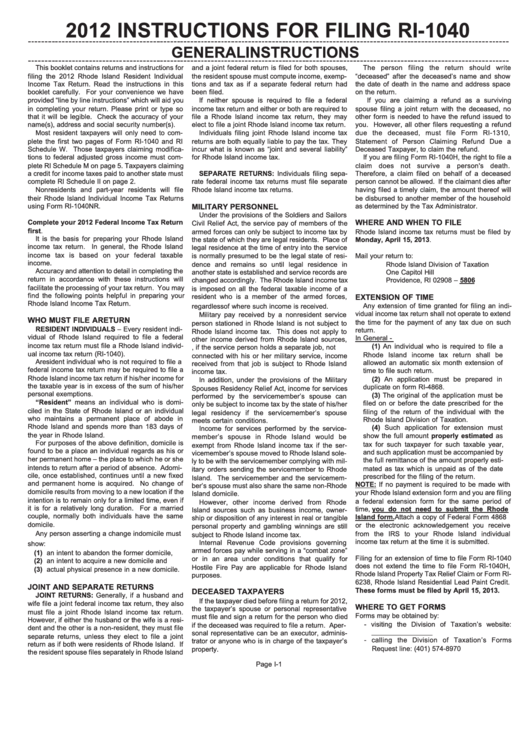

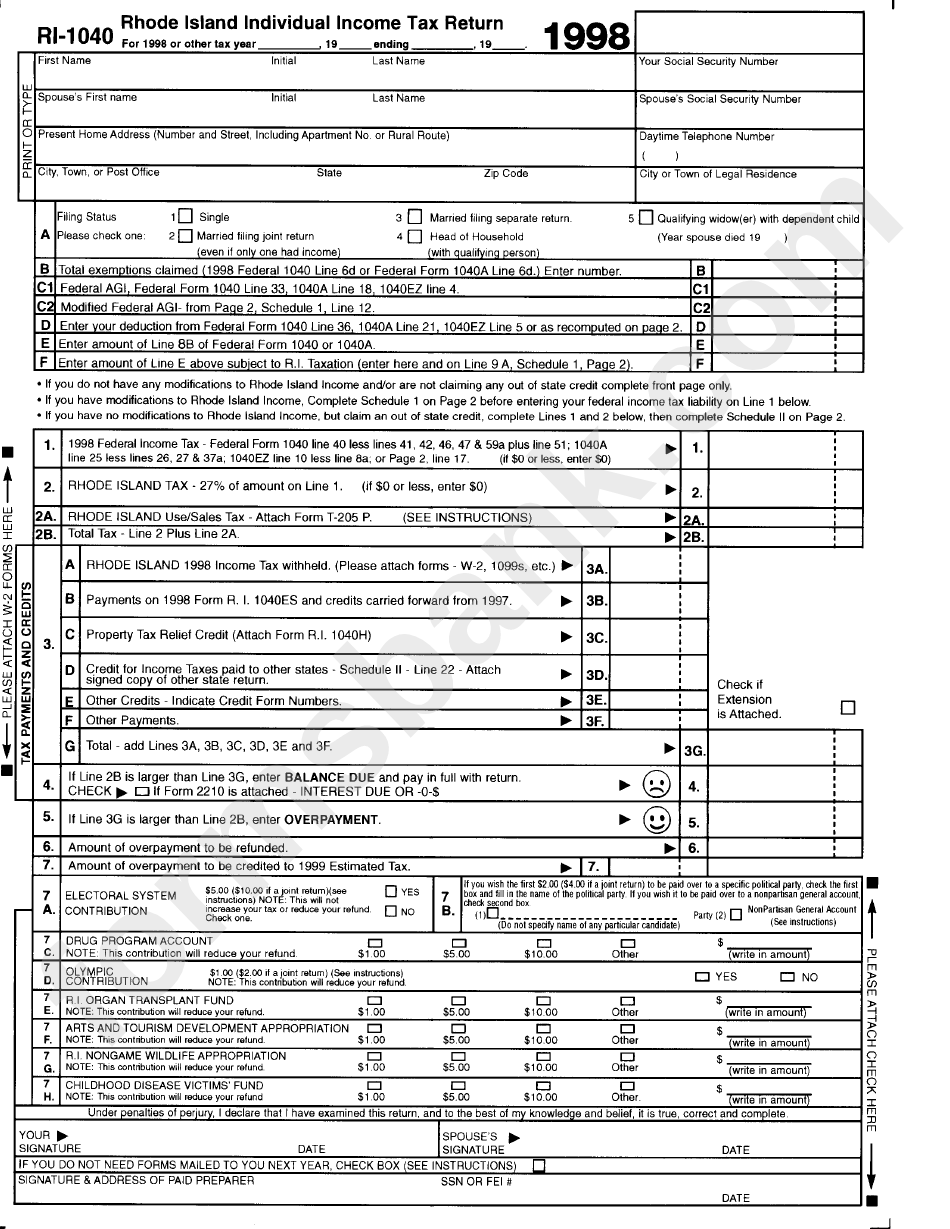

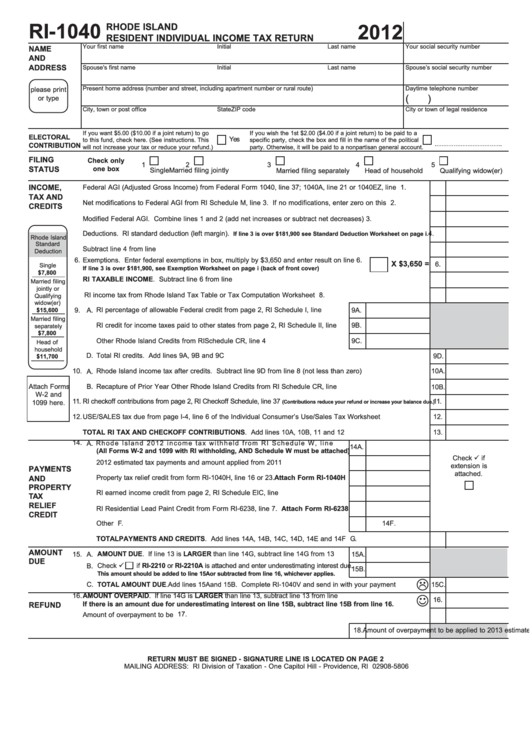

Ri-1040 Form

Ri-1040 Form - You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Those under 65 who are not disabled do not qualify for the credit. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in rhode island during calendar year. 2019 rhode island employer's income tax withholding tables. We last updated the resident tax return in. You can complete the forms with the help of efile.com. Click on the appropriate category below to access the forms and instructions you need:. These 2021 forms and more are available: They may have to file. Web select a different state:

