Rental Expense Form

Rental Expense Form - If you’re the tenant, it’s better to pay by check, money order or electronically than by cash so you have an additional record of payment. Web only your rental expenses may be deducted on schedule e (form 1040). Report real property on schedule e that’s rented: Marcelo • jan 01 2021. Most commonly for the use of cash payment by the tenant to their landlord. Remote workers cannot claim this deduction. Some of your personal expenses may be deductible on schedule a (form 1040) if you itemize your deductions. Web in general, you can deduct expenses of renting property from your rental income. You generally must include in your gross income all amounts you receive as rent. The form may be issued ‘on the spot’ with the landlord completing.

Find current rates in the continental united states (conus rates) by searching below with city and state (or zip code), or by clicking on the map, or use the new per diem tool to calculate trip allowances. Expenses of renting property can be deducted from your gross rental income. (12b) expenses for the period (12c) expenses for the period (if no dates are shown, report expenses for current calendar year) $ $ $ 2. You must also determine if the dwelling unit is considered a home. On schedule e, you can reduce the gross rent by your rental property expenses. A rent ledger (also called a lease ledger) is a document used to keep track of income, expenses, repairs, and other important information for a rental property or group of rental properties. Some of your personal expenses may be deductible on schedule a (form 1040) if you itemize your deductions. Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. Web income and expense statement of_____ i. Web taxpayers can claim the deduction in two ways.

If you’re the tenant, it’s better to pay by check, money order or electronically than by cash so you have an additional record of payment. Remote workers cannot claim this deduction. The second is through a standard formula provided by the irs. The form may be issued ‘on the spot’ with the landlord completing. Web income and expense statement of_____ i. Or you can click here to make a google sheets copy. Find current rates in the continental united states (conus rates) by searching below with city and state (or zip code), or by clicking on the map, or use the new per diem tool to calculate trip allowances. Web rental businesses must be registered and licensed to do business in kansas city, missouri. You can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Current revision form 8825 pdf recent developments none at this time.

