Virginia Military Tax Exemption Form

Virginia Military Tax Exemption Form - $20,000 of eligible military benefits on your tax year 2023 return; Web any person who is active duty military is exempt from taxation if their legal residence or domicile is outside of virginia, pursuant to the federal servicemembers civil relief act. As a veteran over 55, you can deduct up to $40,000. Purchases of prepared or catered meals and. Web be exempt from virginia income tax on your wages if (i) your spouse is a member of the armed forces present in virginia in compliance with military orders; Web exemption for virginia national guard income: Web to apply for an exemption, download and complete the application for vehicle tax exemption of military service member and/or spouse and submit along with the. Virginia taxable income subtraction for military retired pay. Web what form should i file | military spouse va. Web personal property titled jointly with a spouse may be eligible for exemption from the personal property tax, if the spouse also maintains a legal domicile outside of virginia.

Web to apply for exemption, the following documentation is required: During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Web to apply for an exemption, download and complete the application for vehicle tax exemption of military service member and/or spouse and submit along with the. Purchases of prepared or catered meals and. Are issued a certificate of exemption by virginia tax. Ad signnow allows users to edit, sign, fill and share all type of documents online. Despite profiting over $8 billion on commercial and government dod. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. The amount cannot exceed $3,000 or the. Web be exempt from virginia income tax on your wages if (i) your spouse is a member of the armed forces present in virginia in compliance with military orders;

Are issued a certificate of exemption by virginia tax. Web new virginia tax laws for july 1, 2022 starting july 1, 2022, a number of new state and local tax laws go into effect in virginia. Virginia national guard service members, in. Despite profiting over $8 billion on commercial and government dod. Virginia tax exemption for national guard income: National guard income for persons rank 03 and below may be subtracted from the return. Web who reside in fairfax county solely on military orders may qualify for exemption from the local vehicle personal property tax based on certain qualifying conditions provided by the. The amount cannot exceed $3,000 or the. Web to apply for exemption, the following documentation is required: Web virginia is one of the few states to still tax military retirement compensation, and it's past time to alter that.

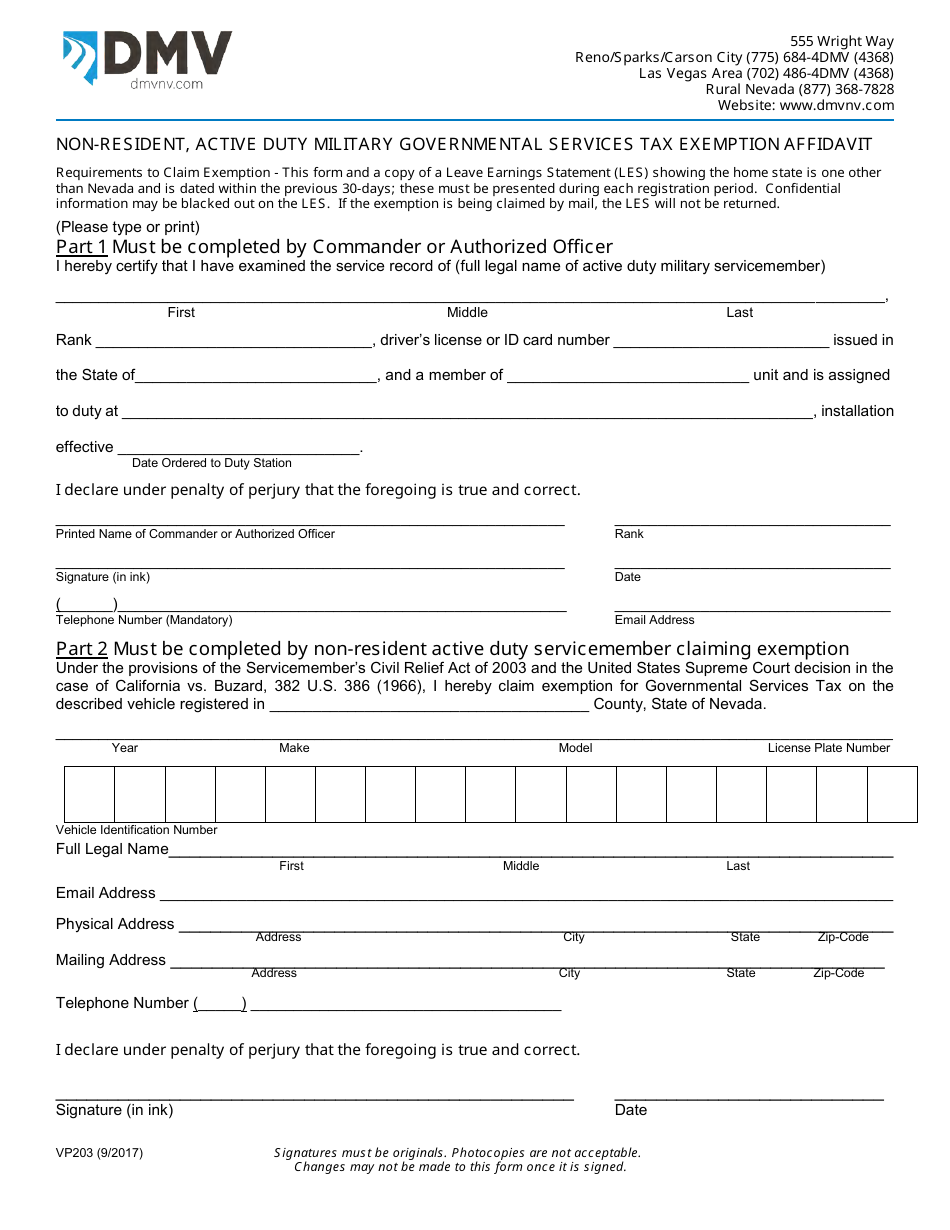

Form VP203 Download Fillable PDF or Fill Online Nonresident, Active

Create legally binding electronic signatures on any device. Web what form should i file | military spouse va. Web any person who is active duty military is exempt from taxation if their legal residence or domicile is outside of virginia, pursuant to the federal servicemembers civil relief act. Web virginia veteran tax benefits include the following. Virginia national guard service.

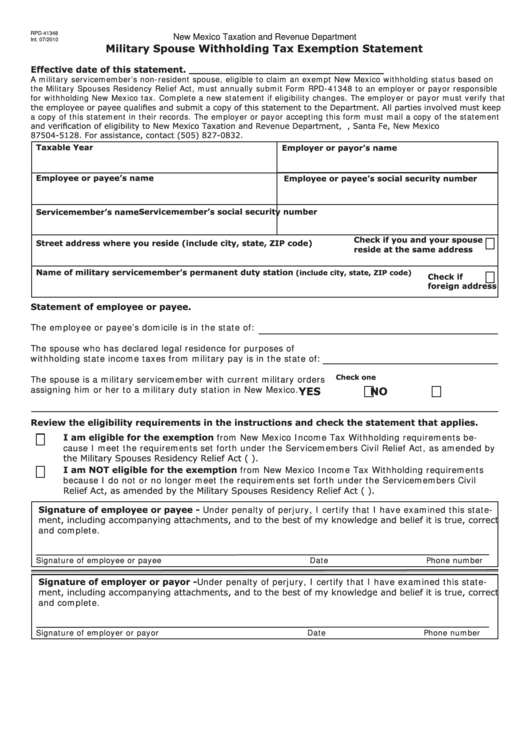

Military Spouse Withholding Tax Exemption Statement printable pdf download

The amount cannot exceed $3,000 or the. Web who reside in fairfax county solely on military orders may qualify for exemption from the local vehicle personal property tax based on certain qualifying conditions provided by the. Web $10,000 of eligible military benefits on your tax year 2022 return; Web what form should i file | military spouse va. Web personal.

