Walmart Tax Form Code

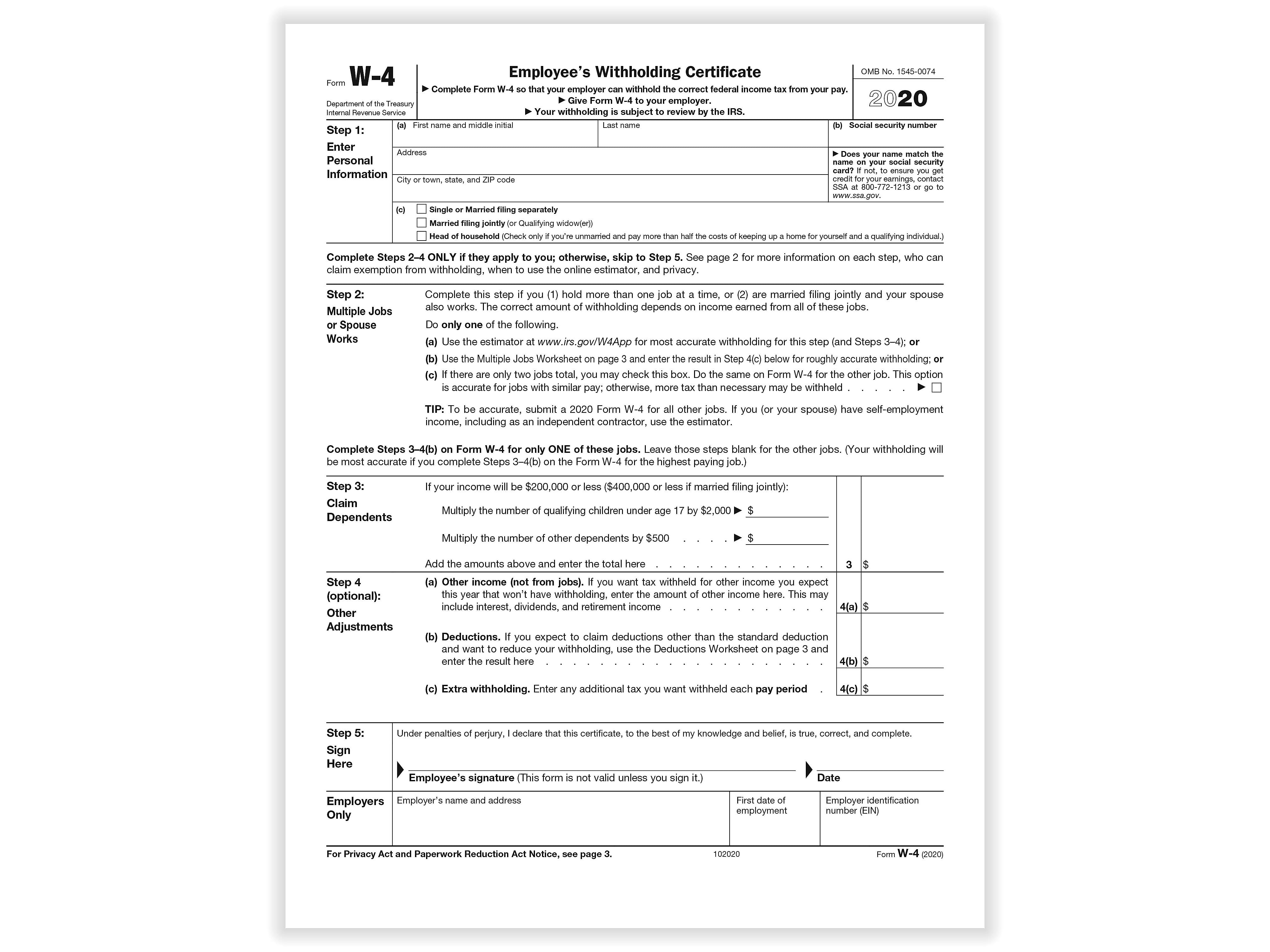

Walmart Tax Form Code - Here's a screenshot showing you how to enter the tax. Include a brief tax policy to let walmart. Web under the tax codes section, enter one tax code per shipping option. It is acceptable to use the generic tax code 2038710. (as a best practice, click the box to remember the. You’ll need them when you apply with walmart business. It is a critical document an employer provides to each walmart employee. Web get online access to your tax forms: Open a support case by clicking the button below. (internal revenue code section 6651) for a detailed calculation of your penalty charges, call 866.

Please complete the required fields to continue: Web we would like to show you a description here but the site won’t allow us. Web walmart notifies suppliers of why they are being penalized by deduction codes. (internal revenue code section 6651) for a detailed calculation of your penalty charges, call 866. Go to mytaxform.com and enter employer code: Remember my employer name or. You’ll need them when you apply with walmart business. An employer sends w2 form on or. Web up to 4% cash back shop walmart.com today for every day low prices. Web up to 4% cash back get all of your tax prep services at walmart.com including tax software, tax forms, label makers, filing storage and binders.

Web get online access to your tax forms: Web up to 4% cash back shop walmart.com today for every day low prices. Web under the tax codes section, enter one tax code per shipping option. (internal revenue code section 6651) for a detailed calculation of your penalty charges, call 866. Please complete the required fields to continue: Go to mytaxform.com and enter employer code: Employees = employer code 10657 step 1: Join walmart+ for unlimited free delivery from your store & free shipping with no order minimum. It is a critical document an employer provides to each walmart employee. Here's a screenshot showing you how to enter the tax.

ComplyRight 2020 W4 Tax Form White 50/Pack (A1393)

Web the item tax code listed under each rate column is the 4 digit suffix of the jurisdiction code for the type of tax rate displayed missouri department of revenue taxation division. Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements.

The Walmart Tax Every American Taxpayer Pays

Go to mytaxform.com and enter employer code: Web walmart notifies suppliers of why they are being penalized by deduction codes. (internal revenue code section 6651) for a detailed calculation of your penalty charges, call 866. Seller help setting up your tax information it’s tax time! Web under the tax codes section, enter one tax code per shipping option.

Watercolors Angel Blog

(as a best practice, click the box to remember the. An employer sends w2 form on or. Web get online access to your tax forms: You’ll need them when you apply with walmart business. Web up to 4% cash back get all of your tax prep services at walmart.com including tax software, tax forms, label makers, filing storage and binders.

'Walmart paid Rs 7,439 cr tax on Flipkart deal; did not deduct taxes

Seller help setting up your tax information it’s tax time! Open a support case by clicking the button below. Go to mytaxform.com and enter employer code: Web under the tax codes section, enter one tax code per shipping option. Please complete the required fields to continue:

The Walmart Tax Institute for Policy Studies

You’ll need them when you apply with walmart business. Web go to your state’s department of revenue website to get your state’s tax forms. Here's a screenshot showing you how to enter the tax. Remember my employer name or. (internal revenue code section 6651) for a detailed calculation of your penalty charges, call 866.

Walmart Tax Software Most Freeware

Please complete the required fields to continue: Web walmart notifies suppliers of why they are being penalized by deduction codes. Go to mytaxform.com and enter employer code: Web the item tax code listed under each rate column is the 4 digit suffix of the jurisdiction code for the type of tax rate displayed missouri department of revenue taxation division. It.

Walmart tax

Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. (internal revenue code section 6651) for a detailed calculation of your penalty charges, call 866. Web agreement with the irs is in effect for the payment of.

Walmart Allegedly Overtaxing On 2For1 Coupon Purchases (PHOTO) HuffPost

Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. Web get online access to your tax forms: You’ll need them when you apply with walmart business. Remember my employer name or. Include a brief tax policy.

The Democracy Labs

Web up to 4% cash back get all of your tax prep services at walmart.com including tax software, tax forms, label makers, filing storage and binders. Web up to 4% cash back shop walmart.com today for every day low prices. It is a critical document an employer provides to each walmart employee. Here's a screenshot showing you how to enter.

THE WALMART WEB ASDA'S Tax Dodging Parent Company Labour Heartlands

Web walmart notifies suppliers of why they are being penalized by deduction codes. Web we would like to show you a description here but the site won’t allow us. Seller help setting up your tax information it’s tax time! Web go to your state’s department of revenue website to get your state’s tax forms. It is a critical document an.

Web Under The Tax Codes Section, Enter One Tax Code Per Shipping Option.

Web generic tax code '2038710' is recommended according to this video: An employer sends w2 form on or. Please complete the required fields to continue: Web up to 4% cash back 1099 misc forms 2022, 1099 misc laser forms irs approved designed for quickbooks and accounting software 2022, 4 part tax forms kit, 25 envelopes.

Web Walmart Notifies Suppliers Of Why They Are Being Penalized By Deduction Codes.

Web up to 4% cash back walmart. Join walmart+ for unlimited free delivery from your store & free shipping with no order minimum. You’ll need them when you apply with walmart business. While there are many deductions that can be.

Include A Brief Tax Policy To Let Walmart.

It is acceptable to use the generic tax code 2038710. Seller help setting up your tax information it’s tax time! Web go to your state’s department of revenue website to get your state’s tax forms. Open a support case by clicking the button below.

(Internal Revenue Code Section 6651) For A Detailed Calculation Of Your Penalty Charges, Call 866.

Web click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are (for example, many states. Remember my employer name or. Here's a screenshot showing you how to enter the tax. Employees = employer code 10657 step 1: