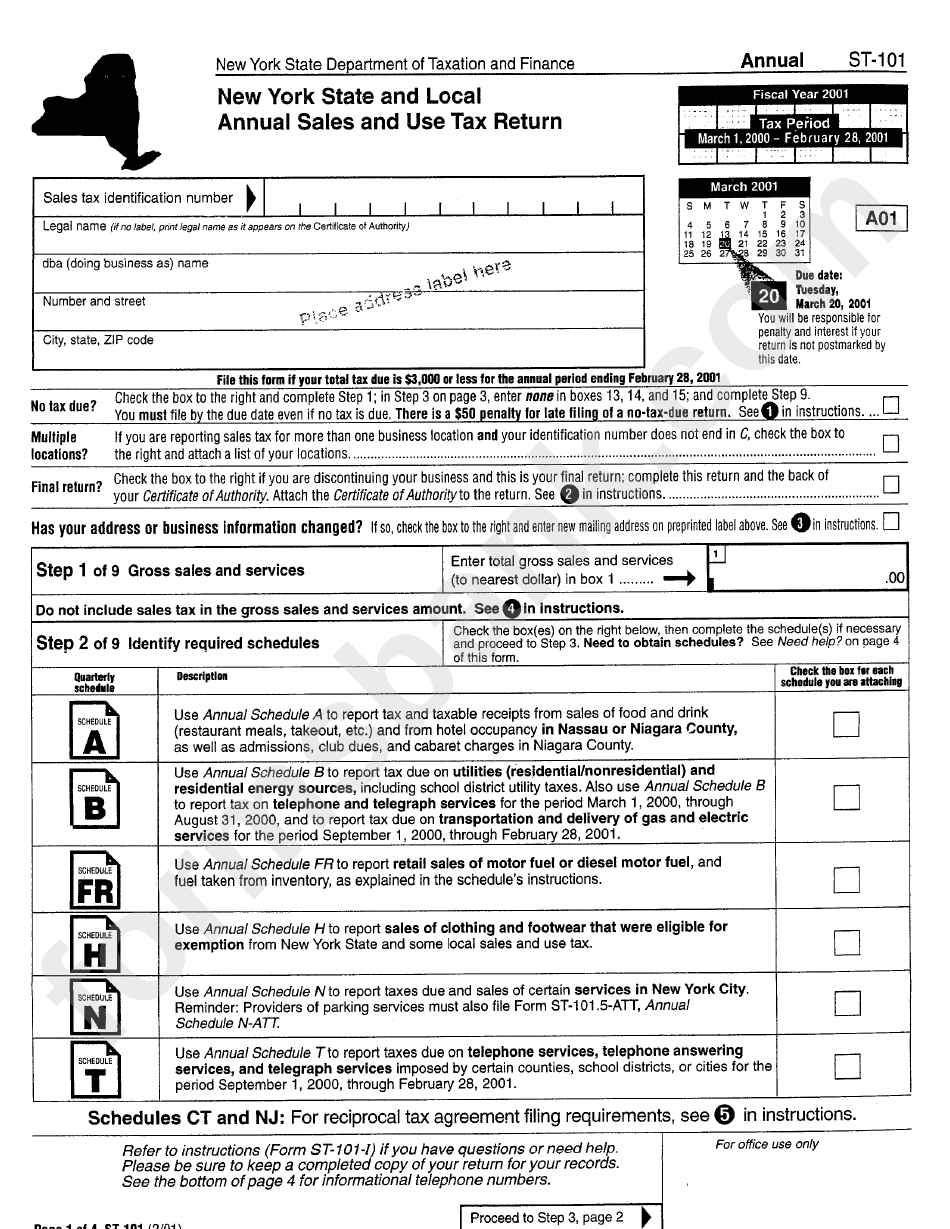

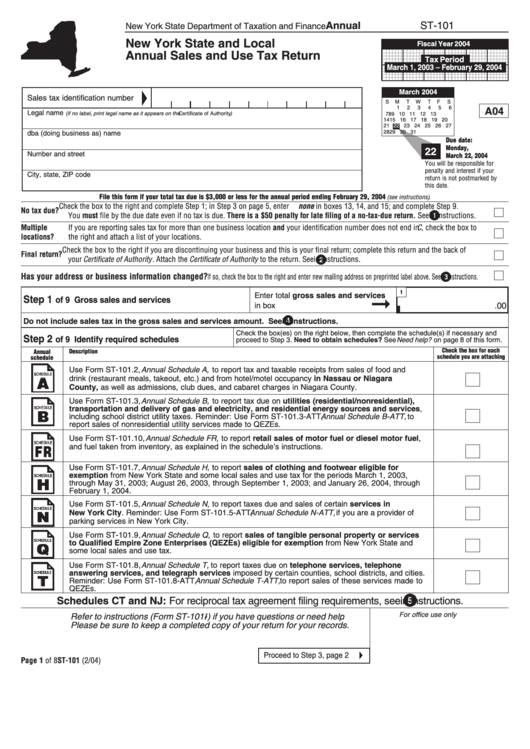

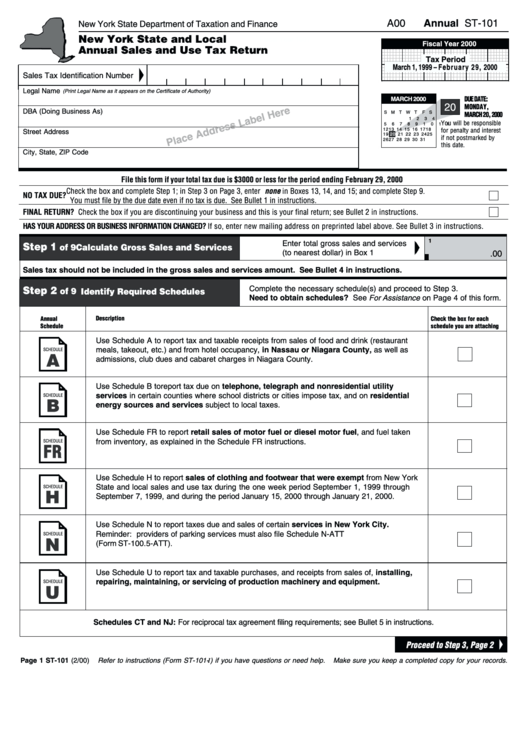

St-101 Form

St-101 Form - These buyers are exempt from tax on all purchases. Filers who owe more than $3,000 in tax for this annual filing Read this section before completing your return. Web sales and use tax return instructions 2022. This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with the tax department. Only licensed nonprofit hospitals qualify. Use sales tax web file to file your annual return. Penalty and interest are calculated on the amount in box 17, taxes due. Nursing homes or similar institutions do not. Travel and convention return instructions 2022.

Penalty and interest are calculated on the amount in box 17, taxes due. Nursing homes or similar institutions do not. Pay penalty and interest if you are filing late penalty and interest Penalty and interest are calculated on the amount in box 17, taxes due. Web sales and use tax return instructions 2022. Pay penalty and interest if you are filing late penalty and interest The seller must keep a copy of the completed form on file. Where to file your return and attachments web file your return at www.tax.ny.gov (see highlights in. These buyers are exempt from tax on all purchases. Filers who owe more than $3,000 in tax for this annual filing

Scheduled payments (up to the due date) instant filing confirmation These buyers are exempt from tax on all purchases. Use sales tax web file to file your annual return. Penalty and interest are calculated on the amount in box 17, taxes due. This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with the tax department. Travel and convention return instructions 2022. Filers who owe more than $3,000 in tax for this annual filing This form is valid only if all information has been completed. This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with the tax department. Read this section before completing your return.

