Oregon Quarterly Tax Report Form Oq 2022

Oregon Quarterly Tax Report Form Oq 2022 - Web employers are required to file an oregon quarterly tax report (form oq) each calendar quarter. Employers will file quarterly through the oregon combined quarterly tax report. • make sure to include your name and address. Web 2022 forms and publications. Web this report is mandatory under oregon state law, ors 657.660, and is authorized by law, 29 u.s.c. • use the correct tax and assessment rates. Download and save the form to your computer, then open it in adobe reader to complete and print. We have drafted updates to the oq & 132 to include paid leave oregon, which. Total for quarter for more detailed instructions, see the oregon. Web form oq, oregon quarterly combined tax report is used to determine how much tax is due each quarter for state unemployment and withholding;

Web effective january 1, 2022 to: Web what is the remittance schedule for taxes? Things you need to know. Your cooperation is needed to make the results of this survey complete,. Web • put the bin and quarter/year on each report form in the appropriate box. Web employers are required to file an oregon quarterly tax report (form oq) each calendar quarter. Employers will file quarterly through the oregon combined quarterly tax report. Web explains that for form oq, oregon quarterly tax report, filed with the department of revenue, if the due date is on a weekend or holiday, the report and payment are due. Web the paid leave oregon program will be part of the oregon combined quarterly tax report schedule. Web the oregon cigarette tax.

Web what is the remittance schedule for taxes? Web the oregon cigarette tax. Web • put the bin and quarter/year on each report form in the appropriate box. Web employers are required to file an oregon quarterly tax report (form oq) each calendar quarter. • use the correct tax and assessment rates. Web form oq, oregon quarterly combined tax report is used to determine how much tax is due each quarter for state unemployment and withholding; Report quarterly employee wages for those working in oregon and employee counts. Web effective january 1, 2022 to: • make sure to include your name and address. Web statewide transit tax (stt) withholding lane transit district (ltd) 12b.

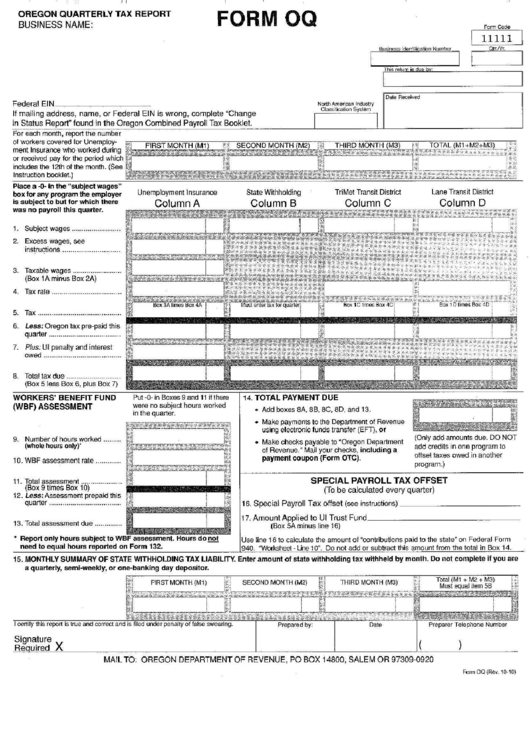

Form Oq Oregon Quaterly Tax Report printable pdf download

Web • put the bin and quarter/year on each report form in the appropriate box. Web statewide transit tax (stt) withholding lane transit district (ltd) 12b. Web explains that for form oq, oregon quarterly tax report, filed with the department of revenue, if the due date is on a weekend or holiday, the report and payment are due. Oregon employers.

