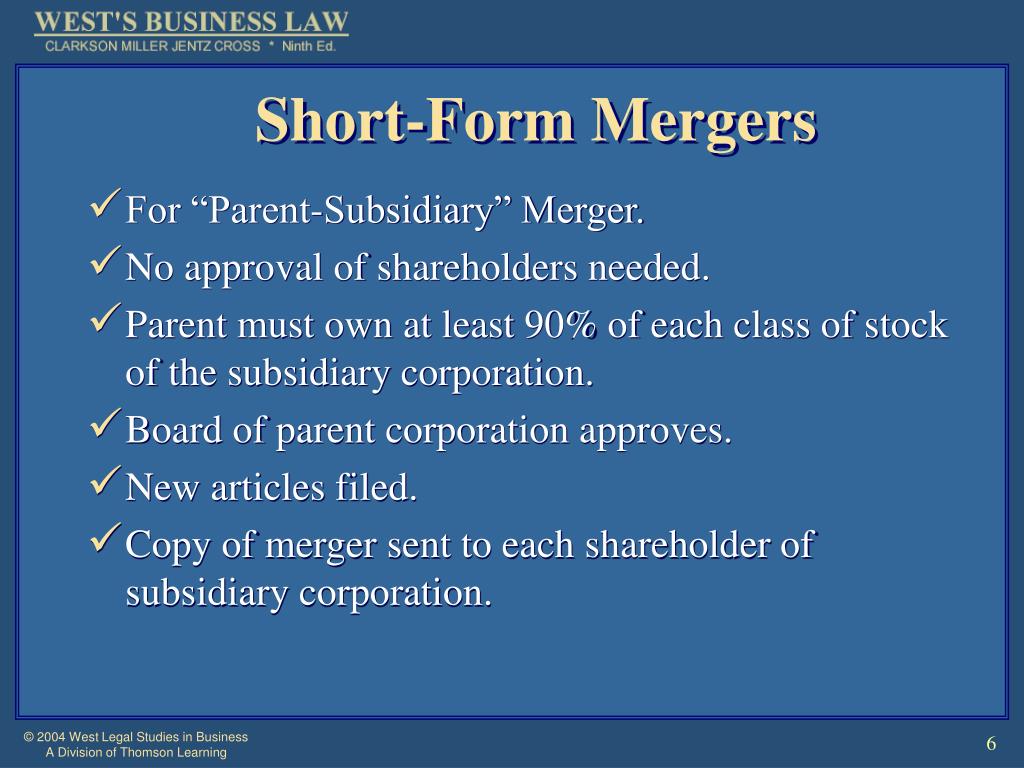

Short Form Merger

Short Form Merger - A short form merger combines a parent company and a subsidiary that is substantially owned by the parent. Web a statutory merger (aka “traditional” or “one step” merger) a traditional merger is the most common type of public acquisition structure. Web what is a short form merger? Target shareholder approval is required Web tuesday, april 23, 2019. The acquiring company makes an offer (or exchange) for the target company’s shares, which is often followed with the buyer owning all of the target company’s shares, which brings us to another wrinkle in the complex world of m&as. Web the approval of extraordinary transactions, such as mergers, significant asset sales, or dissolution, but holders of nonvoting shares are entitled to vote on conversions and transfers, domestications, or continuances; Essentially, this involves a merger of a subsidiary into its parent or vice versa. The requirements for a short form merger are set forth in the statutes of the applicable state government. A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally merge.

Target shareholder approval is required Web tuesday, april 23, 2019. States, for example, a parent that owns at. Web a statutory merger (aka “traditional” or “one step” merger) a traditional merger is the most common type of public acquisition structure. Web the approval of extraordinary transactions, such as mergers, significant asset sales, or dissolution, but holders of nonvoting shares are entitled to vote on conversions and transfers, domestications, or continuances; Either entity can be designated as the survivor of the merger. The requirements for a short form merger are set forth in the statutes of the applicable state government. The acquiring company makes an offer (or exchange) for the target company’s shares, which is often followed with the buyer owning all of the target company’s shares, which brings us to another wrinkle in the complex world of m&as. Web what is a short form merger? To learn more about mergers and acquisitions, explore our website.

