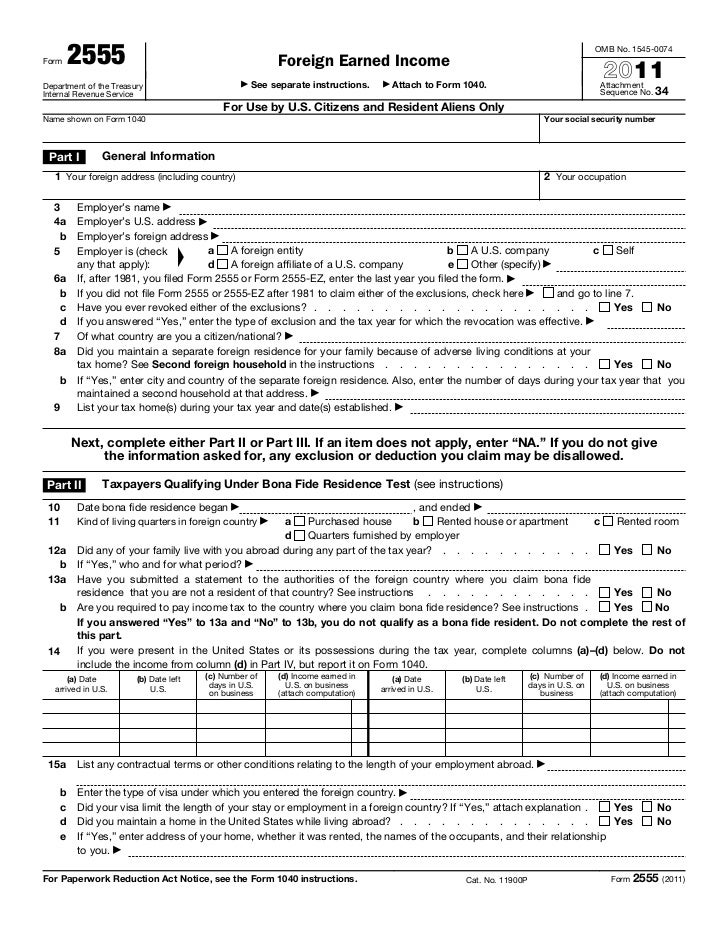

What Is 2555 Form

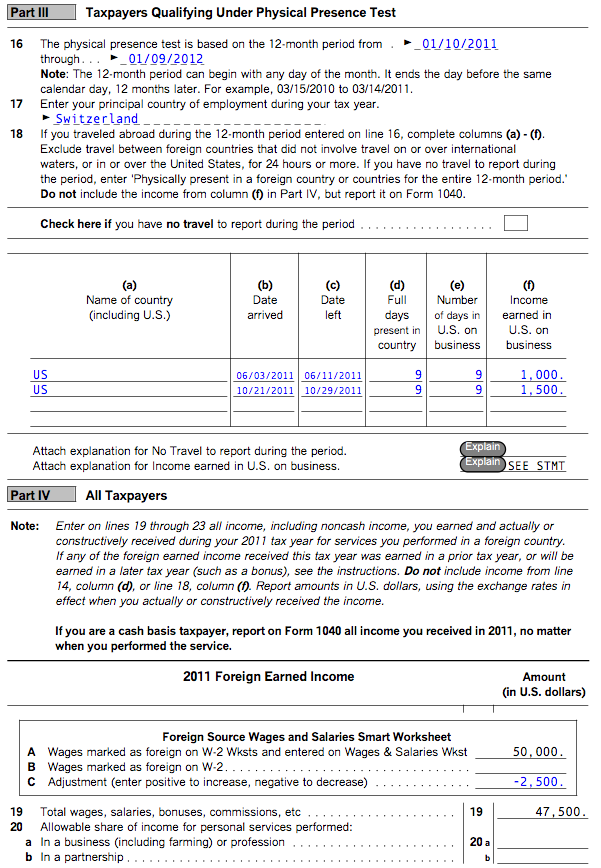

What Is 2555 Form - You cannot exclude or deduct more than the. Get ready for tax season deadlines by completing any required tax forms today. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web form 2555 is the form you need to file to benefit from the feie. Web part ii of form 2555 refers to the physical presence test and requires the taxpayer to provide the following information: The form consists of nine different sections: Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Create legally binding electronic signatures on any device. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web form 2555 (2021) 2 part iii taxpayers qualifying under physical presence test note:

