Third Party Authorization Form

Third Party Authorization Form - See section 2 for a list of transactions requiring a third party loa. Web with a third party—you should too. Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. This authority will expire one year from the due date of the return regardless of any extension dates. Authorization to disclose personal information to a third party. Examples of third partyauthorizations third party authorizations include: Why does the mortgage company care? And (ii) the third party information provided above is true and correct. (i) it is in compliance with regulation o (mortgage assistance relief services), if applicable, and all other applicable laws and regulations; Web 60 days 90 days 120 days life of the loan unless otherwise revoked in writing.

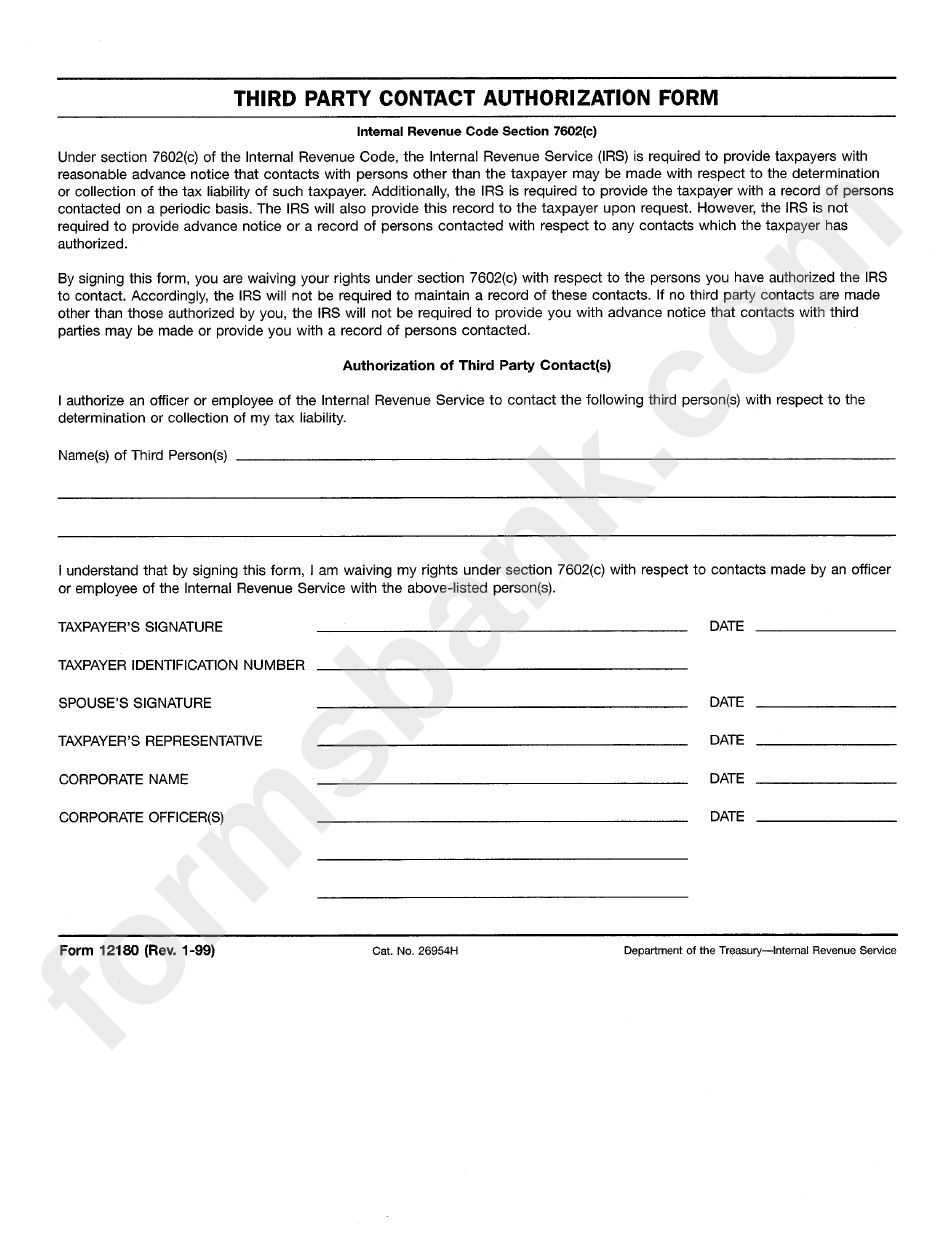

This authority will expire one year from the due date of the return regardless of any extension dates. Web third party authorization is a signed document and/or an oral statement made, by a taxpayer, granting a third party the authority to perform specified acts relative to specific tax matters on behalf of the taxpayer. Web third party designee authority is limited to the specific tax form and period of the return, and is limited to issues involving processing of that specific return. (i) it is in compliance with regulation o (mortgage assistance relief services), if applicable, and all other applicable laws and regulations; Why does the mortgage company care? Web with a third party—you should too. And (ii) the third party information provided above is true and correct. Web instructions • if you are unable to visit a serviceontario centre and are sending someone (third party) to complete transaction(s) on your behalf, a third party letter of authorization (loa) may be required. Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. This authority is to be used for the following:

