Rita Form 37 Turbotax

Rita Form 37 Turbotax - Currently, turbo tax (intuit) does not submit forms electronically to rita. At the screen, in the ohio program, titled a few things before we wrap up your state taxes scroll down to ohio city taxes. See the below link, on the left. Web file form 37 by april 18, 2023. Talking about winnings i do not understand what that. It must be printed and mailed. Web quick steps to complete and design form 37 rita online: Extensions of time to file: Use get form or simply click on the template preview to open it in the editor. If you live in ohio and or work in ohio you may need to file this form.

At the screen, in the ohio program, titled a few things before we wrap up your state taxes scroll down to ohio city taxes. Web quick steps to complete and design form 37 rita online: Web the year, you must file a return with rita unless you are eligible to file a declaration of exemption. For the most up to date list of municipalities that rita collects for and their tax. If your estimated tax liability is $200or more, you are required t o makequarterly paymentsof the anticipated tax due. Excess payroll withholding tax (including tax withheld for a person under 18 years of age): If you live in ohio and or work in ohio you may need to file this form. If your estimated tax liability is $200or more, you are required t o makequarterly payments of the anticipated tax due. Web file form 37 by april 15, 2020. If you file after this date, you may be subject to penalties and interest.

Web can i file electronically through turbo tax? Web file form 37 by april 15, 2020. It is not necessary to file a copy of your federal. Currently, turbo tax (intuit) does not submit forms electronically to rita. Web 37 estimated taxes (line 20a): Web 37 estimated taxes (line 20a): Web preparing form 37 requires completing at a minimum two sections and if needed any of up to three schedules and six worksheets. It must be printed and mailed. At the screen, in the ohio program, titled a few things before we wrap up your state taxes scroll down to ohio city taxes. Start completing the fillable fields and.

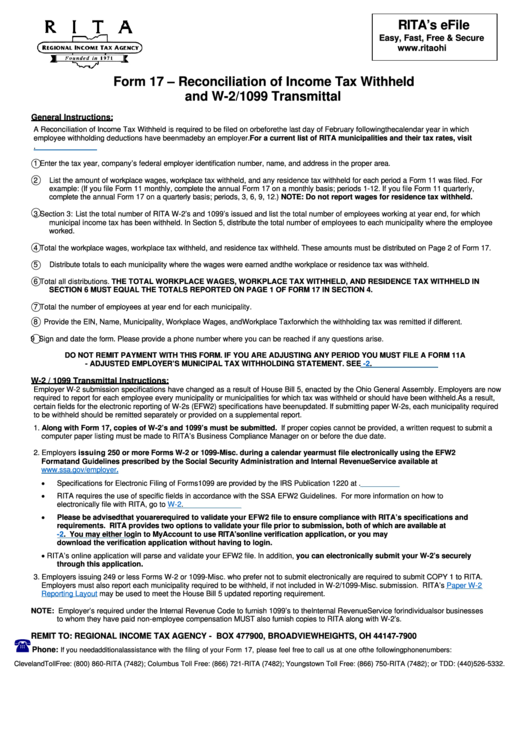

Instructions For Form 17 Reconciliation Of Tax Withheld And W

Web 37 estimated taxes (line 20a): For the most up to date list of municipalities that rita collects for and their tax. If you prepare your rita tax return through turbo tax,. A declaration of exemption form may be filed electronically or downloaded. Web 37 estimated taxes (line 20a):

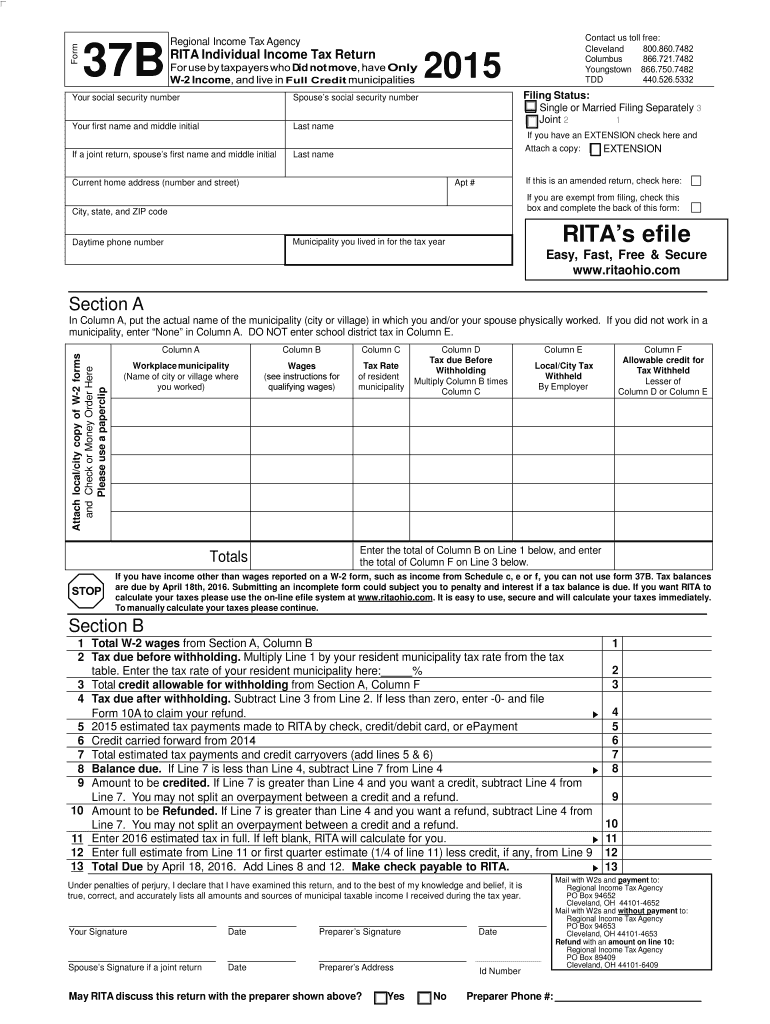

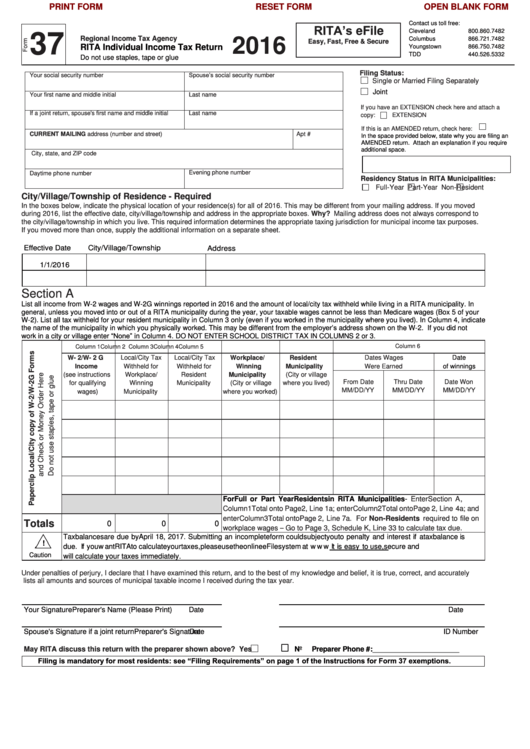

Fillable Form 37 Rita Individual Tax Return Printable Pdf

If you prepare your rita tax return through turbo tax,. Web file form 37 by april 15, 2020. Web this is a form for regional income tax in ohio for ohio city taxes. Web the year, you must file a return with rita unless you are eligible to file a declaration of exemption. If your estimated tax liability is $200or.

Rita Form 27 Fillable Fill Online, Printable, Fillable, Blank pdfFiller

Start completing the fillable fields and. Web file form 37 by april 15, 2020. Web 37 estimated taxes (line 20a): It must be printed and mailed. If you prepare your rita tax return through turbo tax,.

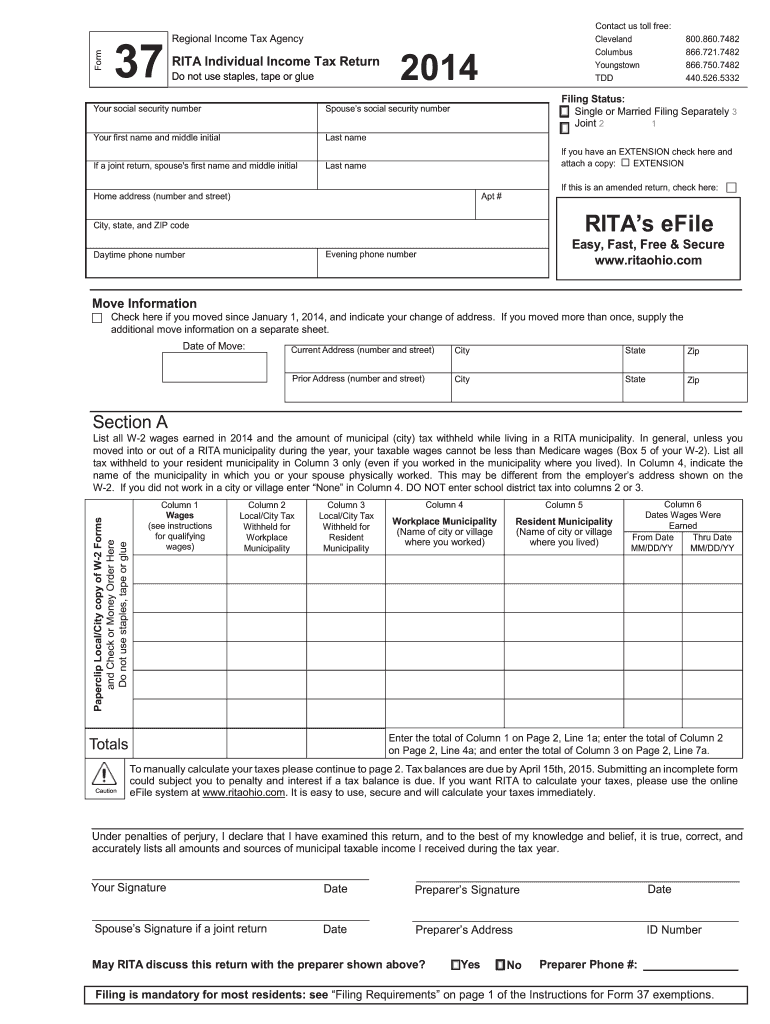

2014 Form OH RITA 37 Fill Online, Printable, Fillable, Blank pdfFiller

Web file form 37 by april 18, 2023. Excess payroll withholding tax (including tax withheld for a person under 18 years of age): Rita will prepare your return for. Web 37 estimated taxes (line 20a): A declaration of exemption form may be filed electronically or downloaded.

Irs form 8962 Turbotax Elegant List the Most Mon Federal Irs Tax forms Co

If you file after this date, you may be subject to penalties and interest. For the most up to date list of municipalities that rita collects for and their tax. Rita will prepare your return for. If your estimated tax liability is $200or more, you are required t o makequarterly payments of the anticipated tax due. If you file after.

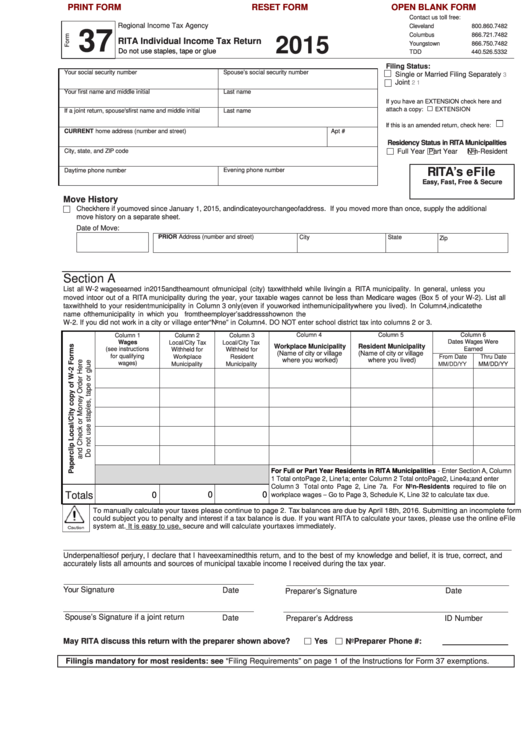

2015 Form OH RITA 37 Fill Online, Printable, Fillable, Blank pdfFiller

Web file form 37 by april 15, 2020. Start completing the fillable fields and. At the screen, in the ohio program, titled a few things before we wrap up your state taxes scroll down to ohio city taxes. Web 37 estimated taxes (line 20a): If you file after this date, you may be subject to penalties and interest.

Fillable Form 37 Rita Individual Tax Return Printable Pdf

Extensions of time to file: If you file after this date, you may be subject to penalties and interest. Web quick steps to complete and design form 37 rita online: Individual municipal income tax return. Talking about winnings i do not understand what that.

Form 37 Download Fillable PDF or Fill Online Rita Individual Tax

Web 37 estimated taxes (line 20a): If your estimated tax liability is $200or more, you are required t o makequarterly payments of the anticipated tax due. Excess payroll withholding tax (including tax withheld for a person under 18 years of age): At the screen, in the ohio program, titled a few things before we wrap up your state taxes scroll.

Extra, extra! Get your RITA forms here

It is not necessary to file a copy of your federal. If you file after this date, you may be subject to penalties and interest. If your estimated tax liability is $200or more, you are required t o makequarterly payments of the anticipated tax due. Rita will prepare your return for. If you live in ohio and or work in.

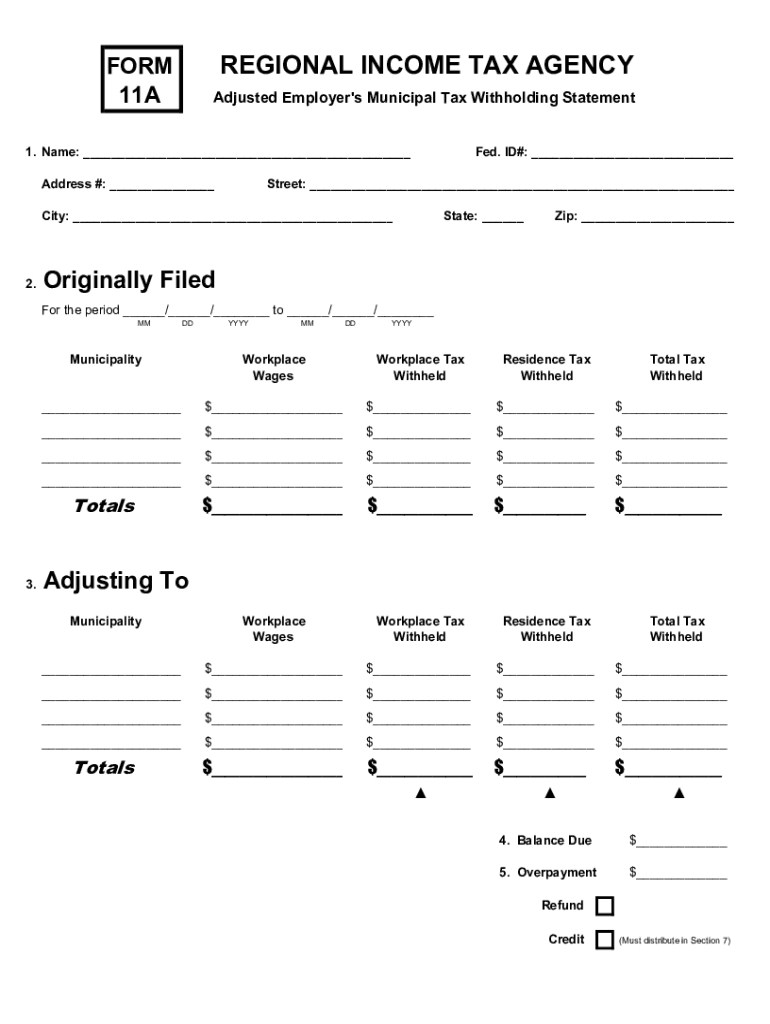

Rita Form 11a Fill Out and Sign Printable PDF Template signNow

For the most up to date list of municipalities that rita collects for and their tax. Use get form or simply click on the template preview to open it in the editor. Web quick steps to complete and design form 37 rita online: Web this is a form for regional income tax in ohio for ohio city taxes. If your.

Web 37 Estimated Taxes (Line 20A):

A declaration of exemption form may be filed electronically or downloaded. Excess payroll withholding tax (including tax withheld for a person under 18 years of age): Extensions of time to file: Rita will prepare your return for.

It Must Be Printed And Mailed.

Use get form or simply click on the template preview to open it in the editor. Web 37 estimated taxes (line 20a): It is not necessary to file a copy of your federal. For the most up to date list of municipalities that rita collects for and their tax.

Start Completing The Fillable Fields And.

Web preparing form 37 requires completing at a minimum two sections and if needed any of up to three schedules and six worksheets. If you file after this date, you may be subject to penalties and interest. Web the year, you must file a return with rita unless you are eligible to file a declaration of exemption. Currently, turbo tax (intuit) does not submit forms electronically to rita.

Web Overpayment Of Estimated Tax Payments:

If you live in ohio and or work in ohio you may need to file this form. Web quick steps to complete and design form 37 rita online: If your estimated tax liability is $200or more, you are required t o makequarterly payments of the anticipated tax due. If your estimated tax liability is $200or more, you are required t o makequarterly paymentsof the anticipated tax due.