Secured Promissory Note Template

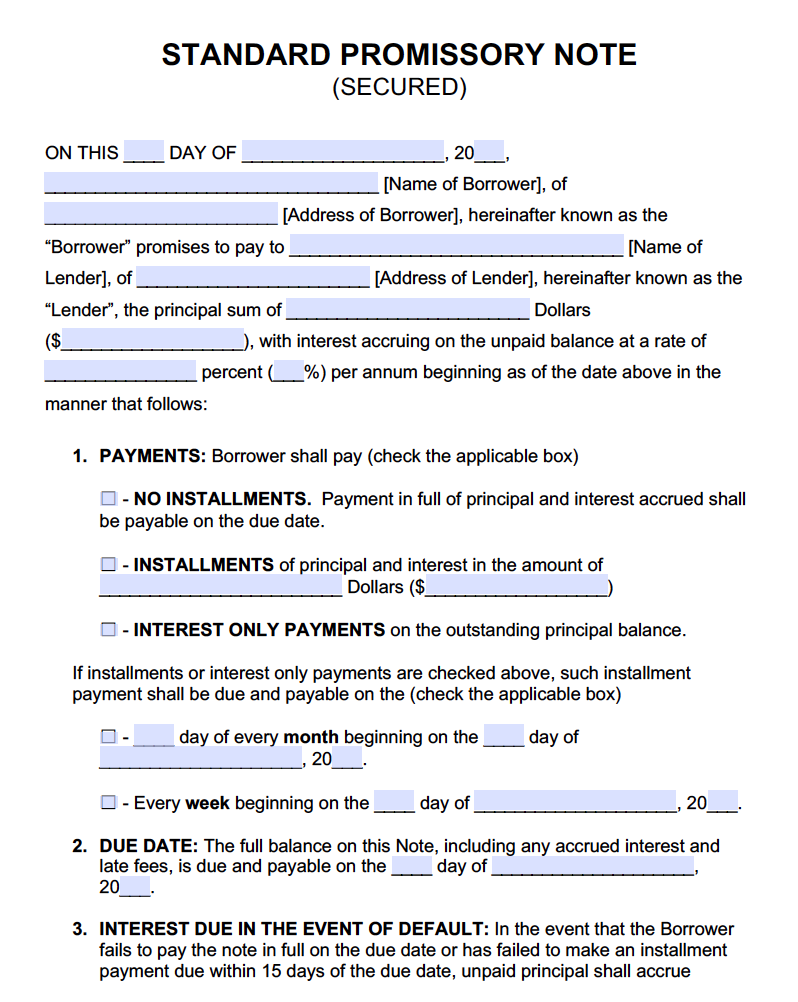

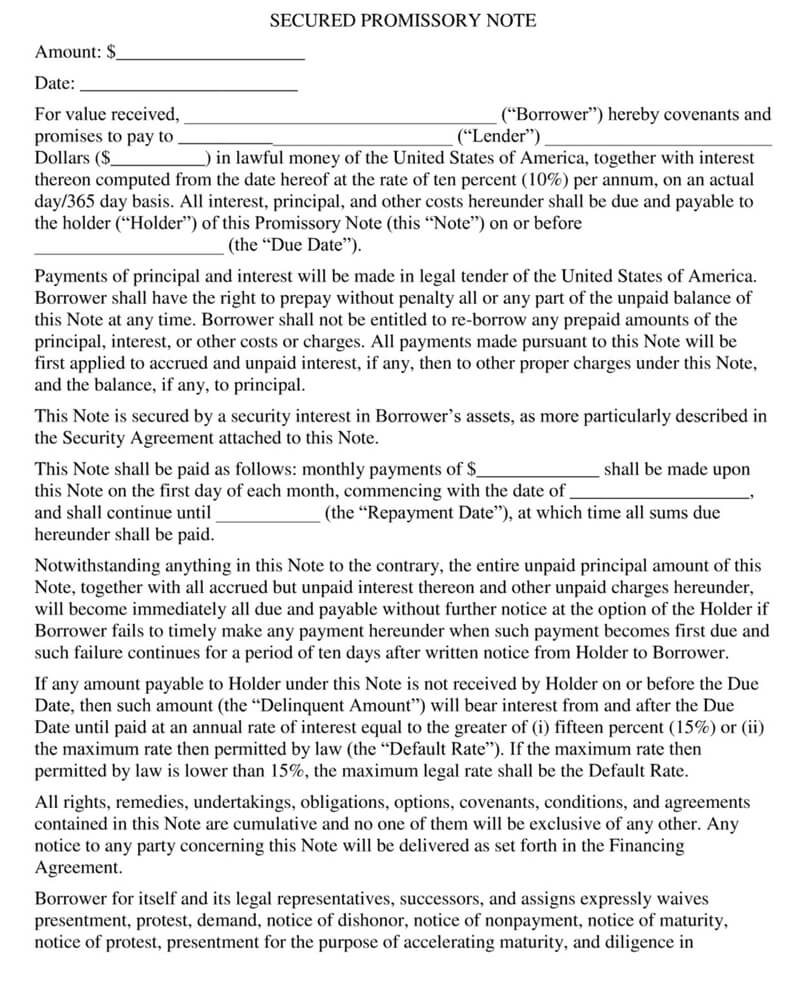

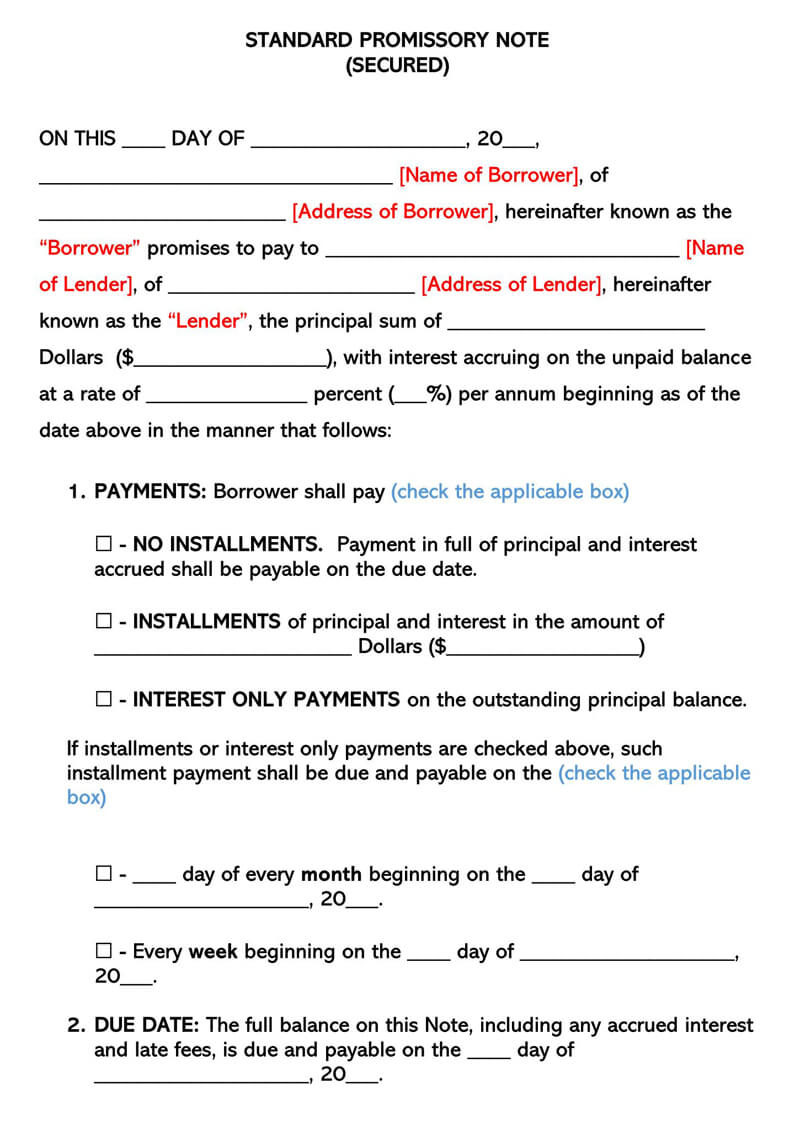

Secured Promissory Note Template - Web secured promissory note templates. This note may not be modified or amended except by a written agreement signed by borrower and lender. Use a secured promissory note template as a starting point for creating your own document. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. Web a promissory note refers to a written agreement to pay a specific amount of money by a set time to the lender named in the promissory note. A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Define the due date of the loan and the terms of. Provide identifying information about the borrower and lender. Web decide whether you want the note to be secured by collateral, or unsecured. Any notices required or permitted to be given hereunder shall be given in

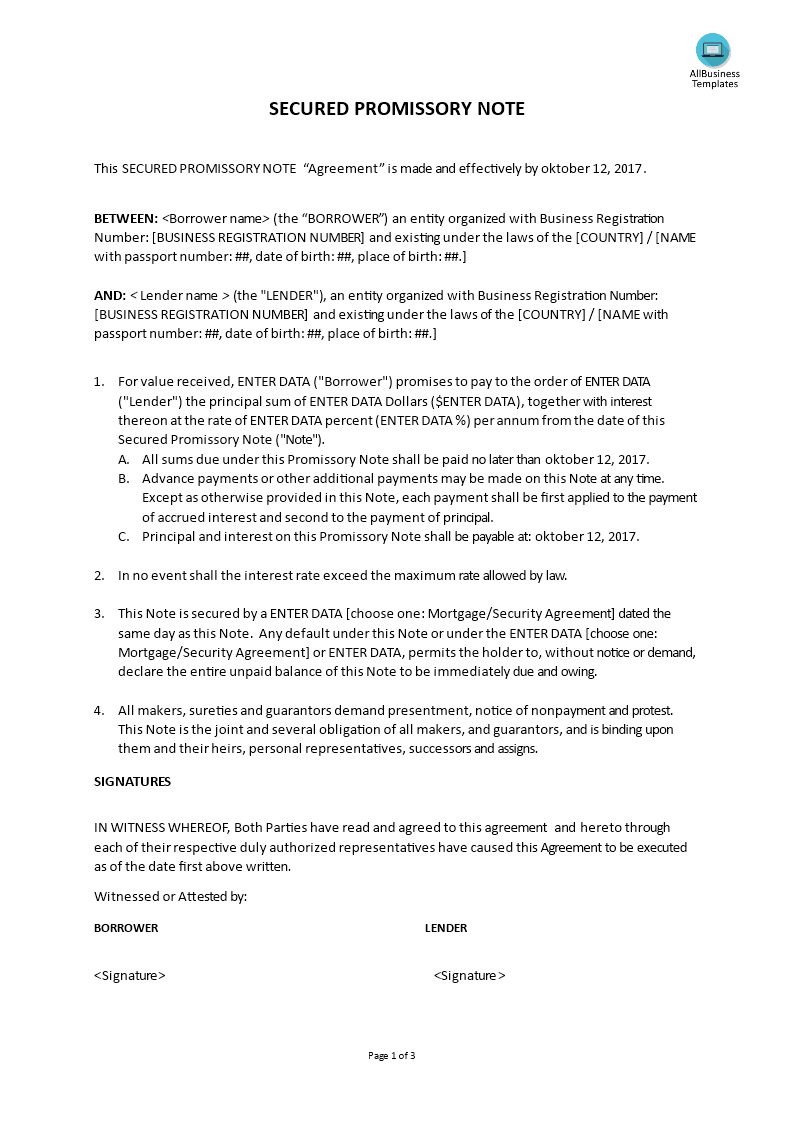

A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Define the due date of the loan and the terms of. All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it. Web the terms of this note. Web decide whether you want the note to be secured by collateral, or unsecured. Web the terms of this note. Fill in the details of the template as thoroughly as possible. In the event of any conflict between the terms of this note and the terms of any security instrument securing payment of this note, the terms of this note shall prevail. It becomes a vital financial document during such agreements as it helps with the mitigation of risks between the involved parties. The secured promissory note is a form that may be used to provide an agreement between a lender and a borrower with regard to the details of any amount of money that is being loaned and borrowed.

The terms of this note shall control over any conflicting terms in any referenced agreement or document. Web here are free secured promissory note templates that can be customized as per need: This note may not be modified or amended except by a written agreement signed by borrower and lender. A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. Web decide whether you want the note to be secured by collateral, or unsecured. Web the terms of this note. The same form would outline the details of an an added asset of value that would be placed into the possession of. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it.

