Stock Split In The Form Of A Dividend

Stock Split In The Form Of A Dividend - Web kellogg company (. Web the company’s most recent quarterly cash dividend was $0.27 per share and was paid on may 20, 2021. Web what stock splits mean to your dividends simply put, a stock's dividend per share will be reduced as a result of a stock split, but the total amount of dividends. Stock split implies the process of dividing the existing. When declaring stock dividends, companies issue additional shares of the same. Web articles of incorporation and revise its dividend projections. A stock split is when existing shares are divided, so everyone. Web gamestop intends to implement a stock split in form of dividend. Web the company has requested stockholder approval to increase in the number of authorized shares of common stock, a move that will enable a stock split of the firm's. A single share exchanged into kenvue stock (assuming an exchange ratio of.

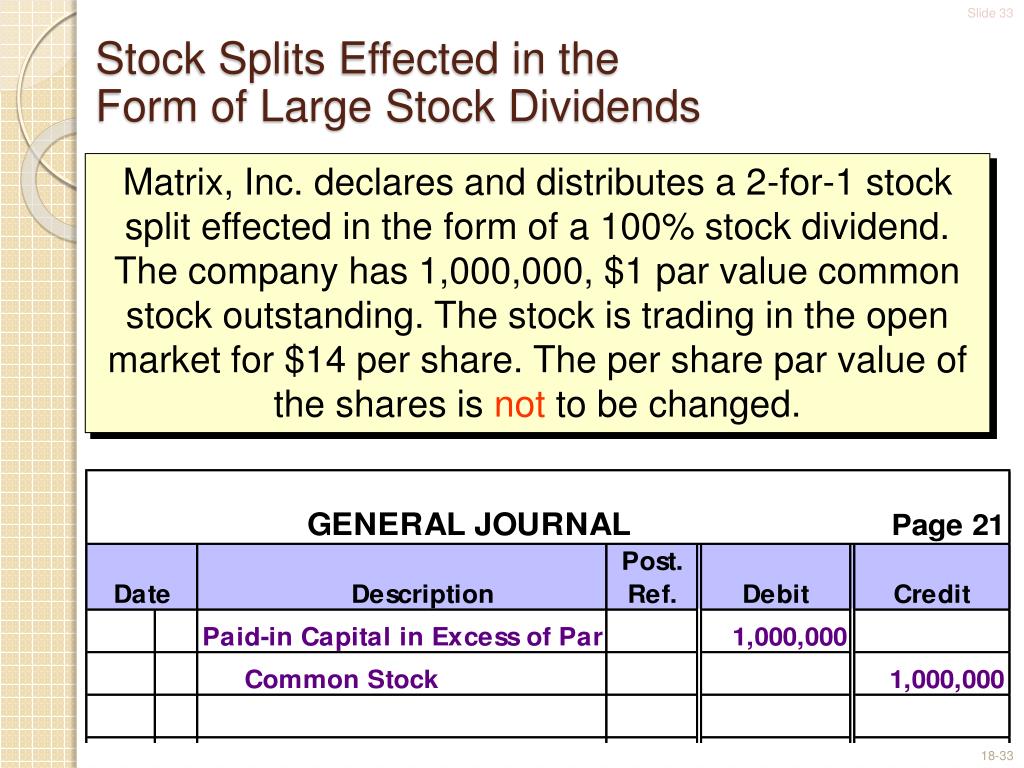

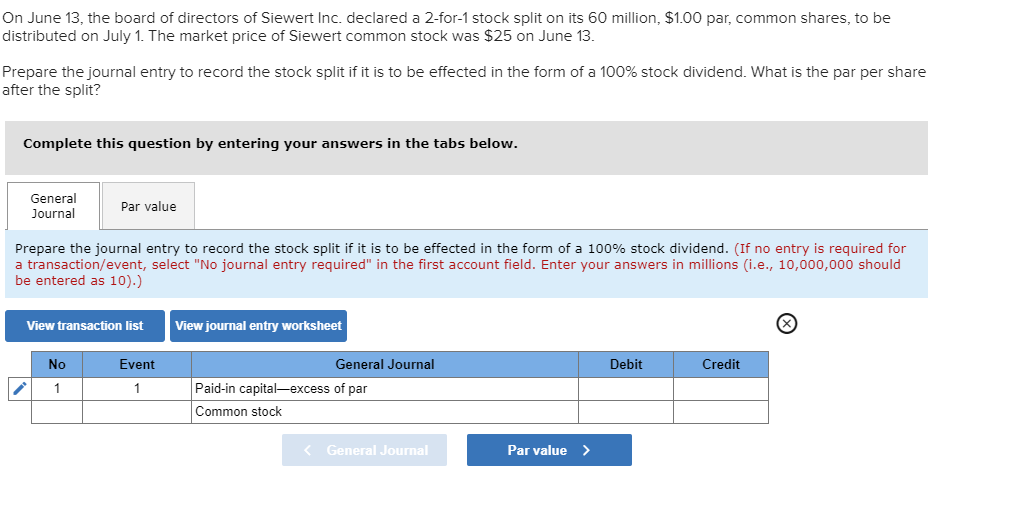

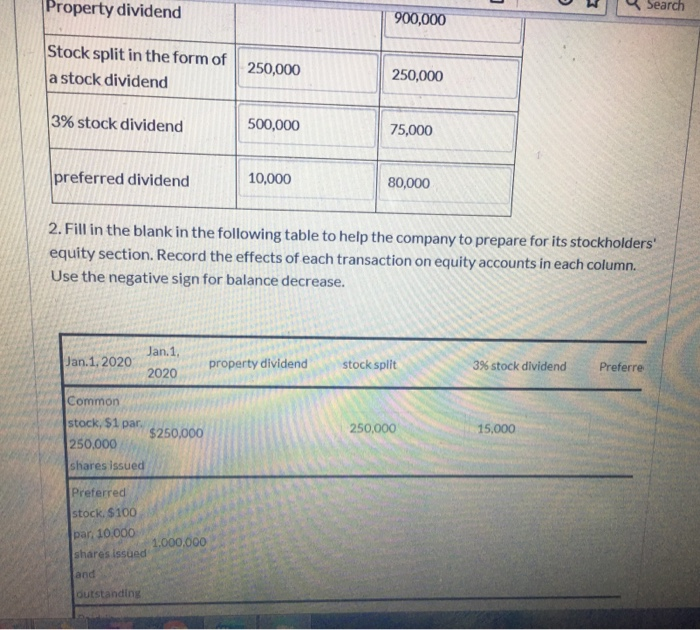

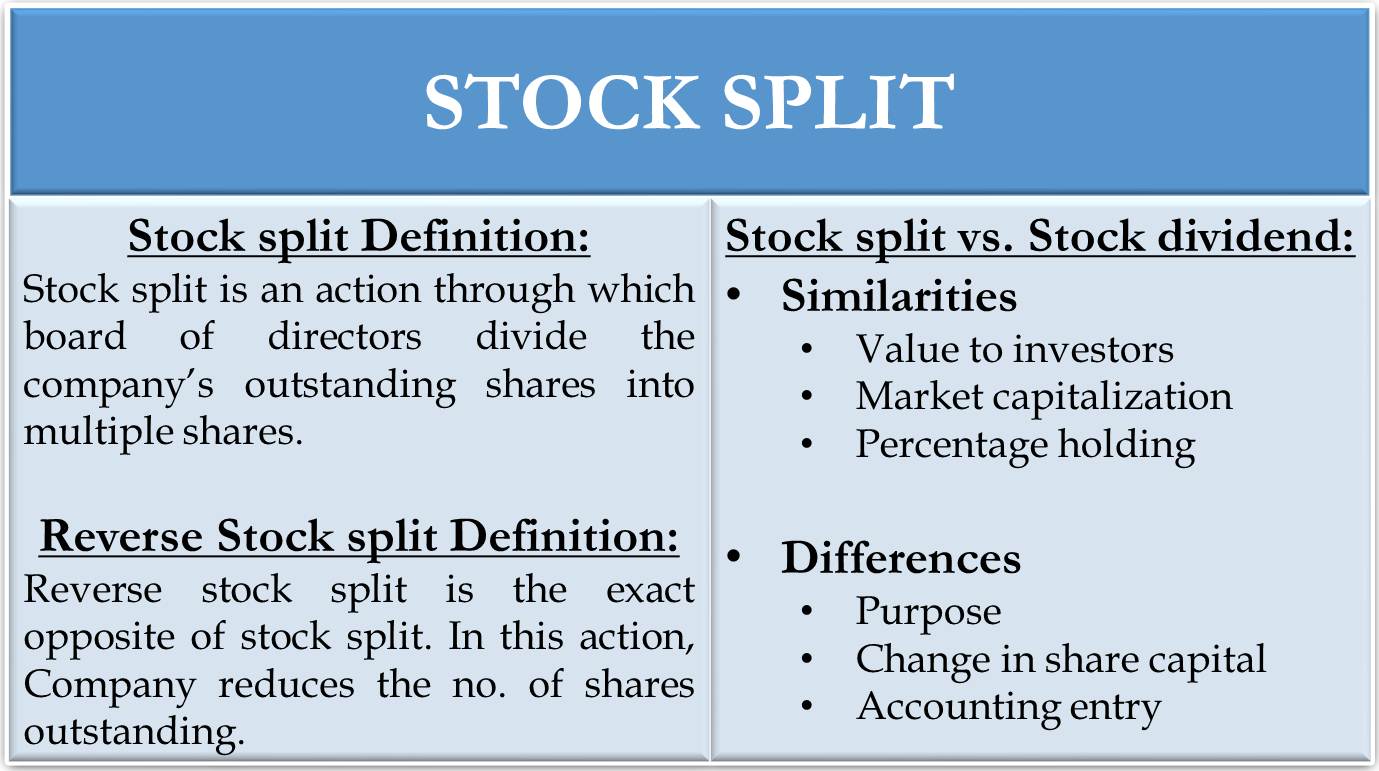