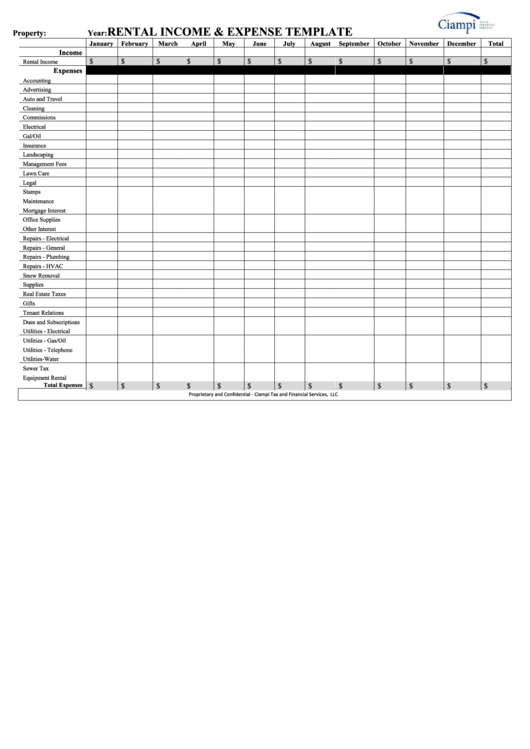

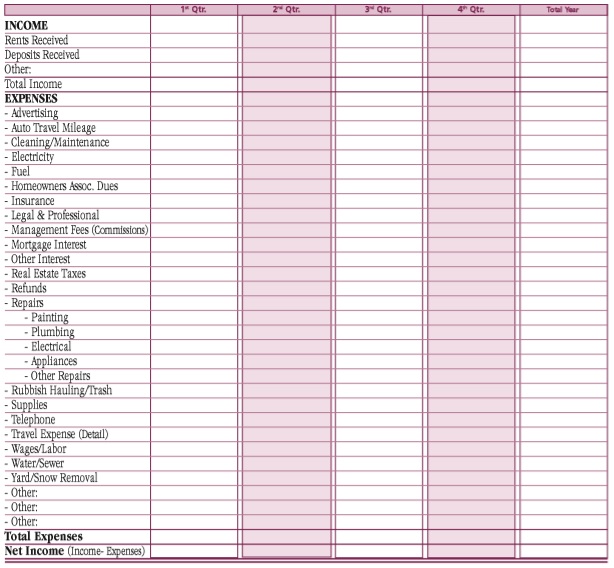

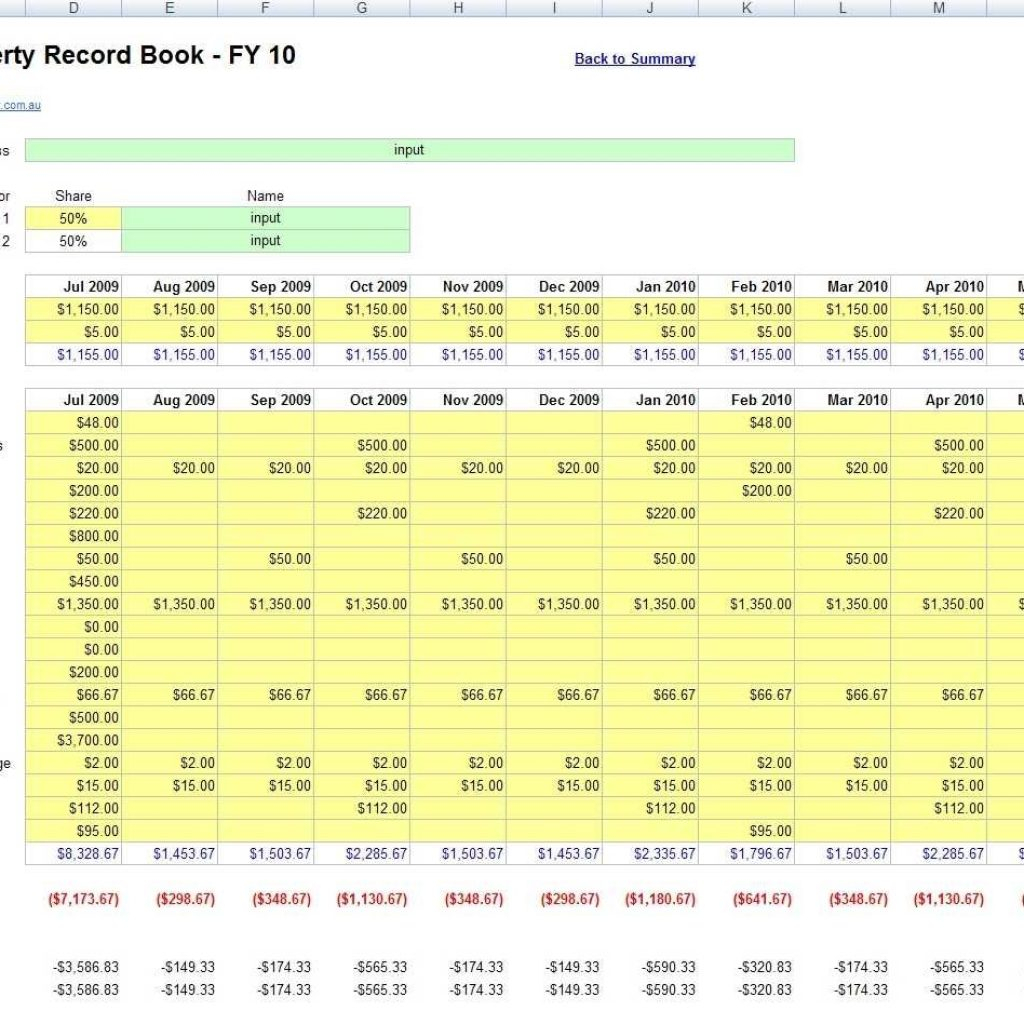

Rental Property and Expense Spreadsheet

Include it in your income when you receive it. Web only your rental expenses may be deducted on schedule e (form 1040). Do not list personal expenditures. List your total income, expenses, and depreciation for each rental property on schedule e. Web updated april 14, 2023.

