Schedule G Form 990

Schedule G Form 990 - Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. If you checked 12d of part i, complete sections a and d, and complete part v.). Web supplemental information regarding fundraising or gaming activities. (form 990) g complete if the. (column (b) must equal form 990, part x, col. Web glossary of the instructions for form 990. Web so the 990 schedule g the first piece has a section about fundraising activities and this is for if you are saying yep, we had professional fundraising expenses,. Get ready for tax season deadlines by completing any required tax forms today. Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total.

(column (b) must equal form 990, part x, col. Complete, edit or print tax forms instantly. Web so the 990 schedule g the first piece has a section about fundraising activities and this is for if you are saying yep, we had professional fundraising expenses,. Organizations that report more than $15,000 of expenses for. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than $15,000 of. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Fill in all needed fields in your document using our professional. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web schedule e (form 990).

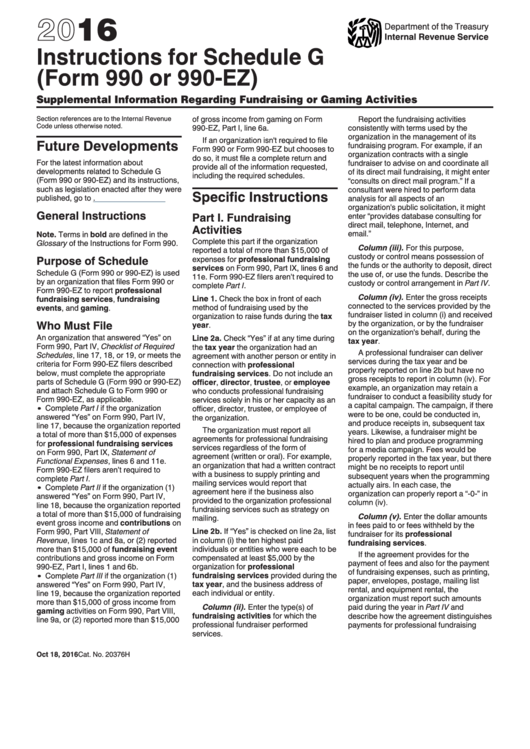

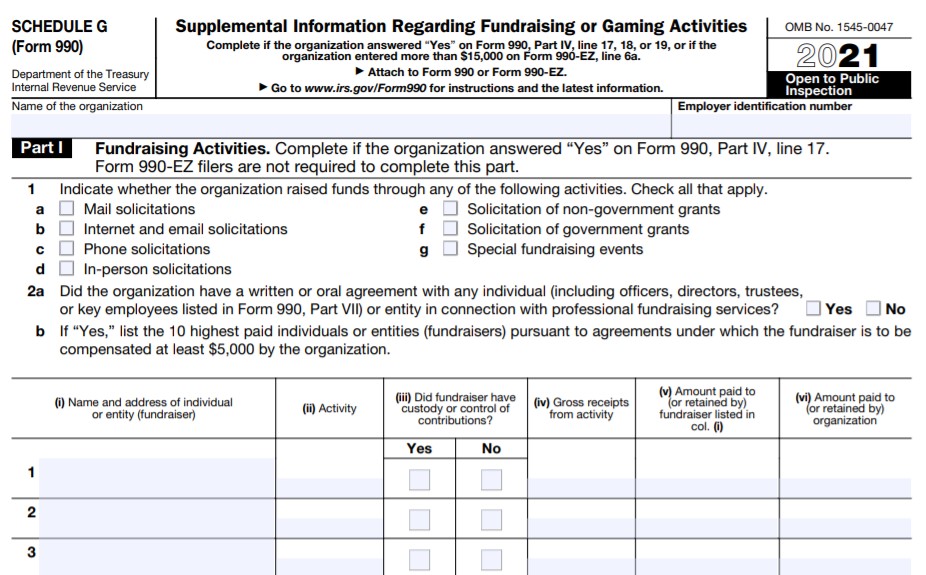

Web schedule g (form 990) 2022 part ii 2 fundraising events. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. (part 3 of 3) published jun 18, 2014 for the strong who survived the. If you checked 12d of part i, complete sections a and d, and complete part v.). Web supplemental information regarding fundraising or gaming activities. Web for tax purposes, an event can only be reportable on schedule g if there is a “quid pro quo,” which is latin for “what for what” or “something for something.” as such, this means. Rate (4.8 / 5) 76 votes. Fill in all needed fields in your document using our professional. Web form 990 series: (form 990) g complete if the.

