Should I Form Llc For Rental Property

Should I Form Llc For Rental Property - Web owners often prefer to form an llc when purchasing real estate—or when transferring titles—so that the llc becomes the legal owner of record, rather than the individual members. Both entities are vehicles that may help investors protect assets and reduce potential risk, although an llc and a trust are used for different purposes. Here are the pros and cons of forming an llc for real estate investments. A real estate llc reduces your personal liability for the. June 15, 2021 one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties and also where they should set up their llc for the best asset protection. Web what are the legal benefits of a rental property llc? Web benefits of an llc for rental properties. If you decide to create an llc for your rental property, make sure you update your rental leases. Plans start at $0 + filing fees. How to create your real estate llc;

Web benefits of an llc for rental properties. A real estate llc reduces your personal liability for the. Web creating an llc for your rental property is a smart choice as a property owner. An llc works a lot like an umbrella: Both entities are vehicles that may help investors protect assets and reduce potential risk, although an llc and a trust are used for different purposes. Ready to start your business? If you decide to create an llc for your rental property, make sure you update your rental leases. Web kathy fettke last updated: There are many reasons why property owners may choose to form an llc to manage their rental properties. Your personal assets are safe from any lawsuits you have more flexibility with your company’s management structure

Web if you’re looking for a way to invest in real estate, you might be considering forming a real estate limited liability company (llc). An llc works a lot like an umbrella: There are many reasons why property owners may choose to form an llc to manage their rental properties. The answer to the first question, which will discuss in detail below, is often a yes for passive investors. Web what are the legal benefits of a rental property llc? Both entities are vehicles that may help investors protect assets and reduce potential risk, although an llc and a trust are used for different purposes. What if the rental property has a mortgage? Web although real estate investors may directly own property as sole proprietors, rental property is often held in a limited liability company (llc) or trust. Here are the pros and cons of forming an llc for real estate investments. How do i transfer deeds to an llc?

Should You Form an LLC for Your Rental Property? Tellus Talk

Is there an alternative to setting up a real estate llc? Web creating an llc for your rental property is a smart choice as a property owner. How do i transfer deeds to an llc? Web owners often prefer to form an llc when purchasing real estate—or when transferring titles—so that the llc becomes the legal owner of record, rather.

Rental Property Tax Forms Real Property Management Southern Utah

Your personal assets are safe from any lawsuits you have more flexibility with your company’s management structure Web if you’re looking for a way to invest in real estate, you might be considering forming a real estate limited liability company (llc). If you decide to create an llc for your rental property, make sure you update your rental leases. When.

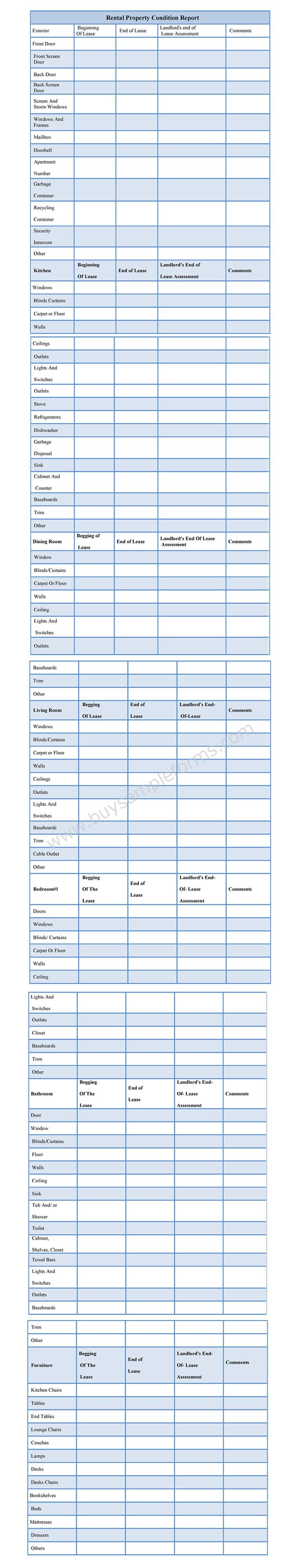

Rental Property Condition Report Form Sample Forms

Web if you’re looking for a way to invest in real estate, you might be considering forming a real estate limited liability company (llc). Web creating an llc for your rental property is a smart choice as a property owner. Web kathy fettke last updated: What if the rental property has a mortgage? Web some of the primary benefits of.

Pin on Tellus Blog

Web if you’re looking for a way to invest in real estate, you might be considering forming a real estate limited liability company (llc). How do i transfer deeds to an llc? The answer to the first question, which will discuss in detail below, is often a yes for passive investors. Web kathy fettke last updated: Ready to start your.

Should You Create An LLC For Rental Property? Pros And Cons New Silver

The answer to the first question, which will discuss in detail below, is often a yes for passive investors. Web some of the primary benefits of having an llc for your rental property include: How do i transfer deeds to an llc? Web owners often prefer to form an llc when purchasing real estate—or when transferring titles—so that the llc.

Why You Should Form an LLC (Explained in 45 Seconds) Lawyers Rock

Is there an alternative to setting up a real estate llc? A real estate llc reduces your personal liability for the. An llc works a lot like an umbrella: Web benefits of an llc for rental properties. Both entities are vehicles that may help investors protect assets and reduce potential risk, although an llc and a trust are used for.

Should I Use an LLC for Rental Property 8 Key Questions & Answers

How to create your real estate llc; Web although real estate investors may directly own property as sole proprietors, rental property is often held in a limited liability company (llc) or trust. Web kathy fettke last updated: Web what are the legal benefits of a rental property llc? The answer to the first question, which will discuss in detail below,.

Should I Form an LLC for Blog? (Lawyer Tips)

Here are the pros and cons of forming an llc for real estate investments. How to create your real estate llc; Web if you’re looking for a way to invest in real estate, you might be considering forming a real estate limited liability company (llc). A real estate llc reduces your personal liability for the. An llc works a lot.

How to Form a LLC (Stepbystep Guide) Community Tax

If you decide to create an llc for your rental property, make sure you update your rental leases. When should a property owner create an llc? June 15, 2021 one of the biggest questions realwealth members ask is whether they should use an llc for their rental properties and also where they should set up their llc for the best.

Should I Form An LLC? 5 Reasons Why It's A Great Idea

Plans start at $0 + filing fees. How do i transfer deeds to an llc? A real estate llc reduces your personal liability for the. The answer to the first question, which will discuss in detail below, is often a yes for passive investors. Web if you’re looking for a way to invest in real estate, you might be considering.

Web If You’re Looking For A Way To Invest In Real Estate, You Might Be Considering Forming A Real Estate Limited Liability Company (Llc).

Your personal assets are safe from any lawsuits you have more flexibility with your company’s management structure Plans start at $0 + filing fees. Ready to start your business? Web benefits of an llc for rental properties.

If You Decide To Create An Llc For Your Rental Property, Make Sure You Update Your Rental Leases.

Web some of the primary benefits of having an llc for your rental property include: How to create your real estate llc; The answer to the first question, which will discuss in detail below, is often a yes for passive investors. It’s easy to set up, easy to use, and protects you from being exposed.

A Real Estate Llc Reduces Your Personal Liability For The.

How do i transfer deeds to an llc? An llc works a lot like an umbrella: Web although real estate investors may directly own property as sole proprietors, rental property is often held in a limited liability company (llc) or trust. When should a property owner create an llc?

Web Kathy Fettke Last Updated:

Is there an alternative to setting up a real estate llc? There are many reasons why property owners may choose to form an llc to manage their rental properties. What if the rental property has a mortgage? Both entities are vehicles that may help investors protect assets and reduce potential risk, although an llc and a trust are used for different purposes.