See section 2 for a list of transactions requiring a third party loa. Web 60 days 90 days 120 days life of the loan unless otherwise revoked in writing. Los angeles county dpw land development division 900 south fremont ave, 3rd fl alhambra, ca 91803 letter of authorization please be advised that _____(owner/applicant name or company name) authorizes _____ (individual name. Web third party authorization is a signed document and/or an oral statement made, by a taxpayer, granting a third party the authority to perform specified acts relative to specific tax matters on behalf of the taxpayer. And (ii) the third party information provided above is true and correct. This authority will expire one year from the due date of the return regardless of any extension dates. Web instructions • if you are unable to visit a serviceontario centre and are sending someone (third party) to complete transaction(s) on your behalf, a third party letter of authorization (loa) may be required. This authority is to be used for the following: There are different types of third party authorizations: Web the third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization.

FREE 9+ Sample Third Party Authorization Letter Templates in PDF MS Word

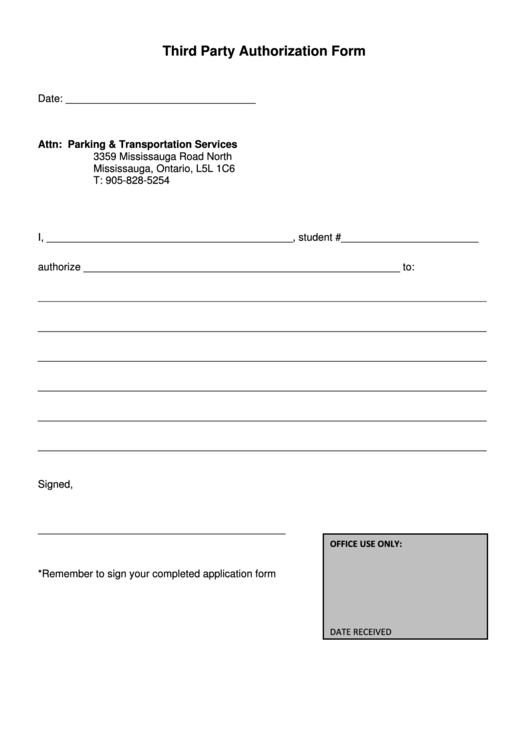

Web a third party authorization form is a document which is used by an individual to assign and formally acknowledge a third party representative to act on his behalf. Web instructions • if you are unable to visit a serviceontario centre and are sending someone (third party) to complete transaction(s) on your behalf, a third party letter of authorization (loa).

Third Party Authorization Form Sample and Template

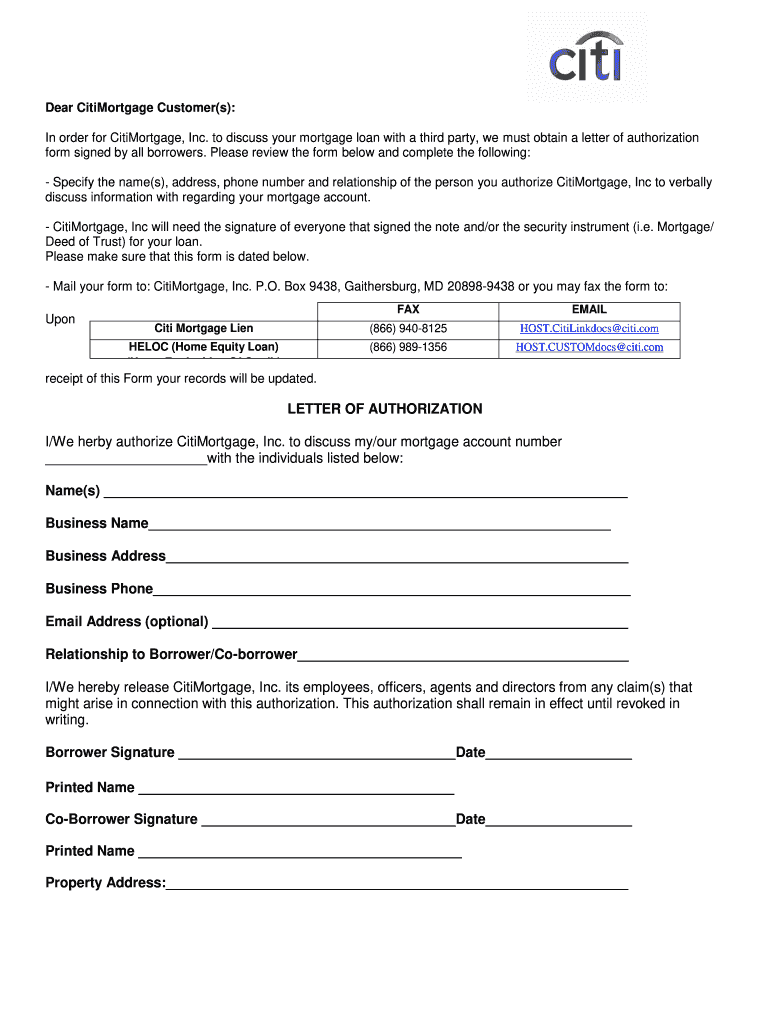

Your mortgage company will not talk with a housing counselor, licensed lawyer or other “third party” about your mortgage unless you authorize the mortgage company to do so, typically by filling out a third party authorization form. Web 60 days 90 days 120 days life of the loan unless otherwise revoked in writing. See section 2 for a list of.

Citibank Third Party Authorization Form Fill Online, Printable

Web with a third party—you should too. There are different types of third party authorizations: Web third party designee authority is limited to the specific tax form and period of the return, and is limited to issues involving processing of that specific return. Web the third party can be a family member or friend, a tax professional, attorney or business,.

FREE 9+ Sample Third Party Authorization Letter Templates in PDF MS Word

Web third party authorization is a signed document and/or an oral statement made, by a taxpayer, granting a third party the authority to perform specified acts relative to specific tax matters on behalf of the taxpayer. Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. Why does the mortgage company care?.

Third Party Authorization Form Fill Out and Sign Printable PDF

Web 60 days 90 days 120 days life of the loan unless otherwise revoked in writing. The original third party loa must be presented to serviceontario. There are different types of third party authorizations: Web the third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. (i) it is in compliance.

FREE 27+ Sample Authorization Forms in MS Word

Web third party authorization is a signed document and/or an oral statement made, by a taxpayer, granting a third party the authority to perform specified acts relative to specific tax matters on behalf of the taxpayer. Los angeles county dpw land development division 900 south fremont ave, 3rd fl alhambra, ca 91803 letter of authorization please be advised that _____(owner/applicant.

Form 12180 Third Party Contact Authorization Form printable pdf download

This authority will expire one year from the due date of the return regardless of any extension dates. The form is important to be presented by the representative before any type of transaction and request can be executed. Web the undersigned, on behalf of the third party, represents that: Web 60 days 90 days 120 days life of the loan.

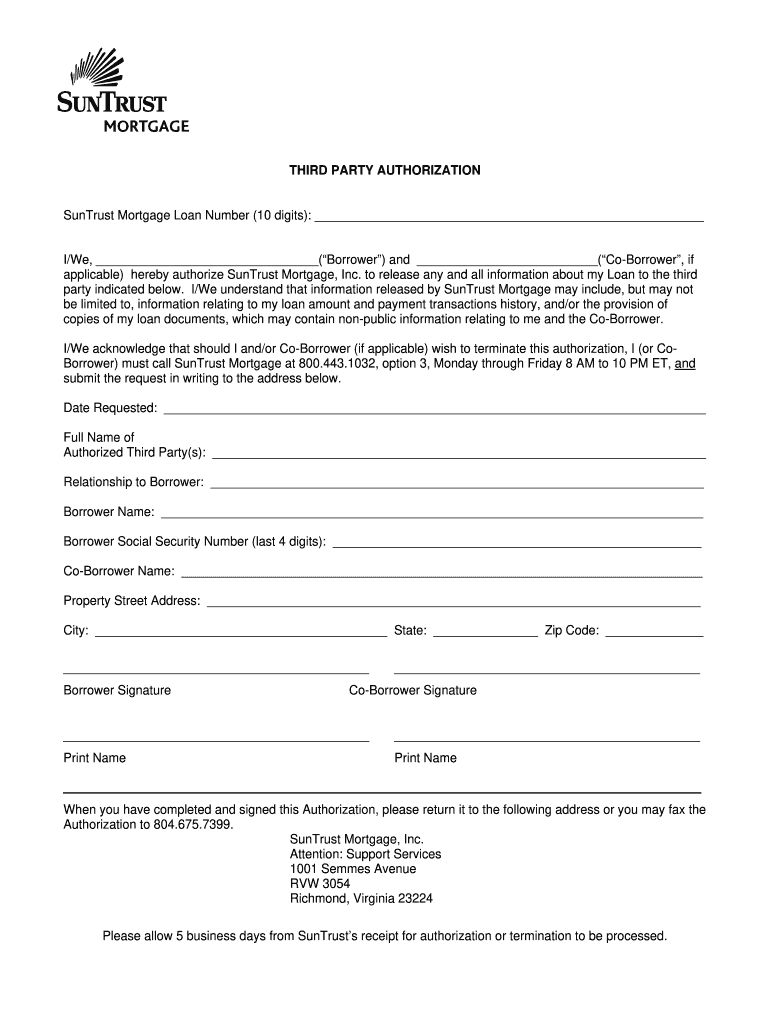

Short sale thirdparty authorization form in Word and Pdf formats

Why does the mortgage company care? Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. This authority will expire one year from the due date of the return regardless of any extension dates. Web instructions • if you are unable to visit a serviceontario centre and are sending someone (third party).

FREE 9+ Sample Third Party Authorization Letter Templates in PDF MS Word

Authorization to disclose personal information to a third party. Web instructions • if you are unable to visit a serviceontario centre and are sending someone (third party) to complete transaction(s) on your behalf, a third party letter of authorization (loa) may be required. This authority will expire one year from the due date of the return regardless of any extension.

Third Party Authorization Form Sample printable pdf download

See section 2 for a list of transactions requiring a third party loa. Los angeles county dpw land development division 900 south fremont ave, 3rd fl alhambra, ca 91803 letter of authorization please be advised that _____(owner/applicant name or company name) authorizes _____ (individual name. Examples of third partyauthorizations third party authorizations include: Web third party designee authority is limited.

See Section 2 For A List Of Transactions Requiring A Third Party Loa.

The form is important to be presented by the representative before any type of transaction and request can be executed. Examples of third partyauthorizations third party authorizations include: This authority will expire one year from the due date of the return regardless of any extension dates. Web with a third party—you should too.

(I) It Is In Compliance With Regulation O (Mortgage Assistance Relief Services), If Applicable, And All Other Applicable Laws And Regulations;

Why does the mortgage company care? Web third party designee authority is limited to the specific tax form and period of the return, and is limited to issues involving processing of that specific return. There are different types of third party authorizations: Web the third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization.

Web A Third Party Authorization Form Is A Document Which Is Used By An Individual To Assign And Formally Acknowledge A Third Party Representative To Act On His Behalf.

The original third party loa must be presented to serviceontario. Authorization to disclose personal information to a third party. Web third party authorization is a signed document and/or an oral statement made, by a taxpayer, granting a third party the authority to perform specified acts relative to specific tax matters on behalf of the taxpayer. Web the undersigned, on behalf of the third party, represents that:

Web Instructions • If You Are Unable To Visit A Serviceontario Centre And Are Sending Someone (Third Party) To Complete Transaction(S) On Your Behalf, A Third Party Letter Of Authorization (Loa) May Be Required.

Web 60 days 90 days 120 days life of the loan unless otherwise revoked in writing. This authority is to be used for the following: Burials and memorials, careers and employment, disability, education and training, health care, housing assistance, life insurance, pension, records. And (ii) the third party information provided above is true and correct.