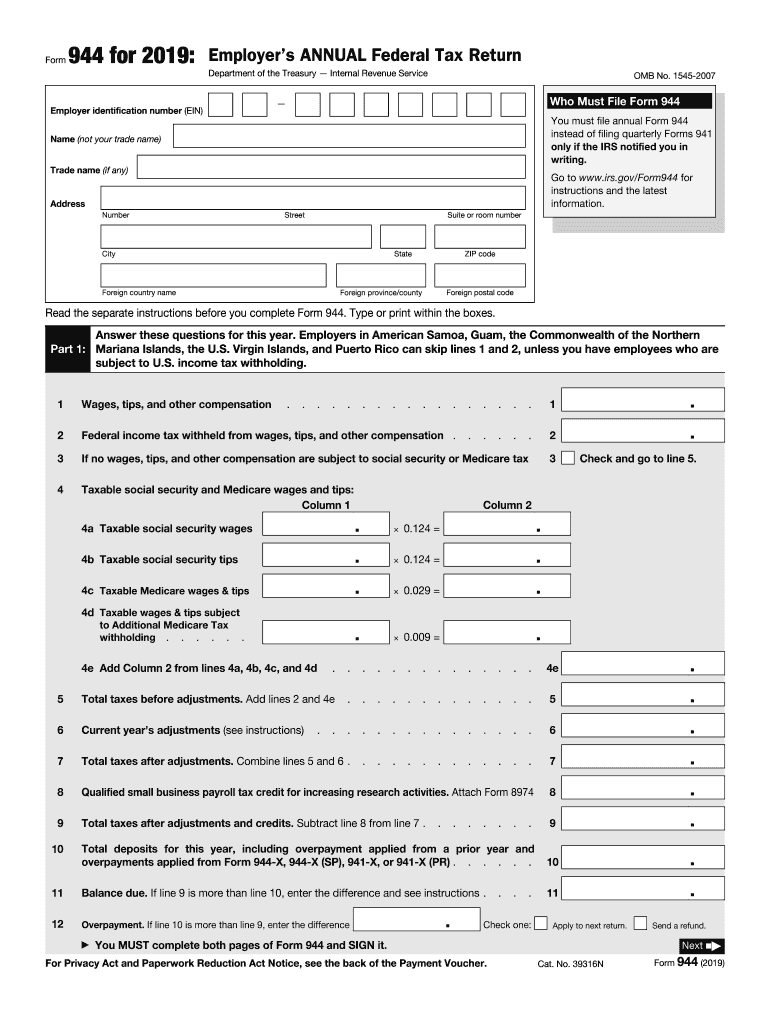

Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Web only employees, or their preparer and/or translator, may correct errors or omissions made in section 1. Who must file form 944? Irs approved tax1099.com allows you to efile your 944 with security and ease, all online. Complete, edit or print tax forms instantly. Web are you looking for where to file 944 online? Web simply follow the steps below to file your form 944: Connecticut, delaware, district of columbia, georgia,. Type or print within the boxes. Irs form 944 is used to report annual.

Irs Form 944 Fill Out and Sign Printable PDF Template signNow

These are the 941 filing deadlines for 2023 tax year. You must complete all five pages. Web irs form 941 is due on the last day of the month following the end of the quarter. Web annual federal tax return. Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate.

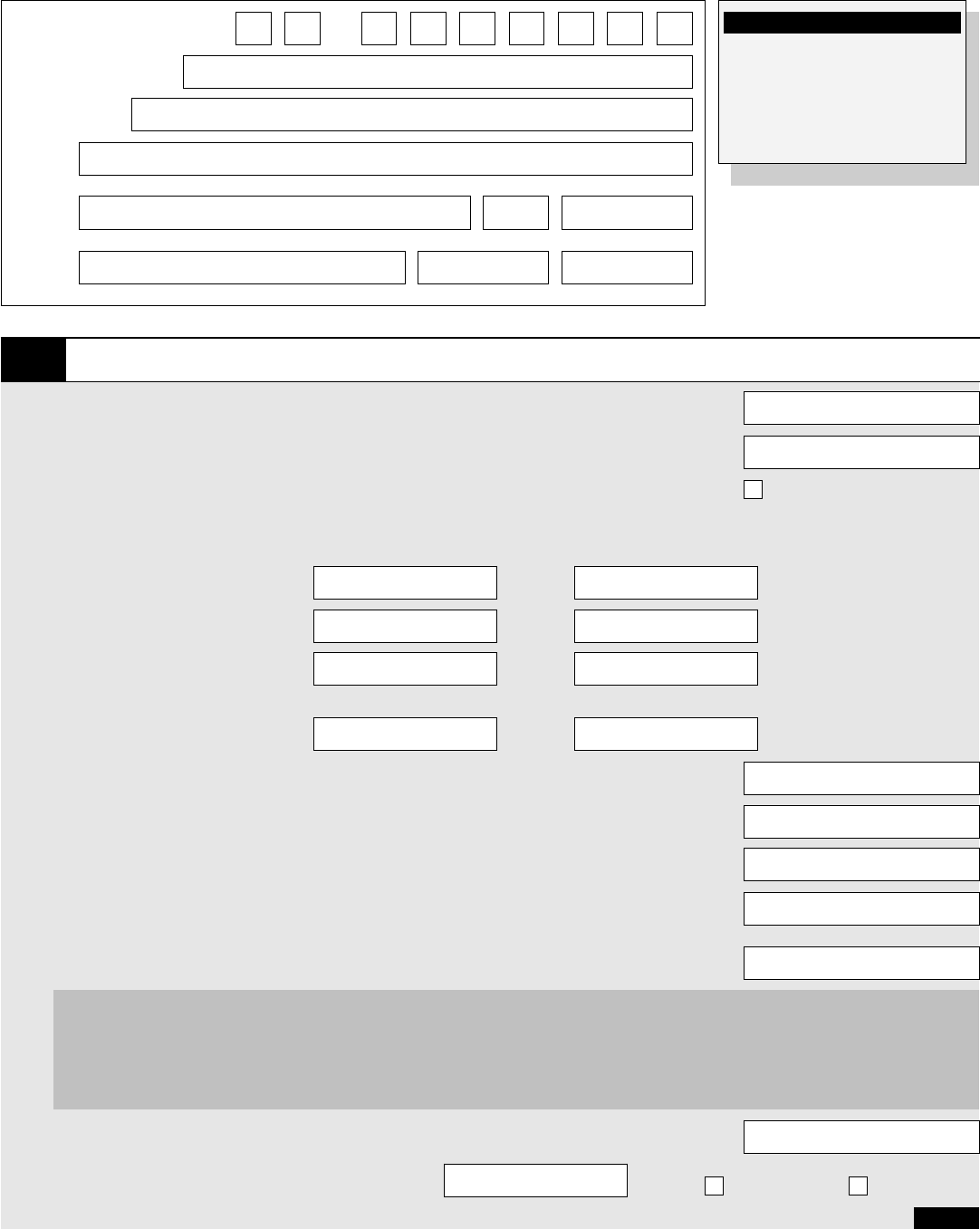

How To Fill Out Form I944 StepByStep Instructions [2021]

How should you complete form 944? Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you. Create a free taxbandits account or login if you have one already step 2: Who must file form 944? Get ready for tax season deadlines.

Sweet Beginning USA Form I944 Declaration of SelfSufficiency In the

Complete, edit or print tax forms instantly. Like form 941, it’s used to. You must complete all five pages. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Connecticut, delaware, district of columbia, georgia,.

File Form 944 Online EFile 944 Form 944 for 2021

Web what is irs form 944? Connecticut, delaware, district of columbia, georgia,. Web are you looking for where to file 944 online? Must you deposit your taxes? These are the 941 filing deadlines for 2023 tax year.

Form 944 Edit, Fill, Sign Online Handypdf

Web simply follow the steps below to file your form 944: Complete, edit or print tax forms instantly. Web what is irs form 944? Must you deposit your taxes? Create a free taxbandits account or login if you have one already step 2:

I 944 Pdf 20202021 Fill and Sign Printable Template Online US

You can find your states local irs office by going onto irs.gov or contacting a tax professional who can better walk you. Who must file form 944? Get ready for tax season deadlines by completing any required tax forms today. You must complete all five pages. Quarter 1 ( january, february, march) may 1st,.

944 Form 2021 2022 IRS Forms Zrivo

You must complete all five pages. Quarter 1 ( january, february, march) may 1st,. Create a free taxbandits account or login if you have one already step 2: Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. How should you complete form 944?

Form 944 Edit, Fill, Sign Online Handypdf

How should you complete form 944? Select form 943 & enter. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. Connecticut, delaware, district of columbia, georgia,. Complete, edit or print tax forms instantly.

File Form 944 Online EFile 944 Form 944 for 2021

Web mailing addresses for forms 944. Web are you looking for where to file 944 online? Create a free taxbandits account or login if you have one already step 2: Web your form 944 can be mailed to your states irs office. Complete, edit or print tax forms instantly.

Type Or Print Within The Boxes.

Get ready for tax season deadlines by completing any required tax forms today. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. 940, 941, 943, 944 and 945.

You Must Complete All Five Pages.

Draw a line through the incorrect. Web annual federal tax return. Complete, edit or print tax forms instantly. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file.

Web What Is Irs Form 944?

Create a free taxbandits account or login if you have one already step 2: Web mailing addresses for forms 944. Web your form 944 can be mailed to your states irs office. Connecticut, delaware, district of columbia, georgia,.

Web February 28, 2020 — If You're Currently Required To File Form 944, Employer's Annual Federal Tax Return, But Estimate Your Tax Liability To Be More Than $1,000, You.

Must you deposit your taxes? Quarter 1 ( january, february, march) may 1st,. Web only employees, or their preparer and/or translator, may correct errors or omissions made in section 1. Web use this form to correct errors you made on form 944, employer’s annual federal tax return.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)