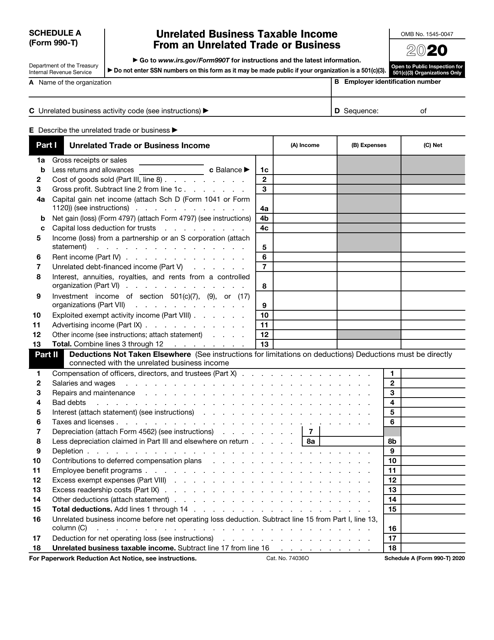

IRS Form 990T Schedule A Download Fillable PDF or Fill Online

Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. (part 3 of 3) published jun 18, 2014 for the strong who survived the. Web so the 990 schedule g the first piece has a section about fundraising activities and this is for if you are saying yep, we had professional fundraising expenses,..

form 990 schedule m instructions 2017 Fill Online, Printable

Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web schedule e (form 990). Fill in all needed fields in your document using our professional. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today.

Electronic IRS Form 990 (Schedule K) 2018 2019 Printable PDF Sample

Get ready for tax season deadlines by completing any required tax forms today. (column (b) must equal form 990, part x, col. If you checked 12d of part i, complete sections a and d, and complete part v.). Web schedule g reporting after determining which events meet the irs definition of a fundraising event, organizations will need to gather the.

IRS Form 990 (Schedule J) 2018 2019 Fill out and Edit Online PDF

(form 990) g complete if the. Web so the 990 schedule g the first piece has a section about fundraising activities and this is for if you are saying yep, we had professional fundraising expenses,. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Complete if the organization answered “yes” to form 990, part iv,.

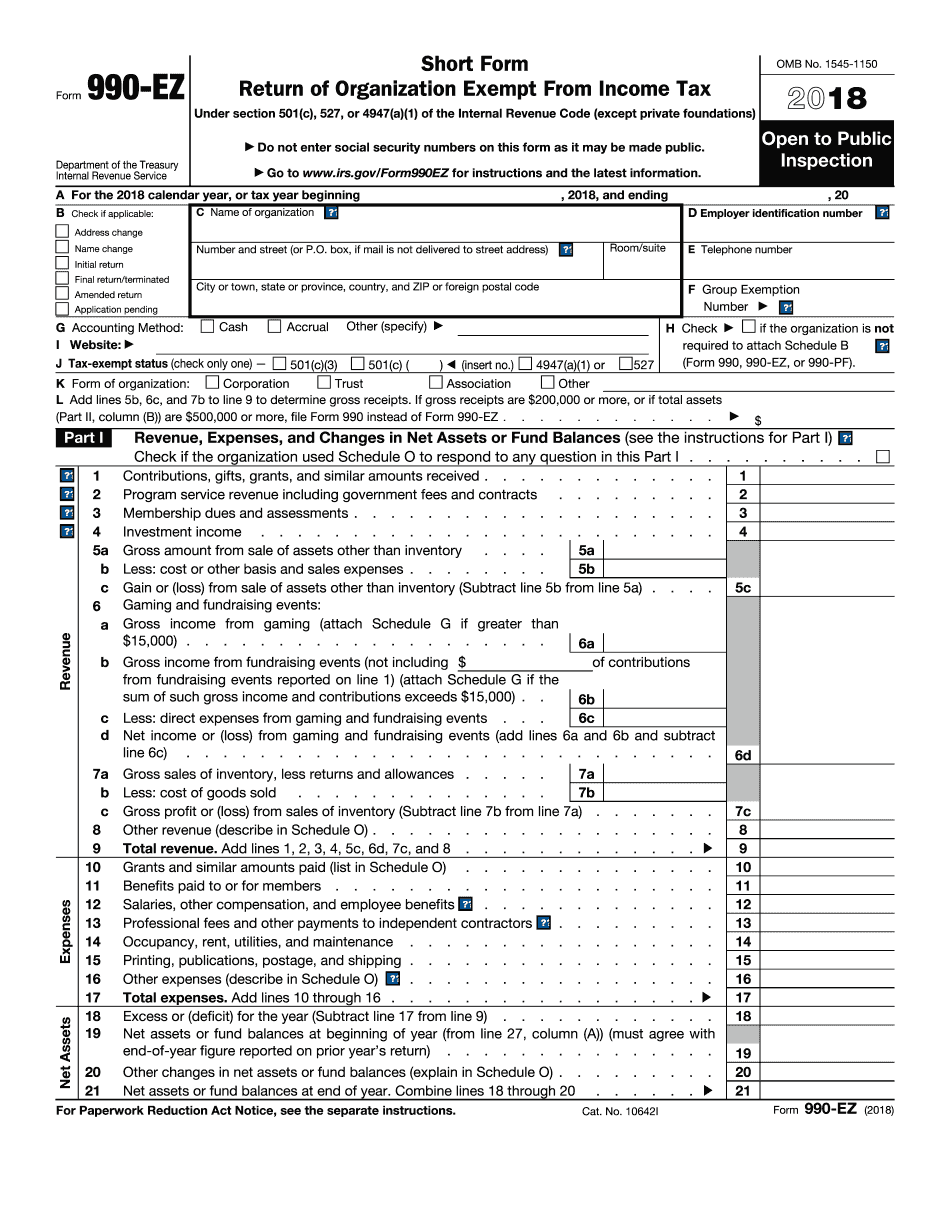

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

(form 990) g complete if the. Web schedule g reporting after determining which events meet the irs definition of a fundraising event, organizations will need to gather the financial. Complete if the organization answered “yes” to form 990, part iv, line 18, or reported more than. Rate (4.8 / 5) 76 votes. Web schedule d (form 990) 2022 schedule d.

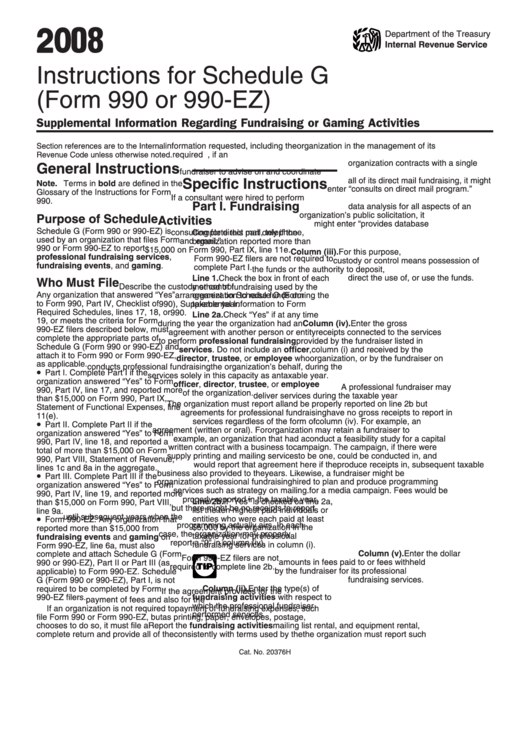

2008 Instructions For Schedule G (Form 990 Or 990Ez) printable pdf

Select the button get form to open it and start modifying. Web so the 990 schedule g the first piece has a section about fundraising activities and this is for if you are saying yep, we had professional fundraising expenses,. Web for paperwork reduction act notice, see the instructions for form 990. Complete if the organization answered “yes” on form.

schedule g form 990 2021 Fill Online, Printable, Fillable Blank

Ad get ready for tax season deadlines by completing any required tax forms today. Web schedule g (form 990) 2022 part ii 2 fundraising events. Complete if the organization answered “yes” to form 990, part iv, line 18, or reported more than. Web glossary of the instructions for form 990. Web schedule a (form 990) 2022 explain in explain in.

