Oregon Income Tax Extension Form

Oregon Income Tax Extension Form - Income tax return (for u.s. Make your check, money order, or cashier’s check payable to the oregon department of revenue. Web oregon filing due date: Citizens and resident aliens abroad who expect to qualify for special. Web apply for an extension. Web a tax extension gives you more time to file, but not more time to pay. Qualified business reduced income tax rate (qbirtr) gig. If you cannot file by that. View all of the current year's forms and publications by popularity or program area. Oregon doesn’t allow an extension of time to pay your tax, even if the irs is allowing an extension.

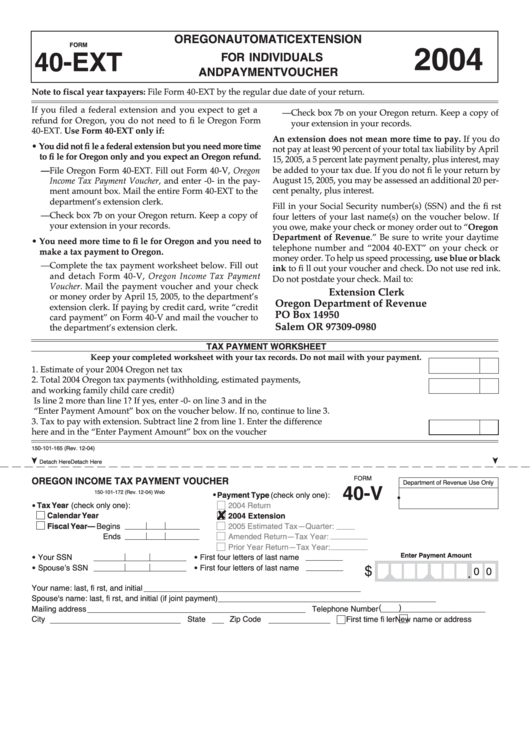

Oregon doesn’t allow an extension of time to pay your tax, even if the irs is allowing an extension. Web a tax extension gives you more time to file, but not more time to pay. View all of the current year's forms and publications by popularity or program area. Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on or before the original due date of your return. Check your irs tax refund status. Web the extension form and instructions are available on revenue online. Oregon individual income tax returns are due by april 15, in most years. Web irs form 4868 $34.95 now only $29.95 file your personal tax extension now! You can complete the forms with the help of. Web the oregon tax forms are listed by tax year below and all or back taxes for previous years would have to be mailed in.

Extended deadline with oregon tax extension: Income tax return (for u.s. Sign into your efile.com account and check acceptance by the irs. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Qualified business reduced income tax rate (qbirtr) gig. Oregon doesn’t allow an extension of time to pay your tax, even if the irs is allowing an extension. Pay all or some of your oregon income taxes online via: Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on or before the original due date of your return. Web irs form 4868 $34.95 now only $29.95 file your personal tax extension now! Web federal tax law no extension to pay.