Top Rental Property Expenses Spreadsheet Templates free to download in

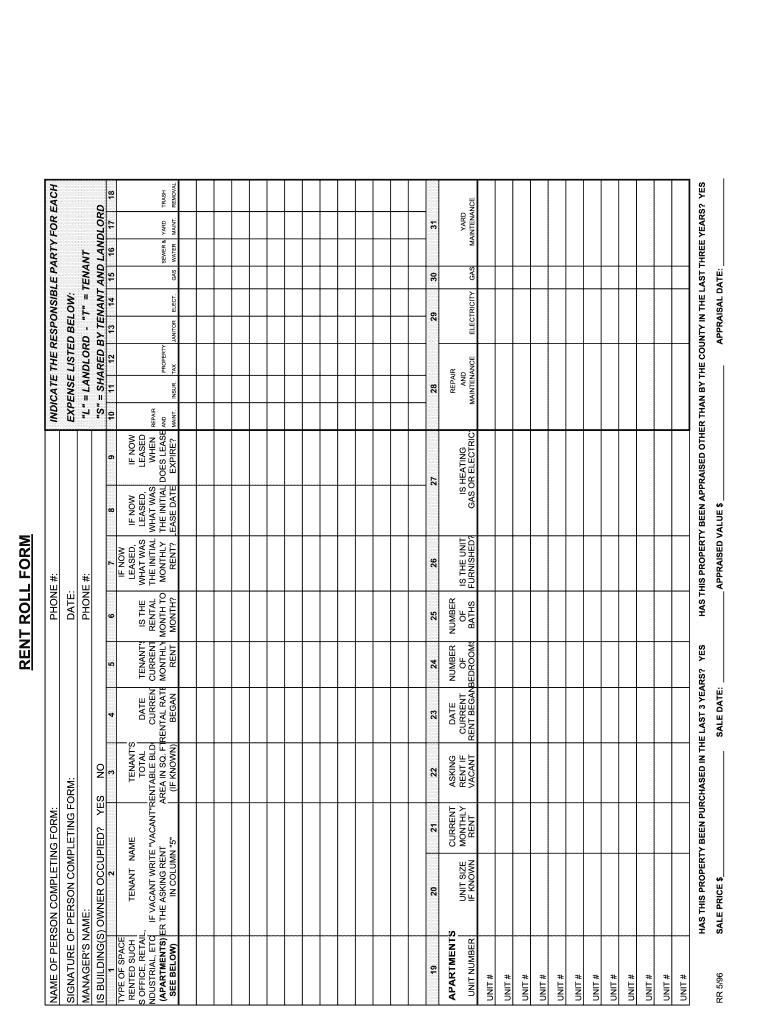

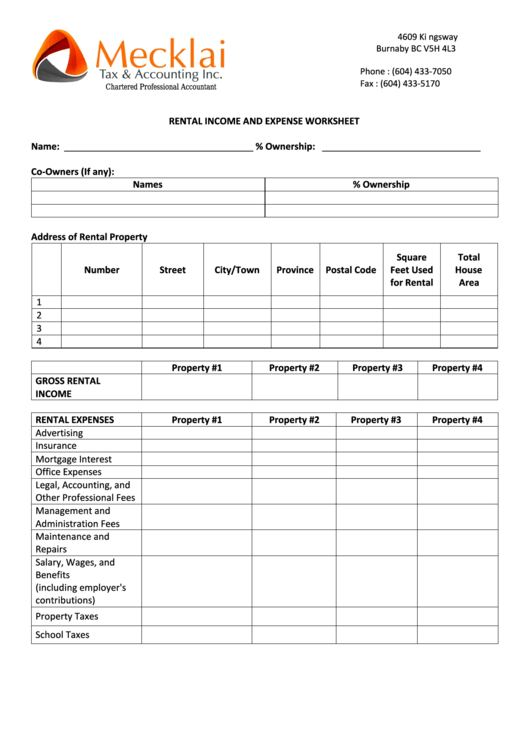

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Rental income is any payment you receive for the use or occupation of property. Web rental income and expense worksheet. You generally must include.

Rental And Expense Worksheet Pdf Fill Online, Printable

Your investment, including expenses, must be at risk. Web rental income and expense worksheet. Expenses of renting property can be deducted from your gross rental income. Remote workers cannot claim this deduction. Web only your rental expenses may be deducted on schedule e (form 1040).

