Schedule Q Form 5471

Schedule Q Form 5471 - January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web separate schedule (s) q (form 5471) are required to be filed only by category 4, 5a, and 5b filers. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. For instructions and the latest information. Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income group to the u.s. Web instructions for form 5471(rev. December 2022) cfc income by cfc income groups. Web schedule p.36 schedule q.37 schedule r.40 future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Web schedule q (form 5471) (december 2020) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. But first, i want to put in a plug for the form 5471 instructions, which is full of instructive information.

For instructions and the latest information. Whether or not a cfc shareholder is required to complete schedule j depends on what category of filer he or she can be classified as. What’s new on form 5471 and separate schedules, in Web schedule q (form 5471) (rev. You can find it on our website at irs.gov. Department of the treasury internal revenue service. Web separate schedule (s) q (form 5471) are required to be filed only by category 4, 5a, and 5b filers. Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income group to the u.s. Web instructions for form 5471(rev. Web schedule q is just one schedule of the form 5471.

Web instructions for form 5471(rev. Web schedule q (form 5471) (rev. Shareholders can use it to properly complete form 1118… The december 2020 revision of separate schedules j, p, and r; Web instructions for form 5471(rev. December 2022) cfc income by cfc income groups. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; What’s new on form 5471 and separate schedules, in Department of the treasury internal revenue service. Web schedule p.36 schedule q.37 schedule r.40 future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471.

A Brief Introduction to the Brand New Schedule Q and Schedule R for IRS

It is not required to be filed by category 1a or 1b filers. Shareholders of the cfc so that the u.s. And the december 2012 revision of separate schedule o.) Whether or not a cfc shareholder is required to complete schedule j depends on what category of filer he or she can be classified as. You can find it on.

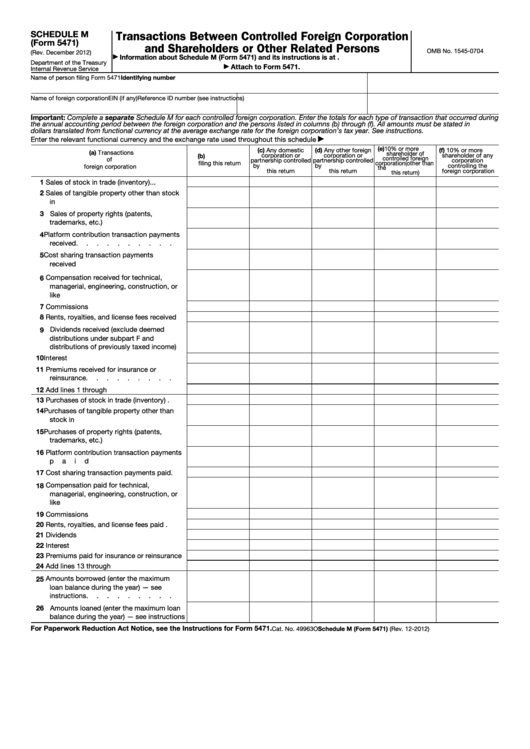

Fillable Schedule M (Form 5471) Transactions Between Controlled

What’s new on form 5471 and separate schedules, in Name of person filing form 5471. It is not required to be filed by category 1a or 1b filers. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. Department of the treasury internal revenue service.

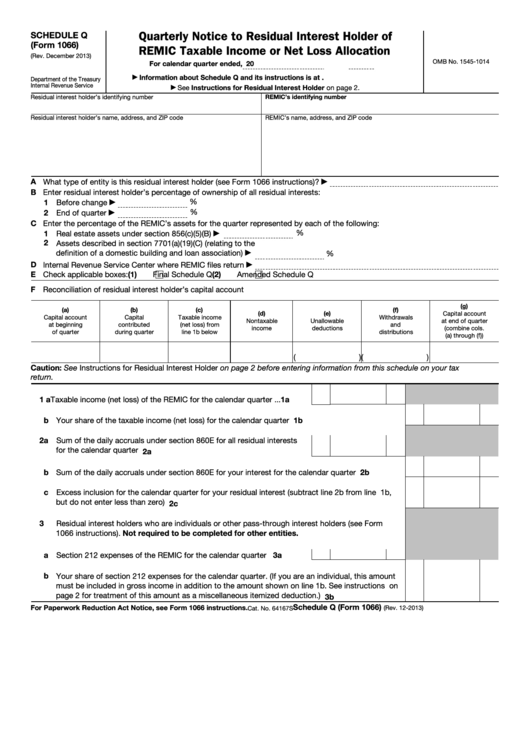

Fillable Schedule Q (Form 1066) Quarterly Notice To Residual Interest

On page 5 of the instructions for form 5471, footnote 1 in the table entitled filing requirements for categories of filers does not apply to category 5b filers who are required to. Web schedule q (form 5471) (december 2020) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Web schedule p.36 schedule.