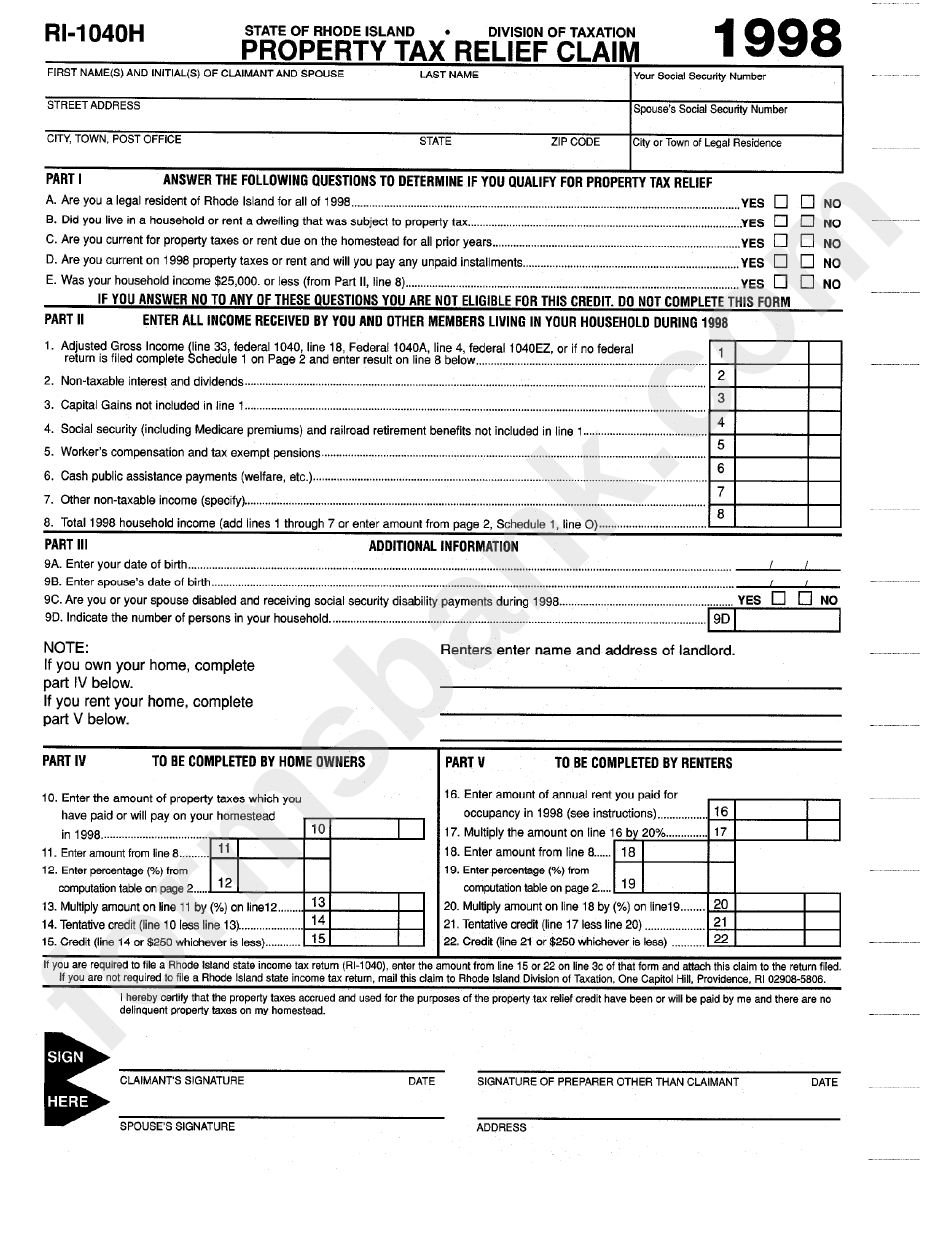

Easily fill out pdf blank, edit, and sign them. 2019 rhode island employer's income tax withholding tables. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in rhode island during calendar year. You can complete the forms with the help of efile.com. For tax year 2021, the property tax relief credit amount increases to $415 from $400. These 2021 forms and more are available: You can download or print current or. Web we last updated the property tax relief claim in february 2023, so this is the latest version of form 1040h, fully updated for tax year 2022. Save or instantly send your ready documents. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in.

2019 rhode island employer's income tax withholding tables. We last updated the resident tax return in. You can complete the forms with the help of efile.com. Click on the appropriate category below to access the forms and instructions you need:. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in rhode island during calendar year. These 2021 forms and more are available: Web select a different state: An extension of time to file form ri. For more information about the rhode. For tax year 2021, the property tax relief credit amount increases to $415 from $400.

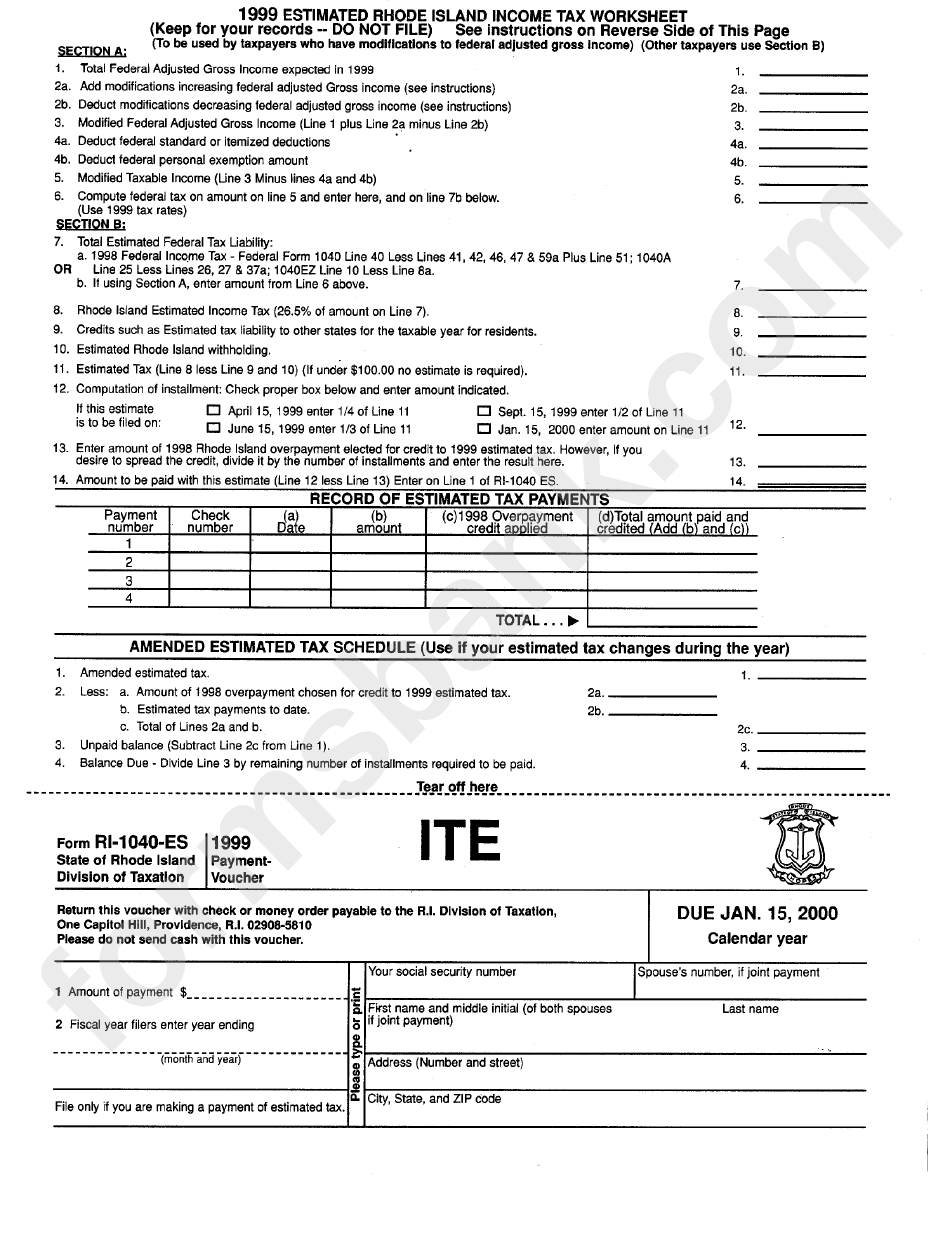

Fillable Form Ri1040Es 1999 Payment Voucher printable pdf download

You can complete the forms with the help of efile.com. Web we last updated the property tax relief claim in february 2023, so this is the latest version of form 1040h, fully updated for tax year 2022. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to.