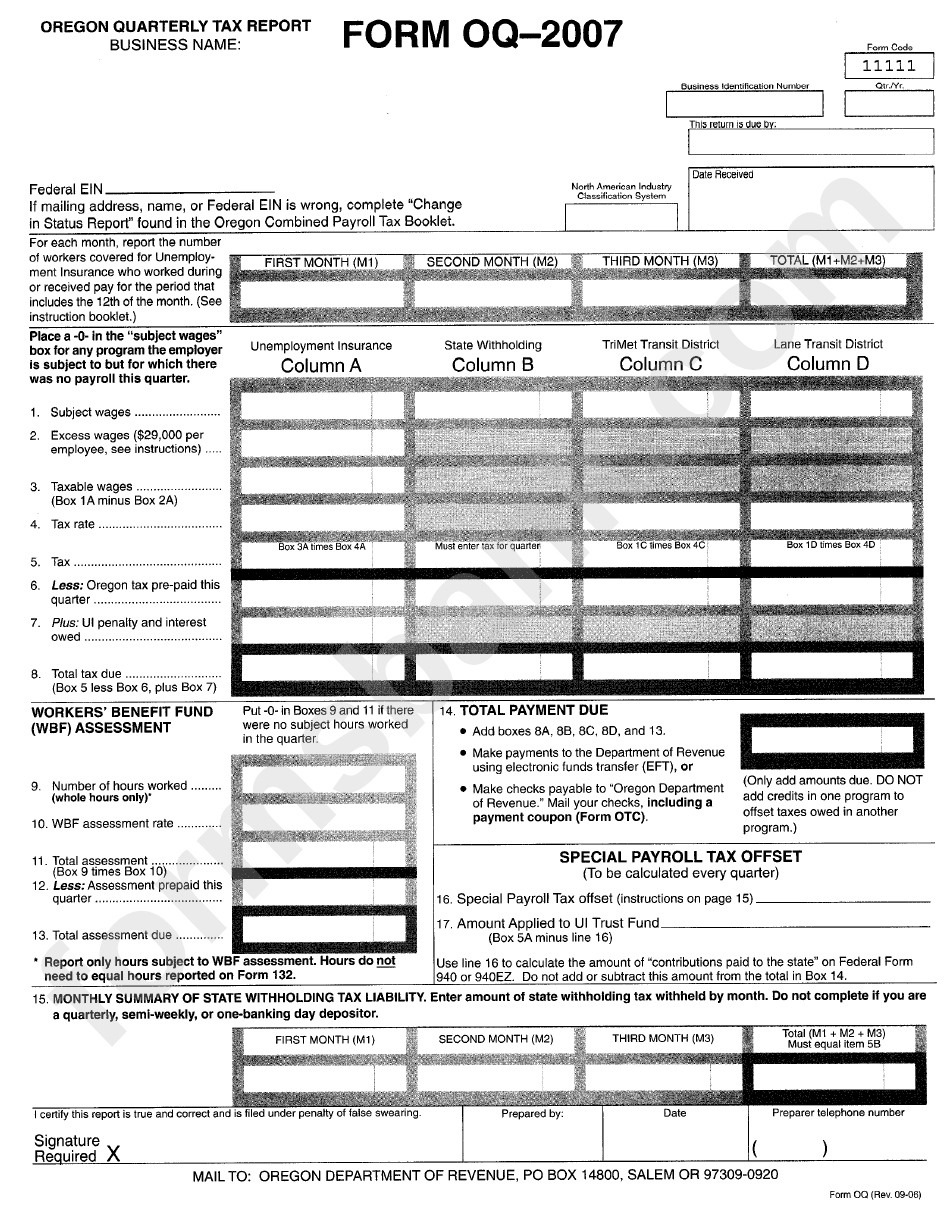

Form Oq Oregon Quarterly Tax Report 2007 printable pdf download

Web employers will report subject employee wages, contributions based on those wages, and employer contributions on a revised quarterly employer tax report (form. Download and save the form to your computer, then open it in adobe reader to complete and print. Filing reports you are expected to file required quarterly reports or annual tax forms on time with. Return and.

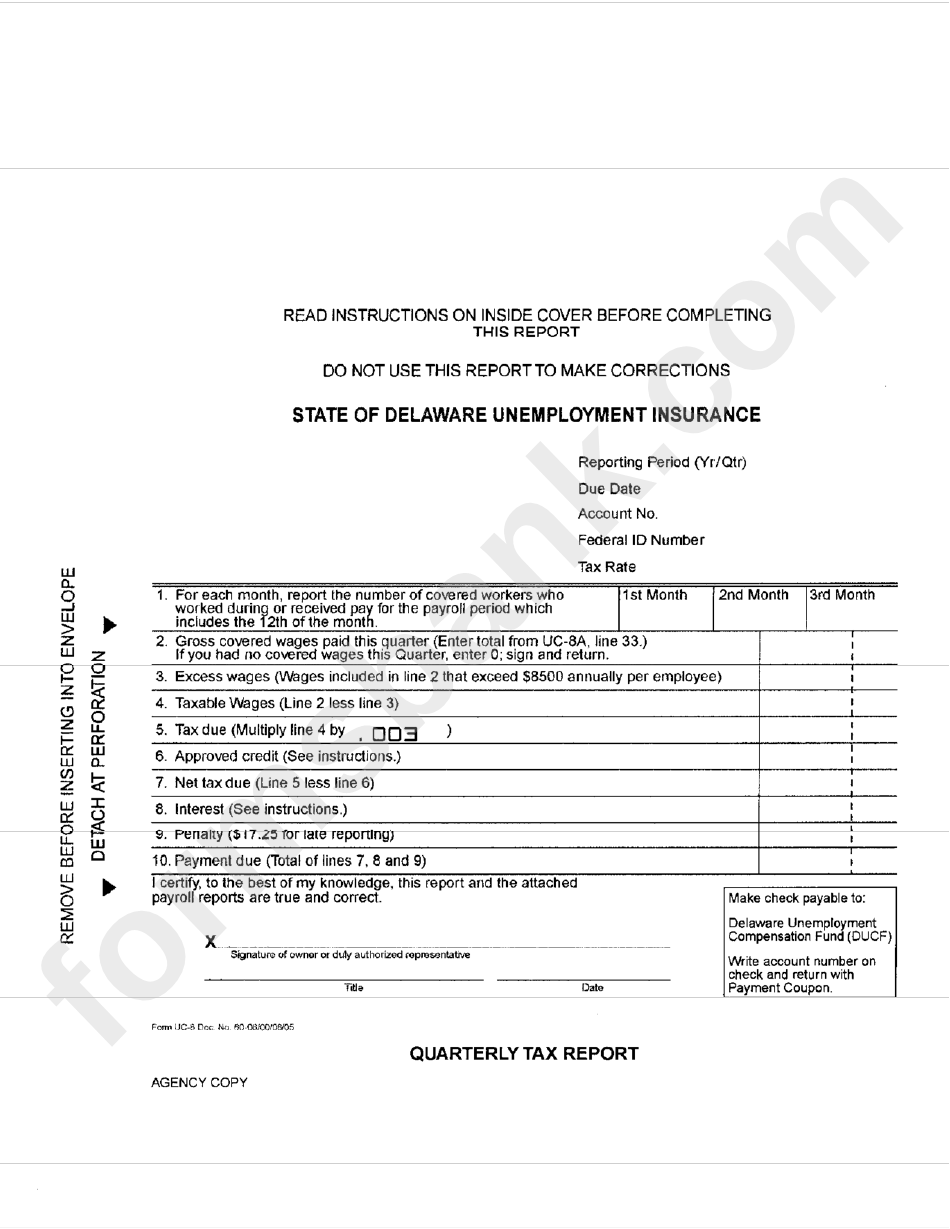

Form Uc8 Quarterly Tax Report printable pdf download

Web • put the bin and quarter/year on each report form in the appropriate box. Total for quarter for more detailed instructions, see the oregon. Web check the box for the quarter in which the statewide transit tax was withheld: Domestic employers (those who employ household workers) may choose to file. Employers will file quarterly through the oregon combined quarterly.

2014 Form OR DoR 40 Fill Online, Printable, Fillable, Blank PDFfiller

Total for quarter for more detailed instructions, see the oregon. • use the correct tax and assessment rates. • make sure to include your name and address. Web check the box for the quarter in which the statewide transit tax was withheld: Report quarterly employee wages for those working in oregon and employee counts.

Deadline for Oregon Quarterly essay contest is Jan. 20 Around the O

Web employer responsibilities all employers with employees working in oregon are required to: Web the paid leave oregon program will be part of the oregon combined quarterly tax report schedule. • make sure to include your name and address. • use the correct tax and assessment rates. Form 132 your filed with form oq on a quarterly basis.

Oregon form oq Fill out & sign online DocHub

We have drafted updates to payroll tax forms, including form oq and. We have drafted updates to the oq & 132 to include paid leave oregon, which. Web form oq, oregon quarterly combined tax report is used to determine how much tax is due each quarter for state unemployment and withholding; Employers will file quarterly through the oregon combined quarterly.

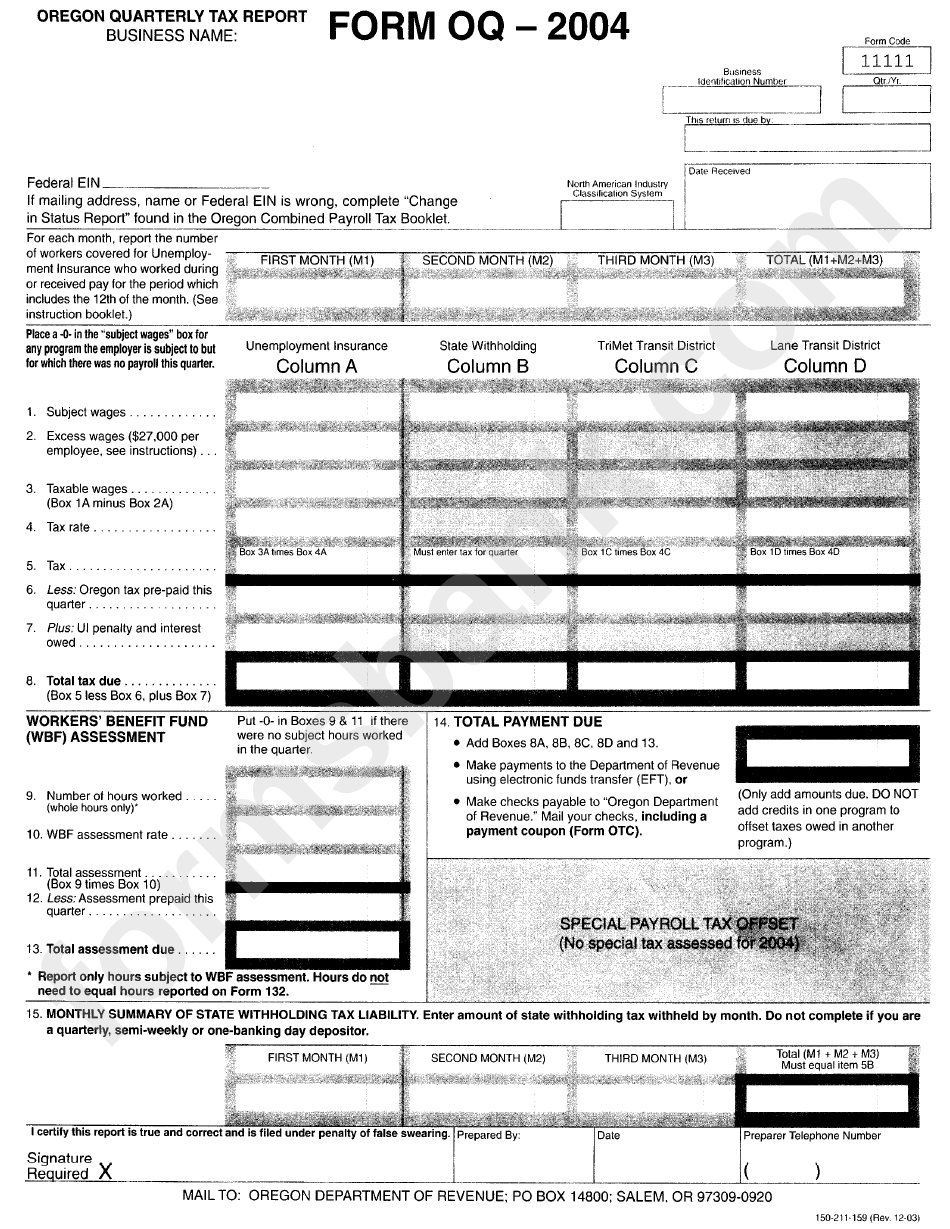

Form Oq Oregon Quarterly Tax Report 2004 printable pdf download

Total for quarter for more detailed instructions, see the oregon. Web effective january 1, 2022 to: Oregon employers the oregon withholding tax tables include: Web the oregon cigarette tax. • make sure to include your name and address.

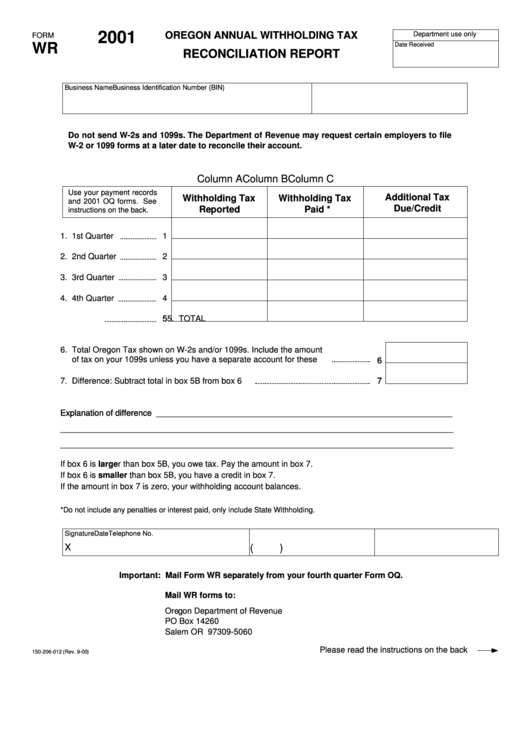

Form Wr, Oregon Annual Withholding Tax Reconciliation Report printable

Report quarterly employee wages for those working in oregon and employee counts. Web • put the bin and quarter/year on each report form in the appropriate box. Web form oq, oregon quarterly combined tax report is used to determine how much tax is due each quarter for state unemployment and withholding; We have drafted updates to. Web 2022 forms and.

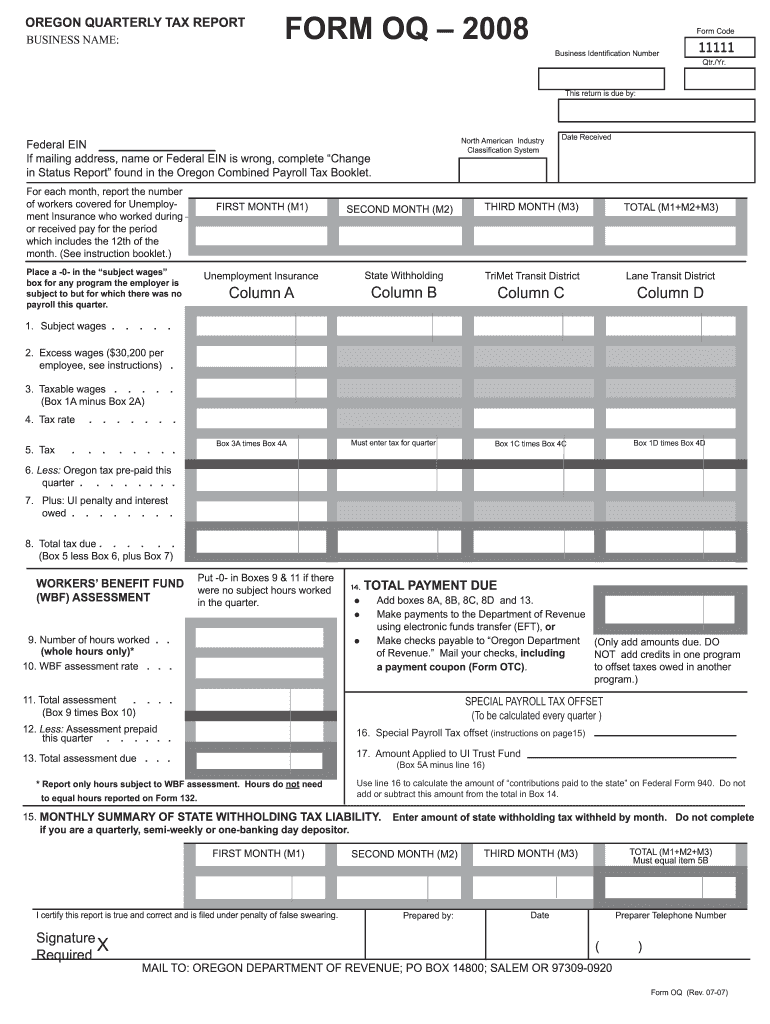

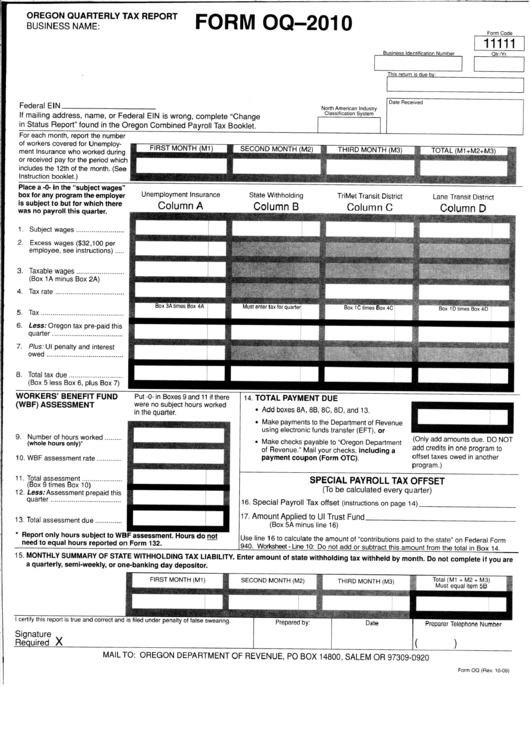

Form Oq2010 Oregon Quarterly Rax Report printable pdf download

Web explains that for form oq, oregon quarterly tax report, filed with the department of revenue, if the due date is on a weekend or holiday, the report and payment are due. We have drafted updates to. Oregon employers the oregon withholding tax tables include: Web employers are required to file an oregon quarterly tax report (form oq) each calendar.

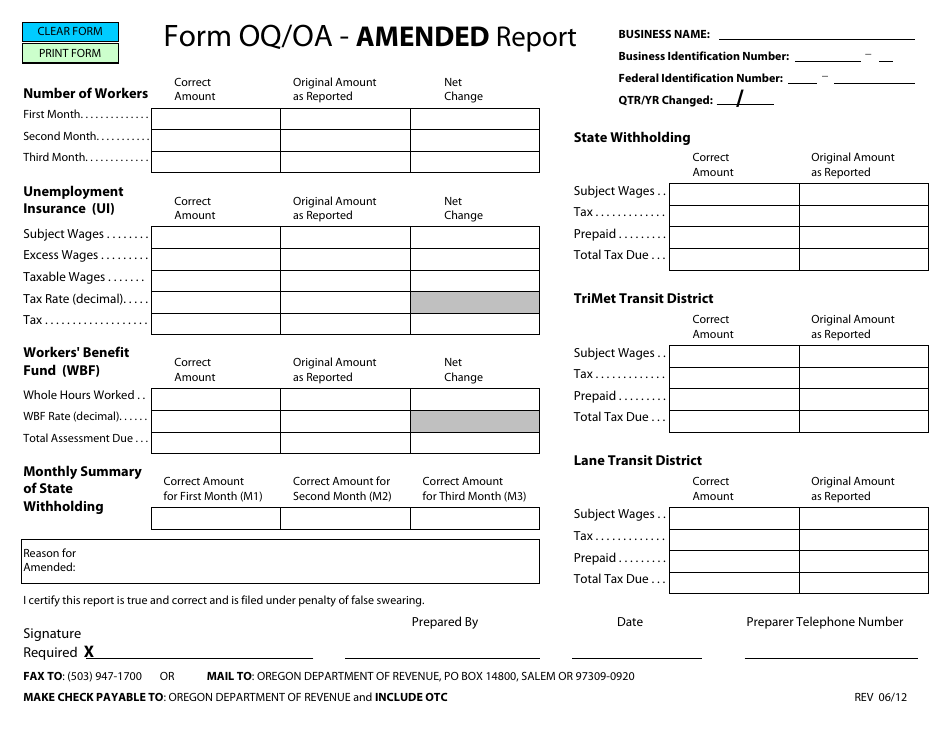

Form OQ/OA Download Fillable PDF or Fill Online Amended Report Oregon

Return and payment are due by april 30, 2022. Form 132 your filed with form oq on a quarterly basis. We have drafted updates to. Web employers are required to file an oregon quarterly tax report (form oq) each calendar quarter. Web effective january 1, 2022 to:

Filing Reports You Are Expected To File Required Quarterly Reports Or Annual Tax Forms On Time With.

Web what is the remittance schedule for taxes? Report quarterly employee wages for those working in oregon and employee counts. Form 132 your filed with form oq on a quarterly basis. Web employers are required to file an oregon quarterly tax report (form oq) each calendar quarter.

• Use The Correct Tax And Assessment Rates.

We have drafted updates to payroll tax forms, including form oq and. Web explains that for form oq, oregon quarterly tax report, filed with the department of revenue, if the due date is on a weekend or holiday, the report and payment are due. Web the oregon cigarette tax. Web taxes you are expected to pay taxes or reimbursements when they are due.

Web This Report Is Mandatory Under Oregon State Law, Ors 657.660, And Is Authorized By Law, 29 U.s.c.

The paid leave oregon program will be a part of the oregon combined quarterly tax report schedule. Things you need to know. Web the paid leave oregon program will be part of the oregon combined quarterly tax report schedule. Web employers will report subject employee wages, contributions based on those wages, and employer contributions on a revised quarterly employer tax report (form.

Oregon Employers The Oregon Withholding Tax Tables Include:

Web check the box for the quarter in which the statewide transit tax was withheld: Return and payment are due by april 30, 2022. Web • put the bin and quarter/year on each report form in the appropriate box. We have drafted updates to the oq & 132 to include paid leave oregon, which.