Stock dividends do not affect the value of the company. Web if the company issues a dividend before the record date, then it will be given to the newly created shares. Stock split implies the process of dividing the existing. Web a stock dividend is a dividend paid to shareholders in the form of additional company shares instead of cash. The board of directors approved a one cent $0.01. Stocksplit in the form of a dividend. Web stock splits effected as stock dividends when a significant increase in shares is accomplished by declaring a large stock dividend, this may be described as a. In the above example, if we assume that the 2 for 1 stock split. Web a stock dividend is a form of a dividend where a company pays shareholders with additional shares. Purpose of the stock split the purpose is to create an environment that makes it.

Web gamestop intends to implement a stock split in form of dividend. That gain would have turned a $10,000 investment into more than $1.3 million. Web revenue rose just 2% to $53.6 billion, reflecting a 4.8% increase in store traffic offset by a 4.3% decrease in average ticket price, and earnings under generally. Web if the company issues a dividend before the record date, then it will be given to the newly created shares. Kellogg ( k) is preparing to split into two public companies. Web a stock dividend is a dividend paid to shareholders in the form of additional company shares instead of cash. Although the number of shares outstanding. Web what stock splits mean to your dividends simply put, a stock's dividend per share will be reduced as a result of a stock split, but the total amount of dividends. This will see it operate as kellanova and wk kellogg. Stock dividends do not affect the value of the company.

PPT Shareholders’ Equity PowerPoint Presentation, free download ID

Web a stock dividend is a form of a dividend where a company pays shareholders with additional shares. Kellogg ( k) is preparing to split into two public companies. Web kellogg company (. This will see it operate as kellanova and wk kellogg. Stock dividends do not affect the value of the company.

Solved On June 13, the board of directors of Siewert Inc.