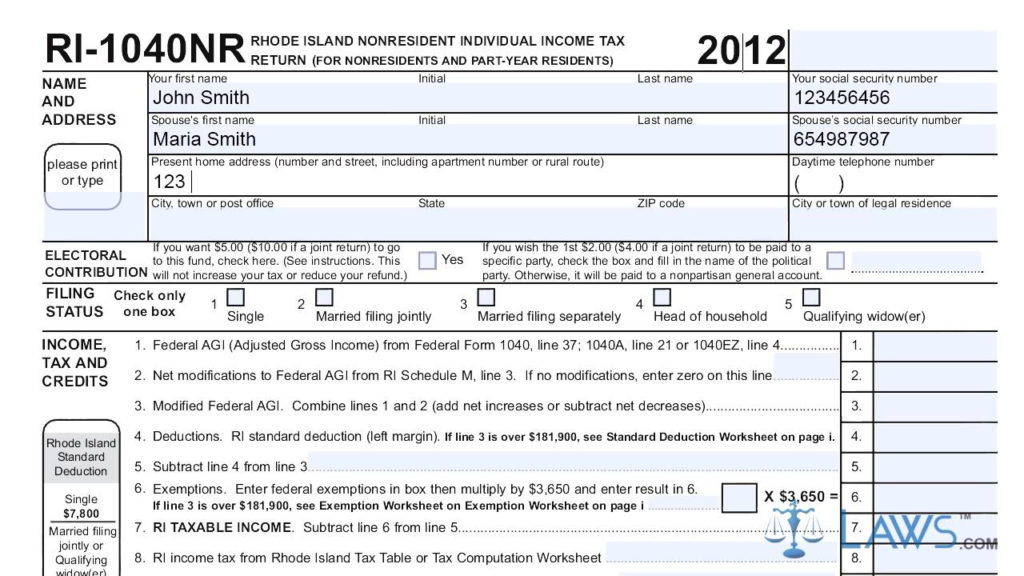

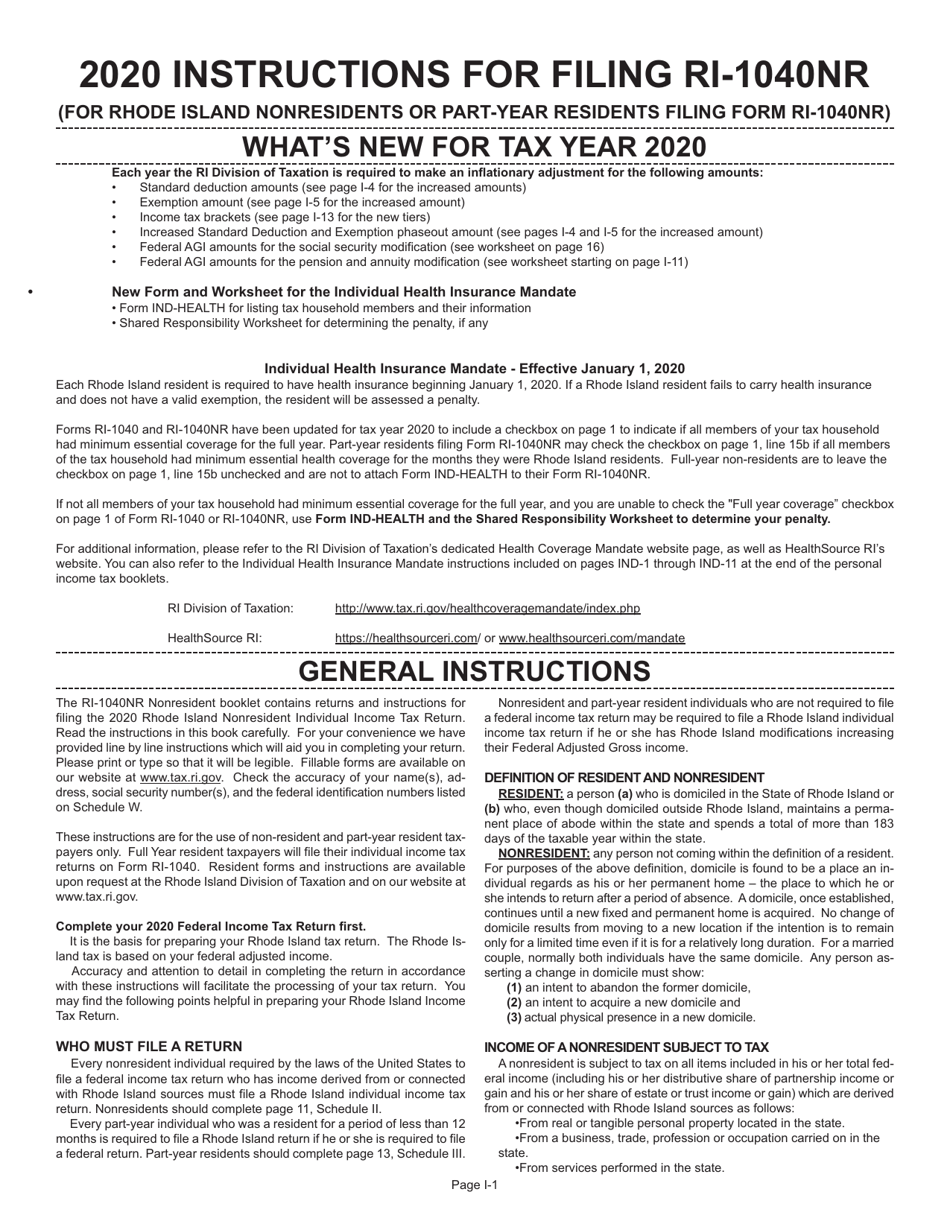

Form Ri 1040nr Nonresident Individual Tax Return 2021 Tax

For more information about the rhode. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in rhode island during calendar year. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. You.

