Tax Form Rut-50

Tax Form Rut-50 - Web rut 50 form pdf details rut form is an annual tax filing requirement for farmers and ranchers with gross income of more than $225,000 from farming or ranching operations. Web what happens if my bank account is closed before my tax refund direct deposit is made? Enjoy smart fillable fields and. Get your online template and fill it in using progressive features. As the society takes a step away from office working conditions, the completion. In other words, if a vehicle is sold out of illinois, they are not. One of these forms must be presented with a separate tax payment made out to the illinois department of. Employee's withholding certificate form 941; Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web employer's quarterly federal tax return.

Web complete tax form rut 50 online with us legal forms. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web tax form rut 50 is a tax form that helps you find the right forms. Employee's withholding certificate form 941; Web what makes the tax form rut 50 legally valid? Reach out to learn how we can help you! If you need to obtain the forms prior to. The eligibility for filing the form is based on the kind of transaction in illinois. Sovos combines tax automation with a human touch. As the society takes a step away from office working conditions, the completion.

Leverage 1040 tax automation software to make tax preparation more profitable. Hitting the orange button down below will bring up our pdf tool. Web ★ 4.8 satisfied 46 votes how to fill out and sign tax form rut 50 online? Easily fill out pdf blank, edit, and sign them. This editor allows anyone to fill out this form. Web what makes the tax form rut 50 legally valid? Employers engaged in a trade or business who. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web tax forms, assistance and statistics. Web use a tax form rut 50 printable 2015 template to make your document workflow more streamlined.

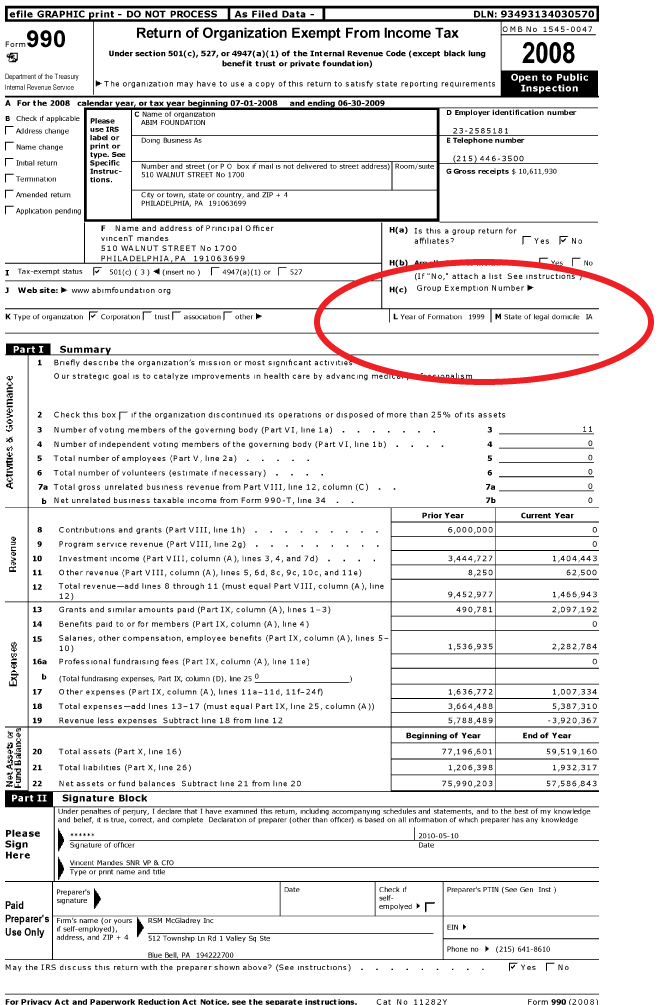

Secretary Cyberdriveillinois Bank Get Fill Online, Printable

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web tax forms, assistance and statistics. Easily fill out pdf blank, edit, and sign them. Web ★ 4.8 satisfied 46 votes how to fill out and sign tax form rut 50 online? Web rut 50 form pdf details rut form is an.

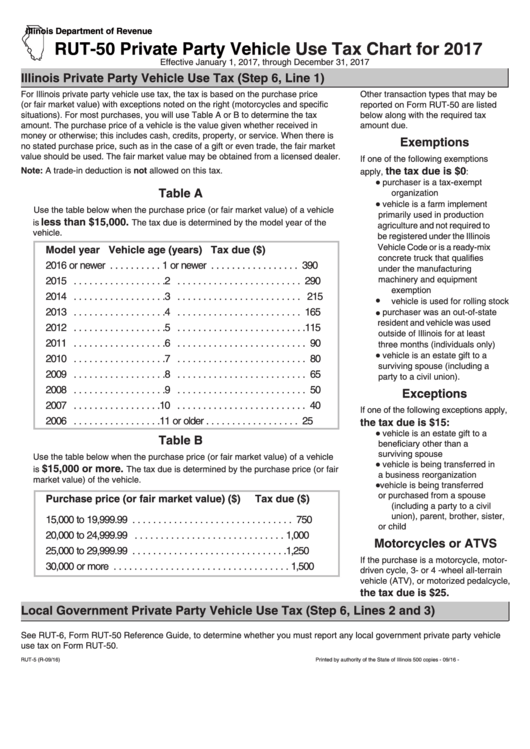

illinois tax rut 50 chart PDFSimpli

This editor allows anyone to fill out this form. Web rate the tax form rut 50 4.8 satisfied 293 votes what makes the rut 50 form legally binding? Web what happens if my bank account is closed before my tax refund direct deposit is made? Easily fill out pdf blank, edit, and sign them. One of these forms must be.

Tax Form Rut50 Printable

Save or instantly send your ready documents. In other words, if a vehicle is sold out of illinois, they are not. Web ★ 4.8 satisfied 46 votes how to fill out and sign tax form rut 50 online? Sovos combines tax automation with a human touch. Web what makes the tax form rut 50 legally valid?

rut 7 form illinois Fill out & sign online DocHub

Hitting the orange button down below will bring up our pdf tool. One of these forms must be presented with a separate tax payment made out to the illinois department of. Reach out to learn how we can help you! Show details how it works open the rut 50 printable form and follow the. This editor allows anyone to fill.

Md state tax form 2004 bxunrtb

Sovos combines tax automation with a human touch. Web tax form rut 50 is a tax form that helps you find the right forms. Web rate the tax form rut 50 4.8 satisfied 293 votes what makes the rut 50 form legally binding? Web what makes the tax form rut 50 legally valid? Employers engaged in a trade or business.

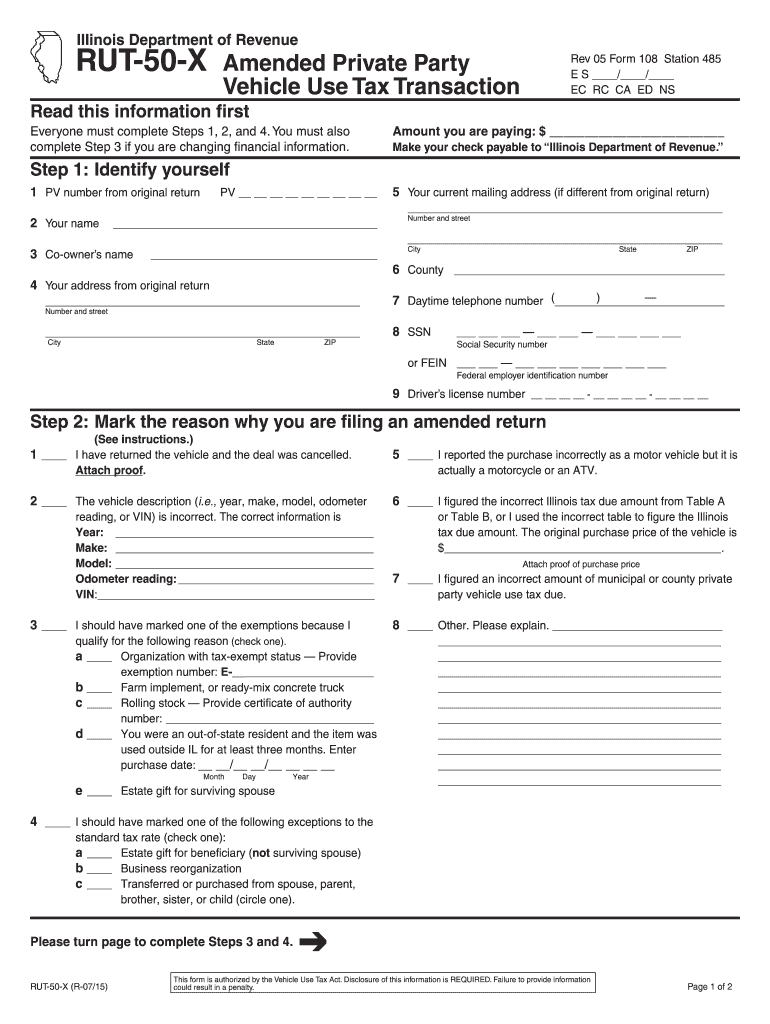

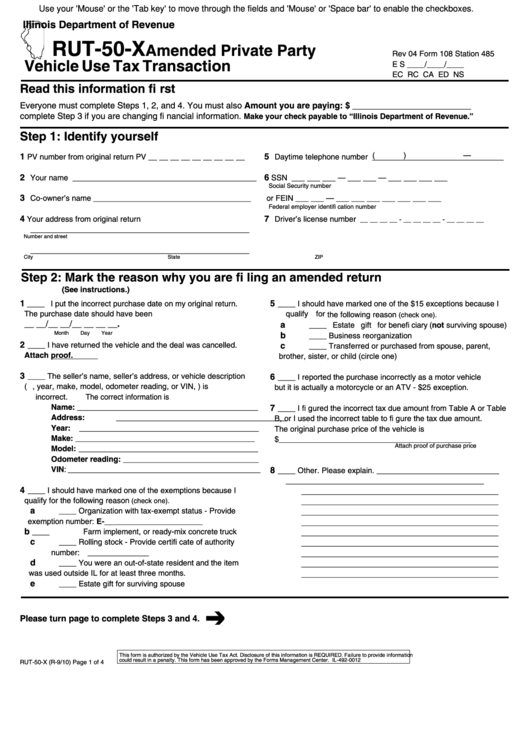

20152022 Form IL RUT50X Fill Online, Printable, Fillable, Blank

If you need to obtain the forms prior to. Web rate the tax form rut 50 4.8 satisfied 293 votes what makes the rut 50 form legally binding? Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web tax form rut 50 is a tax form that helps you find.

Rut 25 X Form Fill Online, Printable, Fillable, Blank pdfFiller

One of these forms must be presented with a separate tax payment made out to the illinois department of. Sovos combines tax automation with a human touch. Employers engaged in a trade or business who. Show details how it works open the rut 50 printable form and follow the. If you need to obtain the forms prior to.

Fillable Form Rut50X Amended Private Party Vehicle Use Tax

Web tax form rut 50 printable rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 52 votes how to fill out and sign rut 50 form illinois 2023 online? Web rut 50 form pdf details rut form is an annual tax filing requirement for farmers and ranchers with gross income of.

Tax Form Rut50 Printable

Employers engaged in a trade or business who. If you need to obtain the forms prior to. Web tax form rut 50 printable rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 52 votes how to fill out and sign rut 50 form illinois 2023 online? Hitting the orange button down.

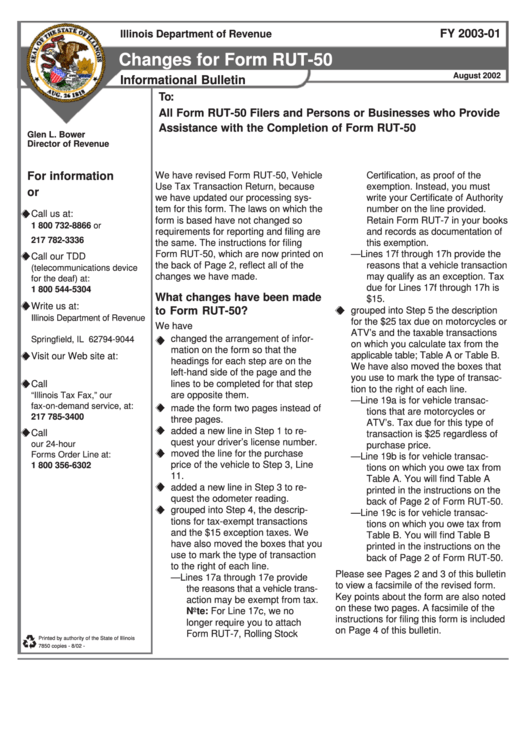

Changes For Form Rut50 printable pdf download

Save or instantly send your ready documents. Leverage 1040 tax automation software to make tax preparation more profitable. Hitting the orange button down below will bring up our pdf tool. Web rate the tax form rut 50 4.8 satisfied 293 votes what makes the rut 50 form legally binding? Web rut 50 form pdf details rut form is an annual.

If You Need To Obtain The Forms Prior To.

Web what happens if my bank account is closed before my tax refund direct deposit is made? Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web rut 50 form pdf details rut form is an annual tax filing requirement for farmers and ranchers with gross income of more than $225,000 from farming or ranching operations. One of these forms must be presented with a separate tax payment made out to the illinois department of.

As The Society Takes A Step Away From Office Working Conditions, The Completion.

Web employer's quarterly federal tax return. Web tax forms, assistance and statistics. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web tax form rut 50 is a tax form that helps you find the right forms.

This Editor Allows Anyone To Fill Out This Form.

Sovos combines tax automation with a human touch. Easily fill out pdf blank, edit, and sign them. Show details how it works open the rut 50 printable form and follow the. Web what makes the tax form rut 50 legally valid?

In Other Words, If A Vehicle Is Sold Out Of Illinois, They Are Not.

Get your online template and fill it in using progressive features. The eligibility for filing the form is based on the kind of transaction in illinois. Leverage 1040 tax automation software to make tax preparation more profitable. Web ★ 4.8 satisfied 46 votes how to fill out and sign tax form rut 50 online?