What Happens When I File Form 8919

What Happens When I File Form 8919 - Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web form 8919 reports how much social security and medicare tax that you, the employer, should have paid to the worker while they were misclassified. Web up to 25% cash back by filing this form, your social security and medicare taxes will be credited to your social security record. Web who has the right to control your behavior at work? If married, complete a separate form 8919 for each spouse who must file this form. Web 2019 attachment sequence no. The internal revenue service (irs) is more likely to consider you an employee if: If married, complete a separate form 8919 for each spouse who must file this form. Web per irs form 8919, you must file this form if all of the following apply. You are likely preparing your return incorrectly.

You believe your pay from the firm wasn’t for services as an. You performed services for a firm. If married, complete a separate form 8919 for each spouse who must file this form. Web what is form 8919? If you fail to file on time, you may face. Web who has the right to control your behavior at work? However, you must be able to claim one of the reasons. You may be eligible for the foreign earned income exclusion. I strongly suggest you use a tax pro in the. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their.

Web 2019 attachment sequence no. Web per irs form 8919, you must file this form if all of the following apply. Web the deadline for filing form 8919 is typically the same as the deadline for filing your income tax return, which is usually april 15th. Web taxpayers must file irs form 8919 if a firm paid them for services provided, the taxpayer believes that the work conducted for the organization was not in line with the services of. The business owner gives you. The internal revenue service (irs) is more likely to consider you an employee if: I strongly suggest you use a tax pro in the. If you fail to file on time, you may face. You performed services for a firm. Web you must file form 8919 if all of the following apply.

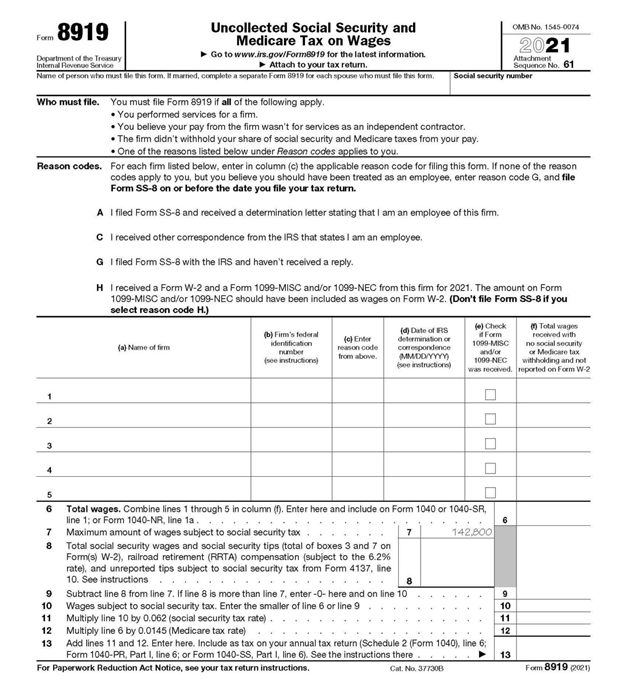

Form 8919 Uncollected Social Security and Medicare Tax on Wages

Workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and. Web form 8919 reports how much social security and medicare tax that you, the employer, should have paid to the worker while they were misclassified. You may be eligible for the foreign earned income exclusion. 61 name of person.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

If you fail to file on time, you may face. You are likely preparing your return incorrectly. You performed services for a firm. If married, complete a separate form 8919 for each spouse who must file this form. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web 2019 attachment sequence no. If you fail to file on time, you may face. Web you must file form 8919 if all of the following apply. You may be eligible for the foreign earned income exclusion. However, you must be able to claim one of the reasons.

When to Use IRS Form 8919 Uncollected Social Security and Medicare Tax

Web who has the right to control your behavior at work? • you performed services for a firm. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web 2019 attachment sequence no. Web when filing a tax return,.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

The business owner gives you. You may be eligible for the foreign earned income exclusion. • you performed services for a firm. However, you must be able to claim one of the reasons. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on.

Tl;dr OP camped in cabin innawoods in winter, encounter mysterious

Web 2019 attachment sequence no. Web up to 25% cash back by filing this form, your social security and medicare taxes will be credited to your social security record. 61 name of person who must file this form. The business owner gives you. You are likely preparing your return incorrectly.

Form 8919 on Tumblr

You believe your pay from the firm wasn’t for services as an. The business owner gives you. You performed services for a firm. Web per irs form 8919, you must file this form if all of the following apply. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social.

IRS expands crypto question on draft version of 1040 Accounting Today

You are likely preparing your return incorrectly. I strongly suggest you use a tax pro in the. If married, complete a separate form 8919 for each spouse who must file this form. Web the deadline for filing form 8919 is typically the same as the deadline for filing your income tax return, which is usually april 15th. Web watch newsmax.

Form 8809 Application for Extension of Time to File Information

The internal revenue service (irs) is more likely to consider you an employee if: By using form 8919, the worker’s social security and medicare taxes will be credited to their. You believe your pay from the firm wasn’t for services as an. If you fail to file on time, you may face. Web watch newsmax live for the latest news.

It Happens Professional Lice Services in Hockley, TX

Web up to 25% cash back by filing this form, your social security and medicare taxes will be credited to your social security record. Web what is form 8919? If you fail to file on time, you may face. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your.

61 Name Of Person Who Must File This Form.

Web form 8919 reports how much social security and medicare tax that you, the employer, should have paid to the worker while they were misclassified. Web 2019 attachment sequence no. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web who has the right to control your behavior at work?

If Married, Complete A Separate Form 8919 For Each Spouse Who Must File This Form.

However, you must be able to claim one of the reasons. Web taxpayers must file irs form 8919 if a firm paid them for services provided, the taxpayer believes that the work conducted for the organization was not in line with the services of. • you believe your pay from the firm wasn’t for services as an independent contractor. You performed services for a firm.

You Are Likely Preparing Your Return Incorrectly.

Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. By using form 8919, the worker’s social security and medicare taxes will be credited to their. If married, complete a separate form 8919 for each spouse who must file this form. Web name of person who must file this form.

• You Performed Services For A Firm.

You may be eligible for the foreign earned income exclusion. Web per irs form 8919, you must file this form if all of the following apply. The internal revenue service (irs) is more likely to consider you an employee if: Web you must file form 8919 if all of the following apply.