Web k stock will undergo a major change later this year. Web stock dividends are payable in additional shares of the declaring corporation’s capital stock. These dividends do not affect the value of a. Although the number of shares outstanding. In the above example, if we assume that the 2 for 1 stock split.

During 2020, Inc. had several transactions

In the above example, if we assume that the 2 for 1 stock split. The board of directors approved a one cent $0.01. Web like stock splits, stock dividends dilute the share price because additional shares have been issued. When declaring stock dividends, companies issue additional shares of the same. Web what stock splits mean to your dividends simply put,.

Dividend Decisions Define, Objective, Good Policy, Types eFM

That gain would have turned a $10,000 investment into more than $1.3 million. When declaring stock dividends, companies issue additional shares of the same. Although the number of shares outstanding. These dividends do not affect the value of a. Web if the company issues a dividend before the record date, then it will be given to the newly created shares.

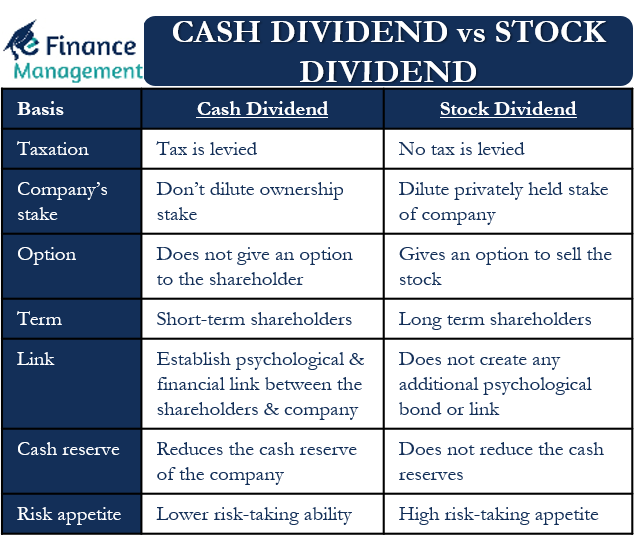

Cash Dividend Vs Stock Dividend Meaning, Differences and More eFM

Web revenue rose just 2% to $53.6 billion, reflecting a 4.8% increase in store traffic offset by a 4.3% decrease in average ticket price, and earnings under generally. Stock dividends do not affect the value of the company. Web the company has requested stockholder approval to increase in the number of authorized shares of common stock, a move that will.

Stock split vs bonus share Basics of stock market Trade Brains

Kellogg ( k) is preparing to split into two public companies. Web what stock splits mean to your dividends simply put, a stock's dividend per share will be reduced as a result of a stock split, but the total amount of dividends. Although the number of shares outstanding. Stock dividends do not affect the value of the company. These dividends.

PPT AND CHANGES IN RETAINED EARNINGS PowerPoint Presentation

Web what stock splits mean to your dividends simply put, a stock's dividend per share will be reduced as a result of a stock split, but the total amount of dividends. Web articles of incorporation and revise its dividend projections. Although the number of shares outstanding. While the general ledger account. Stocksplit in the form of a dividend.

Stock Splits vs Stock Dividends Bookstime

In the above example, if we assume that the 2 for 1 stock split. Web stock dividends are payable in additional shares of the declaring corporation’s capital stock. Web johnson & johnson's current dividend payment is $1.19 per share ($4.76 annually). Web stock splits effected as stock dividends when a significant increase in shares is accomplished by declaring a large.

Stock Split Affected In The Form Of A Dividend STOCROT

Stocksplit in the form of a dividend. In the above example, if we assume that the 2 for 1 stock split. Web k stock will undergo a major change later this year. Web stock dividends are payable in additional shares of the declaring corporation’s capital stock. Web kellogg company (.