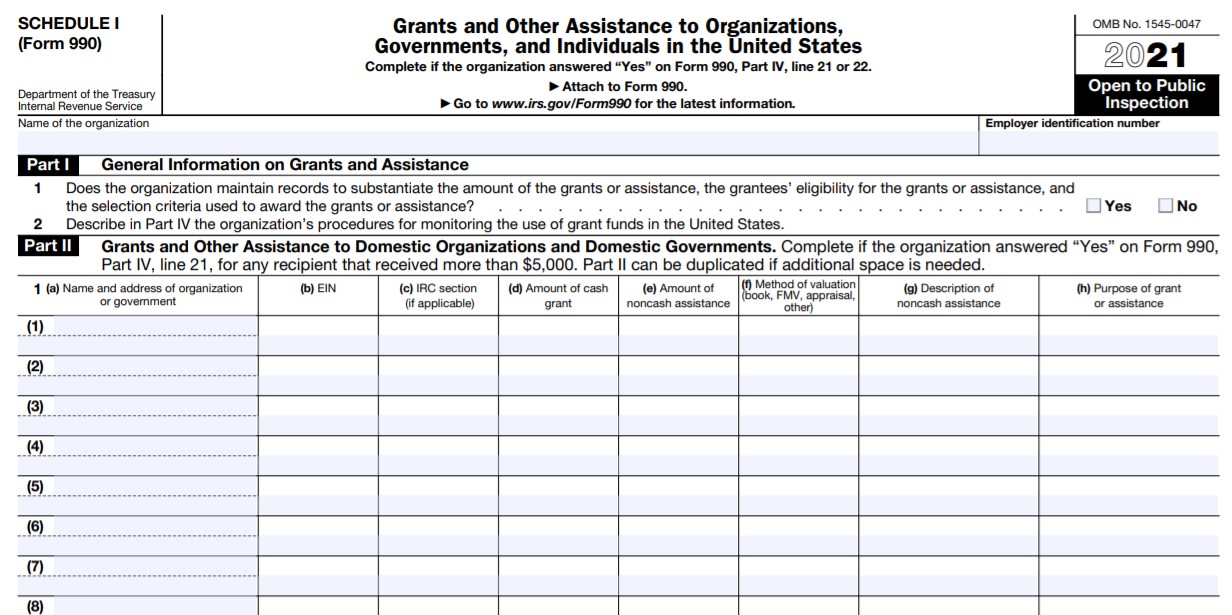

IRS Form 990 Schedule I Instructions Grants & Other Assistance

(part 3 of 3) published jun 18, 2014 for the strong who survived the. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than $15,000 of. Web glossary of the instructions for form 990. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Web schedule.

Instructions For Schedule G (Form 990 Or 990Ez) Supplemental

Web so the 990 schedule g the first piece has a section about fundraising activities and this is for if you are saying yep, we had professional fundraising expenses,. Get ready for tax season deadlines by completing any required tax forms today. (form 990) g complete if the. Complete if the organization answered “yes” to form 990, part iv, line.

What Is Form 990 U1bt Bzd7ectqm / The form 990 is the annual

Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Fill in all needed fields in your document using our professional. Organizations that report more than $15,000 of expenses for. Complete if the organization answered.

(Form 990) G Complete If The.

Web schedule a (form 990) 2022 explain in explain in detail in schedule a (form 990) 2022 page check here if the organization satisfied the integral part test as a qualifying trust. Web supplemental information regarding fundraising or gaming activities. Web form 990 series: Web so the 990 schedule g the first piece has a section about fundraising activities and this is for if you are saying yep, we had professional fundraising expenses,.

Web Form 990 (2022) Page 5 Part V Statements Regarding Other Irs Filings And Tax Compliance (Continued) Yes No 2A Enter The Number Of Employees Reported On Form W.

(part 3 of 3) published jun 18, 2014 for the strong who survived the. Web organizations that file form 990 should include schedule g if they have answered “yes” on form 990, part iv, checklist of required schedules, lines 17, 18, or 19. Web for paperwork reduction act notice, see the instructions for form 990. Complete if the organization answered “yes” to form 990, part iv, line 18, or reported more than.

Rate (4.8 / 5) 76 Votes.

Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Web for tax purposes, an event can only be reportable on schedule g if there is a “quid pro quo,” which is latin for “what for what” or “something for something.” as such, this means. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

(Column (B) Must Equal Form 990, Part X, Col.

Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than $15,000 of. Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Web schedule g (form 990) 2022 part ii 2 fundraising events.