Taxslayer Form 7202

Taxslayer Form 7202 - We stand behind the accuracy of your return and help you get your taxes done right. Credits for sick leave and family leave. Web the income limit for the 2021 recovery rebate credit is $150,000 ($160,000 maximum) for mfj filers, $112,000 ($120,000 maximum) for hoh filers, and $75,000. Web the sick and family leave benefits that were claimed on form 7202 in 2020 have been extended for 2021. Know your dates and your tax software will do the rest! Credits related to offering sick pay and family. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. See how it adds up to $36,220 below. How do i fill out form 7202 in 2023? What is the paid sick leave credi.

Ad sovos combines tax automation with a human touch. Reach out to learn how we can help you! Department of the treasury internal revenue service. Web what are the retirement savings contributions credit (form 8880) requirements? Web i received this reply from taxslayer. How do i fill out form 7202 in 2023? Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web up to 10% cash back file faster with taxslayer and get your biggest refund possible. We stand behind the accuracy of your return and help you get your taxes done right.

Totally free federal filing, 4.8 star rating, user friendly. Reach out to learn how we can help you! Web the income limit for the 2021 recovery rebate credit is $150,000 ($160,000 maximum) for mfj filers, $112,000 ($120,000 maximum) for hoh filers, and $75,000. How do i fill out form 7202 in 2023? See how it adds up to $36,220 below. We have found no information to the contrary at this time. The eligibility requirements and daily dollar amounts are. If you are filing a joint return,. We stand behind the accuracy of your return and help you get your taxes done right. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps.

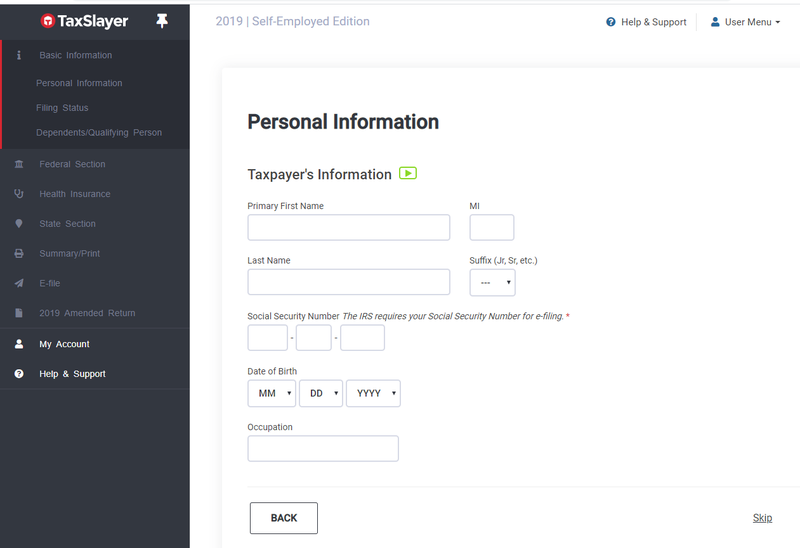

TaxSlayer Review 2021 Features, Pricing & More The Blueprint

Prepare & file prior year taxes fast. Ad always free federal, always simple, always right. Web what are the retirement savings contributions credit (form 8880) requirements? Web up to 10% cash back file faster with taxslayer and get your biggest refund possible. Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow.

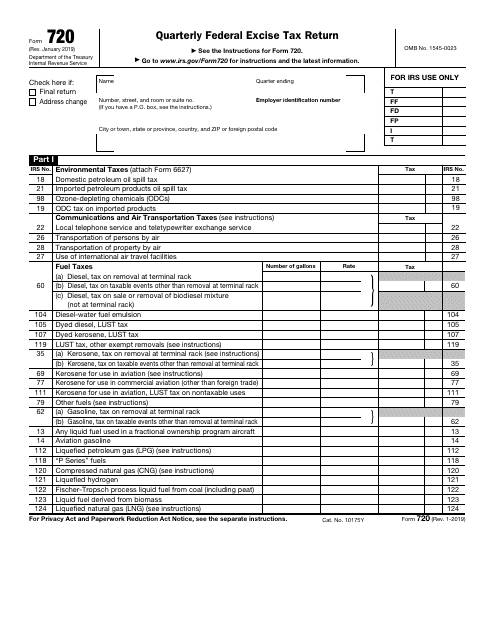

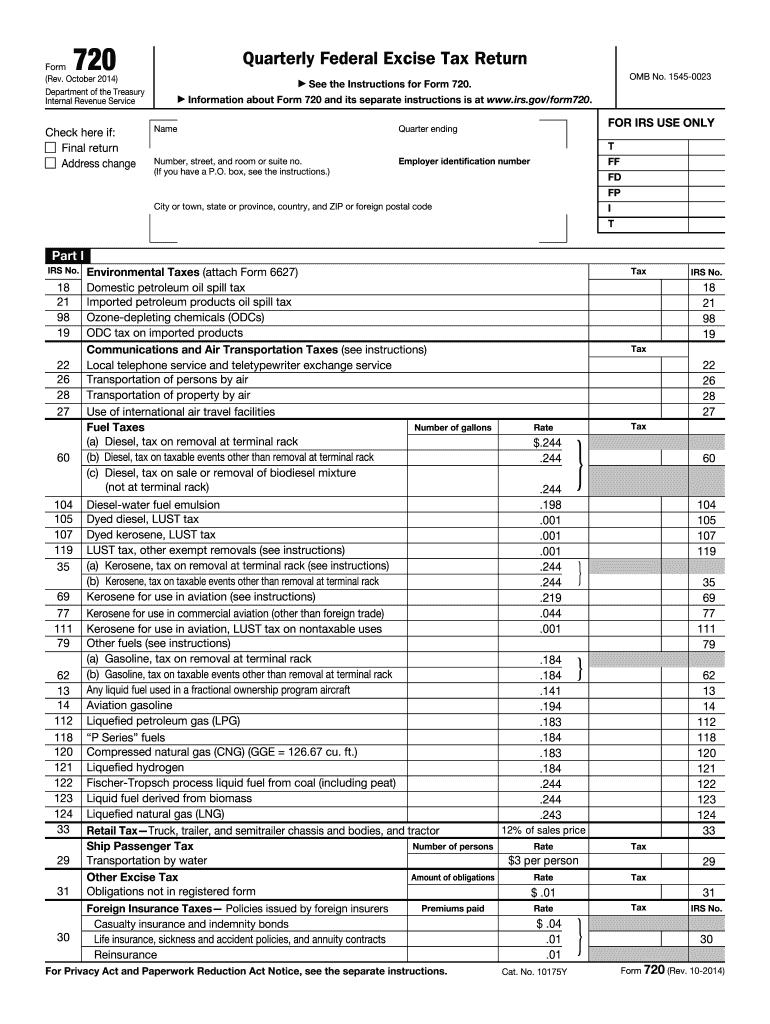

IRS Form 720 Download Fillable PDF or Fill Online Quarterly Federal

Web i received this reply from taxslayer. Web what are the retirement savings contributions credit (form 8880) requirements? Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. How do i fill out form 7202 in 2023? We have found no information.

Desktop 2020 Form 7202 Credits for Sick Leave and Family Leave for

Web i received this reply from taxslayer. If you are filing a joint return,. Ad always free federal, always simple, always right. Totally free federal filing, 4.8 star rating, user friendly. Reach out to learn how we can help you!

TaxSlayer Demo 2018 YouTube

Web the income limit for the 2021 recovery rebate credit is $150,000 ($160,000 maximum) for mfj filers, $112,000 ($120,000 maximum) for hoh filers, and $75,000. The eligibility requirements and daily dollar amounts are. We stand behind the accuracy of your return and help you get your taxes done right. Totally free federal filing, 4.8 star rating, user friendly. Reach out.

Getting Ready for the 2021 Tax Season Basics & Beyond

We stand behind the accuracy of your return and help you get your taxes done right. Web up to 10% cash back file faster with taxslayer and get your biggest refund possible. How do i fill out form 7202 in 2023? Ad sovos combines tax automation with a human touch. See how it adds up to $36,220 below.

How to Complete Form 720 Quarterly Federal Excise Tax Return

Know your dates and your tax software will do the rest! We have found no information to the contrary at this time. Credits related to offering sick pay and family. We stand behind the accuracy of your return and help you get your taxes done right. Prepare & file prior year taxes fast.

2014 Form IRS 720 Fill Online, Printable, Fillable, Blank pdfFiller

Web the sick and family leave benefits that were claimed on form 7202 in 2020 have been extended for 2021. Department of the treasury internal revenue service. Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Credits for sick leave and.

Form 7202 SelfEmployed Audit Risk Form 7202 Tax Return Evidence the

Ad sovos combines tax automation with a human touch. Reach out to learn how we can help you! Department of the treasury internal revenue service. Web up to 10% cash back file faster with taxslayer and get your biggest refund possible. Know your dates and your tax software will do the rest!

TaxSlayer Review 2021 Features, Pricing & More The Blueprint

We have found no information to the contrary at this time. Department of the treasury internal revenue service. How do i fill out form 7202 in 2023? Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Know your dates and your tax software will do.

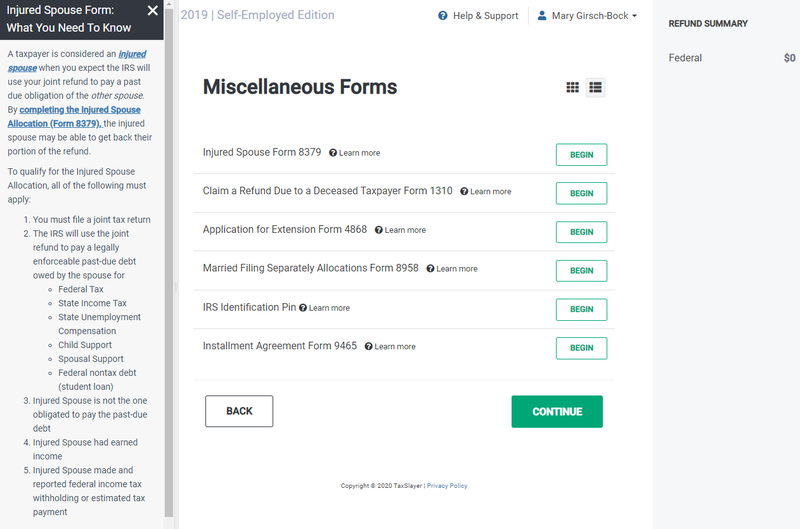

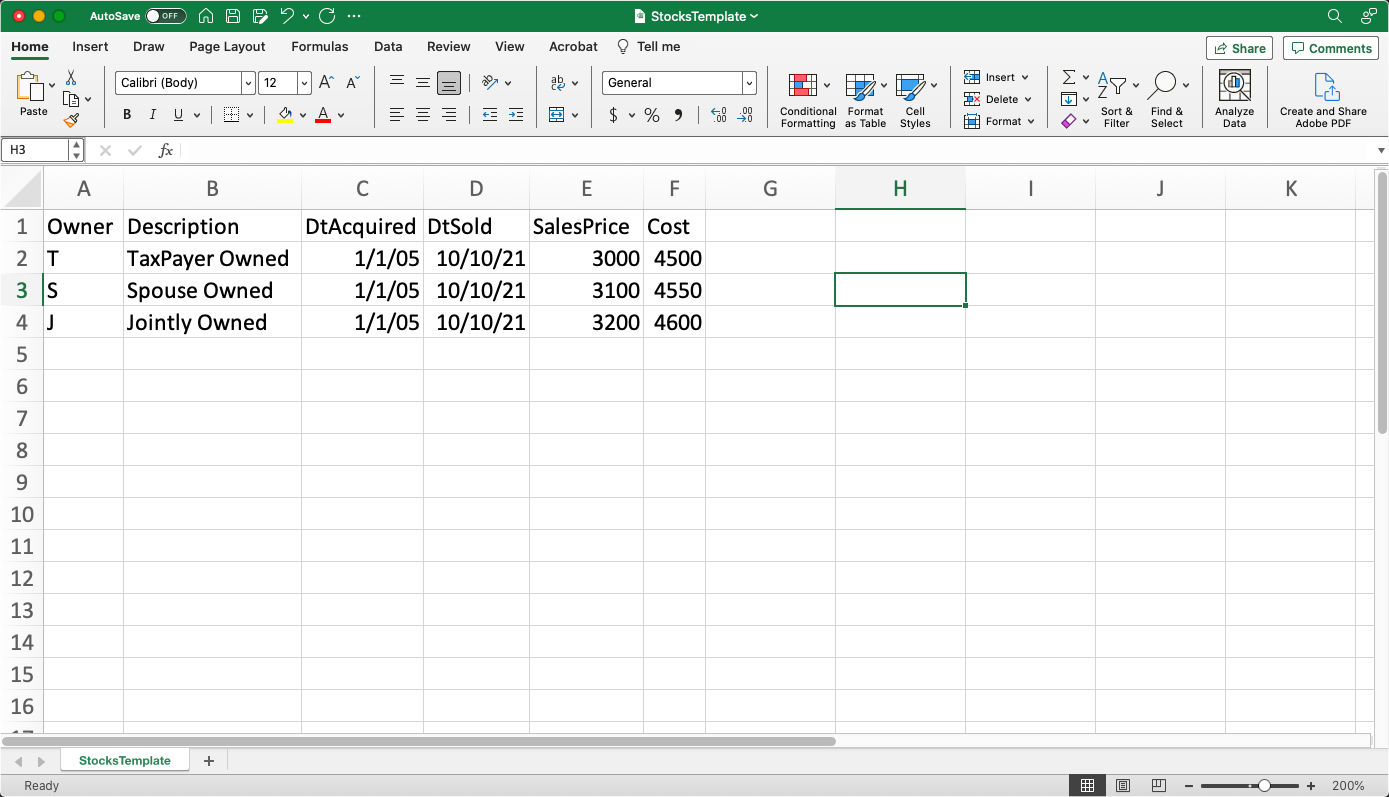

TaxSlayer Form 1099B Import

Web the income limit for the 2021 recovery rebate credit is $150,000 ($160,000 maximum) for mfj filers, $112,000 ($120,000 maximum) for hoh filers, and $75,000. Web up to 10% cash back file faster with taxslayer and get your biggest refund possible. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Ad.

If You Are Filing A Joint Return,.

Prepare & file prior year taxes fast. Ad always free federal, always simple, always right. The eligibility requirements and daily dollar amounts are. Know your dates and your tax software will do the rest!

Web The Income Limit For The 2021 Recovery Rebate Credit Is $150,000 ($160,000 Maximum) For Mfj Filers, $112,000 ($120,000 Maximum) For Hoh Filers, And $75,000.

Web use form 7202 to figure the amount to claim for qualified sick and family leave equivalent credits under the ffcra and attach it to your tax return. Web the sick and family leave benefits that were claimed on form 7202 in 2020 have been extended for 2021. How do i fill out form 7202 in 2023? Web i received this reply from taxslayer.

Totally Free Federal Filing, 4.8 Star Rating, User Friendly.

What is the paid sick leave credi. Credits for sick leave and family leave. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Credits related to offering sick pay and family.

We Stand Behind The Accuracy Of Your Return And Help You Get Your Taxes Done Right.

Web what are the retirement savings contributions credit (form 8880) requirements? Ad sovos combines tax automation with a human touch. Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. See how it adds up to $36,220 below.