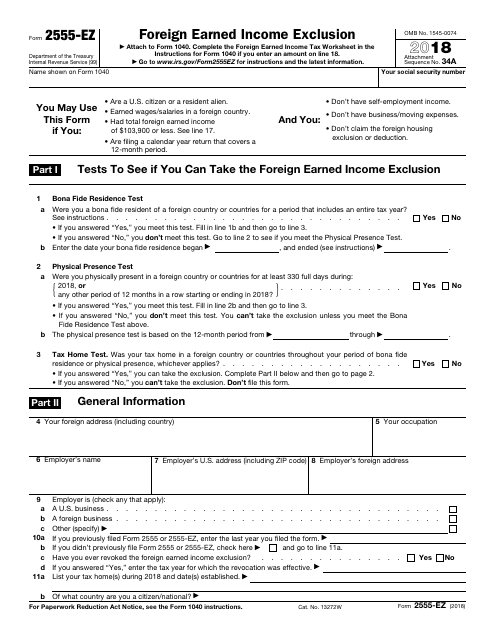

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Create legally binding electronic signatures on any device. It is used to claim the foreign earned income exclusion and/or the. Ad access irs tax forms. Web foreign earned income exclusion (form 2555) u.s. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Citizens and all resident aliens can use this test. This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest. Web what is the foreign earned income exclusion (form 2555)?

If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Ad access irs tax forms. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. It is used to claim the foreign earned income exclusion and/or the. Go to www.irs.gov/form2555 for instructions and the latest. Web irs form 2555 what is form 2555? Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Web part ii of form 2555 refers to the physical presence test and requires the taxpayer to provide the following information:

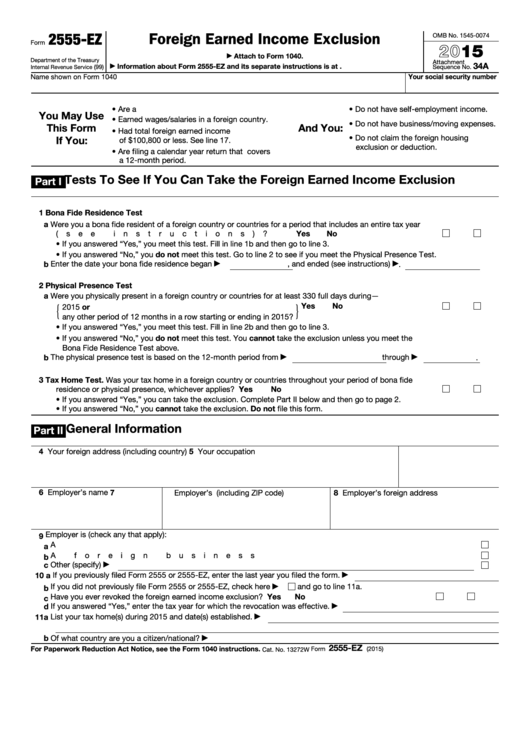

Ssurvivor Form 2555 Ez Instructions 2019

Citizens and all resident aliens can use this test. What this means for most expats is that they can use the feie. Ad access irs tax forms. You cannot exclude or deduct more than the. Complete, edit or print tax forms instantly.

US Tax Abroad Expatriate Form 2555

Web part ii of form 2555 refers to the physical presence test and requires the taxpayer to provide the following information: Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Go to www.irs.gov/form2555 for instructions and the latest. Citizens and all resident aliens can use.

Foreign Earned Exclusion Form 2555 Verni Tax Law

Go to www.irs.gov/form2555 for instructions and the latest. Web foreign earned income exclusion (form 2555) u.s. Web irs form 2555 what is form 2555? Citizens and all resident aliens can use this test. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from.

Fillable Form 2555Ez Foreign Earned Exclusion 2015

Ad access irs tax forms. What this means for most expats is that they can use the feie. Web irs form 2555 what is form 2555? Include information about your employer and. This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest.

US Tax Abroad Expatriate Form 2555

Citizens and all resident aliens can use this test. Web part ii of form 2555 refers to the physical presence test and requires the taxpayer to provide the following information: Web form 2555 is the form you need to file to benefit from the feie. Web irs form 2555 what is form 2555? Get ready for tax season deadlines by.

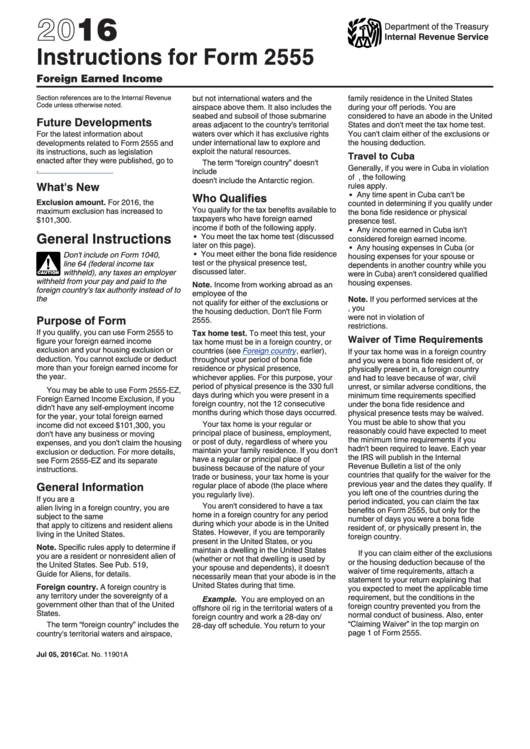

Instructions For Form 2555 2016 printable pdf download

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web what is the foreign earned income exclusion (form 2555)? This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest. Web the tax form 2555, or foreign earned income, is an.

