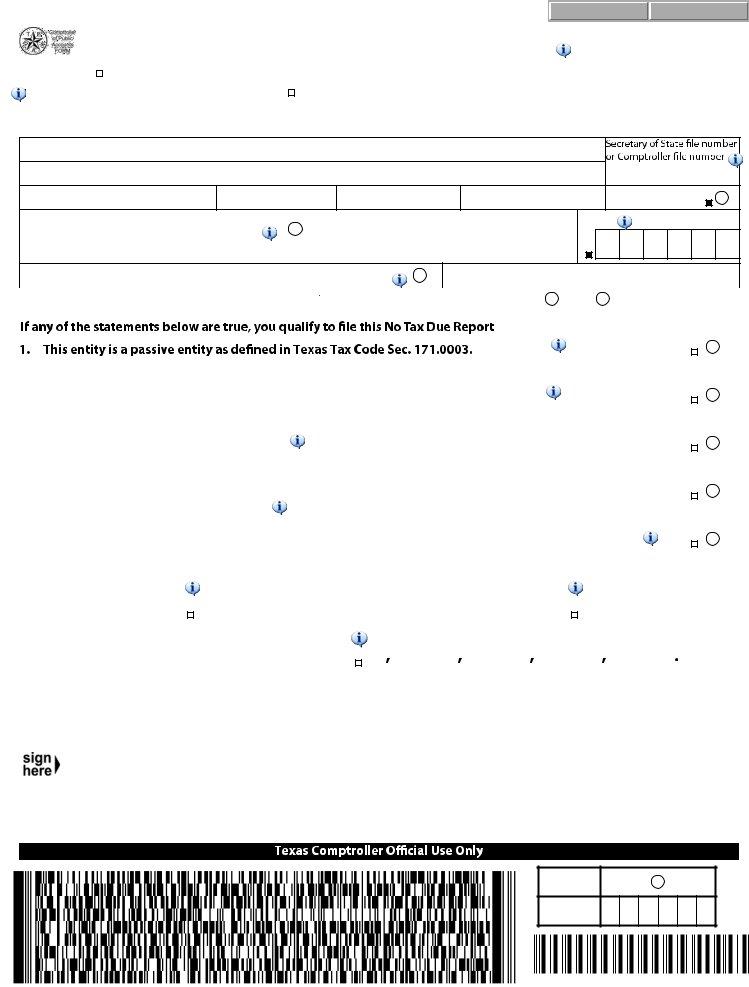

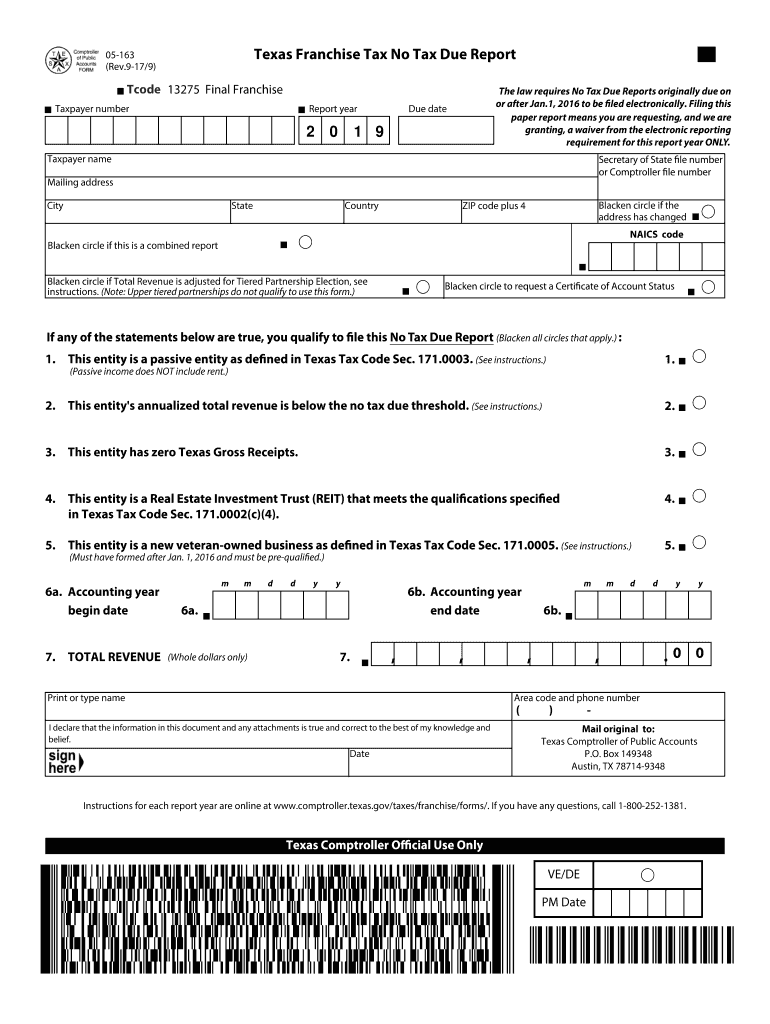

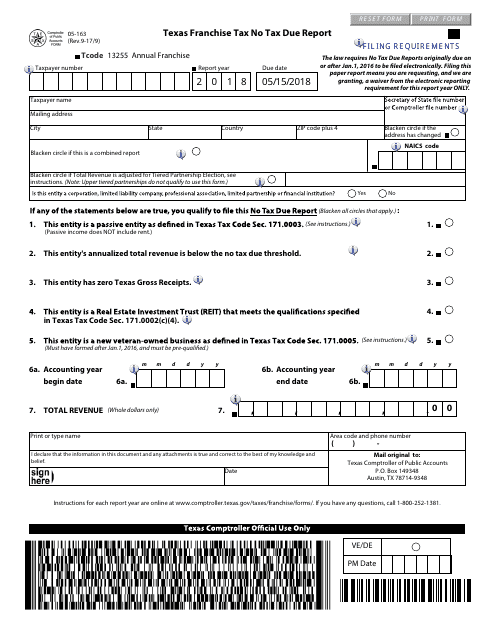

Tx Form 05-163

Tx Form 05-163 - Greater than $1,230,000 but less than $20 million:. Now you'll be able to print, download, or share the document. Is this entity’s annualized total revenue below the no tax due threshold? The entity is passive as defined in chapter. If you have any questions,. The following are the revenue thresholds outlined in the texas franchise tax report. Taxpayer is a newly established texas veteran owned business. Easily fill out pdf blank, edit, and sign them. No tax due information report. Easily fill out pdf blank, edit, and sign them.

Taxpayer is a newly established texas veteran owned business. Complete, edit or print tax forms instantly. If you have any questions,. Now you'll be able to print, download, or share the document. Total revenue (whole dollars only) 6. Easily fill out pdf blank, edit, and sign them. Greater than $1,230,000 but less than $20 million:. On the data tab, select the this entity has zero texas gross receipts checkbox. Save or instantly send your ready documents. Select yes when the entity’s total.

Is this entity’s annualized total revenue below the no tax due threshold? Taxable entities with total revenue of the. Complete, edit or print tax forms instantly. If you have any questions,. Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. There is no minimum tax requirement under the franchise tax. Complete, edit or print tax forms instantly. This form will produce automatically when: Select yes when the entity’s total.

Form 05 163 ≡ Fill Out Printable PDF Forms Online

Easily fill out pdf blank, edit, and sign them. Greater than $1,230,000 but less than $20 million:. No tax due information report. Press done after you complete the form. Select yes when the entity’s total.

