Tax Form 8825

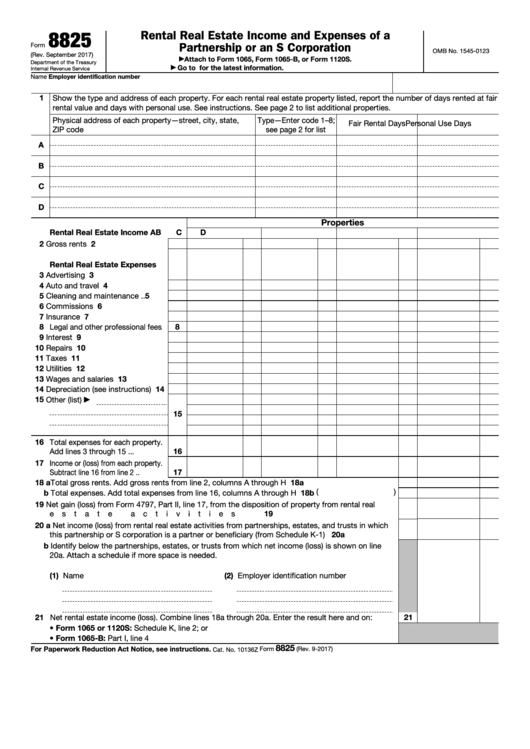

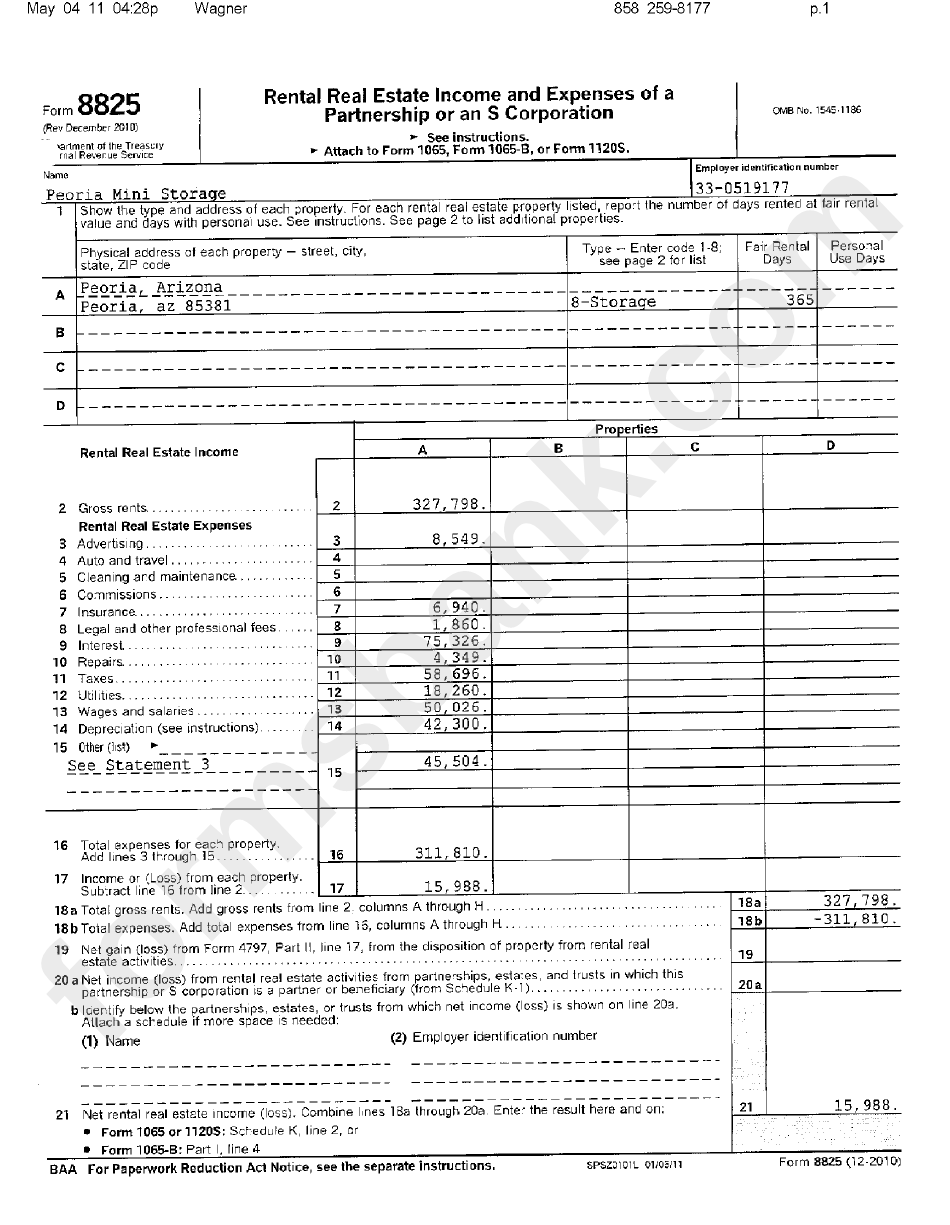

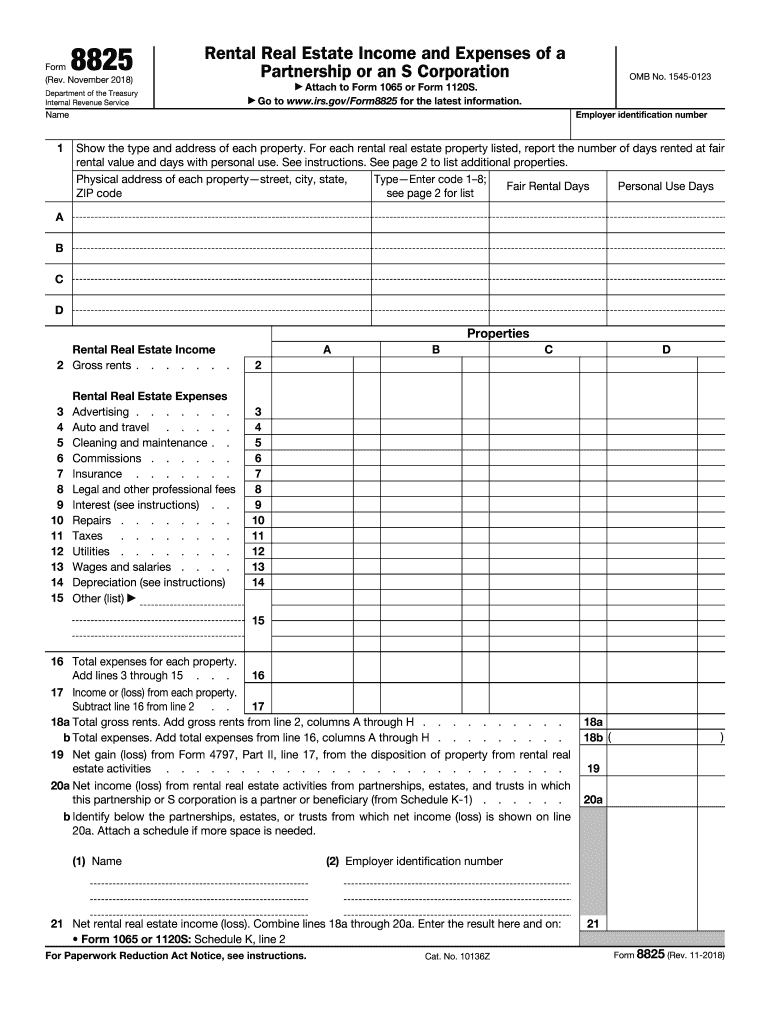

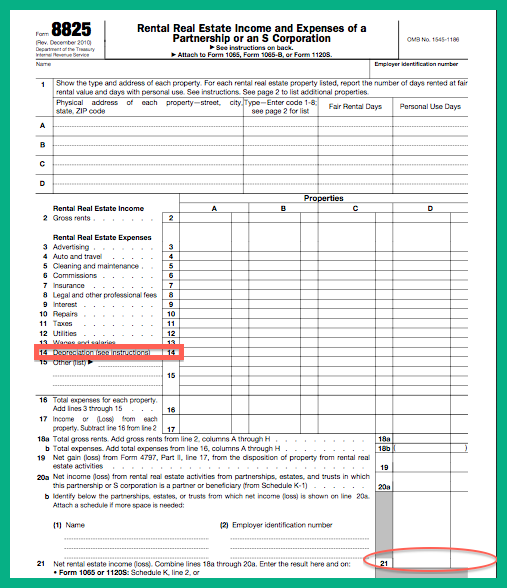

Tax Form 8825 - If the owner is an individual, their share goes to schedule e, page two line 28 column f or g. Go to www.irs.gov/form8825 for the latest information. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. Attach to form 1065 or form 1120s. You will need this form to complete the data. Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. In plain english, it is the company version of the schedule e rental real estate form we often see. In that case, you will need to include the income and expenses of each property on the form. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return:

Rental real estate income and expenses of a partnership or an s corporation. Attach to form 1065 or form 1120s. Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. Form 8825 is used to report income and deductible expenses from rental real estate activities. November 2018) department of the treasury internal revenue service. Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. Web form 8825 reports the rental income of partnerships or s corporations in the united states. You will need this form to complete the data. Then it flows through to the owner’s return. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts.

November 2018) rental real estate income and expenses of a partnership or an s corporation department of the treasury internal revenue service employer identification number name 1 omb no. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Go to www.irs.gov/form8825 for the latest information. Then it flows through to the owner’s return. Web form 8825 reports the rental income of partnerships or s corporations in the united states. Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. Rental real estate income and expenses of a partnership or an s corporation. If you are reporting partnership. All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts.

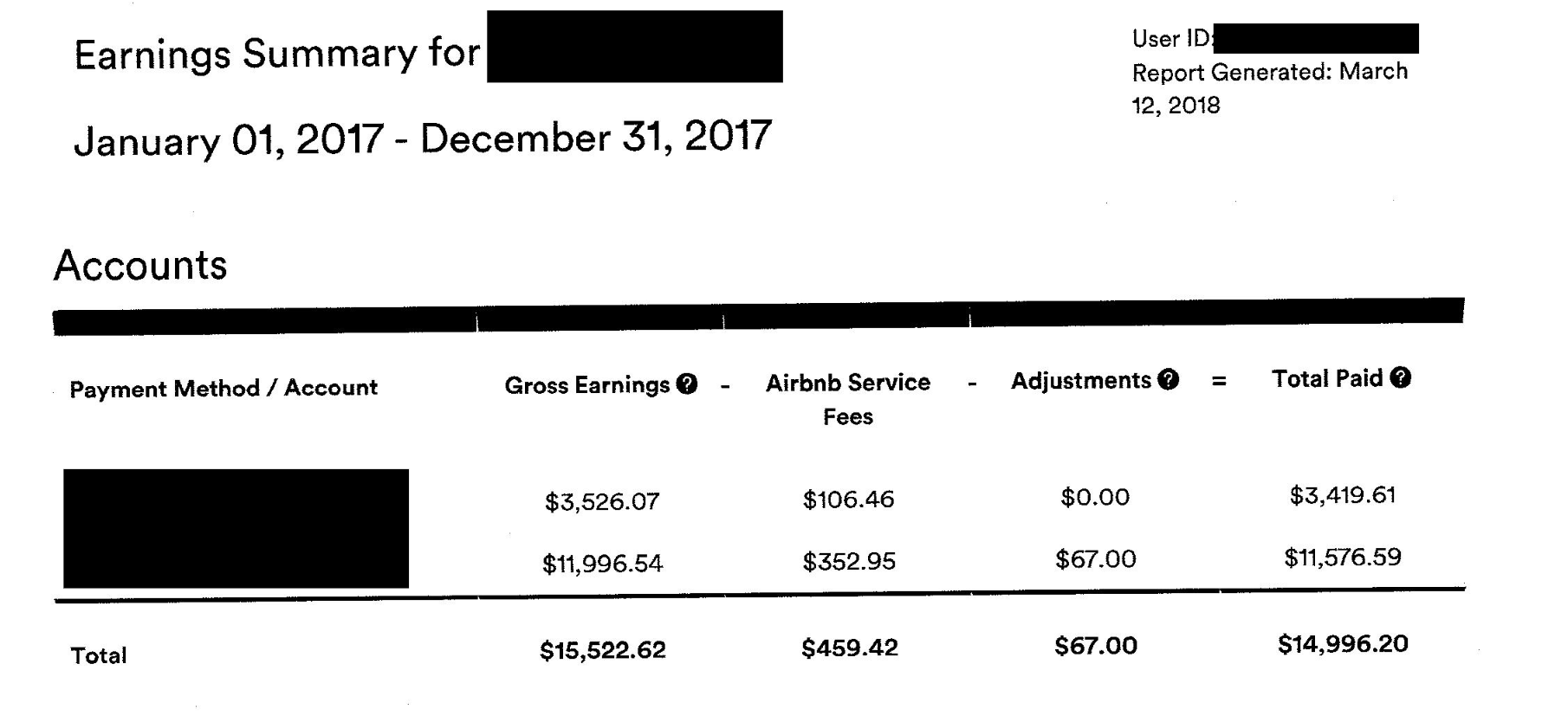

How To Add Airbnb on Your Tax Return VacationLord

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Rental real estate income and expenses of a partnership or an s corporation. If you are reporting partnership. Web an 8825 form is officially.

Fill Free fillable Form 8825 Rental Real Estate and Expenses

November 2018) department of the treasury internal revenue service. In that case, you will need to include the income and expenses of each property on the form. You will need this form to complete the data. Web form 8825 reports the rental income of partnerships or s corporations in the united states. If the owner is an individual, their share.

Top 6 Form 8825 Templates free to download in PDF format

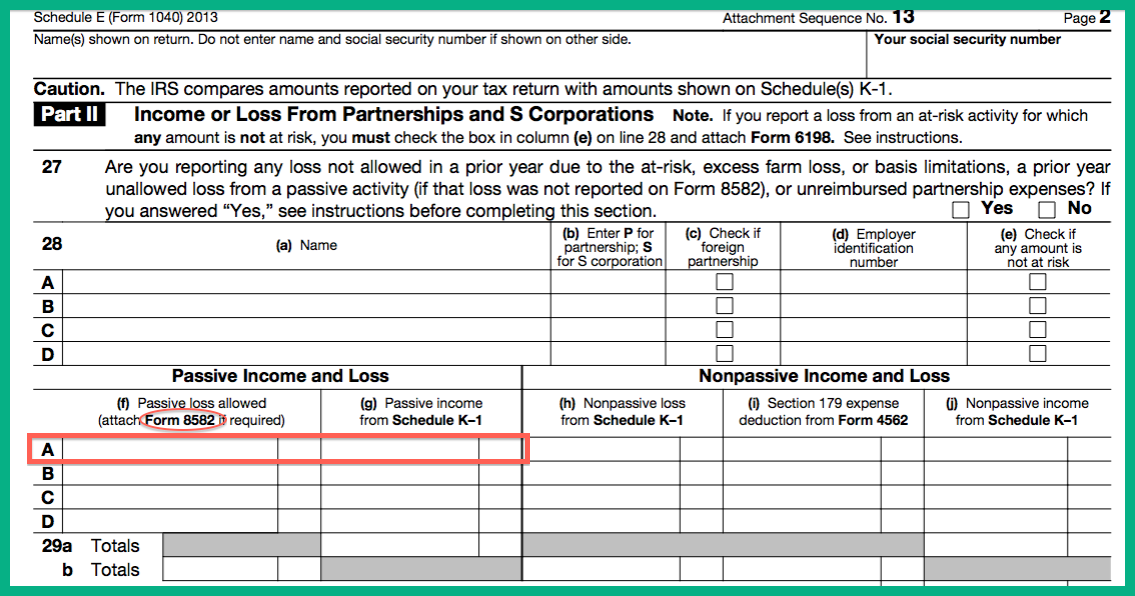

Up to eight different properties may be included on a single 8825 form and information about each property’s expenses and incomes must be provided. If the owner is an individual, their share goes to schedule e, page two line 28 column f or g. Web the 8825 is the real estate form and it flows to the schedule k instead.

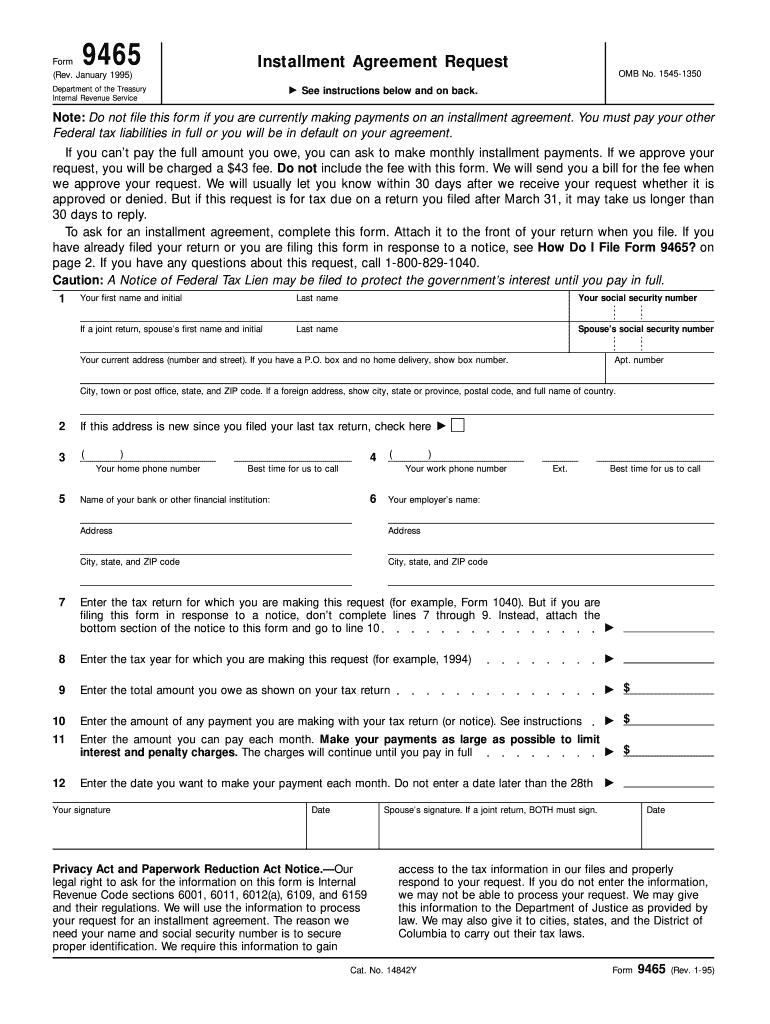

Form 9465 Installment Agreement Request Fill Out and Sign Printable

If you are reporting partnership. Go to www.irs.gov/form8825 for the latest information. Then it flows through to the owner’s return. November 2018) rental real estate income and expenses of a partnership or an s corporation department of the treasury internal revenue service employer identification number name 1 omb no. Attach to form 1065 or form 1120s.

Linda Keith CPA » All about the 8825

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. November 2018) rental real estate income and expenses of a partnership or an s corporation department of the treasury internal revenue service employer identification.

Form 8825 Rental Real Estate And Expenses Of A printable pdf

In plain english, it is the company version of the schedule e rental real estate form we often see. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Rental real estate income and expenses of a partnership or an s corporation. November 2018) rental real.

OMB Archives PDFfiller Blog

Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. You will need this form to complete the data. If you are reporting partnership. All rental real estate activities are reported on form 8825, whether from a trade or business or held for the production of income. November 2018).

20182022 Form IRS 8825 Fill Online, Printable, Fillable, Blank pdfFiller

You will need this form to complete the data. Rental real estate income and expenses of a partnership or an s corporation. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Form 8825 is used to report income and deductible expenses from rental real estate.

Linda Keith CPA » All about the 8825

November 2018) department of the treasury internal revenue service. Then it flows through to the owner’s return. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including.

Form 8805 Foreign Partner's Information Statement of Section 1446 Wi…

In that case, you will need to include the income and expenses of each property on the form. Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. November 2018) rental real estate income and expenses of a partnership or an s corporation department of the treasury internal revenue.

Web Partnerships And S Corporations Use Form 8825 To Report Income And Deductible Expenses From Rental Real Estate Activities, Including Net Income (Loss) From Rental Real Estate Activities That Flow Through From Partnerships, Estates, Or Trusts.

November 2018) department of the treasury internal revenue service. If you are reporting partnership. Then it flows through to the owner’s return. Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file.

All Rental Real Estate Activities Are Reported On Form 8825, Whether From A Trade Or Business Or Held For The Production Of Income.

Form 8825 is used to report income and deductible expenses from rental real estate activities. Rental real estate income and expenses of a partnership or an s corporation. Web form 8825 reports the rental income of partnerships or s corporations in the united states. If the owner is an individual, their share goes to schedule e, page two line 28 column f or g.

Attach To Form 1065 Or Form 1120S.

You will need this form to complete the data. In that case, you will need to include the income and expenses of each property on the form. Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. In plain english, it is the company version of the schedule e rental real estate form we often see.

Up To Eight Different Properties May Be Included On A Single 8825 Form And Information About Each Property’s Expenses And Incomes Must Be Provided.

November 2018) rental real estate income and expenses of a partnership or an s corporation department of the treasury internal revenue service employer identification number name 1 omb no. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Go to www.irs.gov/form8825 for the latest information.