VA Application for Real Property Tax Relief for Veterans with Rated 100

During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Virginia tax exemption for national guard income: Web be exempt from virginia income tax on your wages if (i) your spouse is a member of the armed forces present in virginia in compliance with military orders; $20,000 of.

Military Tax Exempt form Wonderful Arkansas State Tax software

Ad signnow allows users to edit, sign, fill and share all type of documents online. Web to apply for an exemption, download and complete the application for vehicle tax exemption of military service member and/or spouse and submit along with the. Web apply for the exemption with virginia tax; During the taxable year, were you a military spouse covered under.

2015 Form VA DoT ST11 Fill Online, Printable, Fillable, Blank pdfFiller

Web to apply for exemption, the following documentation is required: Purchases of prepared or catered meals and. $30,000 of eligible military benefits on. Are issued a certificate of exemption by virginia tax. Despite profiting over $8 billion on commercial and government dod.

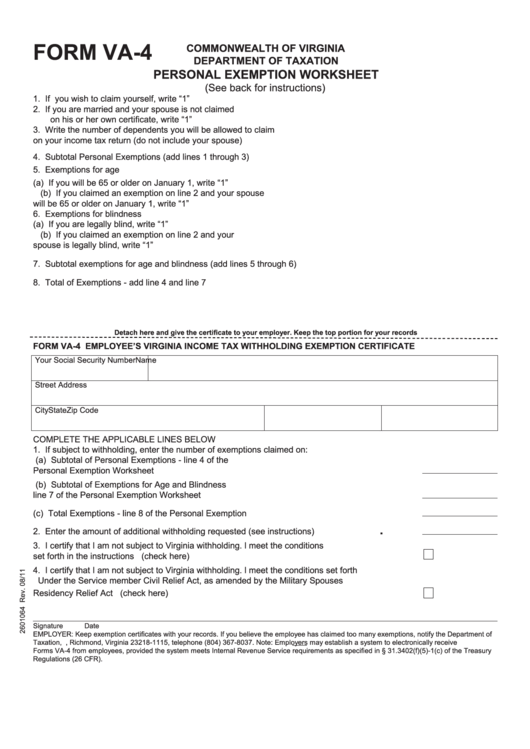

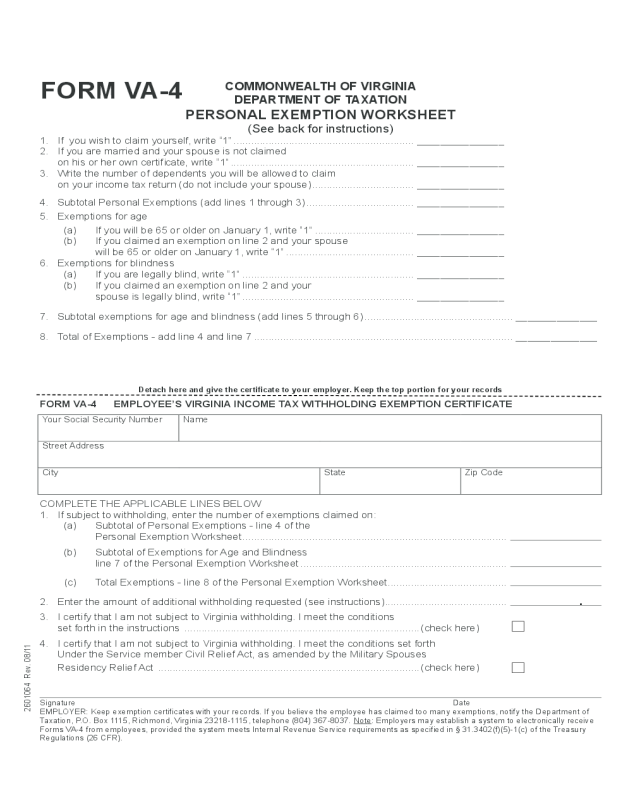

Fillable Form Va4 Personal Exemption Worksheet printable pdf download

Some of the highlights include:. As a veteran over 55, you can deduct up to $40,000. Despite profiting over $8 billion on commercial and government dod. Web exemption for virginia national guard income: Purchases of prepared or catered meals and.

