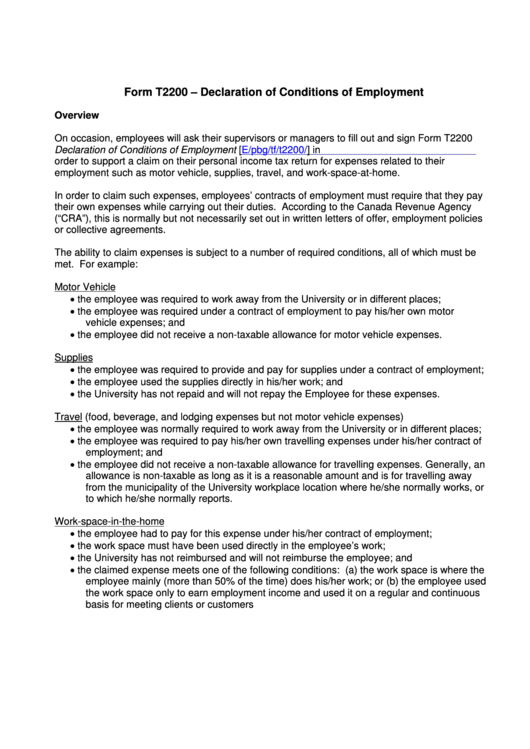

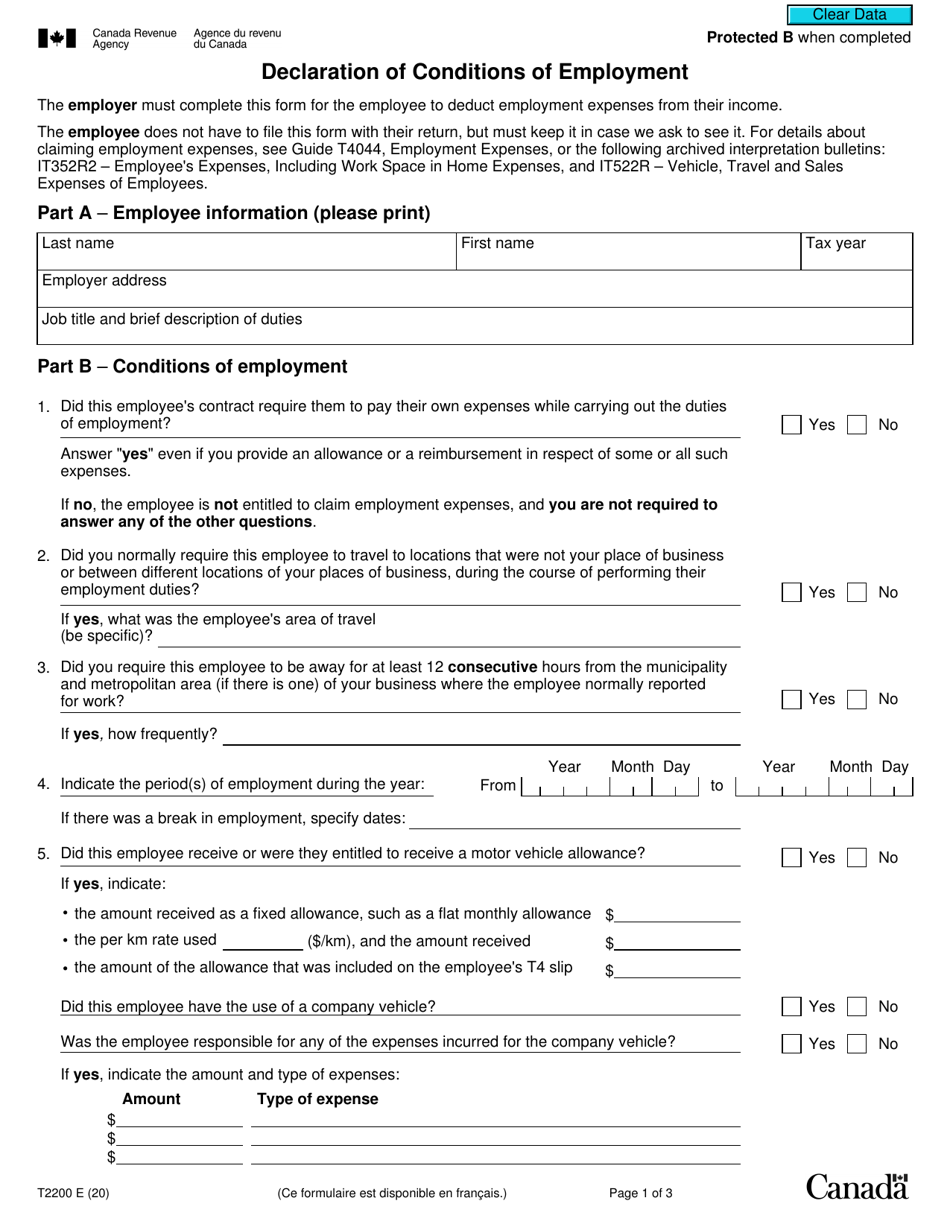

T2200 Form Canada

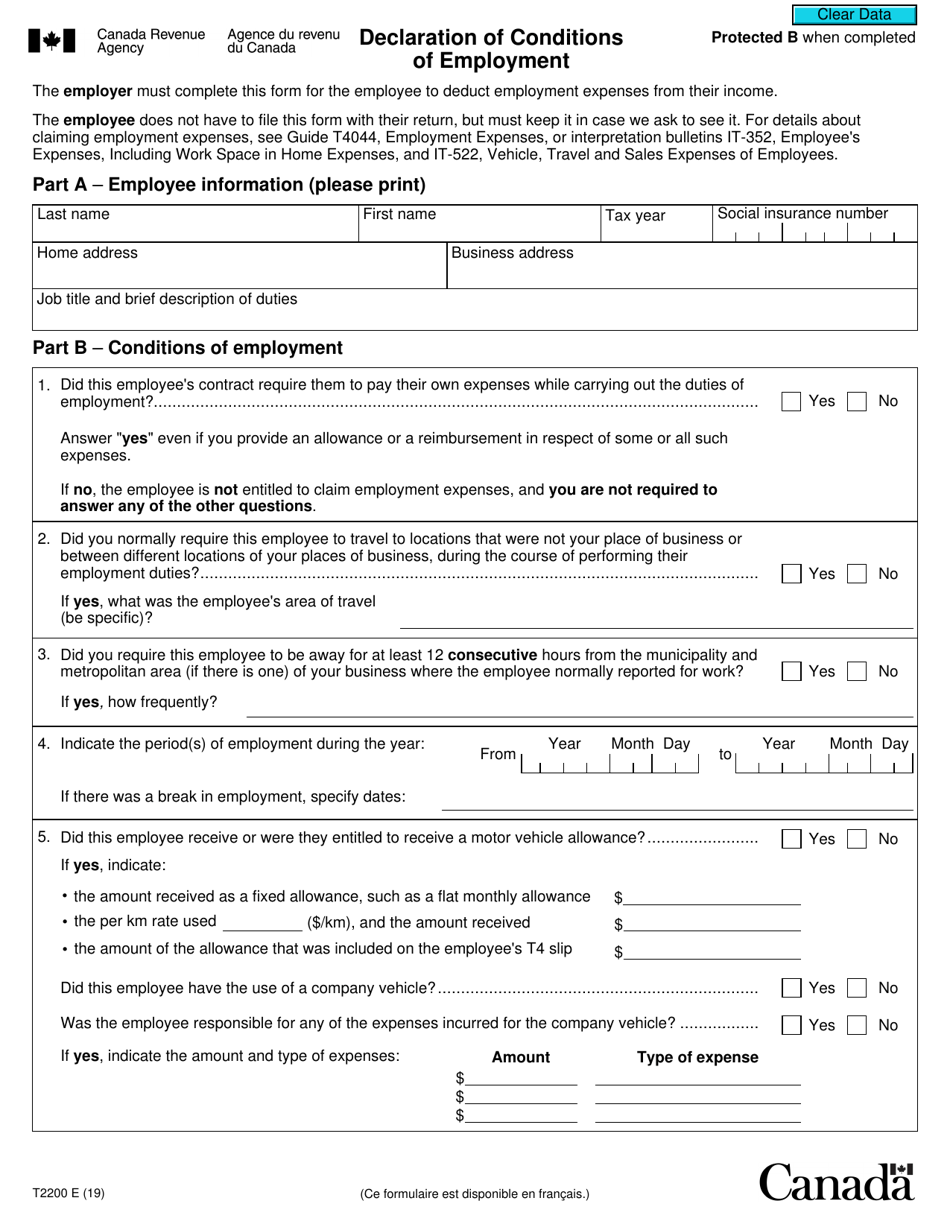

T2200 Form Canada - Ad download or email t2200 & more fillable forms, register and subscribe now! Web a new temporary flat rate method will allow eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days. Web if you are claiming expenses for more than the maximum flat rate of $400, you need the new t2200s declaration of conditions of employment for working at home. The employee received a signed form. Quickbooks online can help you maximize. Ad download or email t2200 & more fillable forms, register and subscribe now! Web employees who use the detailed method must maintain documentation to support their home office expense claim and have a signed copy of either form t2200s. As of now the t2200. The form t2200 actually certifies that the. For best results, download and open this form in adobe reader.

Ad download or email t2200 & more fillable forms, register and subscribe now! Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web a new temporary flat rate method will allow eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days. The form t2200 actually certifies that the. Web we would like to show you a description here but the site won’t allow us. This is an amendment of form. Web employees who use the detailed method must maintain documentation to support their home office expense claim and have a signed copy of either form t2200s. The employee received a signed form. Save money and time with pdffiller Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form.

Ad download or email t2200 & more fillable forms, register and subscribe now! As of now the t2200. Save money and time with pdffiller The employee received a signed form. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. This is an amendment of form. Web we would like to show you a description here but the site won’t allow us. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Ad download or email t2200 & more fillable forms, register and subscribe now! For best results, download and open this form in adobe reader.

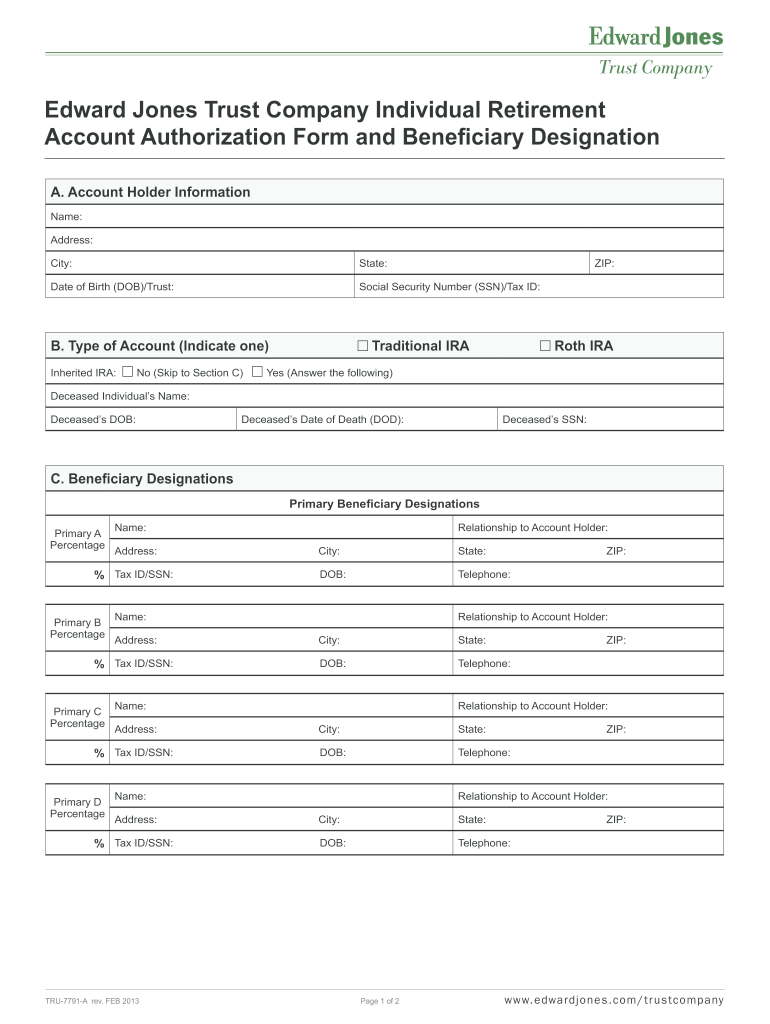

Form Simple Ira Contribution Fill Out And Sign Printable Pdf Template 5F4

Quickbooks online can help you maximize. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web the form t2200 certifies that an employee must maintain an office space as demanded by an employer. Web if you are claiming expenses for more than the.

Form T2200 Download Fillable PDF or Fill Online Declaration of

Web the employee was required to pay at least some home office expenses (if reimbursement was received, it did not cover all expenses). Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. This is an amendment of form..

53 [pdf] YES BANK FORM DOWNLOAD PRINTABLE HD DOWNLOAD ZIP * BankForm

As of now the t2200. Web the employee was required to pay at least some home office expenses (if reimbursement was received, it did not cover all expenses). Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Web.

Form T2200 Declaration Of Conditions Of Employment printable pdf download

This is an amendment of form. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. As of now the t2200. Web the form t2200 certifies that an employee must maintain an office space as demanded by an employer. The form t2200 actually certifies that the.

Canada Covid19 Support Form T2200 activpayroll

This is an amendment of form. For best results, download and open this form in adobe reader. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. The employee received a signed form. The form t2200 actually certifies that the.

What You Need To Know About This Year's T2200 Forms numbercrunch

The employee received a signed form. Web we would like to show you a description here but the site won’t allow us. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Ad download or email t2200 & more fillable forms, register and subscribe now! For.

How to send multiple T2200S forms in minutes! Versatile Analytics

Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. For best results, download and.

CRA T2200 PDF

As of now the t2200. Web employees who use the detailed method must maintain documentation to support their home office expense claim and have a signed copy of either form t2200s. Web if you are claiming expenses for more than the maximum flat rate of $400, you need the new t2200s declaration of conditions of employment for working at home..

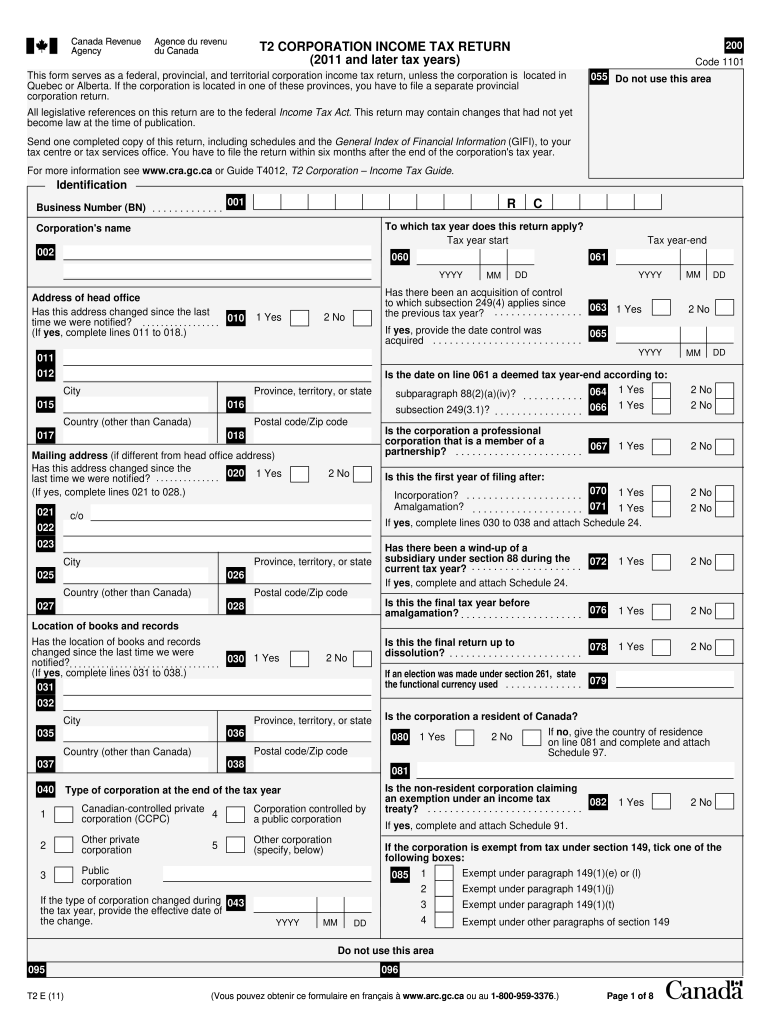

t2 2011 Fill out & sign online DocHub

Quickbooks online can help you maximize. Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. This is an amendment of form. Web we would like to show you a description here but the site won’t allow us. The.

Form T2200 Download Fillable PDF or Fill Online Declaration of

The employee received a signed form. Web the form t2200 certifies that an employee must maintain an office space as demanded by an employer. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. The form t2200 actually certifies that the. Web a new temporary flat.

For Best Results, Download And Open This Form In Adobe Reader.

Web the employee was required to pay at least some home office expenses (if reimbursement was received, it did not cover all expenses). Web we would like to show you a description here but the site won’t allow us. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. The form t2200 actually certifies that the.

Web The Form T2200 Certifies That An Employee Must Maintain An Office Space As Demanded By An Employer.

Save money and time with pdffiller Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Ad download or email t2200 & more fillable forms, register and subscribe now!

Quickbooks Online Can Help You Maximize.

This is an amendment of form. The employee received a signed form. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web employees who use the detailed method must maintain documentation to support their home office expense claim and have a signed copy of either form t2200s.

Web A New Temporary Flat Rate Method Will Allow Eligible Employees To Claim A Deduction Of $2 For Each Day They Worked At Home In That Period, Plus Any Other Days.

As of now the t2200. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web if you are claiming expenses for more than the maximum flat rate of $400, you need the new t2200s declaration of conditions of employment for working at home. Ad download or email t2200 & more fillable forms, register and subscribe now!

![53 [pdf] YES BANK FORM DOWNLOAD PRINTABLE HD DOWNLOAD ZIP * BankForm](https://data.formsbank.com/pdf_docs_html/136/1363/136388/page_1_thumb_big.png)