The requirements for a short form merger are set forth in the statutes of the applicable state government. Web a statutory merger (aka “traditional” or “one step” merger) a traditional merger is the most common type of public acquisition structure. Web what is a short form merger? A short form merger combines a parent company and a subsidiary that is substantially owned by the parent. A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally merge. Web tuesday, april 23, 2019. Target shareholder approval is required States, for example, a parent that owns at. In the next article, we will discuss more mergers and merger waves. To learn more about mergers and acquisitions, explore our website.

What Are the Characteristics of a ShortForm Merger?

To learn more about mergers and acquisitions, explore our website. Target shareholder approval is required A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally merge. Web tuesday, april 23, 2019. Either entity can be designated as the survivor of the merger.

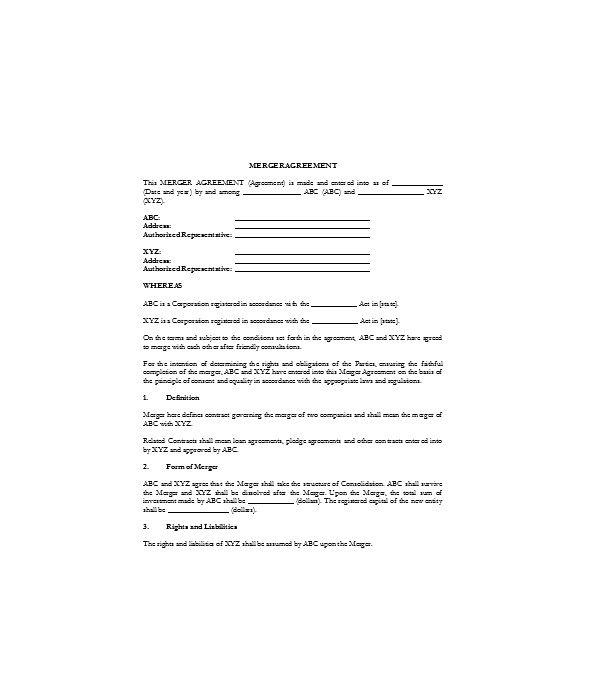

