What Is A 2290 Form In Trucking

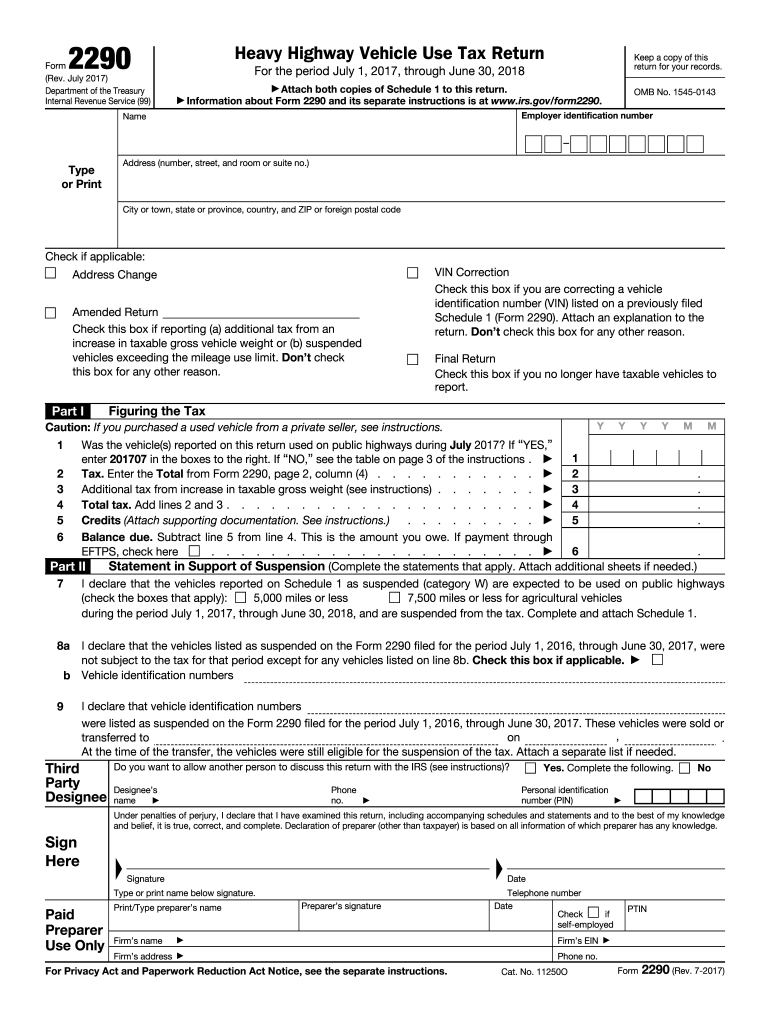

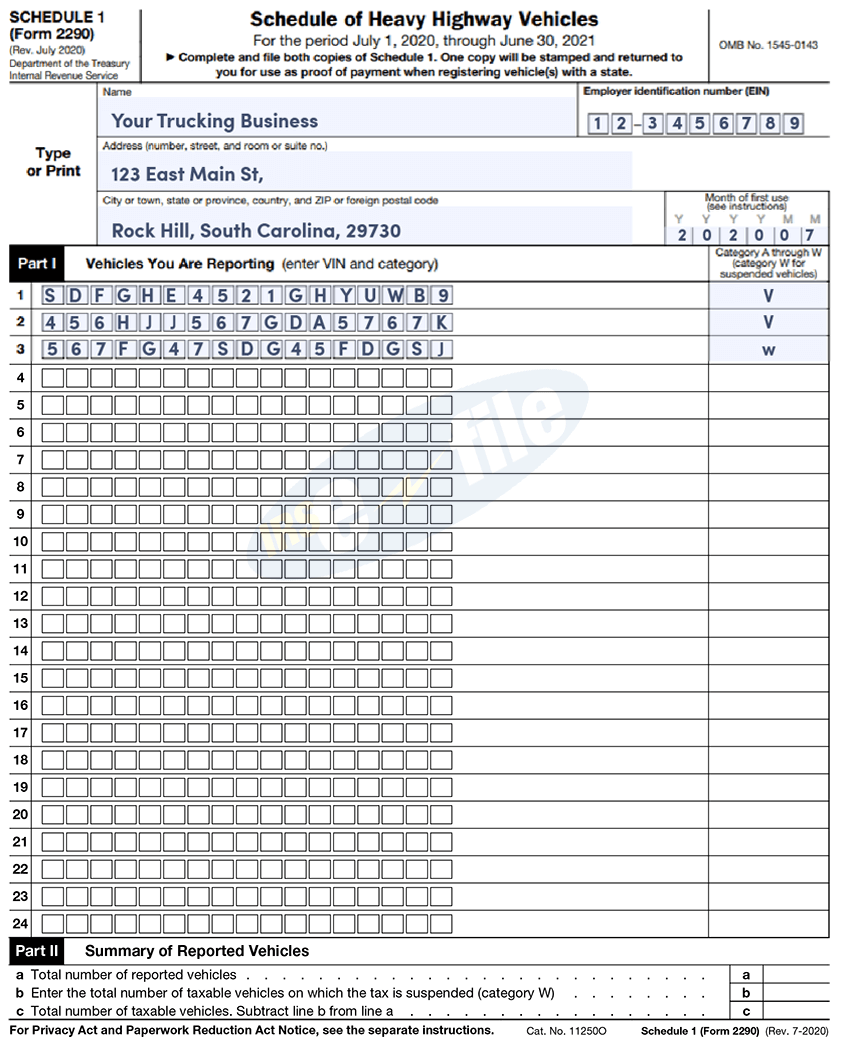

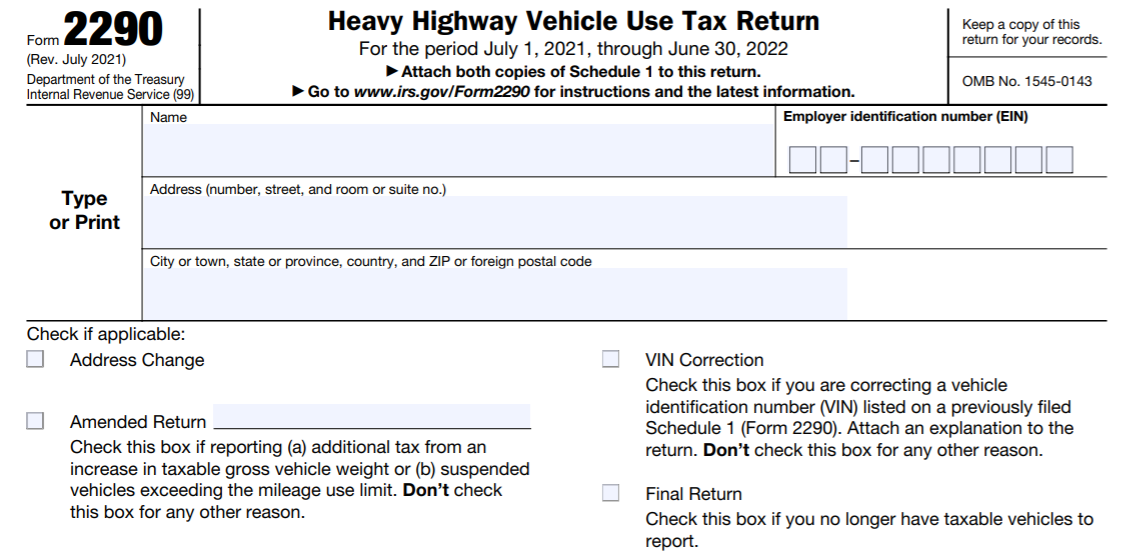

What Is A 2290 Form In Trucking - Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. These due date rules apply whether you are paying the tax or reporting the suspension of tax. Web what is a form 2290? What is a stamped schedule 1? Every truck driver must file this form in order to pay their highway vehicle use tax (hvut). Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. This total is figured using the taxable gross weight for vehicles that weigh 55,000 pounds or more. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles in the taxable year. Web general instructions purpose of form use form 2290 for the following actions. Web you will need to file hvut form 2290 and pay any taxes owed to receive your stamped schedule 1.

Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles in the taxable year. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Use the table below to determine your filing deadline. (this runs from july 1st to june 30th each year) what is the purpose of a form 2290? Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. What is a stamped schedule 1? Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web what is a form 2290? Your stamped schedule 1 is proof of payment for your heavy vehicle use tax.

Web you will need to file hvut form 2290 and pay any taxes owed to receive your stamped schedule 1. Web general instructions purpose of form use form 2290 for the following actions. See when to file form 2290 for more details. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. This tax is imposed on heavy vehicles that operate on public highways with a gross weight of 55,000 pounds or more. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Your stamped schedule 1 is proof of payment for your heavy vehicle use tax. Web form 2290 is a tax return for heavy vehicles to figure out how much taxes a specific vehicle needs to pay. What is a stamped schedule 1?