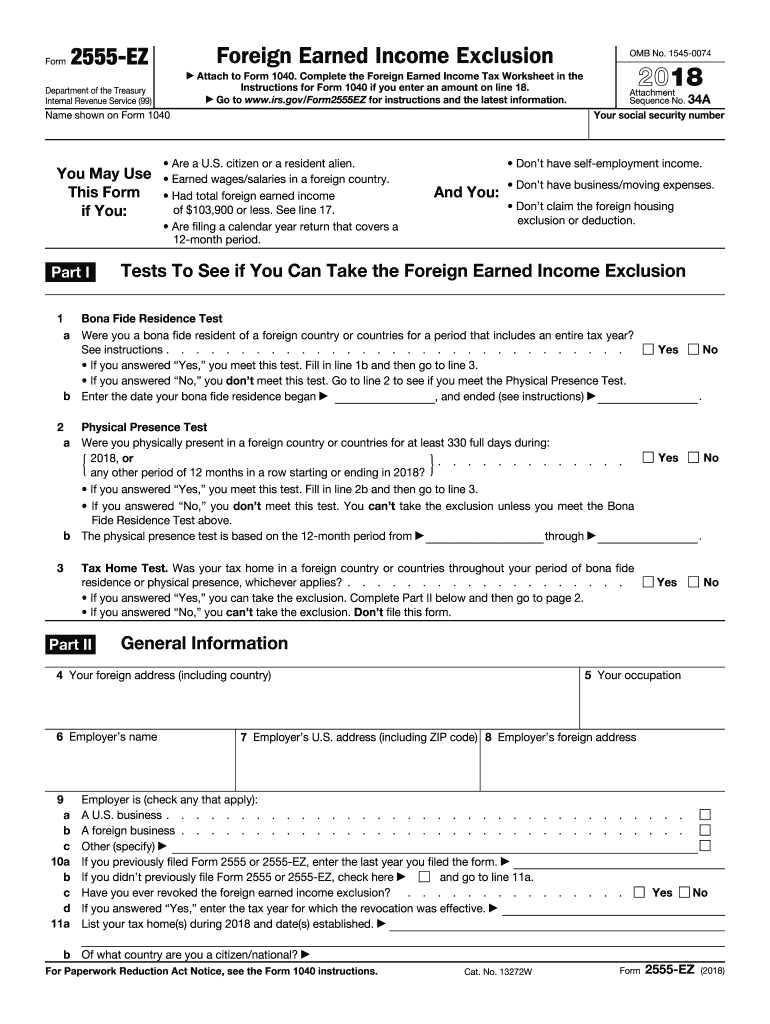

Form 2555 Ez 2020 Pdf Fill Out and Sign Printable PDF Template signNow

Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign.

TurboTax for Expats

If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Citizens and all resident aliens can use this test. Citizens and resident aliens who live and work abroad may be able to exclude all or.

Ssurvivor Form 2555 Instructions 2019

Complete, edit or print tax forms instantly. Web form 2555 is the form you need to file to benefit from the feie. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Web foreign earned income exclusion (form 2555) u.s. If you are living and working abroad, you may be entitled to exclude up to $112,000.

IRS Form 2555EZ Download Fillable PDF or Fill Online Foreign Earned

You cannot exclude or deduct more than the. Go to www.irs.gov/form2555 for instructions and the latest. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Include information about your employer and. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned.

Web Irs Form 2555 What Is Form 2555?

Web what is the foreign earned income exclusion (form 2555)? Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Get ready for tax season deadlines by completing any required tax forms today. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax.

Web April 2, 2022 Form 2555 Can Make An Expat’s Life A Lot Easier!

Web form 2555 is the form you need to file to benefit from the feie. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Web part ii of form 2555 refers to the physical presence test and requires the taxpayer to provide the following information: Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned.

Include Information About Your Employer And.

Citizens and all resident aliens can use this test. Web foreign earned income exclusion (form 2555) u.s. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The form consists of nine different sections:

Citizens And All Resident Aliens Can Use This Test.

Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Complete, edit or print tax forms instantly. Create legally binding electronic signatures on any device. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation.