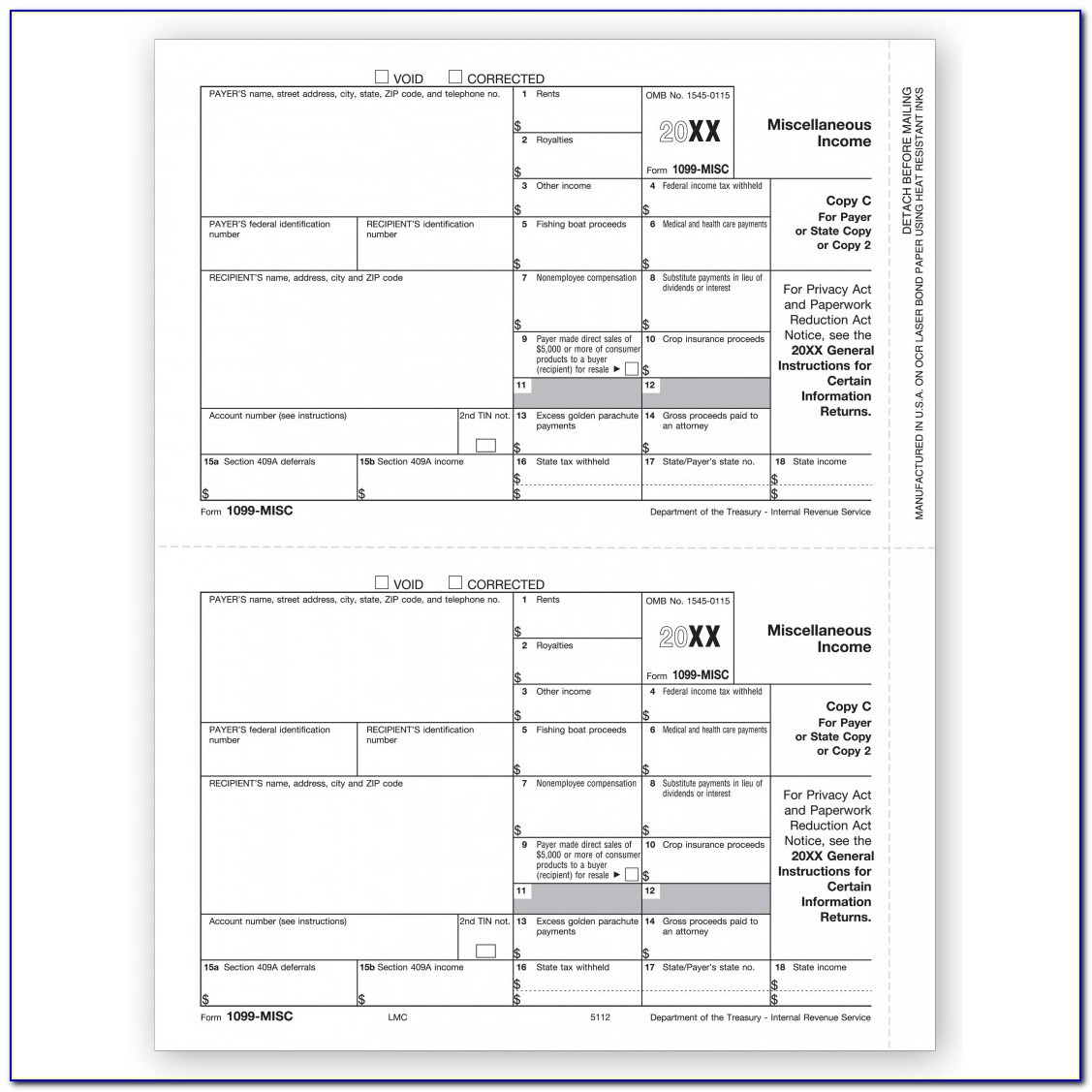

Printable 1099 Misc Form

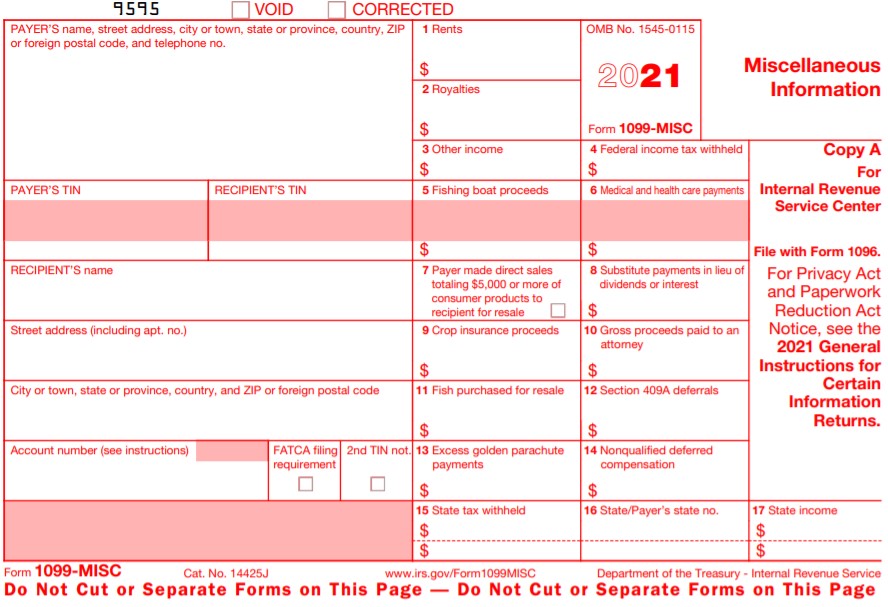

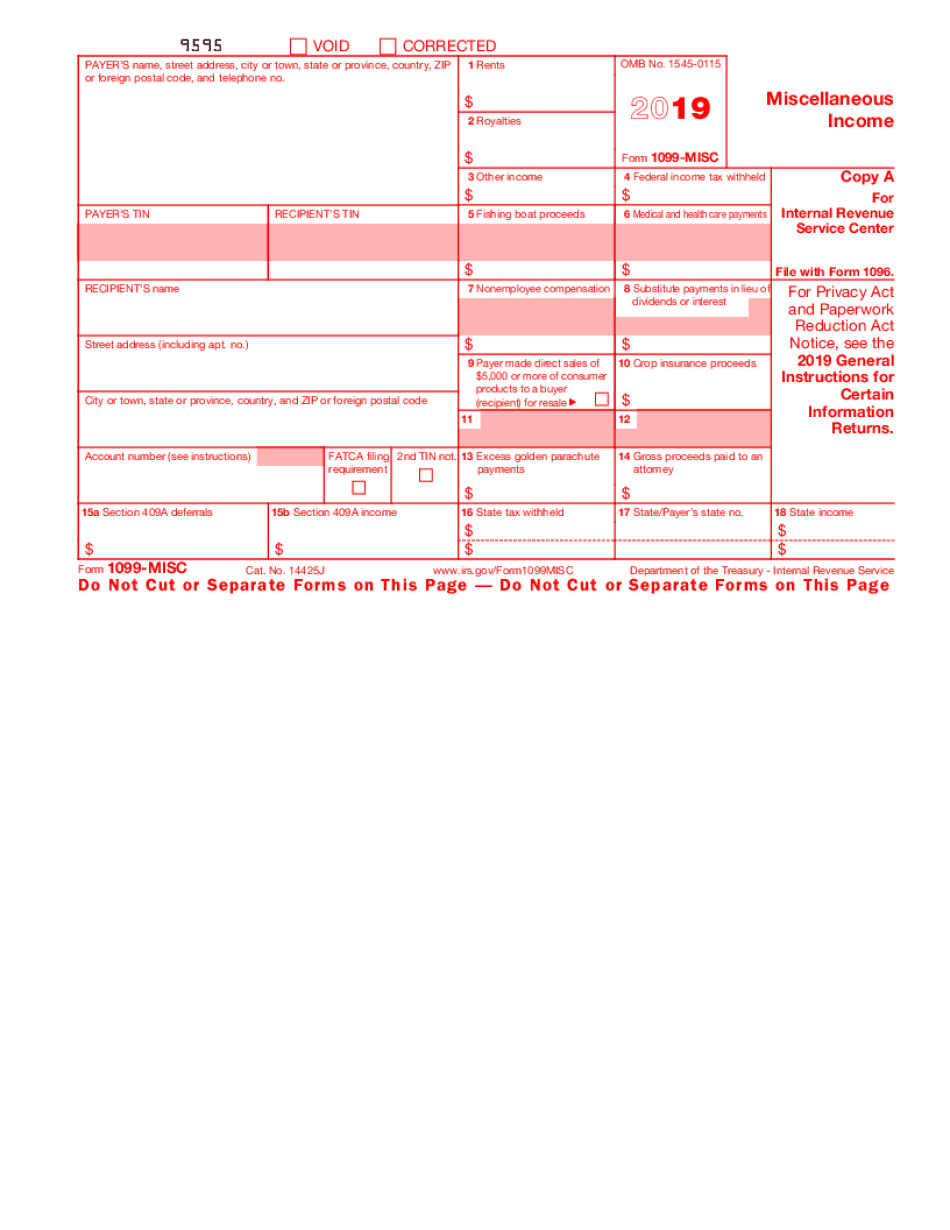

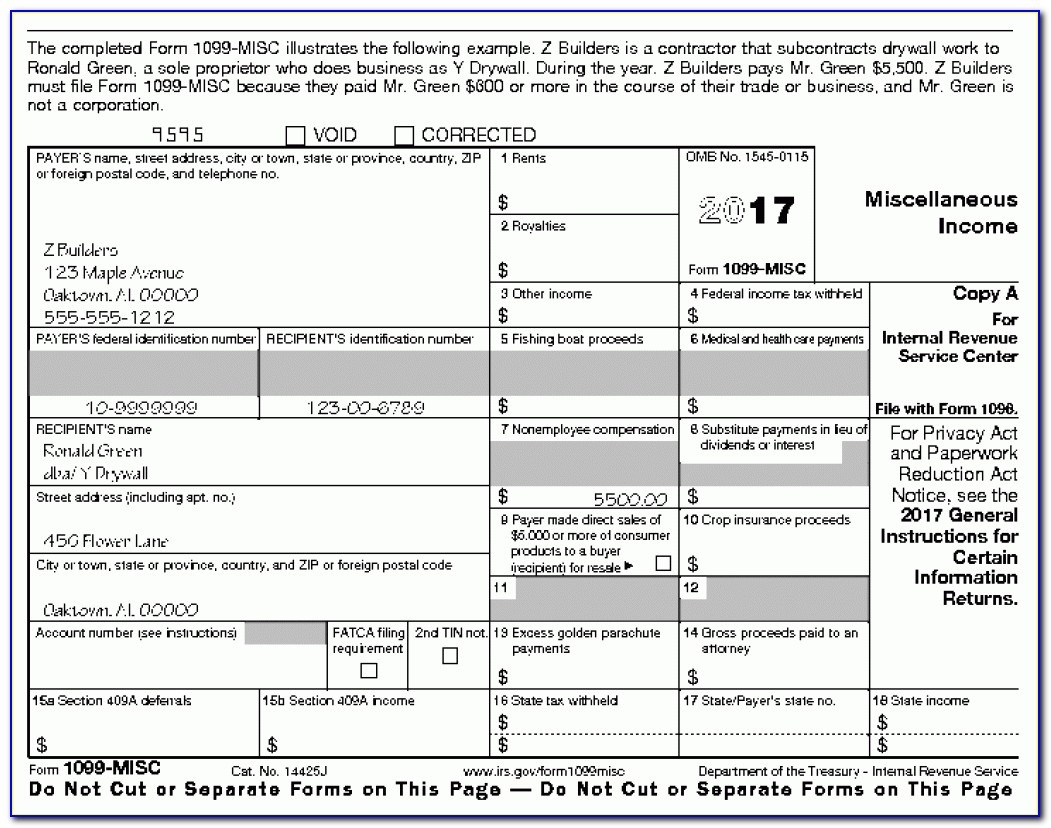

Printable 1099 Misc Form - Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax. These new “continuous use” forms no. Web copy a appears in red, similar to the official irs form. Print and file copy a downloaded from this website; The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. The list of payments that require a business to. A penalty may be imposed for filing with the irs information return forms that can’t be.

The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. Web copy a appears in red, similar to the official irs form. These new “continuous use” forms no. The list of payments that require a business to. A penalty may be imposed for filing with the irs information return forms that can’t be. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax. Print and file copy a downloaded from this website;

Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax. These new “continuous use” forms no. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. Web copy a appears in red, similar to the official irs form. A penalty may be imposed for filing with the irs information return forms that can’t be. The list of payments that require a business to. Print and file copy a downloaded from this website;

Free Printable 1099 Misc Forms Free Printable

These new “continuous use” forms no. Web copy a appears in red, similar to the official irs form. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least.