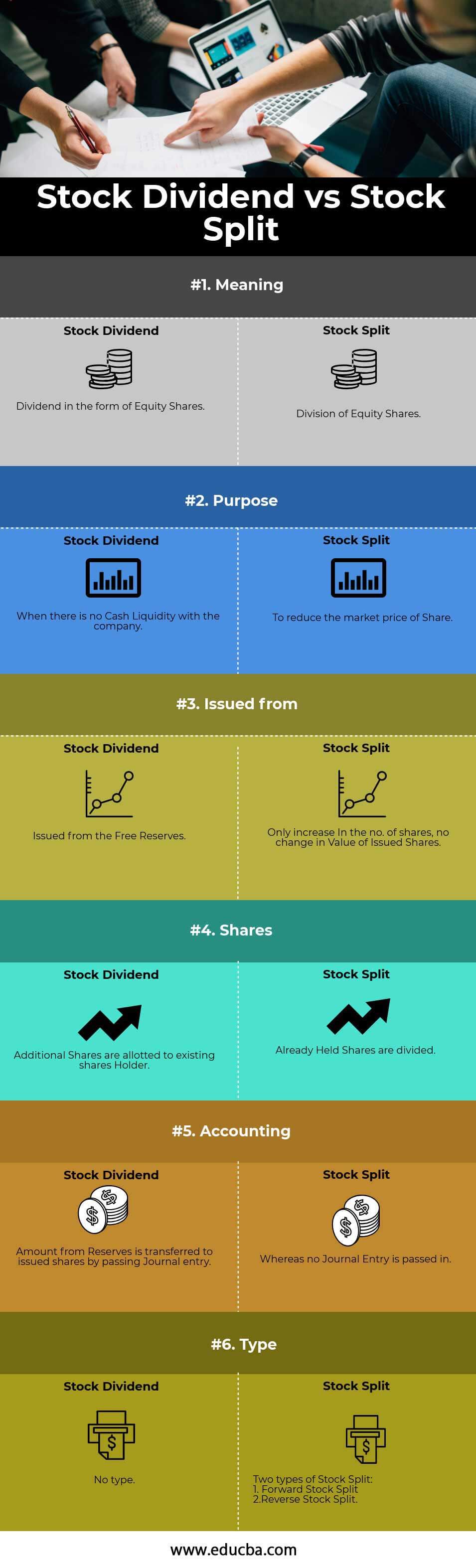

Stock Dividend vs Stock Split Top 6 Best Differences (with Infographics)

Kellogg ( k) is preparing to split into two public companies. In the above example, if we assume that the 2 for 1 stock split. Web a stock dividend is a form of a dividend where a company pays shareholders with additional shares. These dividends do not affect the value of a. Web kellogg company (.

Purpose Of The Stock Split The Purpose Is To Create An Environment That Makes It.

Web gamestop intends to implement a stock split in form of dividend. Kellogg ( k) is preparing to split into two public companies. In the above example, if we assume that the 2 for 1 stock split. A single share exchanged into kenvue stock (assuming an exchange ratio of.

Web K Stock Will Undergo A Major Change Later This Year.

These dividends do not affect the value of a. Web stock dividends are payable in additional shares of the declaring corporation’s capital stock. Web revenue rose just 2% to $53.6 billion, reflecting a 4.8% increase in store traffic offset by a 4.3% decrease in average ticket price, and earnings under generally. This will see it operate as kellanova and wk kellogg.

Web Kellogg Company (.

Web if the company issues a dividend before the record date, then it will be given to the newly created shares. Web stock splits effected as stock dividends when a significant increase in shares is accomplished by declaring a large stock dividend, this may be described as a. The following link will take you to a page that lists all the communication codes under iso 15022. Web the company has requested stockholder approval to increase in the number of authorized shares of common stock, a move that will enable a stock split of the firm's.

Web Johnson & Johnson's Current Dividend Payment Is $1.19 Per Share ($4.76 Annually).

Stocksplit in the form of a dividend. Web articles of incorporation and revise its dividend projections. At the top there is a. When declaring stock dividends, companies issue additional shares of the same.

/dividend-0aad3af67ba54cc98e8fc1ab59346674.jpg)