5+ Free Rental Property Expenses Spreadsheets Excel TMP

The form may be issued ‘on the spot’ with the landlord completing. To download the free rental income and expense worksheet template, click the green button at the top of the page. You rent the property for less than fair market rent. Web appropriate sections are broken down by month and by property. Rental income is any payment you receive.

Rental And Expense Worksheet Pdf Fill Online, Printable

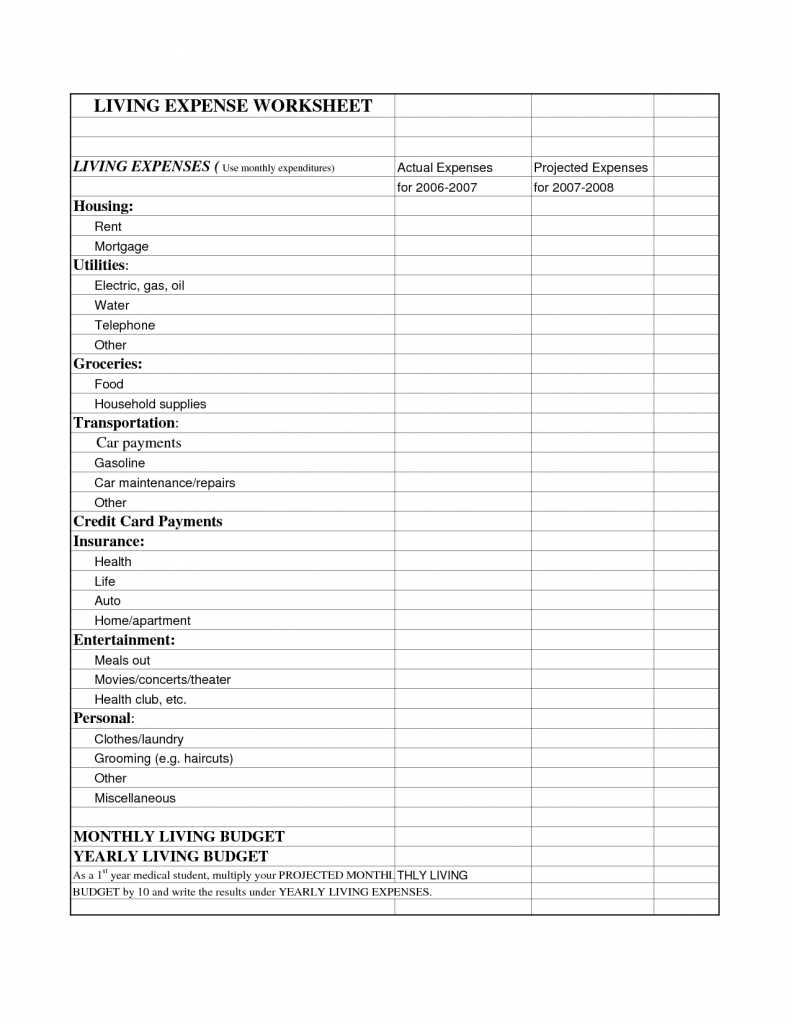

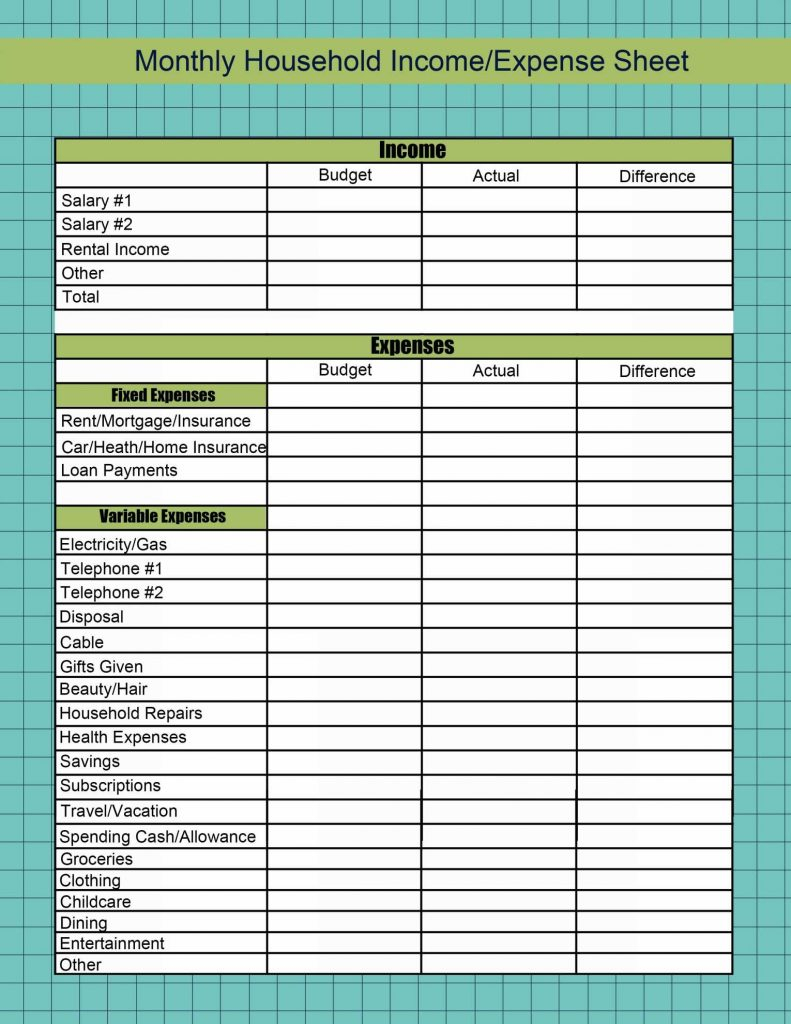

The worksheet on the reverse side should help you document your rental income and identify deductible expenses from rental activities. Rental property tax law special tax laws have been created within the tax code to. Each section automatically calculates the totals to provide your gross income, net income and total expenses for the year. On schedule e, you can reduce.

Rental And Expense Worksheet printable pdf download

Web rental income and expense worksheet. Web only your rental expenses may be deducted on schedule e (form 1040). Web appropriate sections are broken down by month and by property. Go to www.irs.gov/form8825 for the latest information. Web taxpayers can claim the deduction in two ways.

Monthly Living Expenses Spreadsheet In Spreadsheet For Household

If you are reporting partnership. You can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Some of your personal expenses may be deductible on schedule a (form 1040) if you itemize your deductions. Find irs forms and publications about supplemental income (rental). Web foreign source taxable income is.

Rental And Expense Spreadsheet Template 1 Printable Spreadshee

Web to download the free rental income and expense worksheet template, click below to view the google sheet. Rates are set by fiscal year, effective october 1 each year. If you’re the tenant, it’s better to pay by check, money order or electronically than by cash so you have an additional record of payment. Web updated april 14, 2023. (12b).

Rental Expense Spreadsheet —