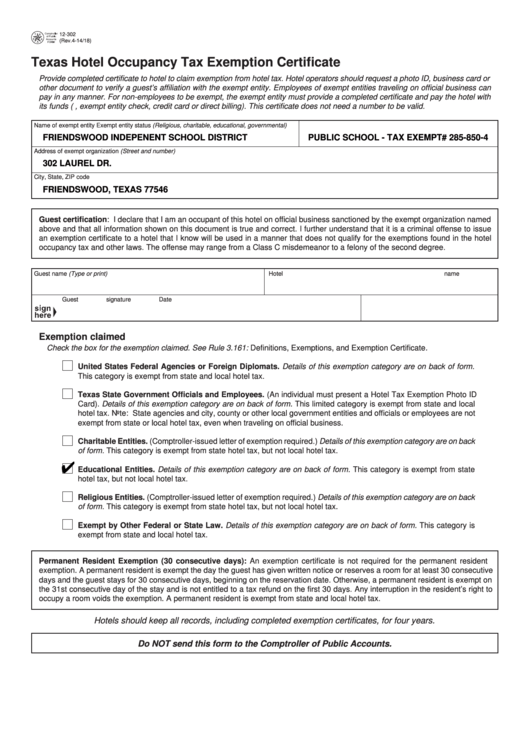

Fillable Form 12302, Hotel Occupancy Tax Exemption Certificate

As a veteran over 55, you can deduct up to $40,000. Web new virginia tax laws for july 1, 2022 starting july 1, 2022, a number of new state and local tax laws go into effect in virginia. Web beginning with tax year 2016, house bill 1589 (chapter 266) requires localities to apply 100% personal property tax relief to the.

Employee's Withholding Exemption Certificate Virginia Edit, Fill

$20,000 of eligible military benefits on your tax year 2023 return; Web to apply for exemption, the following documentation is required: Are issued a certificate of exemption by virginia tax. Despite profiting over $8 billion on commercial and government dod. Web under hb 163, all retired armed forces veterans will have $10,000 exempted in tax year 2022 and $20,000 in.

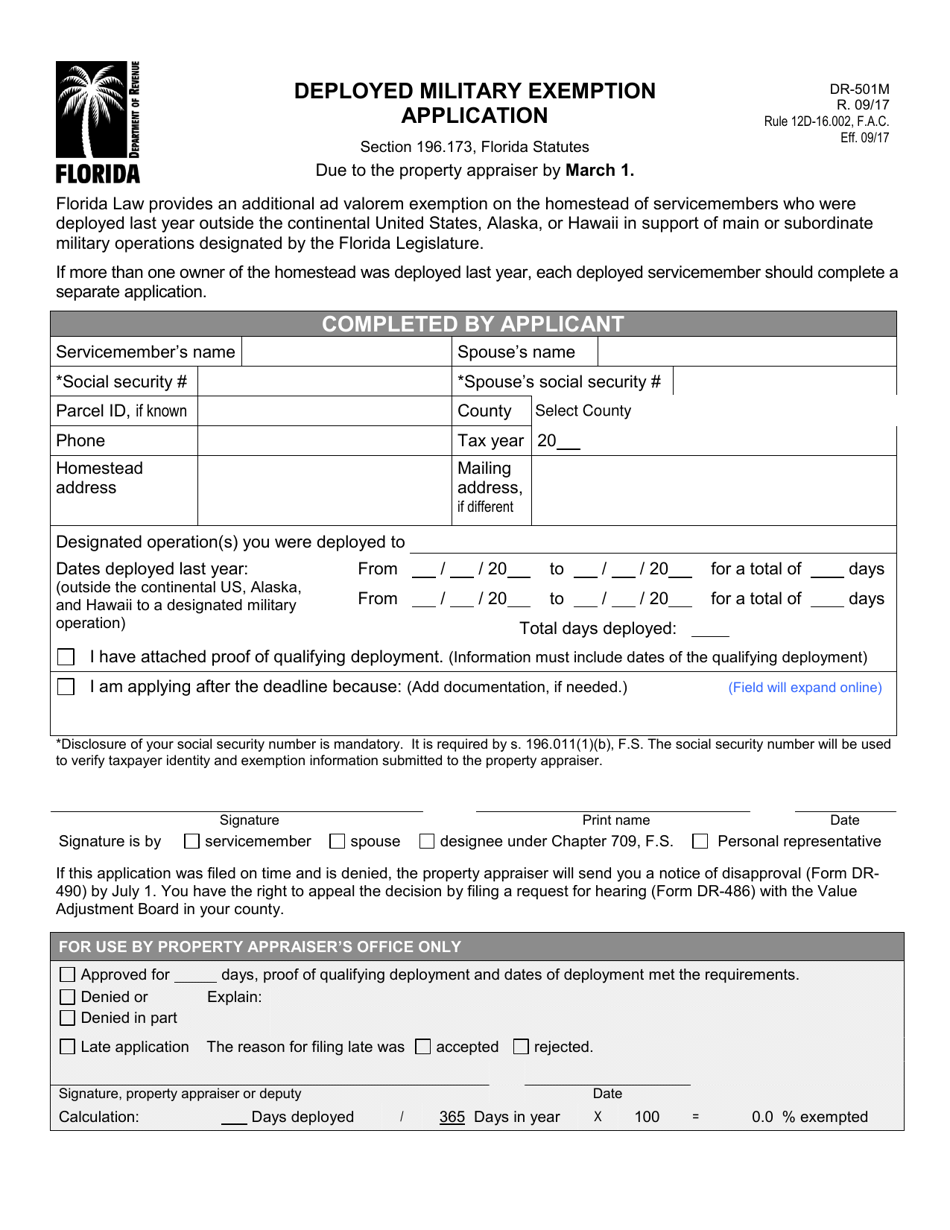

Form DR501M Download Fillable PDF or Fill Online Deployed Military

$30,000 of eligible military benefits on. Web apply for the exemption with virginia tax; Create legally binding electronic signatures on any device. During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a.

Virginia Form VA4 Download Free & Premium Templates, Forms & Samples

From 2024 to 2026, there will be a $30,000. During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Some of the highlights include:. Web an active duty service member here on military orders who maintains domicile outside of virginia is exempt from fairfax county's personal property tax,.

From 2024 To 2026, There Will Be A $30,000.

Ad signnow allows users to edit, sign, fill and share all type of documents online. Web personal property titled jointly with a spouse may be eligible for exemption from the personal property tax, if the spouse also maintains a legal domicile outside of virginia. Web who reside in fairfax county solely on military orders may qualify for exemption from the local vehicle personal property tax based on certain qualifying conditions provided by the. Web virginia veteran tax benefits include the following.

During The Taxable Year, Were You A Military Spouse Covered Under The Provisions Of The Military Spouse Tax Relief Act Whose Legal.

Virginia tax exemption for national guard income: Purchases of prepared or catered meals and. Web $10,000 of eligible military benefits on your tax year 2022 return; Virginia national guard service members, in.

Create Legally Binding Electronic Signatures On Any Device.

$20,000 of eligible military benefits on your tax year 2023 return; Web new virginia tax laws for july 1, 2022 starting july 1, 2022, a number of new state and local tax laws go into effect in virginia. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. Web what form should i file | military spouse va.

Web Be Exempt From Virginia Income Tax On Your Wages If (I) Your Spouse Is A Member Of The Armed Forces Present In Virginia In Compliance With Military Orders;

Are issued a certificate of exemption by virginia tax. Web learn more about the virginia income tax deduction for military pay. Web an active duty service member here on military orders who maintains domicile outside of virginia is exempt from fairfax county's personal property tax, regardless of whether a. Web to apply for exemption, the following documentation is required: