Tax Form Template

Tax Form Template - Read the instructions to find the form that fits best. Web county assessors' template forms notices of valuation. Enter your tax information online. Electronically sign and file your return. Disabled veteran application instructions 2023. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Apply for an employer id number (ein) Web popular forms & instructions; Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Oil and gas leaseholds and lands notice of valuation.

Web file your taxes for free. This may include interest, dividends, and retirement income. Fill out your tax forms • complete the main form and include additional material as needed. For more information about form 4506, visit. Married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) Web prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien. Web instructions for recipient recipient’s taxpayer identification number (tin). Web please send a newly signed copy to the address shown on the top of your notice. Oil and gas leaseholds and lands notice of valuation.

Do not sign this form unless all applicable lines have been completed. Print your return for recordkeeping. Married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) Pandadoc offers tax form templates to help you fill in the necessary details with ease. Web tax form templates submitting complete and accurate tax information to the internal revenue service (irs) should be a best practice in your business operations. Request may be rejected if the form is incomplete or illegible. Choose the income tax form you need. Web (a) other income (not from jobs). Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) For more information about form 4506, visit.

Breanna Tax Return Form 2019 Pdf

Web find the 2022 federal tax forms you need. Choose the income tax form you need. Web tax form templates submitting complete and accurate tax information to the internal revenue service (irs) should be a best practice in your business operations. Web popular forms & instructions; If you received a notice for your 2019 return and you filed timely, please.

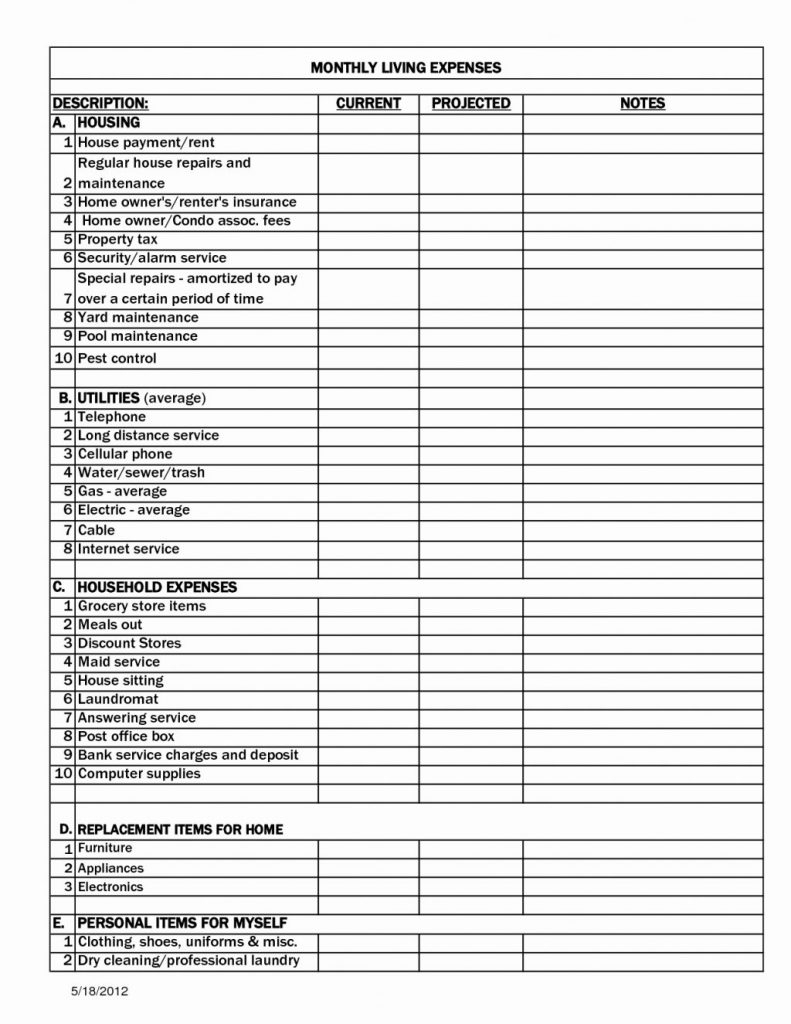

Free Tax Spreadsheet Templates intended for Tax Excel

Web instructions for recipient recipient’s taxpayer identification number (tin). If you received a notice for your 2019 return and you filed timely, please refile the return. Whether you’re a government agency collecting official tax forms or an accountant gathering information from your clients, securely receive tax information online with jotform’s tax forms! Individual tax return form 1040 instructions; Web in.

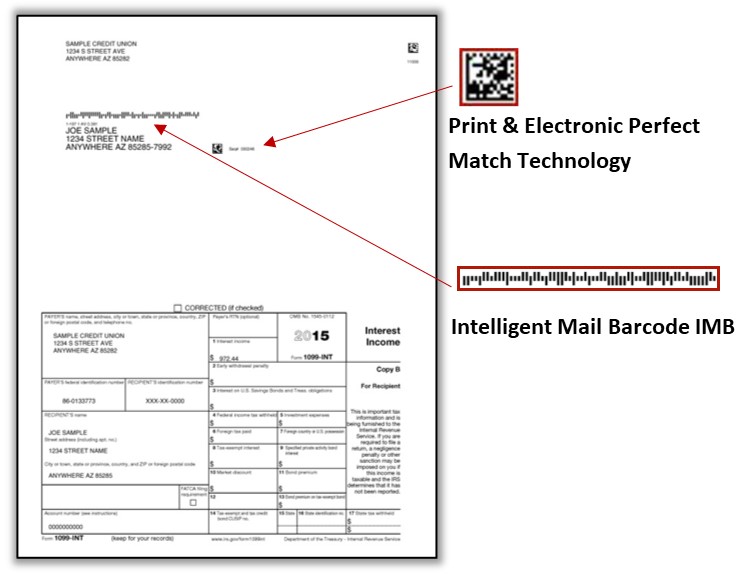

Tax form print and mail, Tax Printing Services, Tax document processing

If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. Married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) Apply for an employer id number (ein) Qualifying veteran with.

Tax Spreadsheet Template Spreadsheet Downloa tax planning spreadsheet

Residents can file form 1040 electronically using one of three approved methods: Whether you’re a government agency collecting official tax forms or an accountant gathering information from your clients, securely receive tax information online with jotform’s tax forms! Web instructions for recipient recipient’s taxpayer identification number (tin). Apply for an employer id number (ein) Web get federal tax forms.

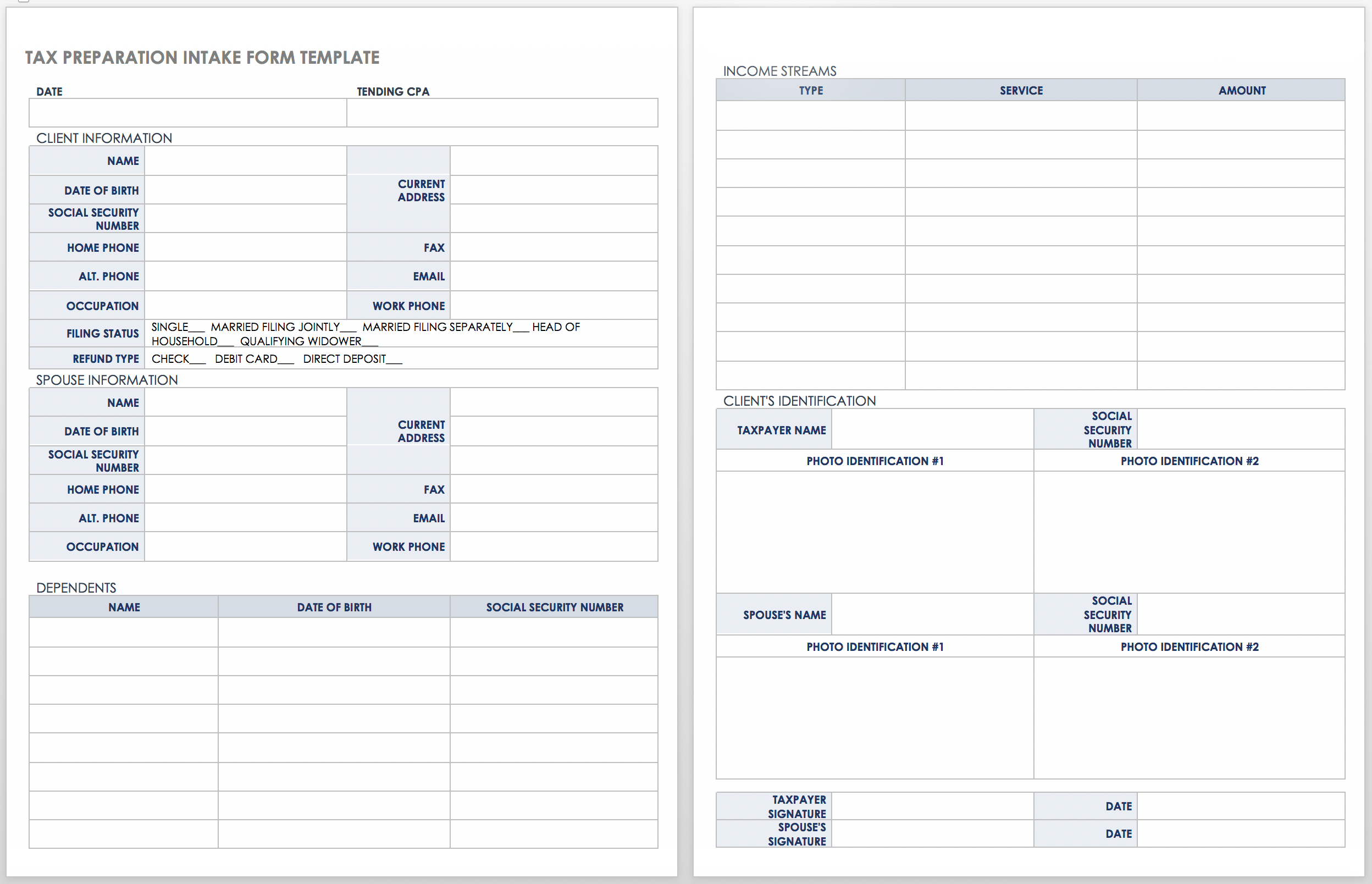

Free Client Intake Templates and Forms Smartsheet

Request for copy of tax return. Web get federal tax return forms and file by mail. Read the instructions to find the form that fits best. This may include interest, dividends, and retirement income. Individual income tax return 2022 department of the treasury—internal revenue service omb no.

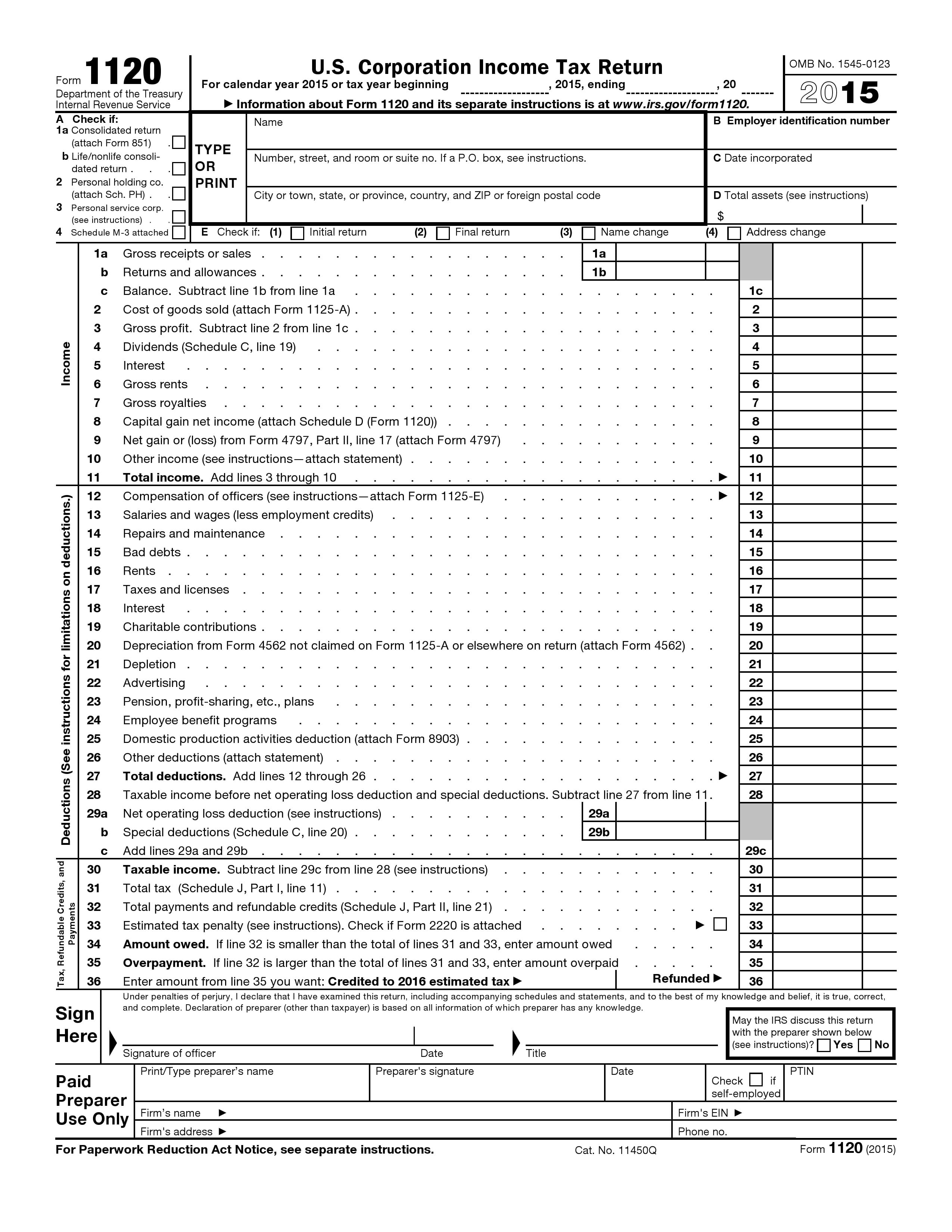

Free Tax Forms PDF Template Form Download

Web get federal tax return forms and file by mail. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien. Print your return for recordkeeping. Most pandadoc templates include an electronic signature section that should be signed and then sent.

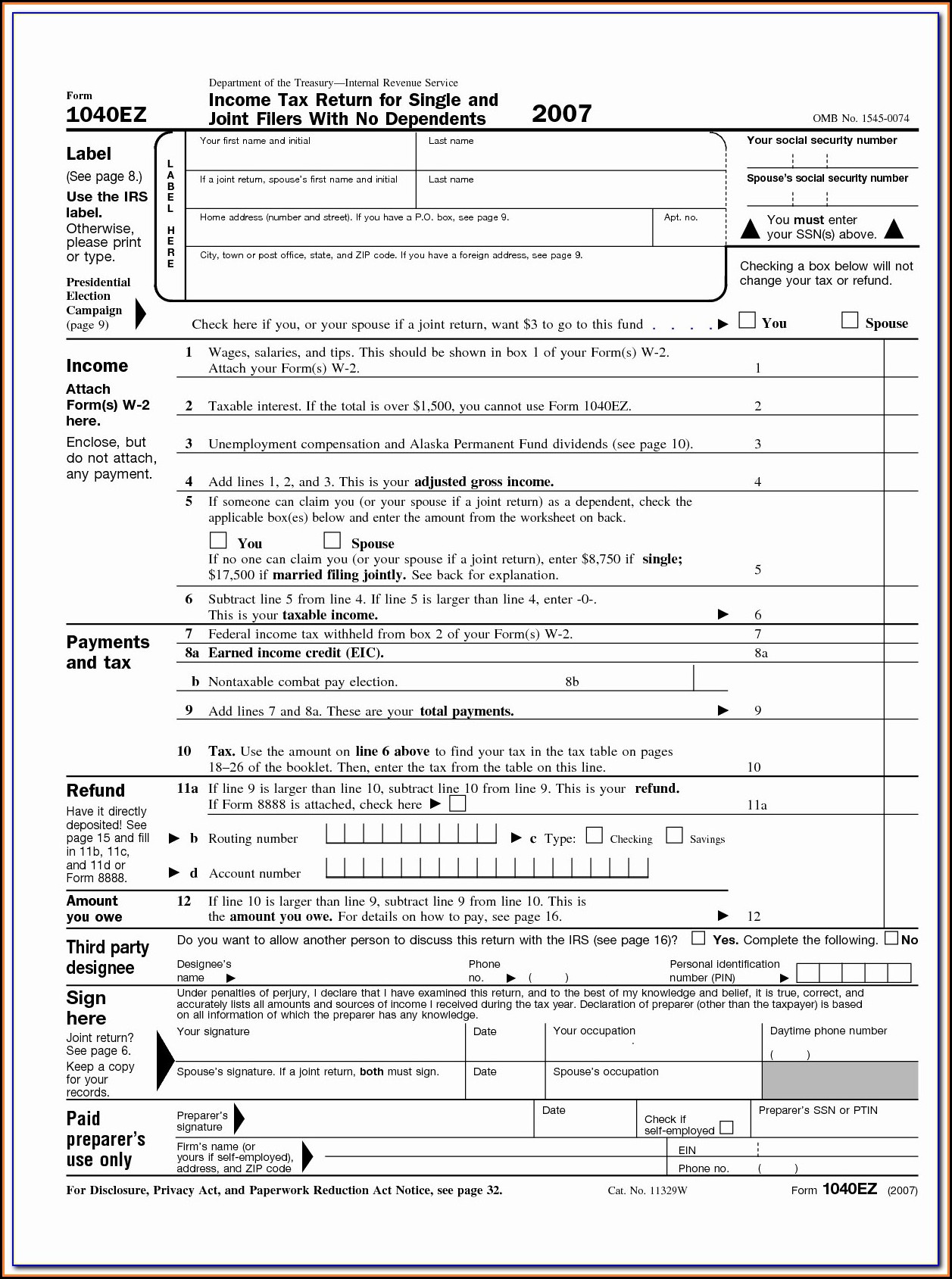

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

Web tax form templates submitting complete and accurate tax information to the internal revenue service (irs) should be a best practice in your business operations. Disabled veteran application instructions 2023. Do not sign this form unless all applicable lines have been completed. Start by selecting a form template below and customizing it to match your needs and branding. You can.

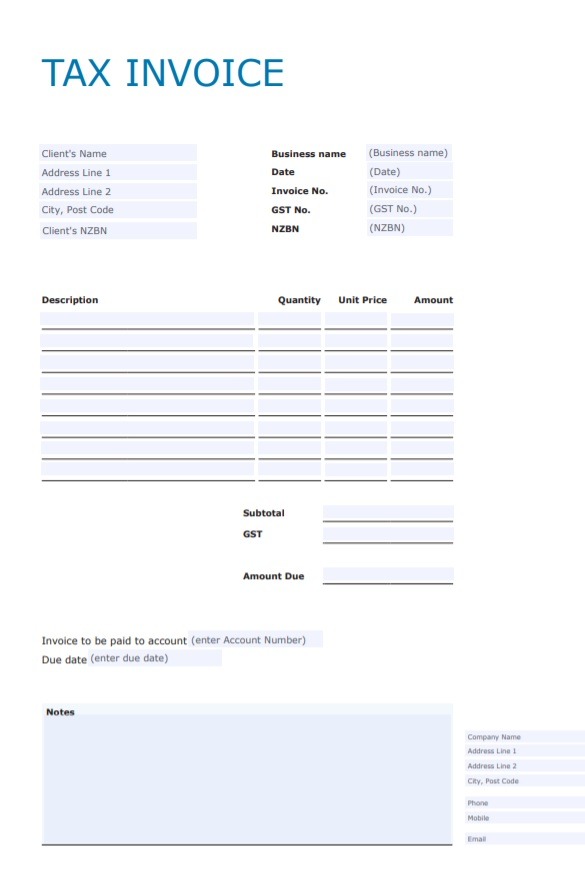

Tax Invoice Template Free Printable Word Templates,

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Disabled veteran application instructions 2023. Web in general, you’ll use the standard form 1040 if you are making itemized deductions, make more than $100,000 per year, or.

Tax form — Stock Photo © AGphoto 1075401

Request may be rejected if the form is incomplete or illegible. If you received a notice for your 2019 return and you filed timely, please refile the return. Electronically sign and file your return. Get answers to your tax questions. Limitations with free file fillable forms include:

Tax Invoice Template Free Word Templates

Request may be rejected if the form is incomplete or illegible. Married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Most pandadoc templates include an electronic signature section that should be signed and then sent to. Sign in to your account.

Check Your Federal Tax Withholding.

Web find the 2022 federal tax forms you need. Web this amount includes the 1.45% medicare tax withheld on all medicare wages and tips shown in box 5, as well as the 0.9% additional medicare tax on any of those medicare wages and tips above $200,000. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Enter your tax information online.

Electronic Filing Of Form 1040.

Irs use only—do not write or staple in this space. If you received a notice for your 2019 return and you filed timely, please refile the return. For information on how to report tips on your tax return, see the form 1040 instructions. Individual tax return form 1040 instructions;

Filing Status Check Only One Box.

Web get federal tax forms. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Get the current filing year’s forms, instructions, and publications for free from the irs.

Fill Out Your Tax Forms • Complete The Main Form And Include Additional Material As Needed.

Whether you’re a government agency collecting official tax forms or an accountant gathering information from your clients, securely receive tax information online with jotform’s tax forms! Web cloned 8,616 tax preparation client intake form is a tool that a taxpayer can use to verify his/her income, expenses, insurance, and other related information about tax for the current year. Do not sign this form unless all applicable lines have been completed. Read the instructions to find the form that fits best.