Schedule Q CFC by Groups IRS Form 5471 YouTube

December 2022) cfc income by cfc income groups. And the december 2012 revision of separate schedule o.) Shareholders can use it to properly complete form 1118… The december 2020 revision of separate schedules j, p, and r; It is not required to be filed by category 1a or 1b filers.

Form 5471 Schedule J Instructions cloudshareinfo

Web separate schedule (s) q (form 5471) are required to be filed only by category 4, 5a, and 5b filers. Shareholders of the cfc so that the u.s. Let's quickly review these three categories. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. For purposes of form 5471, cfc shareholders are.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Let's quickly review these three categories. Whether or not a cfc shareholder is required to complete schedule j depends on what category of filer he or she can be classified as. For purposes of form 5471, cfc shareholders are broken down by the following categories: Web schedule q is just one schedule of the form 5471. What’s new on form.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

December 2022) cfc income by cfc income groups. Go to www.irs.gov/form5471 for instructions and the latest information. But first, i want to put in a plug for the form 5471 instructions, which is full of instructive information. Web instructions for form 5471(rev. Department of the treasury internal revenue service.

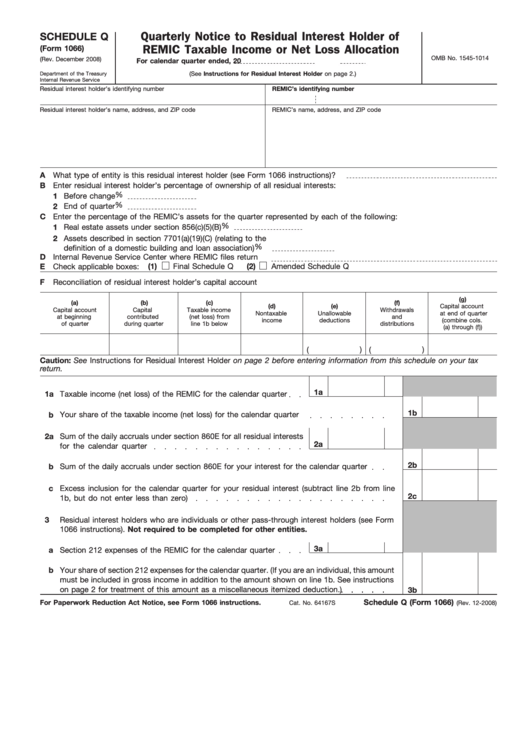

Fillable Schedule Q (Form 1066) Quarterly Notice To Residual Interest

Department of the treasury internal revenue service. Web schedule q (form 5471) (rev. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. On page 5 of the instructions for form 5471, footnote 1 in the table entitled filing requirements for categories of filers does not apply to category 5b filers who.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Web instructions for form 5471(rev. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Department of the treasury internal revenue service. Let's quickly review these three categories. You can find it on our website at irs.gov.

The Tax Times IRS Issues Updated New Form 5471 What's New?

The december 2020 revision of separate schedules j, p, and r; Shareholders can use it to properly complete form 1118… Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income group to the u.s. Name of person filing form 5471..

You Can Find It On Our Website At Irs.gov.

Department of the treasury internal revenue service. But first, i want to put in a plug for the form 5471 instructions, which is full of instructive information. Web schedule p.36 schedule q.37 schedule r.40 future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Name of person filing form 5471.

Web Schedule Q Is Just One Schedule Of The Form 5471.

Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income group to the u.s. Web instructions for form 5471(rev. The december 2018 revision of schedule m; Web schedule q (form 5471) (december 2020) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471.

It Is Not Required To Be Filed By Category 1A Or 1B Filers.

December 2022) cfc income by cfc income groups. Shareholders of the cfc so that the u.s. Go to www.irs.gov/form5471 for instructions and the latest information. The december 2020 revision of separate schedules j, p, and r;

And The December 2012 Revision Of Separate Schedule O.)

Shareholders can use it to properly complete form 1118… Web schedule q (form 5471) (rev. For instructions and the latest information. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r;