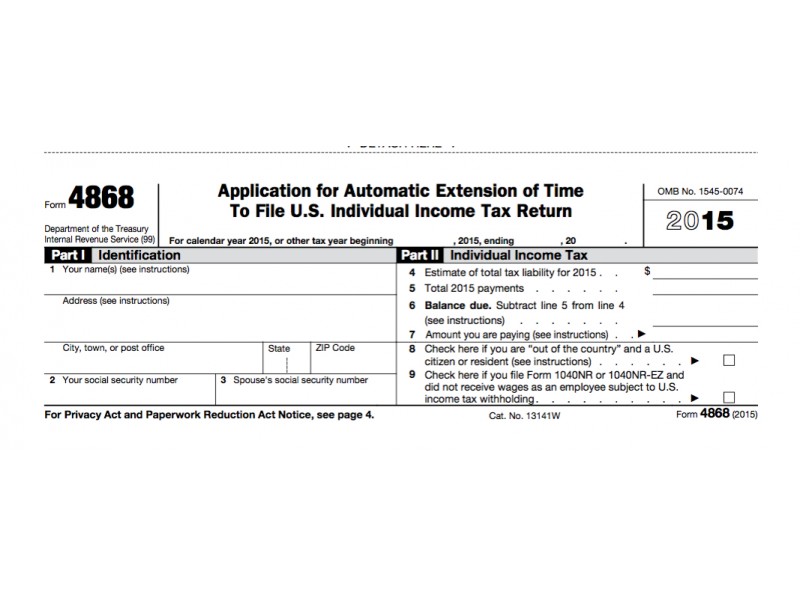

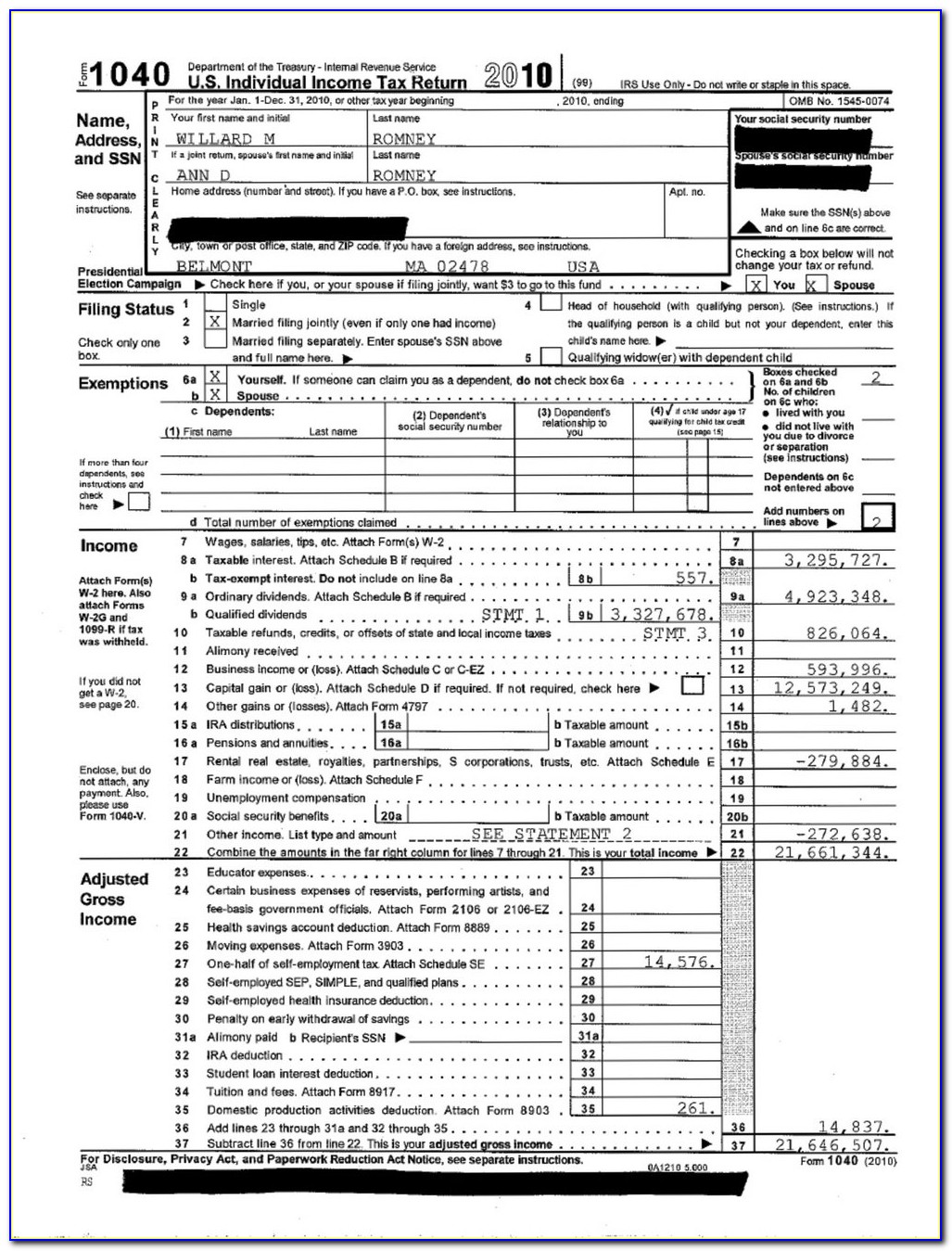

IRS Form 4868 Extension For 2016 Tax Deadline Oregon City, OR Patch

Web oregon filing due date: Make your check, money order, or cashier’s check payable to the oregon department of revenue. Your 2019 oregon tax is due july 15,. Your rights as a taxpayer. You can complete the forms with the help of.

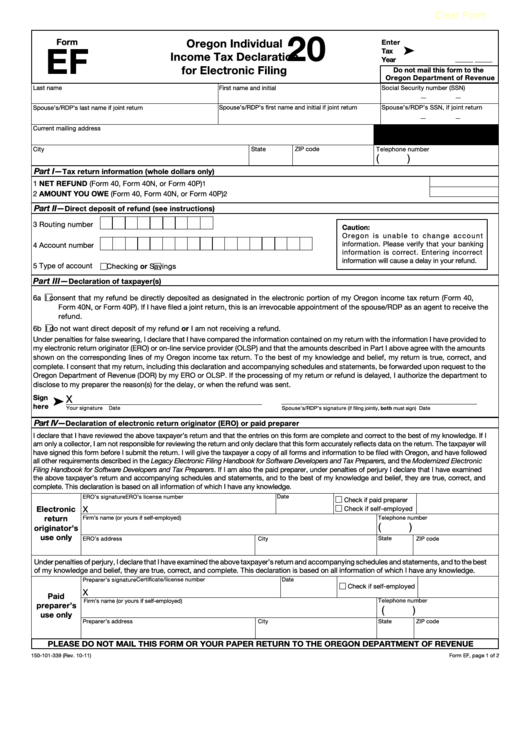

Fillable Form Ef Oregon Individual Tax Declaration For

Web apply for an extension. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Your 2021 oregon tax is due april 18,. Qualified business reduced income tax rate (qbirtr) gig. Make your check, money order, or cashier’s check payable to the oregon department of revenue.

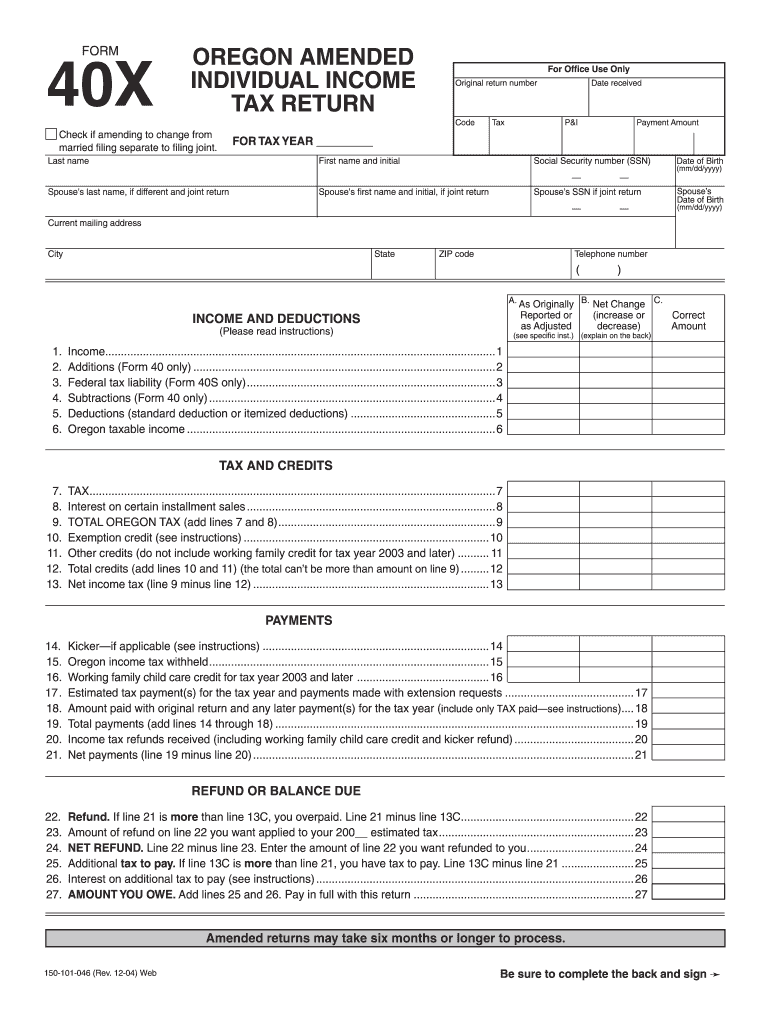

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

Oregon doesn’t allow an extension of time to pay your tax, even if the irs is allowing an extension. If you owe or income taxes, you will either have to submit a or tax. Find more information about filing an extension on the corporate activity tax page, in the faq. Your oregon corporation tax must be fully paid by the.

Fillable Form 40Ext Oregon Automatic Extension For Individuals And

You can complete the forms with the help of. Your rights as a taxpayer. Web the personal income tax rate is 1.5% on multnomah county taxable income over $125,000 for individuals or $200,000 for joint filers, and an additional 1.5% on multnomah county. Citizens and resident aliens abroad who expect to qualify for special. Web the extension form and instructions.

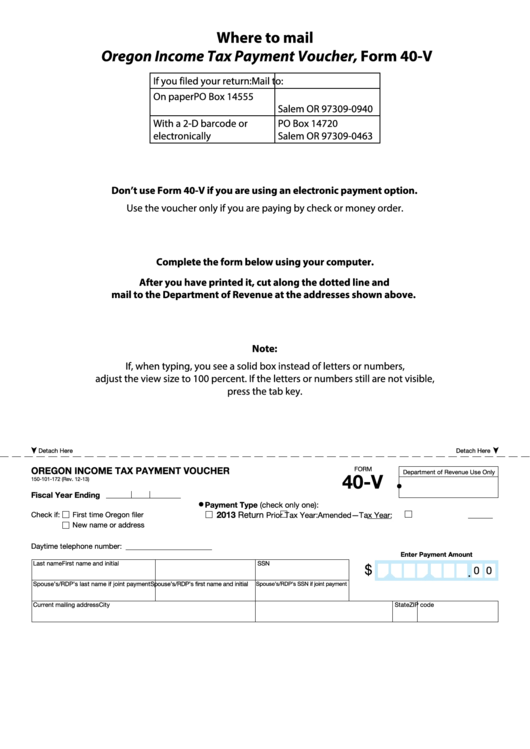

Fillable Form 40V Oregon Tax Payment Voucher printable pdf

Web current forms and publications. Check your irs tax refund status. Web form 2350, application for extension of time to file u.s. You can complete the forms with the help of. Oregon individual income tax returns are due by april 15, in most years.

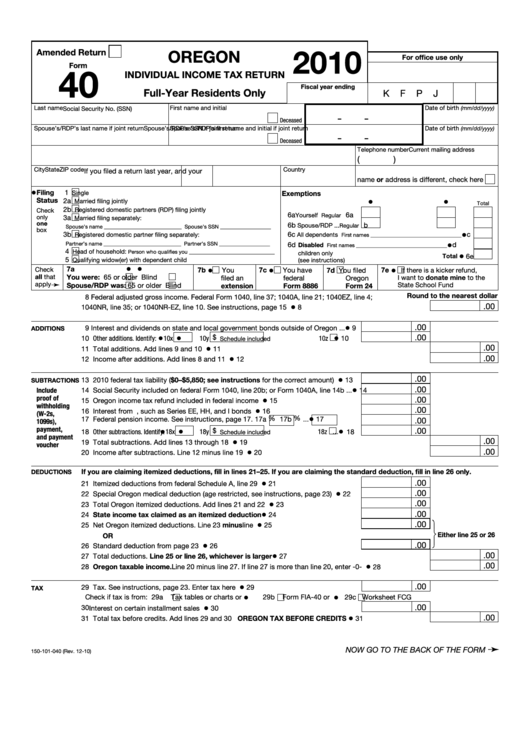

Fillable Form 40 Oregon Individual Tax Return (FullYear

Find more information about filing an extension on the corporate activity tax page, in the faq. Qualified business reduced income tax rate (qbirtr) gig. Web form 2350, application for extension of time to file u.s. Income tax return (for u.s. If you owe or income taxes, you will either have to submit a or tax.

Ny State Tax Extension Form It 201 Form Resume Examples erkKMqB5N8

Web federal tax law no extension to pay. Web apply for an extension. Select a heading to view its forms, then u se the search. Web a tax extension gives you more time to file, but not more time to pay. Make your check, money order, or cashier’s check payable to the oregon department of revenue.