New To Trucking? Here Is What You Should Know About Form 2290 Blog

Without this proof of payment, you will be unable to renew your tags at the dmv or renew your registration for ifta, irp, or ucr. Use the table below to determine your filing deadline. The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Web you must file form 2290 for these.

The Usefulness of Form 2290 to the Trucking Business Diesel trucks

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. This tax is imposed on heavy vehicles that operate on public highways with a gross weight of 55,000 pounds or more. See when to file form 2290 for.

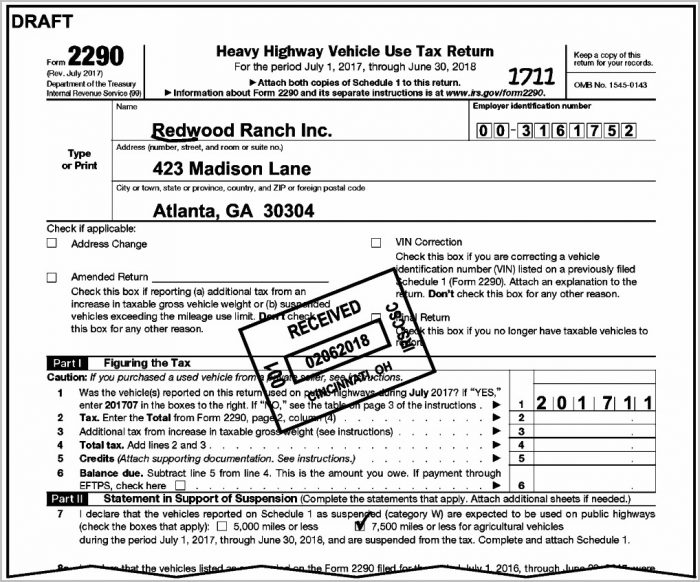

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

This total is figured using the taxable gross weight for vehicles that weigh 55,000 pounds or more. What is a stamped schedule 1? Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue service (irs). Without this.

EFile Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax

It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more. Web you will need to file hvut form 2290 and pay any taxes owed to receive your stamped schedule 1. Your stamped schedule 1 is proof of payment for your heavy vehicle use.

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue service (irs). (this runs from july 1st to june 30th.

Learn How to Fill the Form 2290 Internal Revenue Service Tax YouTube

Use the table below to determine your filing deadline. Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue service (irs). Web you will need to file hvut form 2290 and pay any taxes owed to receive.

Trucking Spotlight Blog ExpressTruckTax EFile IRS Form 2290 Online

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles.

Form 2290 The Trucker's Bookkeeper

(this runs from july 1st to june 30th each year) what is the purpose of a form 2290? Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. What is a stamped schedule 1? Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions.

Trucking Spotlight Blog ExpressTruckTax EFile IRS Form 2290 Online

Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue.

Irs Gives Truckers Three Month Extension; Highway Use Tax Return Due

Web 2290 form, also known as the heavy highway vehicle use tax return, is a federal tax form used to report and pay the heavy vehicle use tax (hvut) to the internal revenue service (irs). Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Everyone must complete.

Web You Will Need To File Hvut Form 2290 And Pay Any Taxes Owed To Receive Your Stamped Schedule 1.

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more. The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax.

(This Runs From July 1St To June 30Th Each Year) What Is The Purpose Of A Form 2290?

Web form 2290 is a tax return for heavy vehicles to figure out how much taxes a specific vehicle needs to pay. These due date rules apply whether you are paying the tax or reporting the suspension of tax. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Your stamped schedule 1 is proof of payment for your heavy vehicle use tax.

Web 2290 Form, Also Known As The Heavy Highway Vehicle Use Tax Return, Is A Federal Tax Form Used To Report And Pay The Heavy Vehicle Use Tax (Hvut) To The Internal Revenue Service (Irs).

In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles in the taxable year. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Use the table below to determine your filing deadline. Web general instructions purpose of form use form 2290 for the following actions.

This Tax Is Imposed On Heavy Vehicles That Operate On Public Highways With A Gross Weight Of 55,000 Pounds Or More.

What is a stamped schedule 1? Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Without this proof of payment, you will be unable to renew your tags at the dmv or renew your registration for ifta, irp, or ucr. This total is figured using the taxable gross weight for vehicles that weigh 55,000 pounds or more.