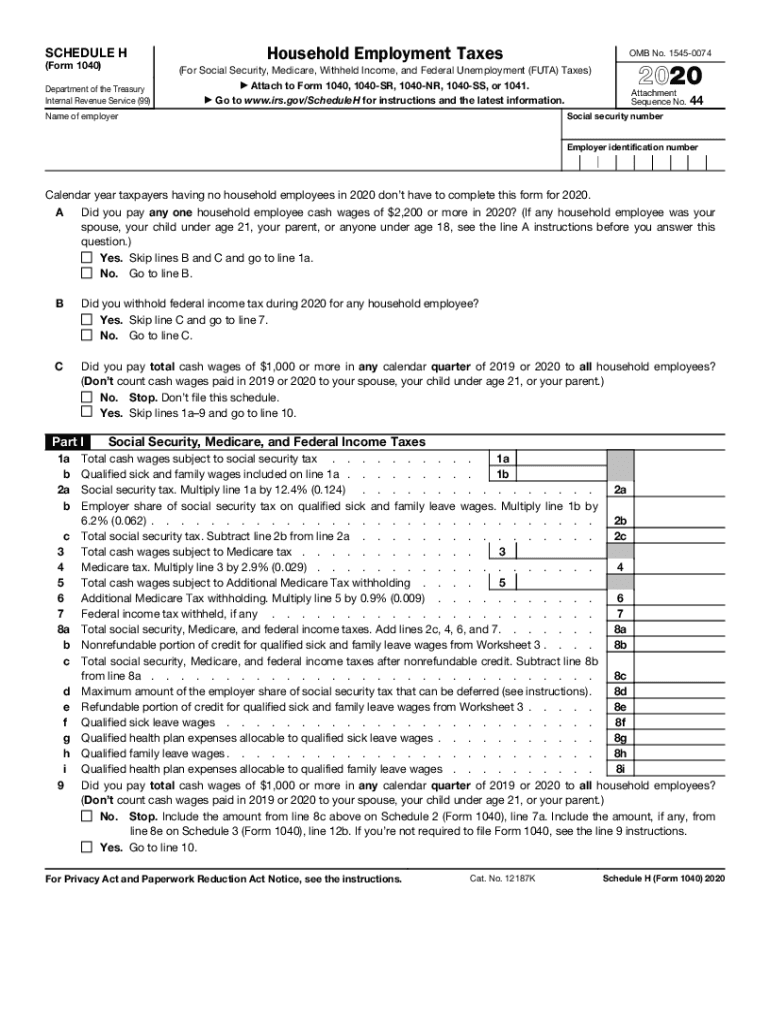

Schedule H Fill Out and Sign Printable PDF Template signNow

Web to have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov; Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in rhode island during calendar year. Those under 65 who are not disabled do not qualify for the credit. Easily fill out pdf blank, edit, and.