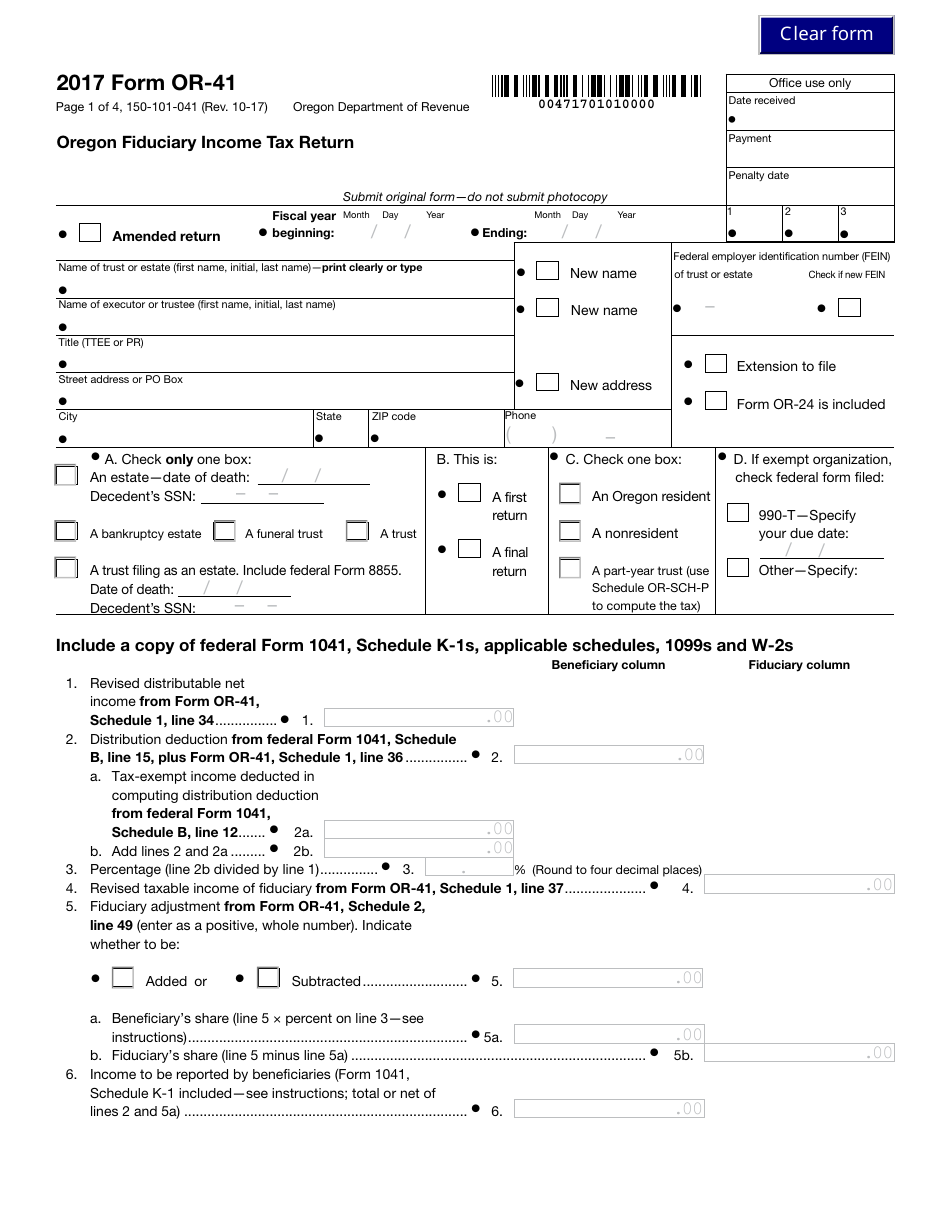

Form OR41 Download Fillable PDF or Fill Online Oregon Fiduciary

Web the oregon tax forms are listed by tax year below and all or back taxes for previous years would have to be mailed in. Select a heading to view its forms, then u se the search. Web current forms and publications. Web federal tax law no extension to pay. Qualified business reduced income tax rate (qbirtr) gig.

