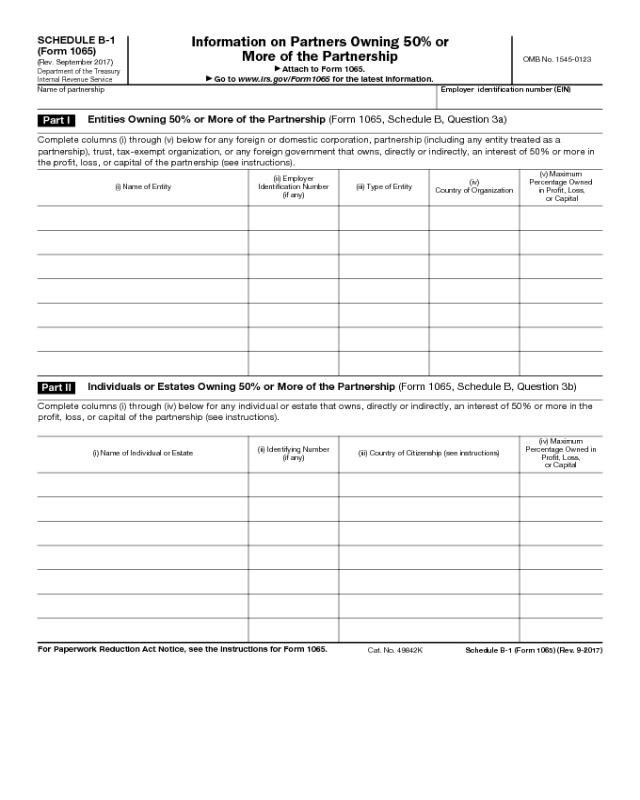

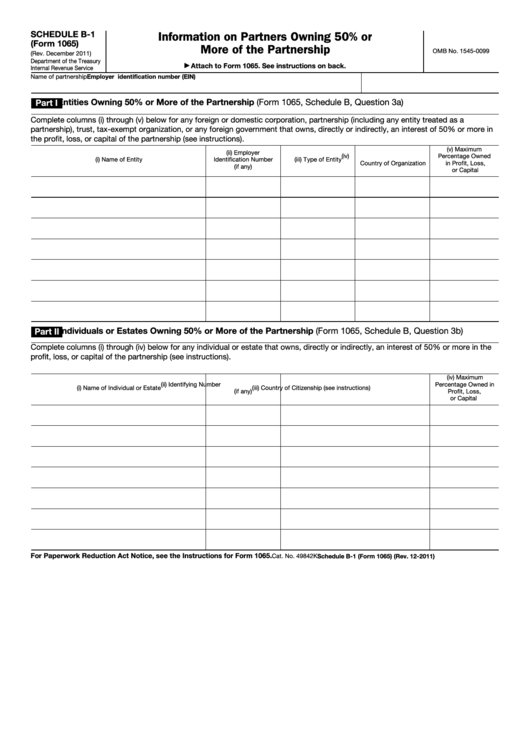

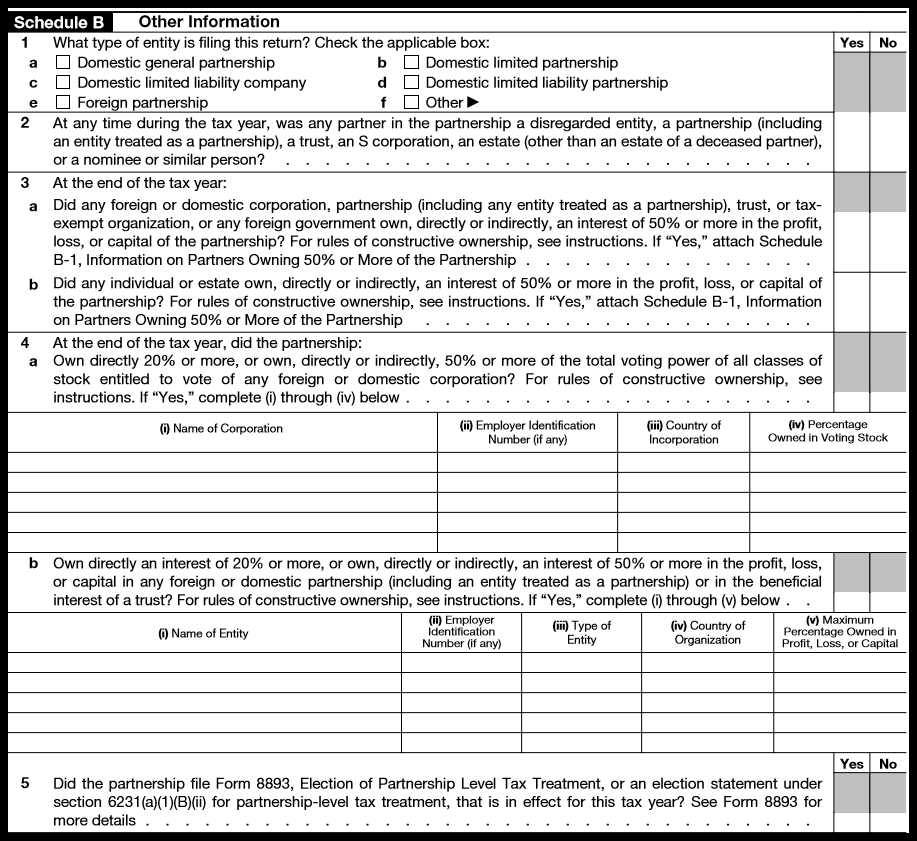

Schedule B-1 Form 1065

Schedule B-1 Form 1065 - Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). The greater of the profit, loss, or capital percentage at the end of. Total assets (see instructions) $ g. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions. Web schedule b reports the interest and dividend income you receive during the tax year. Web form 1065, u.s. However, you don’t need to attach a schedule b every year you earn interest. From within your taxact return ( online or desktop), click federal. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions. The new audit regime applies to all partnerships. The greater of the profit, loss, or capital percentage at the end of. This code will let you know if you should. Web schedule b reports the interest and dividend income you receive during the tax year. Web a 1065 form is the annual us tax return filed by partnerships. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. However, you don’t need to attach a schedule b every year you earn interest. Web to select your partnership entity type within taxact ® 1065: Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

