W-4 Form Arizona

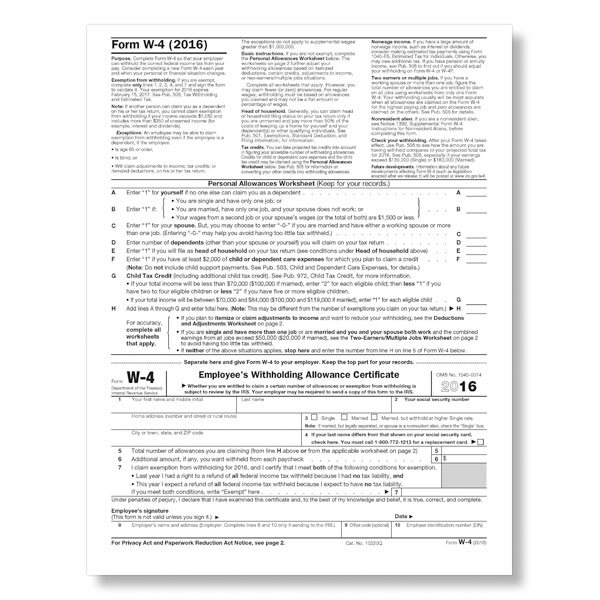

W-4 Form Arizona - Web employers withhold state income taxes from employee wages. This form is for income earned in tax year 2022,. 100 n 15th ave, #301. As a result, we are revising withholding percentages and are requiring. You can use your results from the. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. One difference from prior forms is the expected filing. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. As a result, we are revising withholding percentages and are requiring.

As a result, we are revising withholding percentages and are requiring. Web employers withhold state income taxes from employee wages. Web the form has steps 1 through 5 to guide employees through it. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. As a result, we are revising withholding percentages and are requiring. You can use your results from the. One difference from prior forms is the expected filing. Web adoa human resources.

As a result, we are revising withholding percentages and are requiring. Web the form has steps 1 through 5 to guide employees through it. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. 100 n 15th ave, #301. You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return. It works similarly to a. As a result, we are revising withholding percentages and are requiring. If too little is withheld, you will generally owe tax when you file your tax return. One difference from prior forms is the expected filing.

w 4 form DriverLayer Search Engine

Web adoa human resources. It works similarly to a. Web employers withhold state income taxes from employee wages. This form is for income earned in tax year 2022,. 100 n 15th ave, #301.

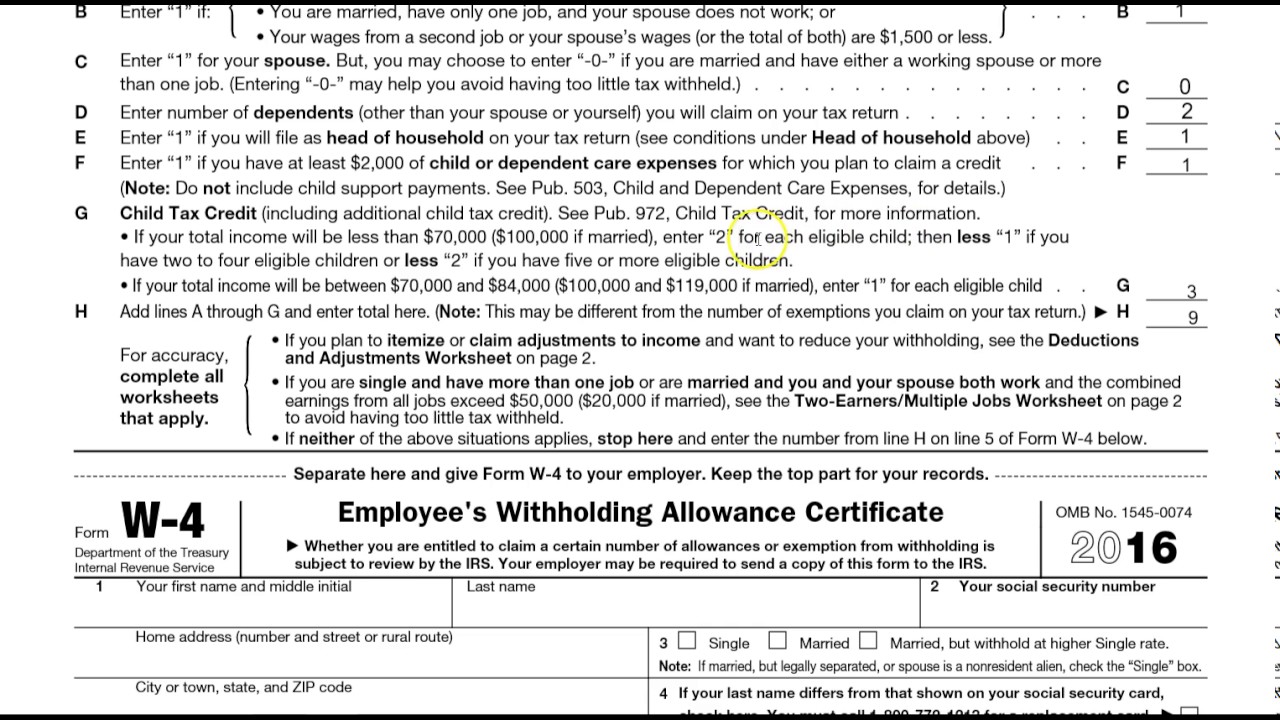

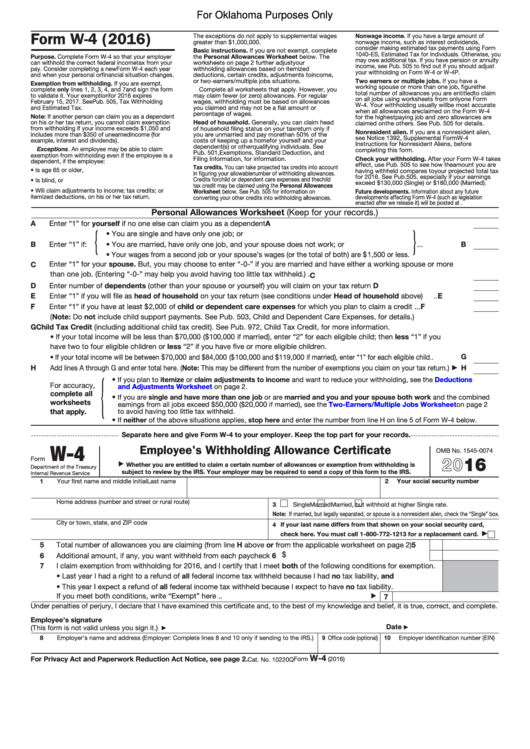

Form W4 Employee'S Withholding Allowance Certificate (Oklahoma

One difference from prior forms is the expected filing. Web employers withhold state income taxes from employee wages. If too little is withheld, you will generally owe tax when you file your tax return. As a result, we are revising withholding percentages and are requiring. Web adoa human resources.

Il W 4 2020 2022 W4 Form

If too little is withheld, you will generally owe tax when you file your tax return. It works similarly to a. As a result, we are revising withholding percentages and are requiring. Web adoa human resources. As a result, we are revising withholding percentages and are requiring.

Michigan W4 Form and Instructions for Nonresident Aliens University

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. It works similarly to a. This form is for income earned in tax year 2022,. One difference from prior forms is the expected filing. As a result, we are revising withholding percentages.

How to Fill Out a W4 Form and Decide How Much to Claim NerdWallet

You can use your results from the. Web adoa human resources. It works similarly to a. One difference from prior forms is the expected filing. If too little is withheld, you will generally owe tax when you file your tax return.

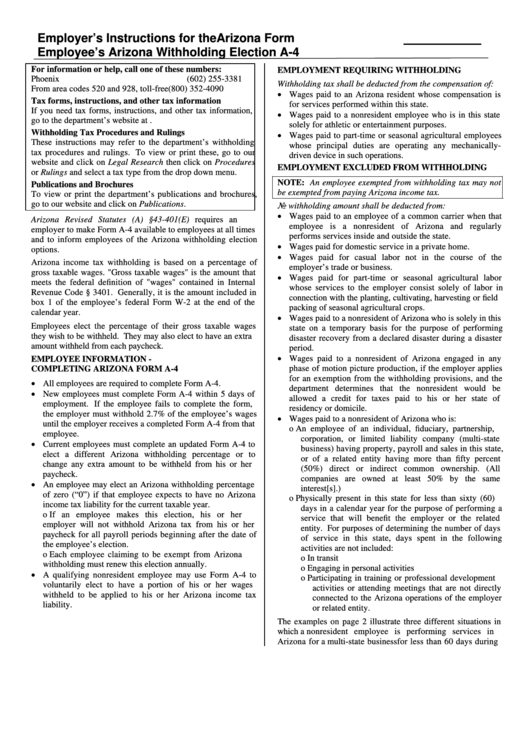

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

If too little is withheld, you will generally owe tax when you file your tax return. As a result, we are revising withholding percentages and are requiring. As a result, we are revising withholding percentages and are requiring. This form is for income earned in tax year 2022,. Web to compute the amount of tax to withhold from compensation paid.

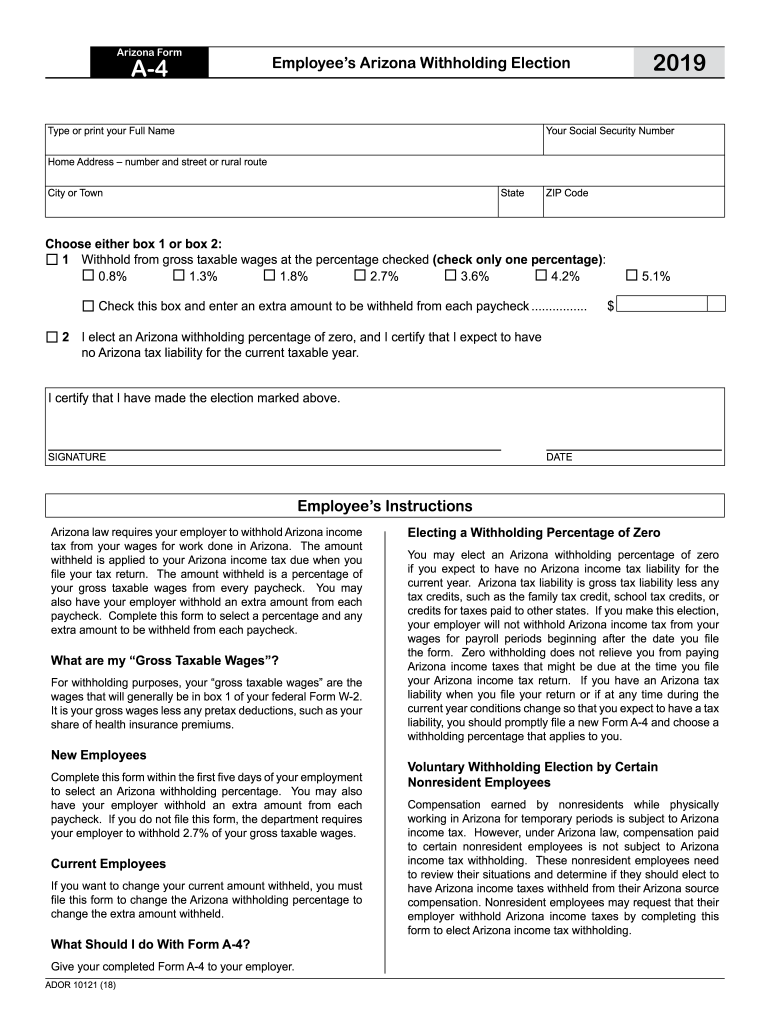

Arizona W 4 2019 Printable justgoing 2020

As a result, we are revising withholding percentages and are requiring. One difference from prior forms is the expected filing. You can use your results from the. This form is for income earned in tax year 2022,. If too little is withheld, you will generally owe tax when you file your tax return.

2019 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

100 n 15th ave, #301. As a result, we are revising withholding percentages and are requiring. You can use your results from the. Web adoa human resources. Web employers withhold state income taxes from employee wages.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

As a result, we are revising withholding percentages and are requiring. This form is for income earned in tax year 2022,. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. If too little is withheld, you will generally owe tax when.

W4 Forms for New Hires New Hire Forms

It works similarly to a. If too little is withheld, you will generally owe tax when you file your tax return. As a result, we are revising withholding percentages and are requiring. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding..

100 N 15Th Ave, #301.

If too little is withheld, you will generally owe tax when you file your tax return. Web the form has steps 1 through 5 to guide employees through it. You can use your results from the. One difference from prior forms is the expected filing.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web adoa human resources. It works similarly to a. Web employers withhold state income taxes from employee wages.

This Form Is For Income Earned In Tax Year 2022,.

As a result, we are revising withholding percentages and are requiring. As a result, we are revising withholding percentages and are requiring.