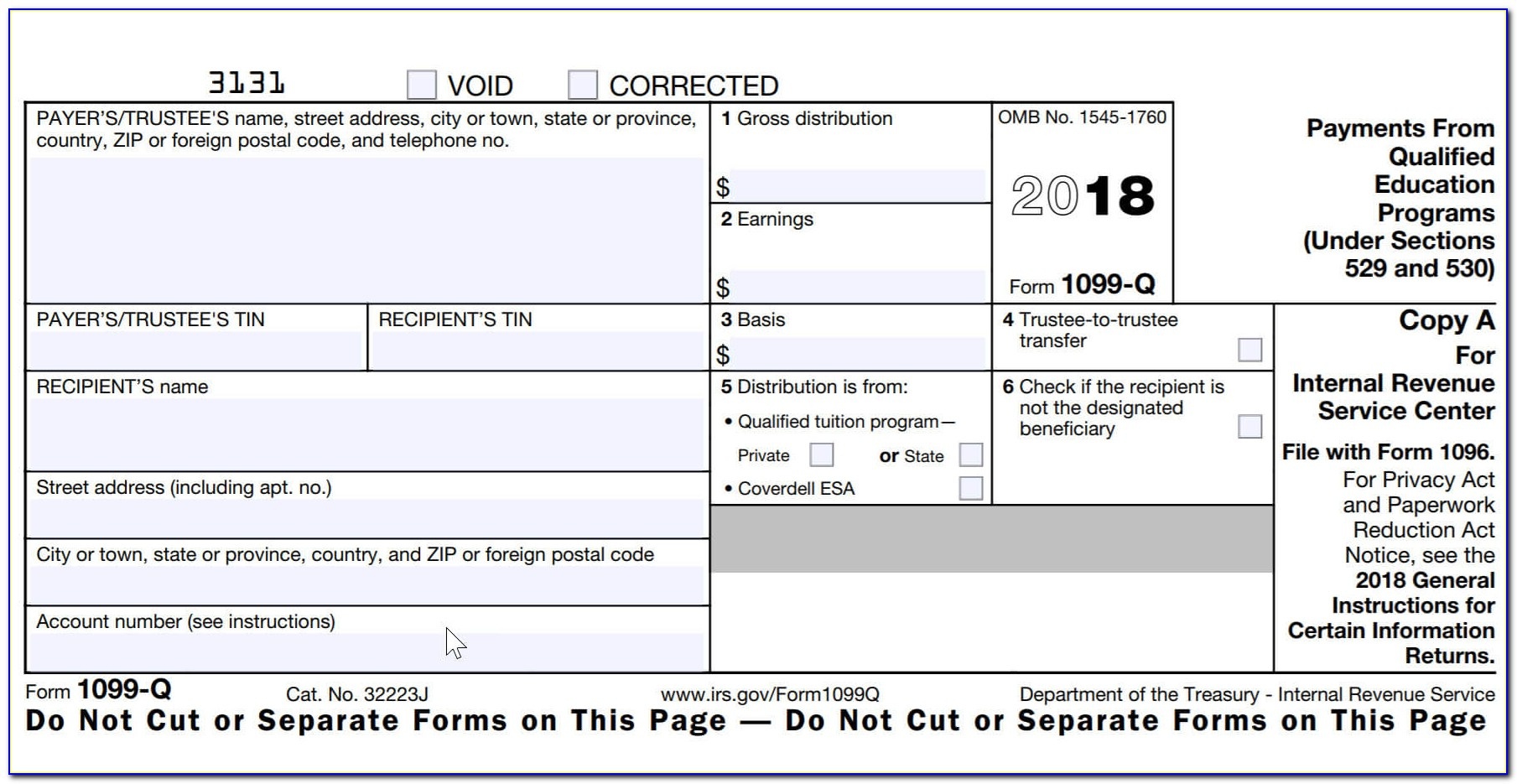

1099MISC Tax Basics

Print and file copy a downloaded from this website; These new “continuous use” forms no. The list of payments that require a business to. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax. The official printed version of copy a.

Free Printable 1099 Misc Forms Free Printable

Web copy a appears in red, similar to the official irs form. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. These new “continuous use” forms no. Print and file copy a downloaded from this website; However, this form recently changed, and it no.

EFile 1099 File Form 1099 Online Form 1099 for 2020

The list of payments that require a business to. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. These new “continuous use” forms no. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of.

1099MISC Form Printable and Fillable PDF Template

The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. These new “continuous use” forms no. A penalty may be imposed for filing with the irs information return forms that can’t be. However, this form recently changed, and it no longer includes nonemployee compensation the.

11 Common Misconceptions About Irs Form 11 Form Information Free

Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax. Print and file copy a downloaded from this website; The list of payments that require a business to. Web copy a appears in red, similar to the official irs form. However,.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

The list of payments that require a business to. Web copy a appears in red, similar to the official irs form. A penalty may be imposed for filing with the irs information return forms that can’t be. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website,.

Free Printable 1099 Misc Forms Free Printable

Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. However, this form recently changed, and.

11 Common Misconceptions About Irs Form 11 Form Information Free

However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Web copy a appears in red, similar to the official irs form. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax..

When is tax form 1099MISC due to contractors? GoDaddy Blog

Web copy a appears in red, similar to the official irs form. Print and file copy a downloaded from this website; A penalty may be imposed for filing with the irs information return forms that can’t be. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments.

The List Of Payments That Require A Business To.

Print and file copy a downloaded from this website; A penalty may be imposed for filing with the irs information return forms that can’t be. Web copy a appears in red, similar to the official irs form. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past.

The Official Printed Version Of Copy A Of This Irs Form Is Scannable, But The Online Version Of It, Printed From This Website, Is Not.

Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker payments in lieu of dividends or tax. These new “continuous use” forms no.