Web intuit help intuit input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries. Total assets (see instructions) $ g. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. However, you don’t need to attach a schedule b every year you earn interest. Web form 1065, u.s. From within your taxact return ( online or desktop), click federal. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions. The new audit regime applies to all partnerships. Return of partnership income, schedule b instructions to form 1065,. Web a 1065 form is the annual us tax return filed by partnerships.

How to fill out an LLC 1065 IRS Tax form

Web to select your partnership entity type within taxact ® 1065: Web schedule b reports the interest and dividend income you receive during the tax year. Return of partnership income, schedule b instructions to form 1065, u.s. Web form 1065, u.s. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

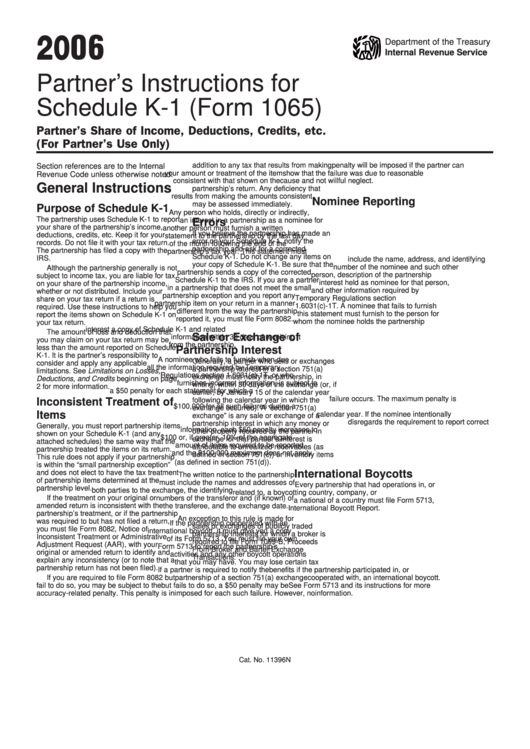

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Total assets (see instructions) $ g. Web to select your partnership entity type within taxact ® 1065: It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Return of partnership income, schedule b instructions to form 1065, u.s. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

How to fill out a 1065 tax form hohpaken

This code will let you know if you should. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. The greater of the profit, loss, or capital percentage at the end of. Total assets (see instructions) $ g. Web entering form 1065, schedule b in proconnect.

Publication 541 Partnerships; Form 1065 Example

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago.

Form 1065 Schedule B1 Edit, Fill, Sign Online Handypdf

This code will let you know if you should. The new audit regime applies to all partnerships. Web schedule b reports the interest and dividend income you receive during the tax year. Total assets (see instructions) $ g. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

IRS 1065 Schedule K1 2020 Fill out Tax Template Online US Legal

Total assets (see instructions) $ g. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. From within your taxact return ( online or desktop), click federal. The greater of the profit, loss, or capital percentage at the end of. Ad file partnership and llc form.

Fillable Schedule B1 (Form 1065) Information On Partners Owning 50

The new audit regime applies to all partnerships. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Solved•by intuit•7•updated august 05, 2022. Web schedule b reports the interest and dividend income you receive during the tax.

How To Complete Form 1065 US Return of Partnership

This code will let you know if you should. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. The greater of the profit, loss, or capital percentage at the end of. Web the new audit regime replaces the consolidated audit proceedings under the tax equity.

How to fill out an LLC 1065 IRS Tax form

Return of partnership income, schedule b instructions to form 1065,. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Web intuit help intuit input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries..

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web schedule b reports the interest and dividend income you receive during the tax year. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web a 1065 form is the annual us tax return filed by partnerships. Total assets.

Web To Select Your Partnership Entity Type Within Taxact ® 1065:

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income, schedule b instructions to form 1065,. Web schedule b reports the interest and dividend income you receive during the tax year. However, you don’t need to attach a schedule b every year you earn interest.

Web The Partnership Should Use This Code To Report Your Share Of Income/Gain That Comes From Your Total Net Section 743 (B) Basis Adjustments.

Web intuit help intuit input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Total assets (see instructions) $ g. This code will let you know if you should.

Web A 1065 Form Is The Annual Us Tax Return Filed By Partnerships.

The new audit regime applies to all partnerships. Solved•by intuit•7•updated august 05, 2022. Web form 1065, u.s. From within your taxact return ( online or desktop), click federal.

Web Entering Form 1065, Schedule B In Proconnect Tax Solved • By Intuit • 1 • Updated 1 Year Ago Proconnect Tax Will Automatically Fill Out Many Of The Schedule B Questions.

The greater of the profit, loss, or capital percentage at the end of. Return of partnership income, schedule b instructions to form 1065, u.s. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra).

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/word-image-743.png)