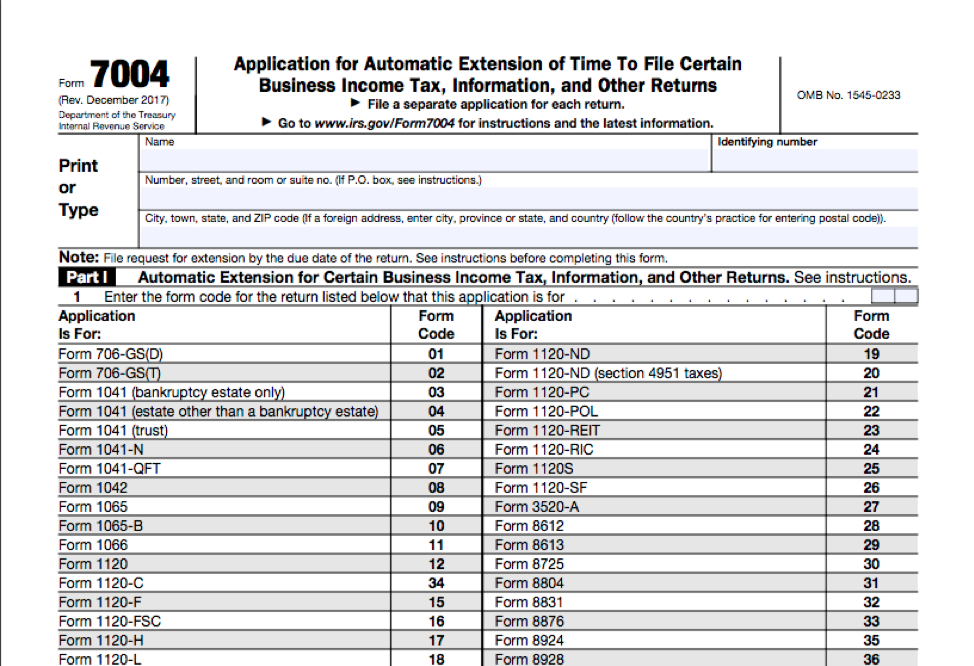

How Long Is An Extension For Business Taxes Business Walls

Pay all or some of your oregon income taxes online via: Oregon doesn’t allow an extension of time to pay your tax, even if the irs is allowing an extension. Web form 2350, application for extension of time to file u.s. If you cannot file by that. Oregon individual income tax returns are due by april 15, in most years.

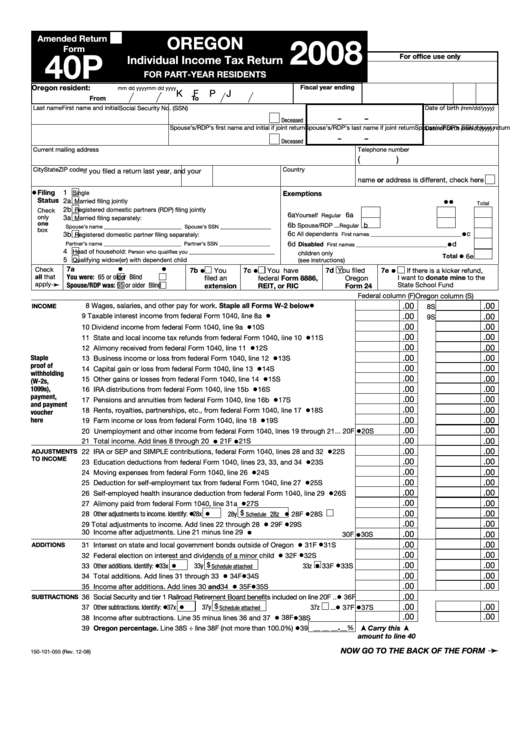

Fillable Form 40p Oregon Individual Tax Return For PartYear

Income tax return (for u.s. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Web the extension form and instructions are available on revenue online. Pay all or some of your oregon income taxes online via: Web apply for an extension.

Pay All Or Some Of Your Oregon Income Taxes Online Via:

Web the oregon tax forms are listed by tax year below and all or back taxes for previous years would have to be mailed in. Sign into your efile.com account and check acceptance by the irs. Web current forms and publications. Check your irs tax refund status.

Web If You Don’t Have A Valid Federal Extension And Owe State Tax Due, File A Separate State Tax Extension Form On Or Before The Original Due Date Of Your Return.

Income tax return (for u.s. Your rights as a taxpayer. Oregon individual income tax returns are due by april 15, in most years. Web arts tax returns arts tax returns in additional languages 2022 personal income tax returns 2021 personal income tax returns general portland/multnomah county.

Or Personal Income Tax Returns Are Due By April 15 Th In Most Years.

Qualified business reduced income tax rate (qbirtr) gig. Citizens and resident aliens abroad who expect to qualify for special. Web the personal income tax rate is 1.5% on multnomah county taxable income over $125,000 for individuals or $200,000 for joint filers, and an additional 1.5% on multnomah county. Make your check, money order, or cashier’s check payable to the oregon department of revenue.

Oregon Doesn’t Allow An Extension Of Time To Pay Your Tax, Even If The Irs Is Allowing An Extension.

Select a heading to view its forms, then u se the search. Web a tax extension gives you more time to file, but not more time to pay. Web form 2350, application for extension of time to file u.s. Your 2019 oregon tax is due july 15,.