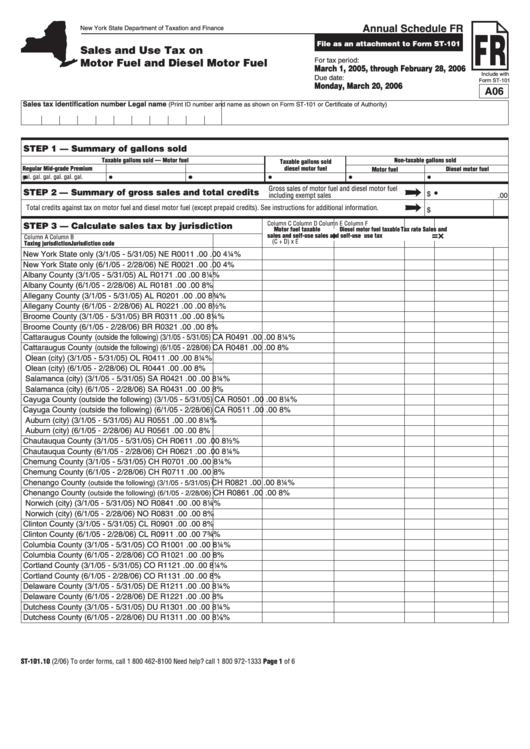

Form St101.10 Sales And Use Tax On Motor Fuel And Diesel Motor Fuel

This form is valid only if all information has been completed. Scheduled payments (up to the due date) instant filing confirmation Where to file your return and attachments web file your return at www.tax.ny.gov (see highlights in. Penalty and interest are calculated on the amount in box 17, taxes due. Contact any tax commission office to obtain the required language.

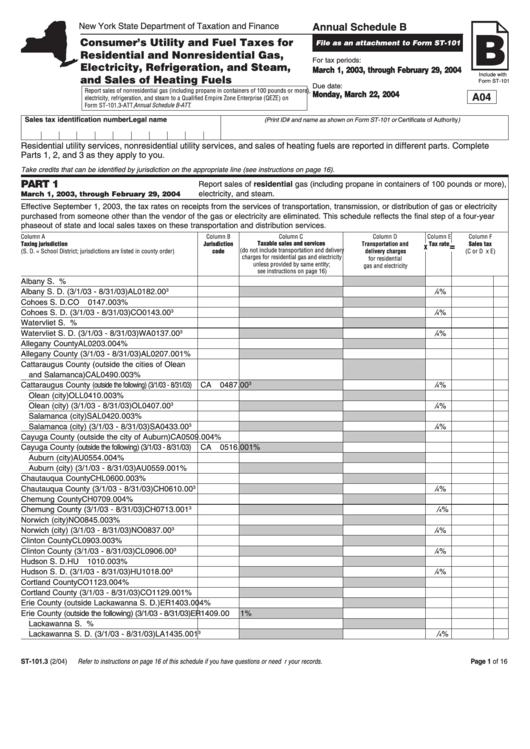

Form St101 Consumer'S Utility And Fuel Taxes For Residential And

The seller must keep a copy of the completed form on file. Penalty and interest are calculated on the amount in box 17, taxes due. The seller is responsible for collecting sales tax if the form isn’t completed. You may claim a credit in step 5 for taxes you paid with your quarterly returns. Buyer, if the goods you’re buying.

Form St 101 ≡ Fill Out Printable PDF Forms Online

Filers who owe more than $3,000 in tax for this annual filing Buyer, if the goods you’re buying don’t qualify for the Automatic calculation of amounts due; Use sales tax web file to file your annual return. Where to file your return and attachments web file your return at www.tax.ny.gov (see highlights in.

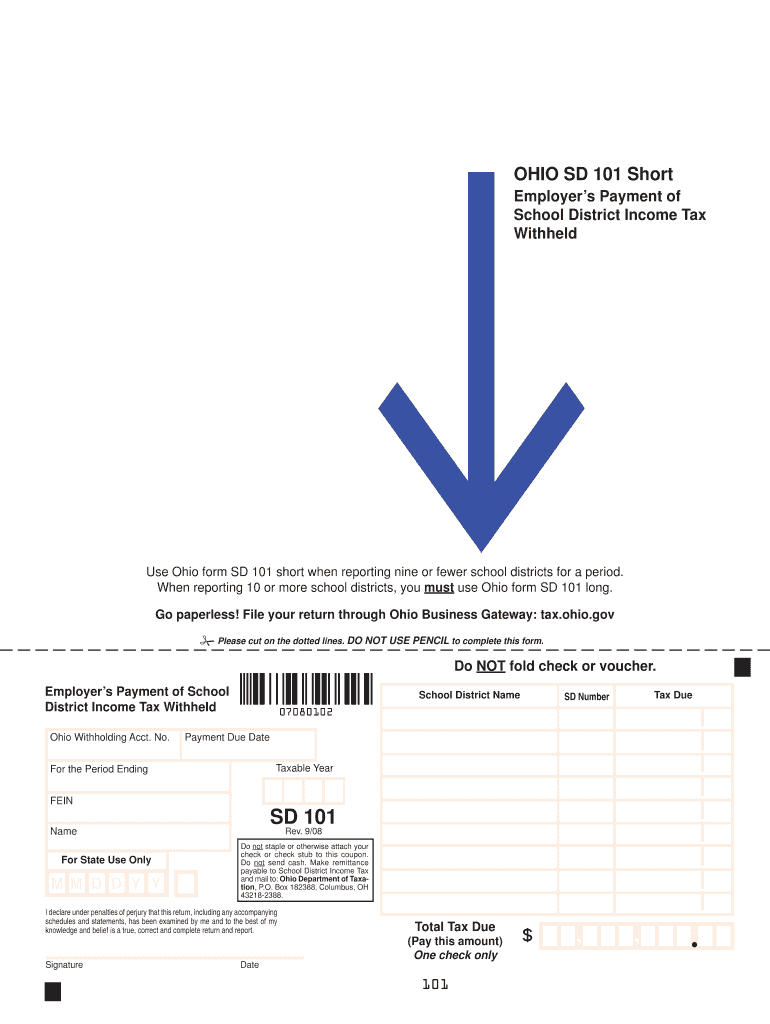

Sd 101 Form Fill Out and Sign Printable PDF Template signNow

Penalty and interest are calculated on the amount in box 17, taxes due. Web sales and use tax return instructions 2022. Buyer, if the goods you’re buying don’t qualify for the Pay penalty and interest if you are filing late penalty and interest Travel and convention return instructions 2022.

Form St101 New York State And Local Annual Sales And Use Tax Return

You may claim a credit in step 5 for taxes you paid with your quarterly returns. Read this section before completing your return. Nursing homes or similar institutions do not. Buyer, if the goods you’re buying don’t qualify for the This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with.

Nys annual st 101 form Fill out & sign online DocHub

Automatic calculation of amounts due; Buyer, if the goods you’re buying don’t qualify for the This form is valid only if all information has been completed. Filers who owe more than $3,000 in tax for this annual filing Where to file your return and attachments web file your return at www.tax.ny.gov (see highlights in.

