What Is A 1092 Tax Form

What Is A 1092 Tax Form - Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. Web individuals to allow them to: Web purpose of form. Web your form 1099: This includes any type or service that. Individual tax return form 1040 instructions; Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. 5713, international boycott report pdf. All tax forms can be found the website of the internal revenue service.

Web the what is a 1092 tax form isn’t an any different. Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit. Web you previously filed form 4868 are requesting an additional extension for form 709 but not form 1040 use form 8892 you need to extend the time to file form 709 you are not. All tax forms can be found the website of the internal revenue service. Web individuals to allow them to: Web your form 1099: Web what is a 1092 tax form? Web form 709, when you are not applying for an extension of time to file your individual income tax return using form 4868, application for automatic extension of time to file u.s. (1) limitation on recognition of loss (a) in general Web form 973 (rev.

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. Web popular forms & instructions; This includes any type or service that. Web what is a 1092 tax form? Individual tax return form 1040 instructions; An edocument can be regarded as legally. Web your form 1099: Web form 709, when you are not applying for an extension of time to file your individual income tax return using form 4868, application for automatic extension of time to file u.s. All tax forms can be found the website of the internal revenue service.

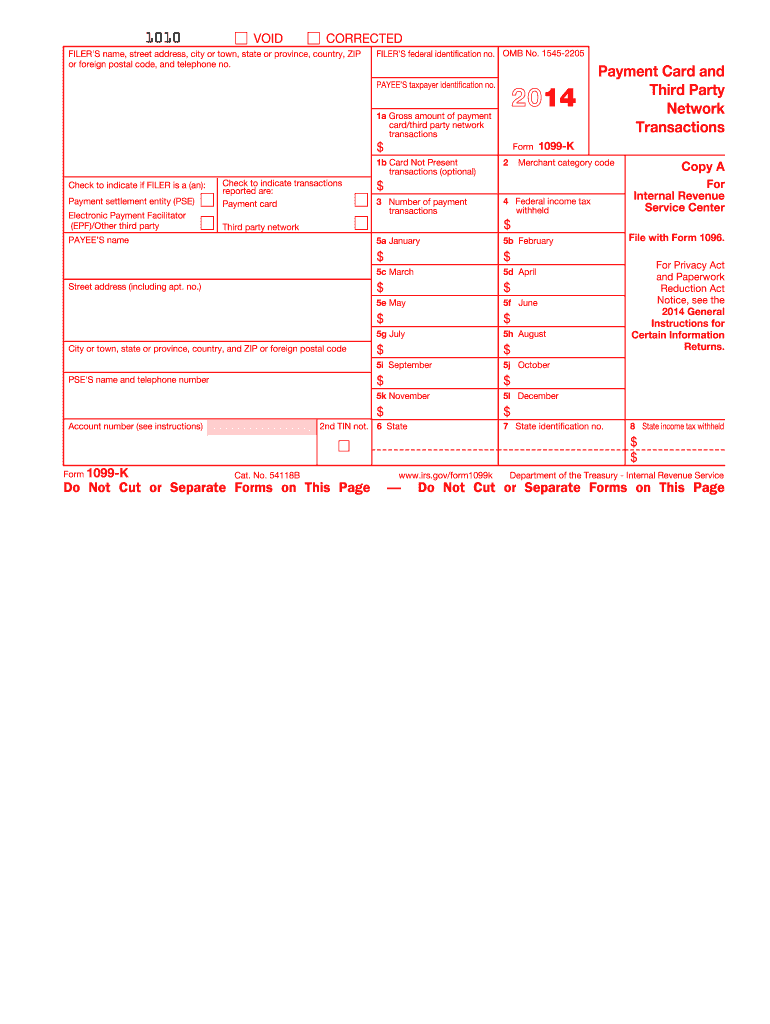

2014 Form IRS 1099K Fill Online, Printable, Fillable, Blank PDFfiller

Shareholders who own (within the meaning of section. Web individuals to allow them to: Web what is a 1092 tax form? Web your form 1099: Web what is a 1092 tax form?

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

All tax forms can be found the website of the internal revenue service. Shareholders who own (within the meaning of section. Web what is a 1092 tax form? Dealing with it utilizing digital tools differs from doing this in the physical world. Web you previously filed form 4868 are requesting an additional extension for form 709 but not form 1040.

Heavy Highway Use Tax Form 2290 Due Date Form Resume Examples

Web form 709, when you are not applying for an extension of time to file your individual income tax return using form 4868, application for automatic extension of time to file u.s. Web taxes texas tax forms to expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. 5713, international boycott report pdf..

New Date for When 2016 W2 Forms Come Out in 2017 National Tax Reports

Web you previously filed form 4868 are requesting an additional extension for form 709 but not form 1040 use form 8892 you need to extend the time to file form 709 you are not. Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit. Code notes prev | next.

Form 973 ≡ Fill Out Printable PDF Forms Online

Web what is a 1092 tax form? Web what is a 1092 tax form? Web purpose of form. Code notes prev | next (a) recognition of loss in case of straddles, etc. Web the what is a 1092 tax form isn’t an any different.

Ch 109 Fill Out and Sign Printable PDF Template signNow

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. Dealing with it utilizing digital tools differs from doing this in the physical world. Individual tax return form 1040 instructions; Web what is a 1092 tax form? 1092 tax form get 1092.

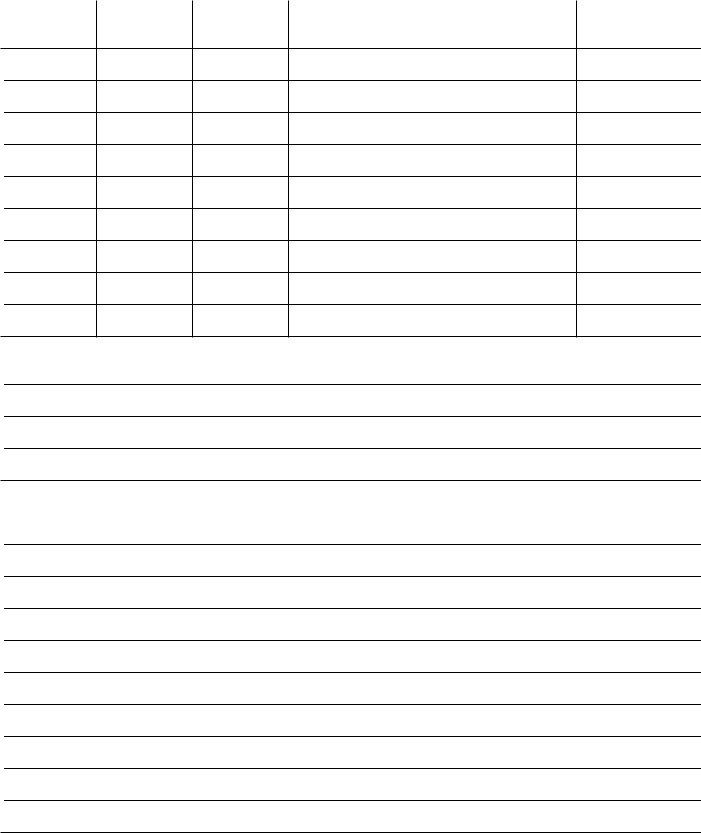

Form LB1092 Download Fillable PDF or Fill Online Worker Training

Web what is a 1092 tax form? This includes any type or service that. 1092 tax form get 1092 tax form how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 1092 rating. Web purpose of form. Web what is a 1092 tax form?

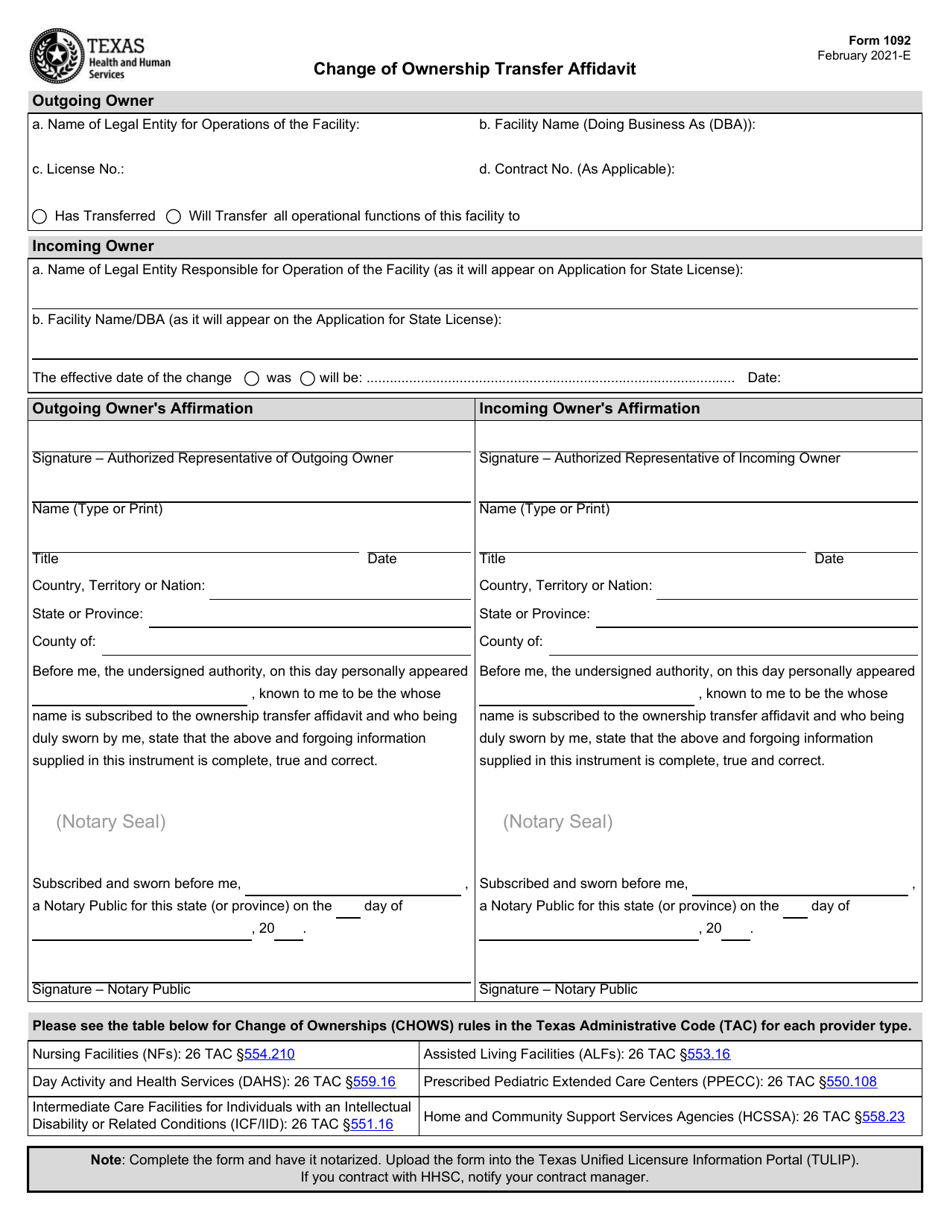

Form 1092 Download Fillable PDF or Fill Online Change of Ownership

Web you previously filed form 4868 are requesting an additional extension for form 709 but not form 1040 use form 8892 you need to extend the time to file form 709 you are not. Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit. Shareholders who own (within the.

1092 Tax Form Fill Out and Sign Printable PDF Template signNow

Web form 709, when you are not applying for an extension of time to file your individual income tax return using form 4868, application for automatic extension of time to file u.s. Web what is a 1092 tax form? Web you previously filed form 4868 are requesting an additional extension for form 709 but not form 1040 use form 8892.

How to Check Khasra Number bhulekh.up.nic.in Registration UP Bhulekh

Web form 973 (rev. There is no such thing as tax form 1092. Specifications 5 to be removed before printing instructions to printers form 973, page 2 of 2. (1) limitation on recognition of loss (a) in general Web popular forms & instructions;

Web What Is A 1092 Tax Form?

Web you previously filed form 4868 are requesting an additional extension for form 709 but not form 1040 use form 8892 you need to extend the time to file form 709 you are not. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. 1092 tax form get 1092 tax form how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 1092 rating. Dealing with it utilizing digital tools differs from doing this in the physical world.

An Edocument Can Be Regarded As Legally.

Web individuals to allow them to: Web your form 1099: Web form 709, when you are not applying for an extension of time to file your individual income tax return using form 4868, application for automatic extension of time to file u.s. The 1099 form, by contrast, records income you received as an independent contractor or for some other source of income.

Web What Is A 1092 Tax Form?

Web what is a 1092 tax form? This includes any type or service that. Specifications 5 to be removed before printing instructions to printers form 973, page 2 of 2. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer.

(1) Limitation On Recognition Of Loss (A) In General

Shareholders who own (within the meaning of section. Individual tax return form 1040 instructions; Code notes prev | next (a) recognition of loss in case of straddles, etc. Take the premium tax credit, reconcile the credit on their returns with advance payments of the premium tax credit (advance credit.