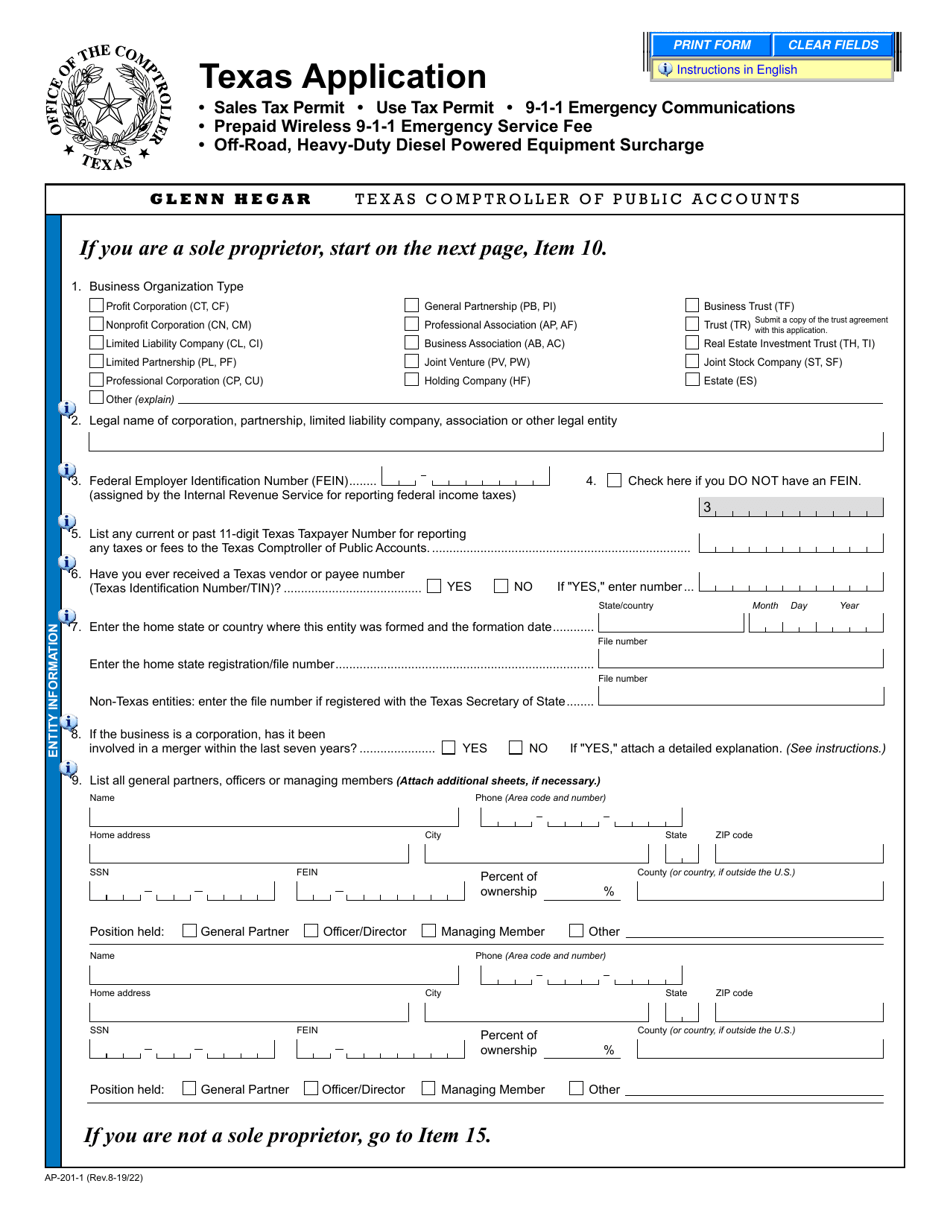

Texas Sales And Use Tax Permit Video Bokep Ngentot

The following are the revenue thresholds outlined in the texas franchise tax report. Easily fill out pdf blank, edit, and sign them. Select yes when the entity’s total. If you have any questions,. Is this entity’s annualized total revenue below the no tax due threshold?

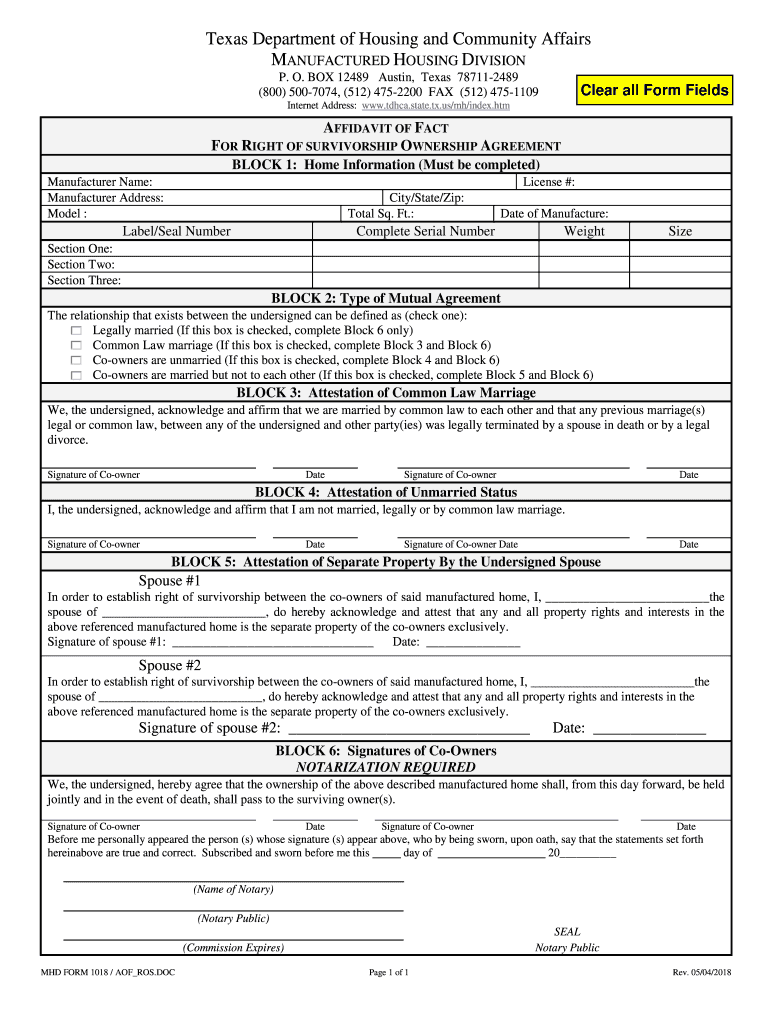

TX MHD FORM 1018 20182021 Complete Legal Document Online US Legal

Taxpayer is a passive entity. There is no minimum tax requirement under the franchise tax. Press done after you complete the form. Total revenue (whole dollars only) 6. Easily fill out pdf blank, edit, and sign them.

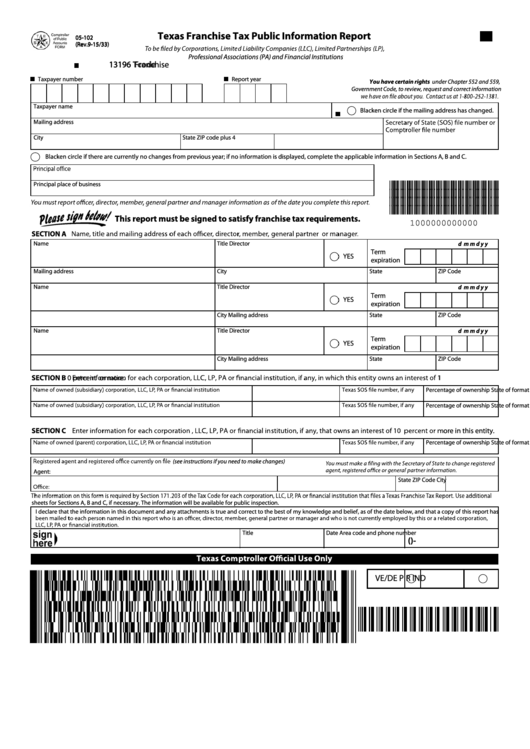

Fillable 05102 Texas Franchise Tax Public Information printable pdf

Now you'll be able to print, download, or share the document. Select yes when the entity’s total. Taxpayer is a newly established texas veteran owned business. For more information on the texas franchise tax no. Easily fill out pdf blank, edit, and sign them.

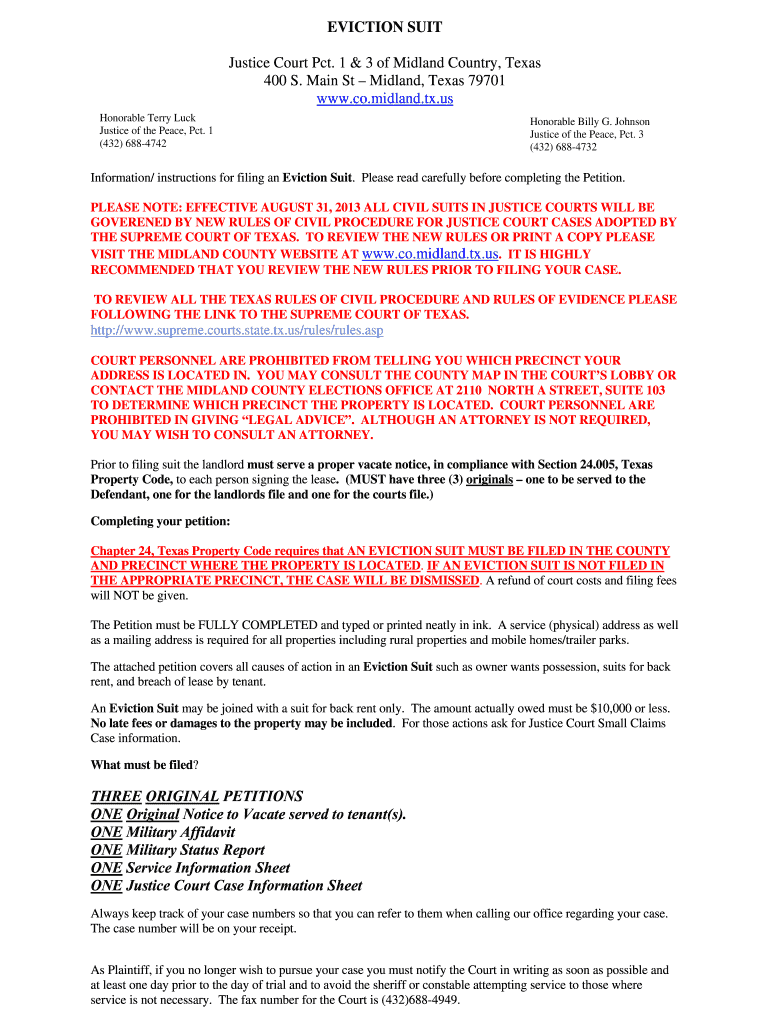

Eviction Suit in Midland Tx Form Fill Out and Sign Printable PDF

Web texas franchise tax no tax due report tcode 13255 annual due date the law requires no tax due reports originally due on paper report means you are requesting, and we. The entity is passive as defined in chapter. There is no minimum tax requirement under the franchise tax. Complete, edit or print tax forms instantly. No tax due information.

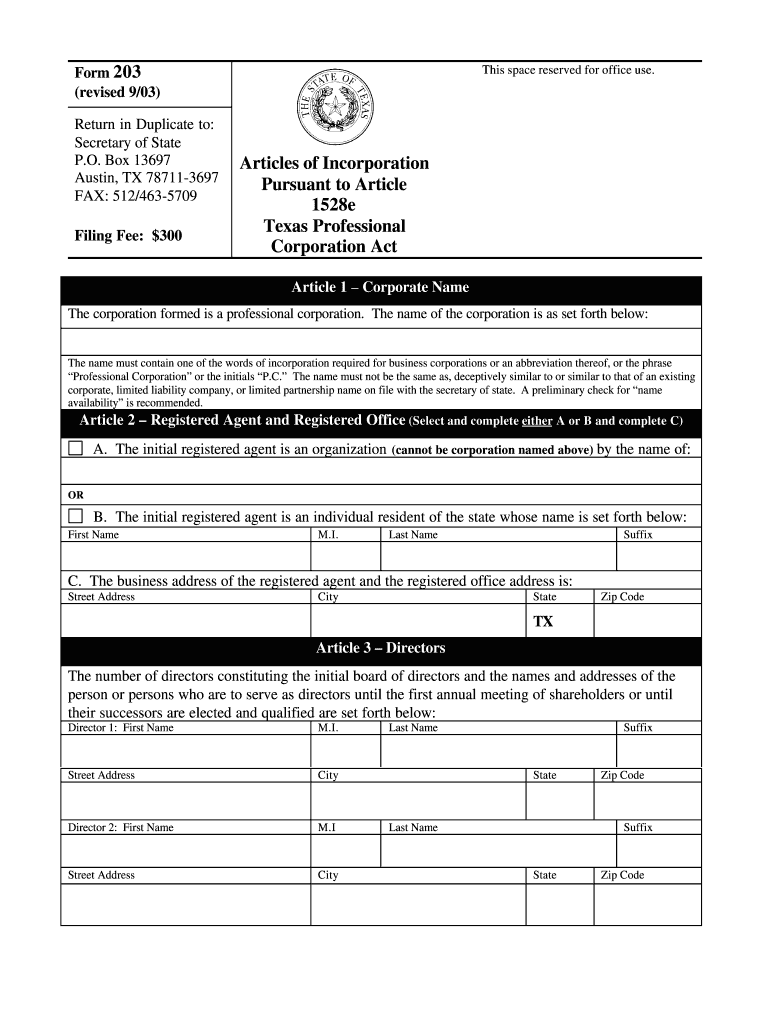

Articles Of Incorporation Texas Fill Out and Sign Printable PDF

Save or instantly send your ready documents. Greater than $1,230,000 but less than $20 million:. If you have any questions,. Is this entity’s annualized total revenue below the no tax due threshold? No tax due information report.

2019 Form TX Comptroller 05163 Fill Online, Printable, Fillable, Blank

Greater than $1,230,000 but less than $20 million:. The entity is passive as defined in chapter. Save or instantly send your ready documents. Taxpayer is a passive entity. Taxpayer is a newly established texas veteran owned business.

Form 05163 Download Fillable PDF or Fill Online Texas Franchise Tax No

On the data tab, select the this entity has zero texas gross receipts checkbox. This form will produce automatically when: Taxpayer is a passive entity. Total revenue (whole dollars only) 6. Is this entity’s annualized total revenue below the no tax due threshold?

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Greater than $1,230,000 but less than $20 million:. This form will produce automatically when: Easily fill out pdf blank, edit, and sign them. Total revenue (whole dollars only) 6. Now you'll be able to print, download, or share the document.

Taxable Entities With Total Revenue Of The.

There is no minimum tax requirement under the franchise tax. Greater than $1,230,000 but less than $20 million:. Is this entity’s annualized total revenue below the no tax due threshold? Easily fill out pdf blank, edit, and sign them.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

The following are the revenue thresholds outlined in the texas franchise tax report. Select yes when the entity’s total. Save or instantly send your ready documents. If you have any questions,.

Now You'll Be Able To Print, Download, Or Share The Document.

Taxpayer is a passive entity. Web texas franchise tax no tax due report tcode 13255 annual due date the law requires no tax due reports originally due on paper report means you are requesting, and we. The entity is passive as defined in chapter. Easily fill out pdf blank, edit, and sign them.

On The Data Tab, Select The This Entity Has Zero Texas Gross Receipts Checkbox.

No tax due information report. This form will produce automatically when: Taxpayer is a newly established texas veteran owned business. For more information on the texas franchise tax no.