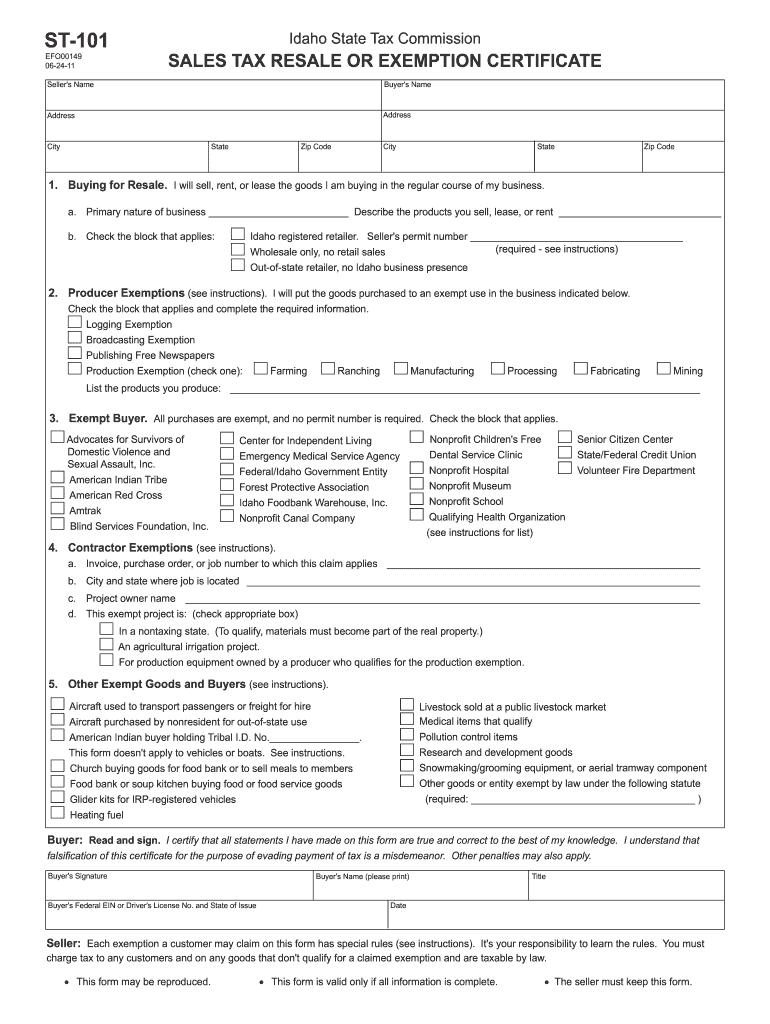

ST 101 Idaho State Tax Commission Tax Idaho Fill Out and Sign

The seller is responsible for collecting sales tax if the form isn’t completed. Penalty and interest are calculated on the amount in box 17, taxes due. Travel and convention return instructions 2022. This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with the tax department. Buyer, if the goods you’re.

Form St101 New York State And Local Annual Sales And Use Tax Return

Buyer, if the goods you’re buying don’t qualify for the Travel and convention return instructions 2022. Web sales and use tax return instructions 2022. Scheduled payments (up to the due date) instant filing confirmation Nursing homes or similar institutions do not.

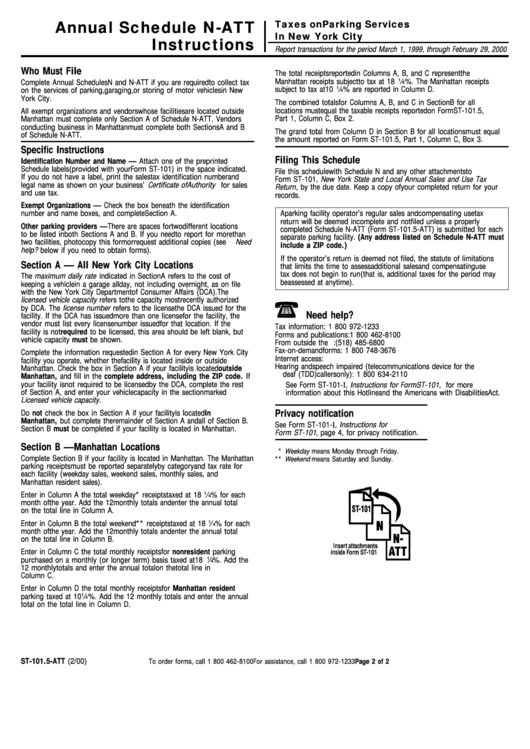

Form St101.5Att Annual Schedule NAtt Instructions printable pdf

Web sales and use tax return instructions 2022. Buyer, if the goods you’re buying don’t qualify for the This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with the tax department. Scheduled payments (up to the due date) instant filing confirmation Penalty and interest are calculated on the amount in.

Form St101 Annual Sales And Use Tax Return 2000 printable pdf download

You may claim a credit in step 5 for taxes you paid with your quarterly returns. The seller is responsible for collecting sales tax if the form isn’t completed. Travel and convention return instructions 2022. Where to file your return and attachments web file your return at www.tax.ny.gov (see highlights in. Use sales tax web file to file your annual.

This Form Is Valid Only If All Information Has Been Completed.

These buyers are exempt from tax on all purchases. Penalty and interest are calculated on the amount in box 17, taxes due. Scheduled payments (up to the due date) instant filing confirmation Automatic calculation of amounts due;

Use Sales Tax Web File To File Your Annual Return.

You may claim a credit in step 5 for taxes you paid with your quarterly returns. Read this section before completing your return. The seller is responsible for collecting sales tax if the form isn’t completed. Contact any tax commission office to obtain the required language for the statement.

Web Sales And Use Tax Return Instructions 2022.

Only licensed nonprofit hospitals qualify. Filers who owe more than $3,000 in tax for this annual filing Nursing homes or similar institutions do not. This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with the tax department.

Buyer, If The Goods You’re Buying Don’t Qualify For The

Pay penalty and interest if you are filing late penalty and interest This form can be completed electronically using your computer and adobe reader 11.0 or higher, and printed for filing with the tax department. Where to file your return and attachments web file your return at www.tax.ny.gov (see highlights in. Penalty and interest are calculated on the amount in box 17, taxes due.