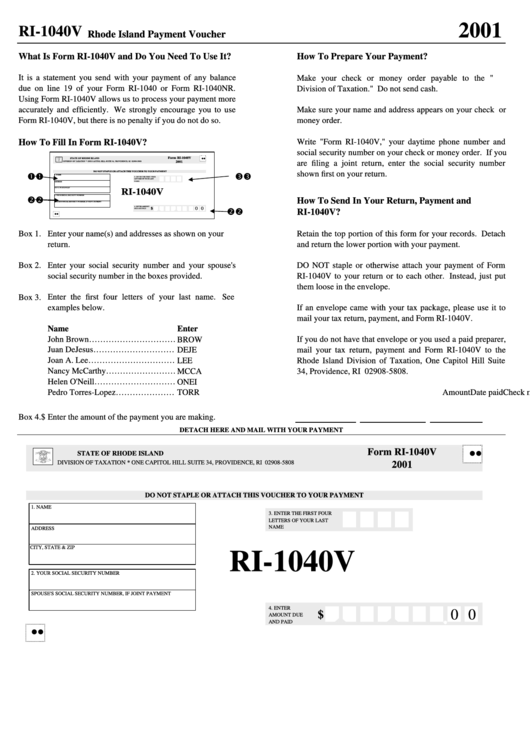

Form Ri1040v Rhode Island Payment Voucher printable pdf download

You can download or print current or. Save or instantly send your ready documents. These 2021 forms and more are available: Web the irs to your rhode island individual income tax return at the time it is submitted. They may have to file.

Download Instructions for Form RI1040NR Nonresident Individual

Web the irs to your rhode island individual income tax return at the time it is submitted. These 2021 forms and more are available: You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Click on the appropriate category below to access the forms and instructions you need:. An extension of time.

Fillable Form Ri1040h Property Tax Relief Claim State Of Rhode

Web we last updated the property tax relief claim in february 2023, so this is the latest version of form 1040h, fully updated for tax year 2022. An extension of time to file form ri. Save or instantly send your ready documents. They may have to file. Web select a different state:

Instructions For Form Ri1040 2012 printable pdf download

Those under 65 who are not disabled do not qualify for the credit. For more information about the rhode. 2019 rhode island employer's income tax withholding tables. Web the irs to your rhode island individual income tax return at the time it is submitted. Web the rhode island tax forms are listed by tax year below and all ri back.

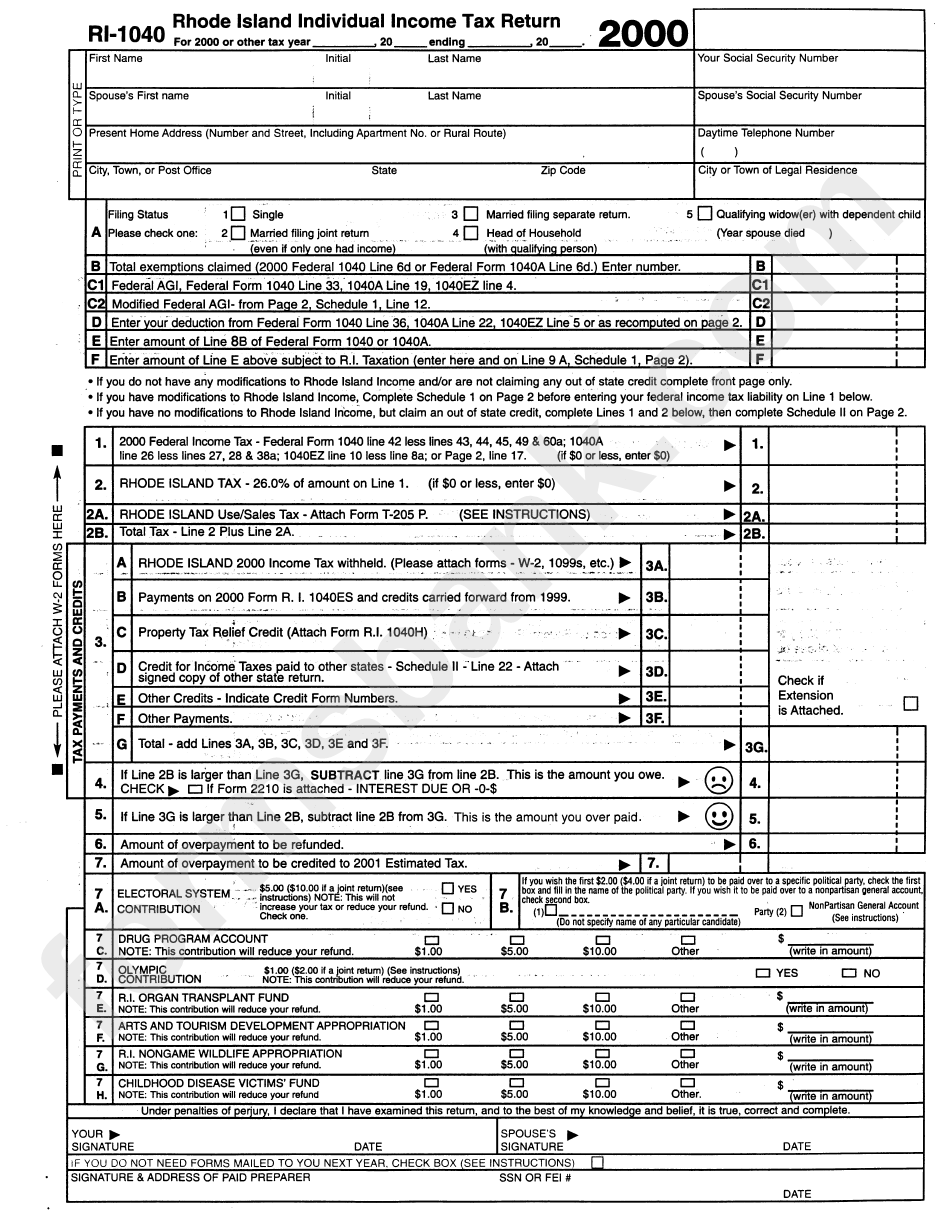

Form Ri1040 Rhode Island Individual Tax Return 2000

Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. Easily fill out pdf blank, edit, and sign them. For more information about the rhode. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal.

Fillable Form Ri1040 Rhode Island Individual Tax Return

For tax year 2021, the property tax relief credit amount increases to $415 from $400. Easily fill out pdf blank, edit, and sign them. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Click on the appropriate category below to access the forms and instructions you need:. Web the irs to.

Fillable Form Ri1040 Rhode Island Resident Individual Tax

You can complete the forms with the help of efile.com. Web to have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov; For tax year 2021, the property tax relief credit amount increases to $415 from $400. We last updated the resident tax return in. These 2021 forms and more are available:

Web These Where To File Addresses Are To Be Used Only By Taxpayers And Tax Professionals Filing Individual Federal Tax Returns In Rhode Island During Calendar Year.

An extension of time to file form ri. They may have to file. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. You can download or print current or.

For Tax Year 2021, The Property Tax Relief Credit Amount Increases To $415 From $400.

These 2021 forms and more are available: Web select a different state: Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them.

We Last Updated The Resident Tax Return In.

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Learn more 2004 instructions for form 1040 (all) p 72 i1040. Web the irs to your rhode island individual income tax return at the time it is submitted. Web to have forms mailed to you, please call 401.574.8970 or email tax.forms@tax.ri.gov;

For More Information About The Rhode.

2019 rhode island employer's income tax withholding tables. You can complete the forms with the help of efile.com. Web we last updated the property tax relief claim in february 2023, so this is the latest version of form 1040h, fully updated for tax year 2022. Click on the appropriate category below to access the forms and instructions you need:.