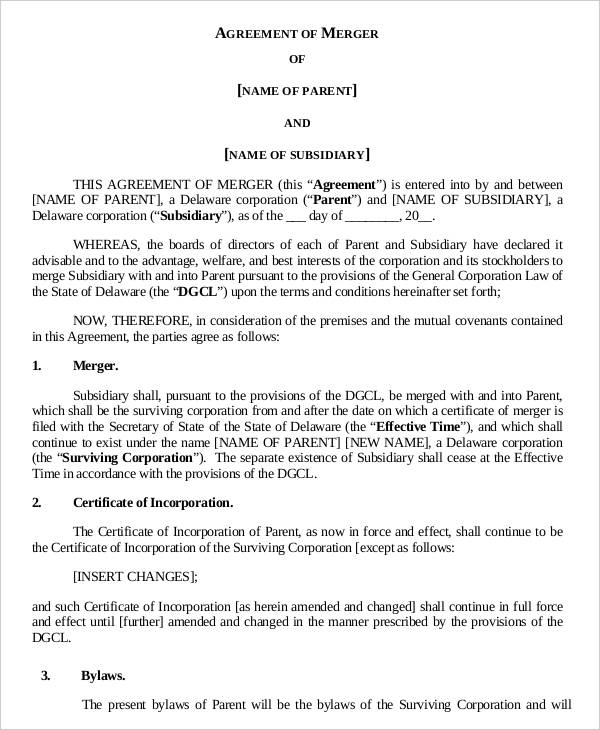

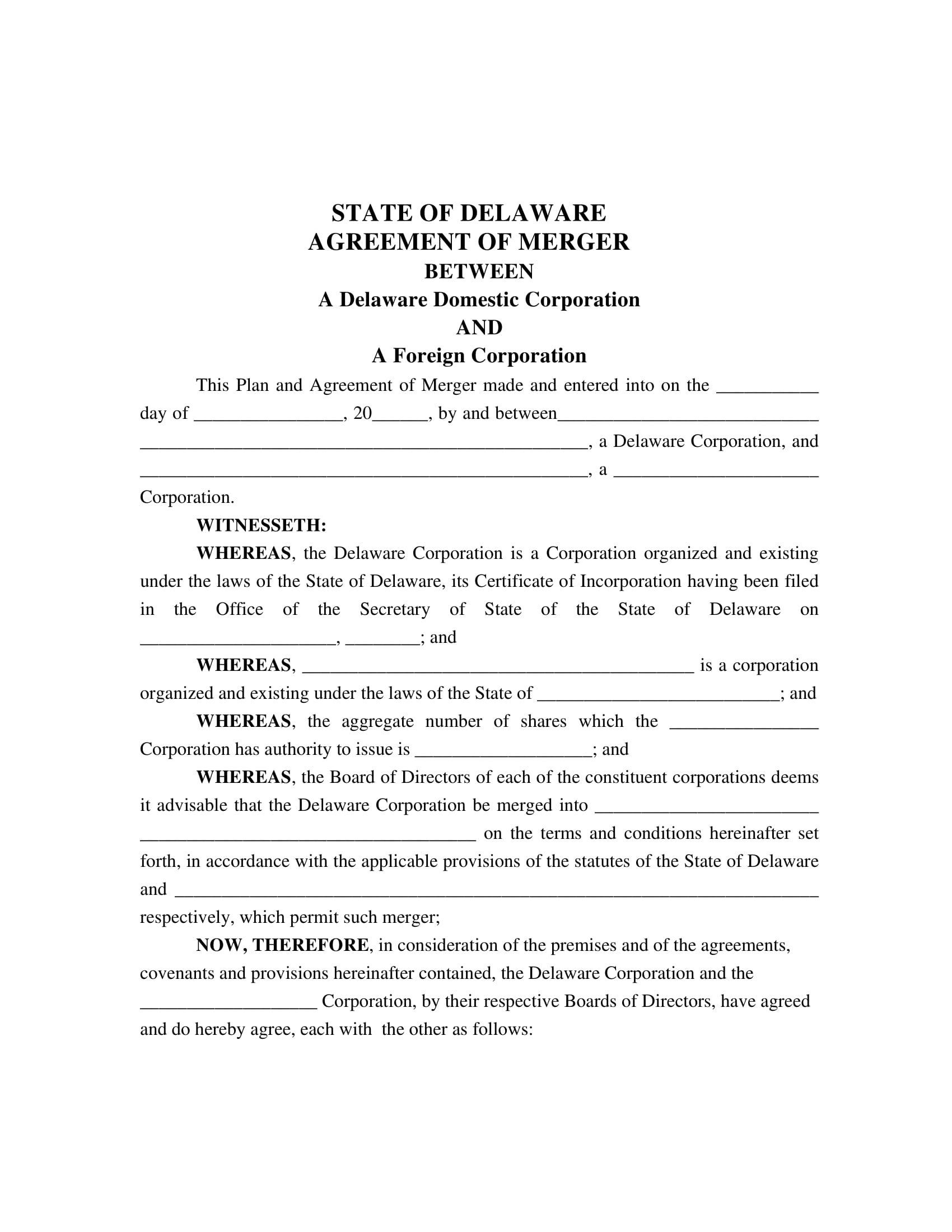

FREE 5+ Merger Agreement Contract Forms in PDF MS Word

Web tuesday, april 23, 2019. Either entity can be designated as the survivor of the merger. A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally merge. States, for example, a parent that owns at. Essentially, this involves a merger of a subsidiary into its parent or vice versa.

What is a shortform merger

Web tuesday, april 23, 2019. Target shareholder approval is required Either entity can be designated as the survivor of the merger. Web what is a short form merger? A short form merger combines a parent company and a subsidiary that is substantially owned by the parent.

Shortform Merger YouTube

The requirements for a short form merger are set forth in the statutes of the applicable state government. Either entity can be designated as the survivor of the merger. States, for example, a parent that owns at. To learn more about mergers and acquisitions, explore our website. A short form merger combines a parent company and a subsidiary that is.

For four reasons, shortform mergers are required

Essentially, this involves a merger of a subsidiary into its parent or vice versa. States, for example, a parent that owns at. Web a statutory merger (aka “traditional” or “one step” merger) a traditional merger is the most common type of public acquisition structure. A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally.

Merger Agreement Templates 10 Free Word, PDF Format Download Free

To learn more about mergers and acquisitions, explore our website. Web a statutory merger (aka “traditional” or “one step” merger) a traditional merger is the most common type of public acquisition structure. The requirements for a short form merger are set forth in the statutes of the applicable state government. Target shareholder approval is required In the next article, we.

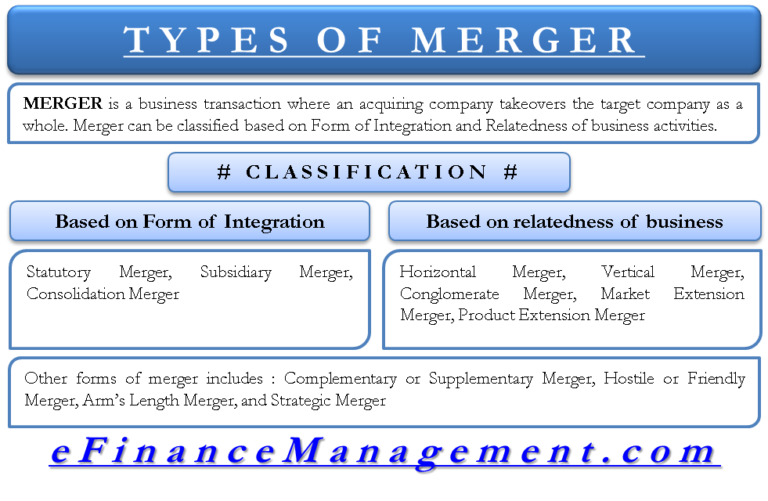

Classification / Types of Mergers

Web tuesday, april 23, 2019. A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally merge. The requirements for a short form merger are set forth in the statutes of the applicable state government. In the next article, we will discuss more mergers and merger waves. Web a statutory merger (aka “traditional” or “one.

FREE 5+ Merger Agreement Contract Forms in PDF MS Word

Essentially, this involves a merger of a subsidiary into its parent or vice versa. The acquiring company makes an offer (or exchange) for the target company’s shares, which is often followed with the buyer owning all of the target company’s shares, which brings us to another wrinkle in the complex world of m&as. Web the approval of extraordinary transactions, such.

What are the defining characteristics of a merger David Klasing Tax Law

Web what is a short form merger? In the next article, we will discuss more mergers and merger waves. A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally merge. States, for example, a parent that owns at. A short form merger combines a parent company and a subsidiary that is substantially owned by.

PPT Chapter 39 Corporations Merger, Consolidation, and Termination

The requirements for a short form merger are set forth in the statutes of the applicable state government. A merger describes an acquisition in which two companies jointly negotiate a merger agreement and legally merge. To learn more about mergers and acquisitions, explore our website. Target shareholder approval is required Web a statutory merger (aka “traditional” or “one step” merger).

A Merger Describes An Acquisition In Which Two Companies Jointly Negotiate A Merger Agreement And Legally Merge.

A short form merger combines a parent company and a subsidiary that is substantially owned by the parent. In the next article, we will discuss more mergers and merger waves. States, for example, a parent that owns at. Essentially, this involves a merger of a subsidiary into its parent or vice versa.

Web A Statutory Merger (Aka “Traditional” Or “One Step” Merger) A Traditional Merger Is The Most Common Type Of Public Acquisition Structure.

The requirements for a short form merger are set forth in the statutes of the applicable state government. The acquiring company makes an offer (or exchange) for the target company’s shares, which is often followed with the buyer owning all of the target company’s shares, which brings us to another wrinkle in the complex world of m&as. To learn more about mergers and acquisitions, explore our website. Either entity can be designated as the survivor of the merger.

Web The Approval Of Extraordinary Transactions, Such As Mergers, Significant Asset Sales, Or Dissolution, But Holders Of Nonvoting Shares Are Entitled To Vote On Conversions And Transfers, Domestications, Or Continuances;

Web what is a short form merger? Web tuesday, april 23, 2019. Target shareholder approval is required