Tax Form 7004 E File

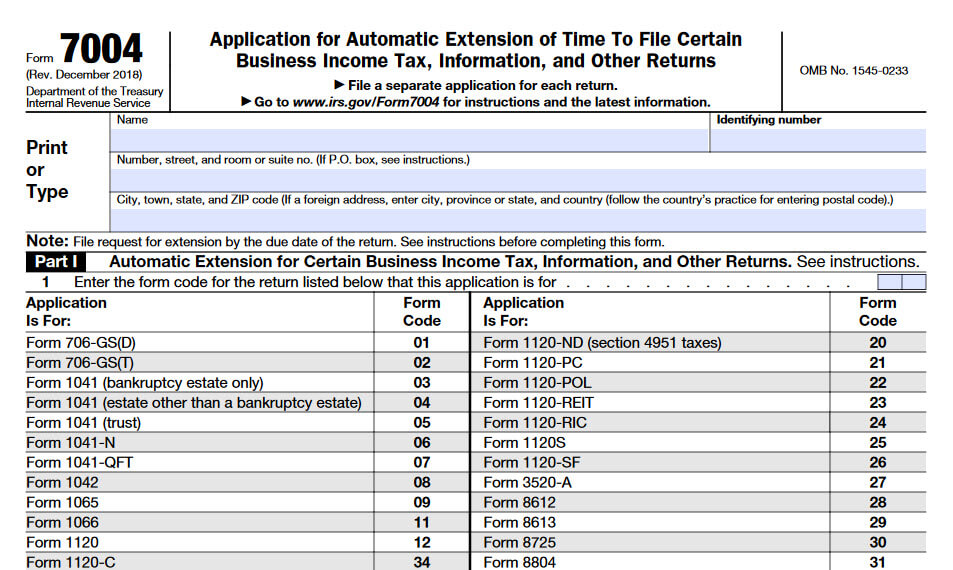

Tax Form 7004 E File - Web how and where to file. Web how and where to file form 7004 can be filed electronically for most returns. Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business: Form 7004 can be filed electronically for most returns. Complete, edit or print tax forms instantly. Always free federal, $14.99 state You can extend filing form 1120s when you file form 7004. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Web irs form 7004 extends the filing deadline for another: Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns.

Web the deadline for tax filing will differ based on the type of business entity. Web how and where to file form 7004 can be filed electronically for most returns. Enter code 25 in the box on form 7004, line 1. Web should file form 7004 by the 15th day of the 6th month following the close of the tax year. Complete, edit or print tax forms instantly. Web how and where to file. Select business entity & form step 3: However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. However, form 7004 cannot be filed electronically for forms 8612, 8613,. Transmit your form to the irs ready to e.

Do not attach form 7004. Web use the chart to determine where to file form 7004 based on the tax form you complete. Ad access irs tax forms. Complete, edit or print tax forms instantly. For estates, partnerships, and trusts the original due date is april 5 th. Select the tax year step 4: You can also download and print an interactive version of. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Complete irs tax forms online or print government tax documents. Form 7004 can be filed electronically for most returns.

Efile Form 7004 & get extension up to 6 months. in 2021 Business tax

Web should file form 7004 by the 15th day of the 6th month following the close of the tax year. Select business entity & form step 3: Web form 7004 is used to request an automatic extension of time to file certain business income tax, information and other returns. Web how and where to file form 7004 can be filed.

EFile IRS Form 7004 Business Tax Extension Form 7004 Online

Select the tax year step 4: Complete, edit or print tax forms instantly. You can extend filing form 1120s when you file form 7004. Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. For estates, partnerships, and trusts the original due date.

File form 7004 tax extension

Always free federal, $14.99 state To file form 7004 using taxact. Web how and where to file form 7004 can be filed electronically for most returns. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Web where the corporation will file its income tax return.

Tax extension form 7004

Payment of tax.—form 7004 does not extend the time for payment of tax. You can extend filing form 1120s when you file form 7004. However, form 7004 cannot be filed electronically for forms 8612, 8613,. Generally, form 7004 must be filed on or before the. Web irs form 7004 extends the filing deadline for another:

EFile 7004 Online 2022 File Business Tax extension Form

Web how and where to file form 7004 can be filed electronically for most returns. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web should file form 7004 by the 15th day of the 6th month.

E File Tax Form 7004 Universal Network

To file form 7004 using taxact. Complete, edit or print tax forms instantly. Web irs form 7004, also known as the application for automatic extension of time to file certain business income tax, information, and other returns, is a crucial document for. Select business entity & form step 3: Web where the corporation will file its income tax return.

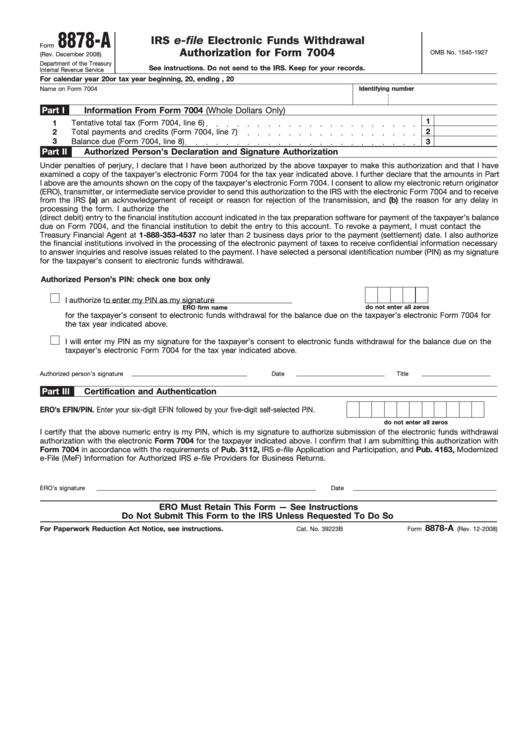

Fillable Form 8878A Irs EFile Electronic Funds Withdrawal

For estates, partnerships, and trusts the original due date is april 5 th. Complete irs tax forms online or print government tax documents. The following links provide information on the companies that have passed the internal revenue service (irs). Enter business details step 2: Web use the chart to determine where to file form 7004 based on the tax form.

Efile Tax Form 7004 Universal Network

Transmit your form to the irs ready to e. Select business entity & form step 3: Web irs form 7004 extends the filing deadline for another: Web how and where to file form 7004 can be filed electronically for most returns. Complete irs tax forms online or print government tax documents.

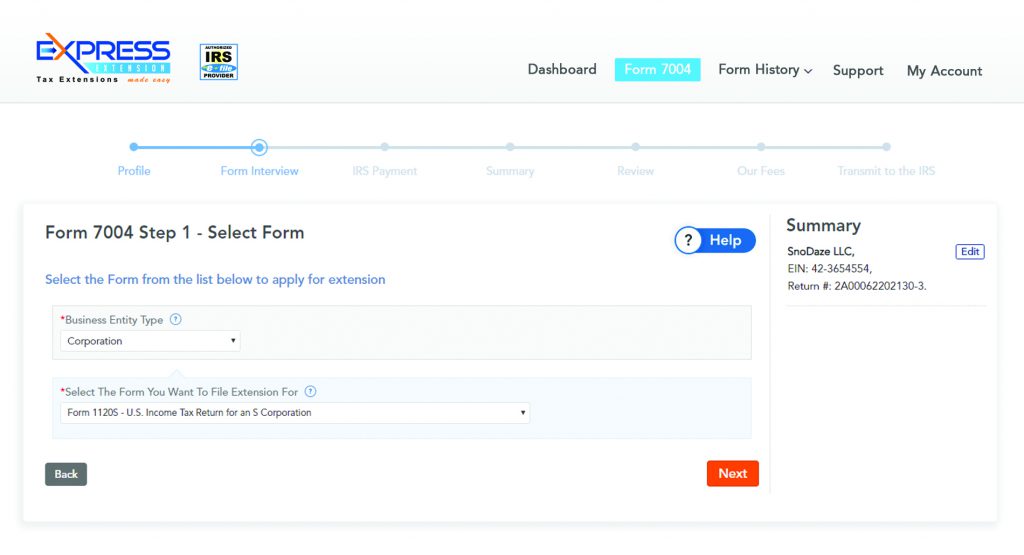

How To File Your Extension Form 7004? Blog ExpressExtension

You can also download and print an interactive version of. Always free federal, $14.99 state Web the purpose of irs tax form 7004 is to request an extension to file these specific income returns, enabling taxpayers to avoid potential late filing penalties. The following links provide information on the companies that have passed the internal revenue service (irs). Enter business.

When is Tax Extension Form 7004 Due? Tax Extension Online

Web the deadline for tax filing will differ based on the type of business entity. Complete irs tax forms online or print government tax documents. Use form 7004 to request an automatic 6. Enter business details step 2: Web how and where to file form 7004 can be filed electronically for most returns.

Do Not Attach Form 7004.

Select the tax year step 4: Web form 7004 is used to extend the deadline for filing tax returns (certain business tax, information, and other returns). Web use the chart to determine where to file form 7004 based on the tax form you complete. Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business:

Form 7004 Can Be Filed Electronically For Most Returns.

You can also download and print an interactive version of. Web how and where to file. Transmit your form to the irs ready to e. The following links provide information on the companies that have passed the internal revenue service (irs).

Ad Access Irs Tax Forms.

Web the purpose of irs tax form 7004 is to request an extension to file these specific income returns, enabling taxpayers to avoid potential late filing penalties. Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. For estates, partnerships, and trusts the original due date is april 5 th. The irs form 7004 offers businesses an extension of.

To File Form 7004 Using Taxact.

Enter business details step 2: Select business entity & form step 3: Complete, edit or print tax forms instantly. Web how and where to file form 7004 can be filed electronically for most returns.