Secured Promissory Note Templates Promissory Notes Promissory Notes

Web here are free secured promissory note templates that can be customized as per need: This note may not be modified or amended except by written agreement signed by borrower and lender. Any notices required or permitted to be given hereunder shall be given in In the event of any conflict between the terms of this note and the terms.

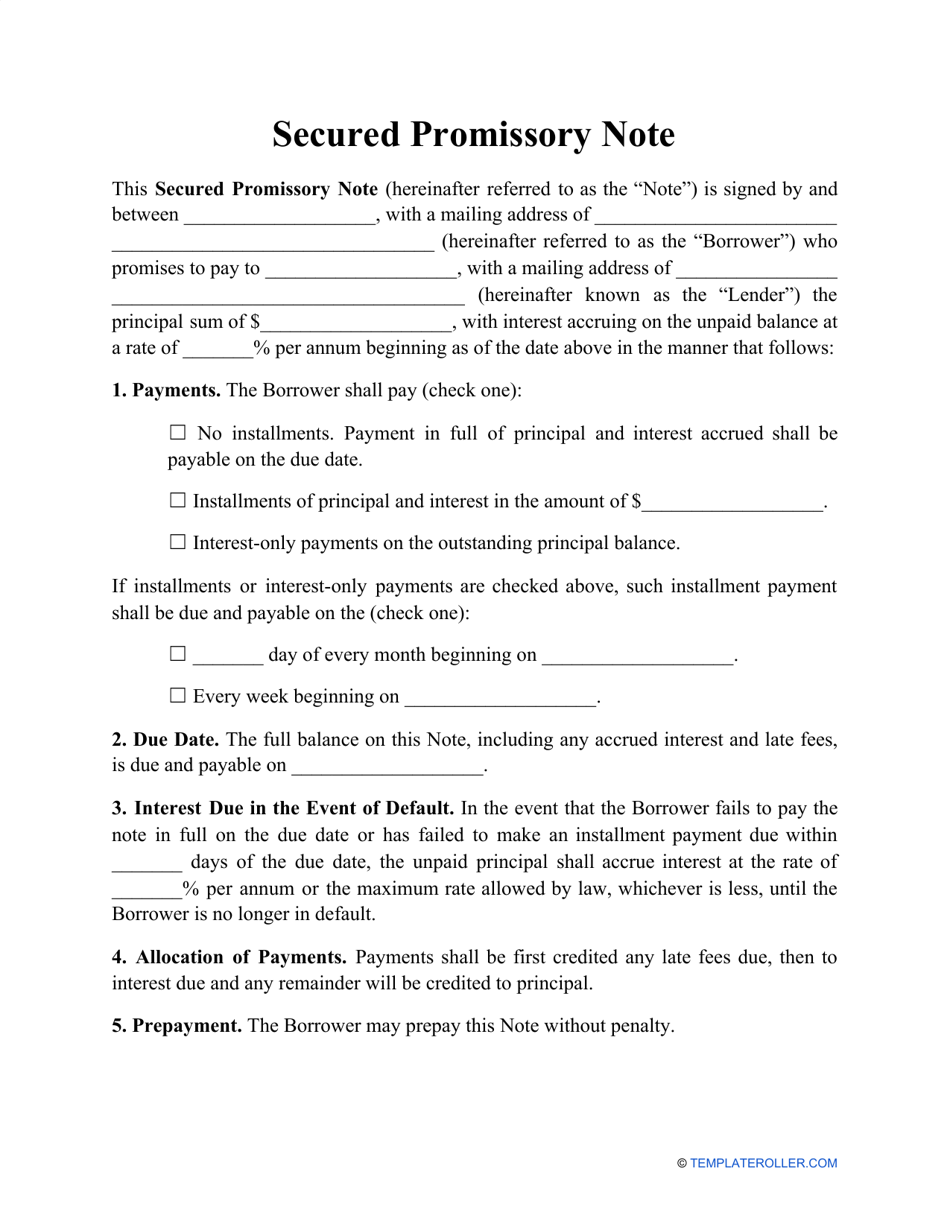

Secured Promissory Note Template Download Printable PDF Templateroller

A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. In the event of any conflict between the terms of this note and the terms of any security instrument securing payment of this note, the terms of.

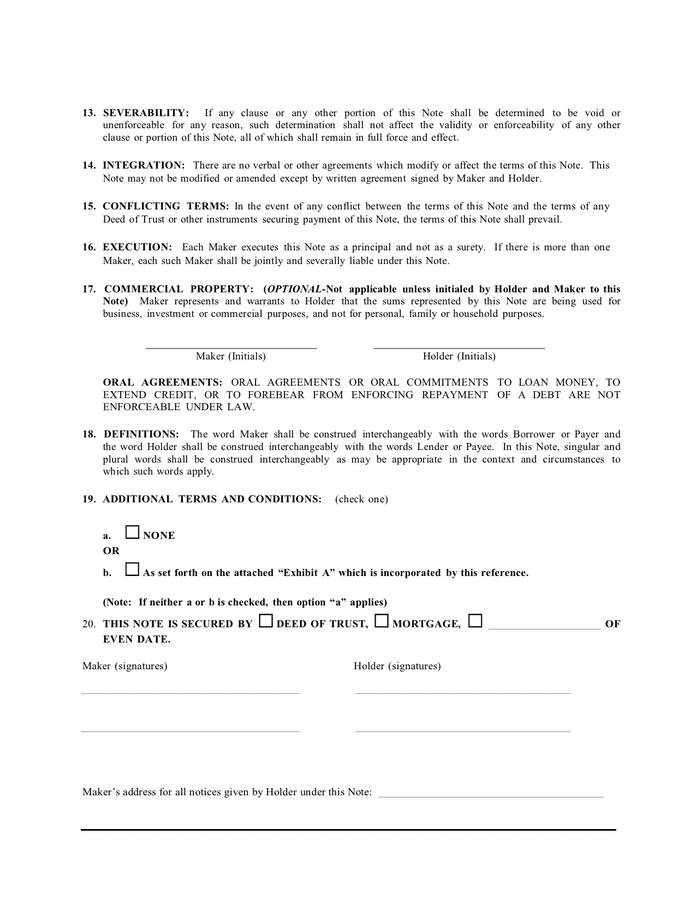

Secured promissory note template in Word and Pdf formats page 3 of 4

Web here are free secured promissory note templates that can be customized as per need: In the event of any conflict between the terms of this note and the terms of any security instrument securing payment of this note, the terms of this note shall prevail. Web the terms of this note. The secured promissory note is a form that.

Secured Promissory Note Template Word Template 1 Resume Examples

If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. Web a promissory note refers to a written agreement to pay a specific amount of money by a set time to the lender named in the promissory note. All borrowers on the promissory note.

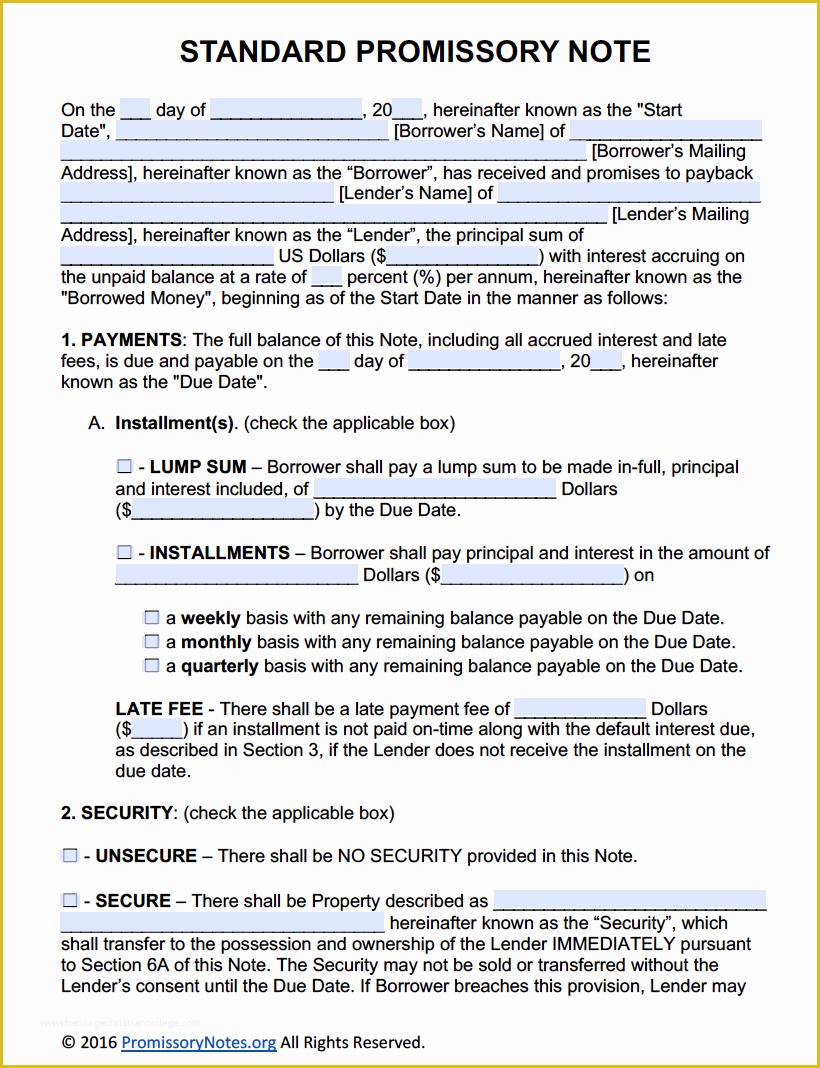

Florida Promissory Note Template Free Of Free Promissory Note Template

This note may not be modified or amended except by a written agreement signed by borrower and lender. Web it is fast and simple to get what you need with a free secured promissory note template from rocket lawyer: This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. The.

Free Secured Promissory Note Template & FAQs Rocket Lawyer

This note may not be modified or amended except by a written agreement signed by borrower and lender. All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it. In the event of any conflict between the terms of this note and the terms of any security instrument securing payment.

Mortgage Promissory Note Template For Your Needs

The secured promissory note is a form that may be used to provide an agreement between a lender and a borrower with regard to the details of any amount of money that is being loaned and borrowed. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property.

Promissory Note Template 20+ Free (For Word, PDF)

Fill in the details of the template as thoroughly as possible. Use a secured promissory note template as a starting point for creating your own document. This note may not be modified or amended except by a written agreement signed by borrower and lender. The terms of this note shall control over any conflicting terms in any referenced agreement or.

Secured Loan Promissory Note example Templates at

Web secured promissory note template. All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it. Define the due date of the loan and the terms of. This note may not be modified or amended except by written agreement signed by borrower and lender. Create a high quality document online.

Legal structure Secured promissory note sec

It becomes a vital financial document during such agreements as it helps with the mitigation of risks between the involved parties. Use a secured promissory note template as a starting point for creating your own document. All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it. This note may.

Fill In The Details Of The Template As Thoroughly As Possible.

The terms of this note shall control over any conflicting terms in any referenced agreement or document. This document is used when a borrower agrees to give up collateral (property) if they fail to repay the loan. Web it is fast and simple to get what you need with a free secured promissory note template from rocket lawyer: The secured promissory note is a form that may be used to provide an agreement between a lender and a borrower with regard to the details of any amount of money that is being loaned and borrowed.

If The Borrower Does Not Pay Back The Amount Within The Mandated Timeframe, The Lender Will Have The Right To Obtain The Property Of The Borrower.

All borrowers on the promissory note should sign it, but it’s optional for the lender of the money to sign it. The same form would outline the details of an an added asset of value that would be placed into the possession of. Provide identifying information about the borrower and lender. Web decide whether you want the note to be secured by collateral, or unsecured.

Web Secured Promissory Note Template.

Web the terms of this note. This note may not be modified or amended except by written agreement signed by borrower and lender. It becomes a vital financial document during such agreements as it helps with the mitigation of risks between the involved parties. Web a promissory note refers to a written agreement to pay a specific amount of money by a set time to the lender named in the promissory note.

Use A Secured Promissory Note Template As A Starting Point For Creating Your Own Document.

A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. Standard templates purpose a secured promissory note is often used when lending or borrowing a significant amount of money. Define the due date of the loan and the terms of. This note may not be modified or amended except by a written agreement signed by borrower and lender.