Sc Sales Tax Exempt Form

Sc Sales Tax Exempt Form - Web to claim agriculture sales tax exemptions in south carolina, you must have a south carolina agricultural tax exemption (scate) card. A rental, lease, or other form of agreement; Driver's license renewal [pdf] disabled placards and. Log in with your credentials or register. Notary public application [pdf] motor vehicle forms. Taxpayers owing $15,000 or more per month may be mandated to file their. South carolina has recent rate changes. The statewide sales and use tax rate is six percent (6%). Web south carolina supports electronic filing of sales tax returns, which is often much faster than filing via mail. And a transfer of title or possession, or both.

Web for payment, including installment and credit sales; South carolina has recent rate changes. Web what is sales tax? You will need to provide your file number when. Driver's license renewal [pdf] disabled placards and. A license to use or consume; Taxpayers owing $15,000 or more per month may be mandated to file their. And a transfer of title or possession, or both. 8/8/06) 5010 state of south carolina department of revenue resale certificate notice to seller: Web state south carolina department of revenue agricultural exemption certificate for sales and tax (rev.

Log in with your credentials or register. A rental, lease, or other form of agreement; Web to claim agriculture sales tax exemptions in south carolina, you must have a south carolina agricultural tax exemption (scate) card. Web adhere to the instructions below to complete south carolina sales tax exemption certificate online quickly and easily: What you need to apply: Web the state sales tax rate in south carolina is 6.000%. Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies, such as a price cap. Web for payment, including installment and credit sales; A license to use or consume; You will need to provide your file number when.

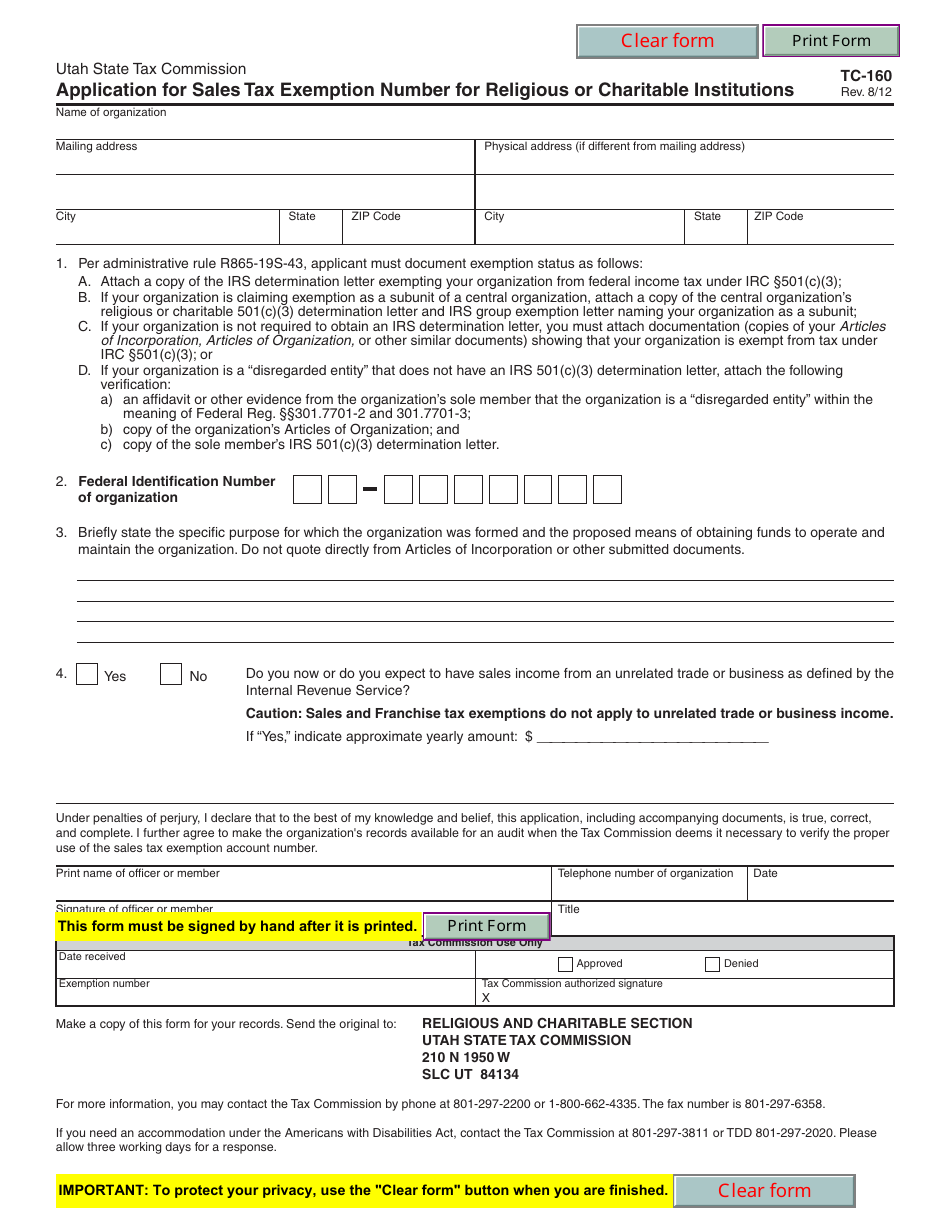

Form TC160 Download Fillable PDF or Fill Online Application for Sales

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south carolina sales. The scdor offers sales & use tax exemptions to qualified taxpayers. Web adhere to the instructions below to complete south carolina sales tax exemption certificate online quickly and easily: Web state south.

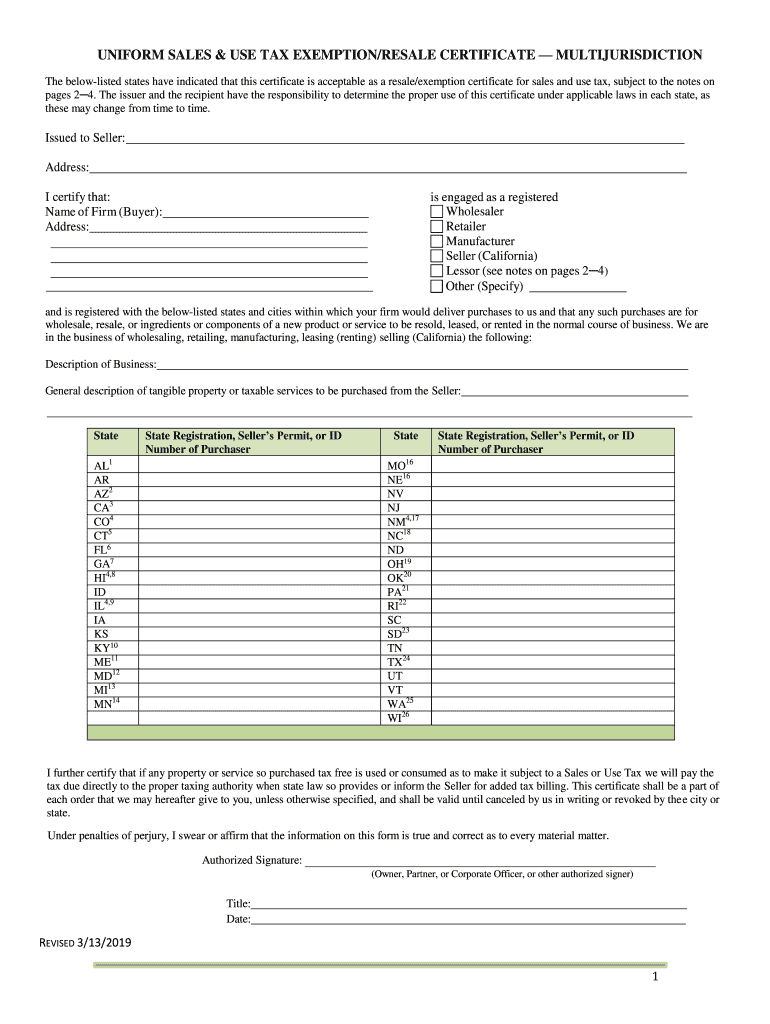

Top 19 Sc Tax Exempt Form Templates free to download in PDF format

A rental, lease, or other form of agreement; South carolina has recent rate changes. You will need to provide your file number when. Web south carolina supports electronic filing of sales tax returns, which is often much faster than filing via mail. Web to claim agriculture sales tax exemptions in south carolina, you must have a south carolina agricultural tax.

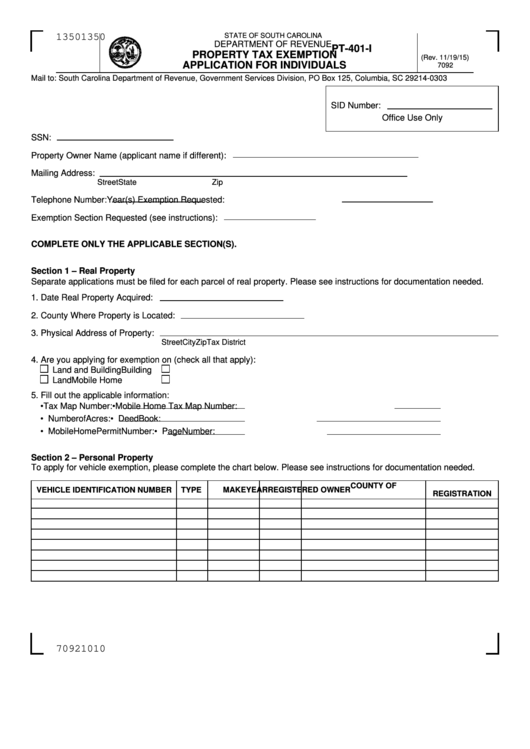

2008 Form SC ST10 Fill Online, Printable, Fillable, Blank pdfFiller

The statewide sales and use tax rate is six percent (6%). And a transfer of title or possession, or both. Log in to your account. Web to claim agriculture sales tax exemptions in south carolina, you must have a south carolina agricultural tax exemption (scate) card. With local taxes, the total sales tax rate is between 6.000% and 9.000%.

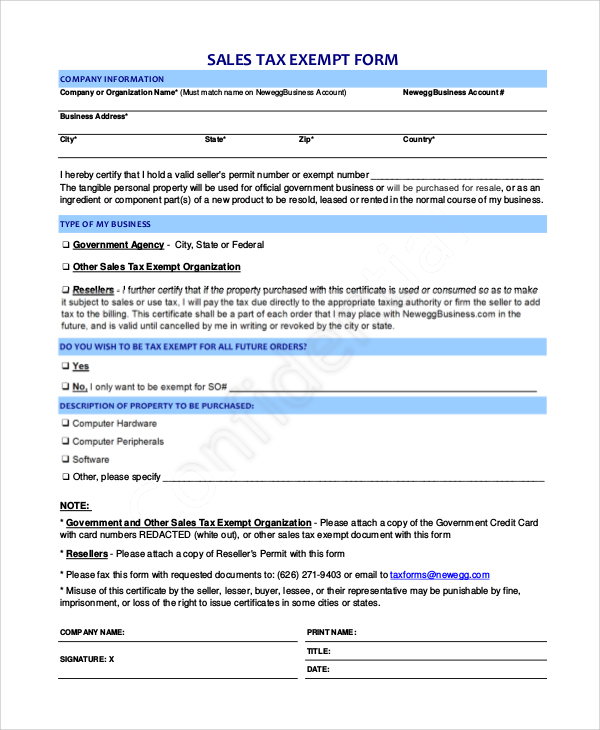

Tax Exempt Forms San Patricio Electric Cooperative

7/12/10) 5075 this exemption certificate. Web vehicles more south carolina agricultural exemption certificate a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making. Log in with your credentials or register. South carolina has recent rate changes. Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further.

Tax Exempt Certificate Form Fill Out and Sign Printable PDF Template

Web applying for a sales & use tax exemption. You will need to provide your file number when. With local taxes, the total sales tax rate is between 6.000% and 9.000%. A rental, lease, or other form of agreement; And a transfer of title or possession, or both.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

7/12/10) 5075 this exemption certificate. 7/2/07) 5009 schedule of exemptions found at chapter 36 of title 12 of the code of laws of south carolina 1976,. The statewide sales and use tax rate is six percent (6%). And a transfer of title or possession, or both. Web the south carolina department of revenue (scdor) no longer accepts paper copies of.

FREE 10+ Sample Tax Exemption Forms in PDF

And a transfer of title or possession, or both. 7/12/10) 5075 this exemption certificate. Log in to your account. Web to claim agriculture sales tax exemptions in south carolina, you must have a south carolina agricultural tax exemption (scate) card. Notary public application [pdf] motor vehicle forms.

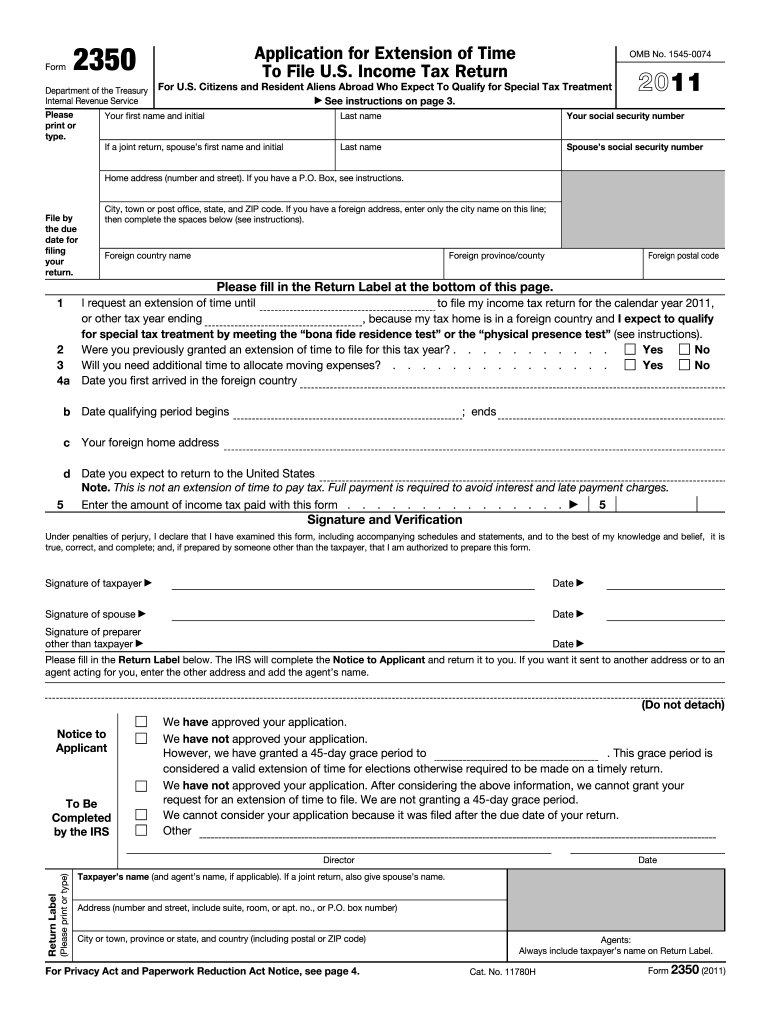

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

Driver's license renewal [pdf] disabled placards and. Taxpayers owing $15,000 or more per month may be mandated to file their. You will need to provide your file number when. 7/12/10) 5075 this exemption certificate. Web what is sales tax?

FREE 10+ Sample Tax Exemption Forms in PDF

Driver's license renewal [pdf] disabled placards and. Web tax and legal forms. A license to use or consume; Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies, such as a price cap. Web what is sales tax?

20162021 Form SC ST8 Fill Online, Printable, Fillable, Blank pdfFiller

South carolina has recent rate changes. 8/8/06) 5010 state of south carolina department of revenue resale certificate notice to seller: Web adhere to the instructions below to complete south carolina sales tax exemption certificate online quickly and easily: Web exempt prepared food 11% prescription drugs exempt otc drugs these categories may have some further qualifications before the special rate applies,.

You Will Need To Provide Your File Number When.

South carolina has recent rate changes. Web vehicles more south carolina agricultural exemption certificate a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making. Log in to your account. Web adhere to the instructions below to complete south carolina sales tax exemption certificate online quickly and easily:

The Scdor Offers Sales & Use Tax Exemptions To Qualified Taxpayers.

Log in with your credentials or register. The statewide sales and use tax rate is six percent (6%). Web to claim agriculture sales tax exemptions in south carolina, you must have a south carolina agricultural tax exemption (scate) card. Web the state sales tax rate in south carolina is 6.000%.

Web Exempt Prepared Food 11% Prescription Drugs Exempt Otc Drugs These Categories May Have Some Further Qualifications Before The Special Rate Applies, Such As A Price Cap.

What you need to apply: 7/2/07) 5009 schedule of exemptions found at chapter 36 of title 12 of the code of laws of south carolina 1976,. Notary public application [pdf] motor vehicle forms. A rental, lease, or other form of agreement;

With Local Taxes, The Total Sales Tax Rate Is Between 6.000% And 9.000%.

Web for payment, including installment and credit sales; Web state south carolina department of revenue agricultural exemption certificate for sales and tax (rev. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south carolina sales. Sales tax is imposed on the sale of goods and certain services in south carolina.