Include it in your income when you receive it. Web foreign source taxable income is foreign source gross income less allocable expenses. (12b) expenses for the period (12c) expenses for the period (if no dates are shown, report expenses for current calendar year) $ $ $ 2. To download the free rental income and expense worksheet template, click the green.

Free Rental Expense Spreadsheet within Property Management Expenses

Security deposits used as a final payment of rent are considered advance rent. You must include $10,000 in your income in the first year. Marcelo • jan 01 2021. Find irs forms and publications about supplemental income (rental). You can also download the sheet as an excel file to use on your home machine offline.

Web Income And Expense Statement Of_____ I.

Most commonly for the use of cash payment by the tenant to their landlord. You have personal use of the property. If you are reporting partnership. Web appropriate sections are broken down by month and by property.

Web Typically, The Rental Income Tax Forms You’ll Use To Report Your Rental Income Include:

You rent the property for less than fair market rent. Web in the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease. Your investment, including expenses, must be at risk. The first is by calculating the actual value of the space, based on the actual costs of the space.

Web Do You Receive Rental Income?

November 2018) department of the treasury internal revenue service name rental real estate income and expenses of a partnership or an s corporation attach to form 1065 or form 1120s. Each section automatically calculates the totals to provide your gross income, net income and total expenses for the year. Web total expenses relating to rental property or operation of business. Rental property tax law special tax laws have been created within the tax code to.

Report Real Property On Schedule E That’s Rented:

Gross wages per pay period $_____. Download the rental income and expense worksheet here note: Web this rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Go to www.irs.gov/form8825 for the latest information.