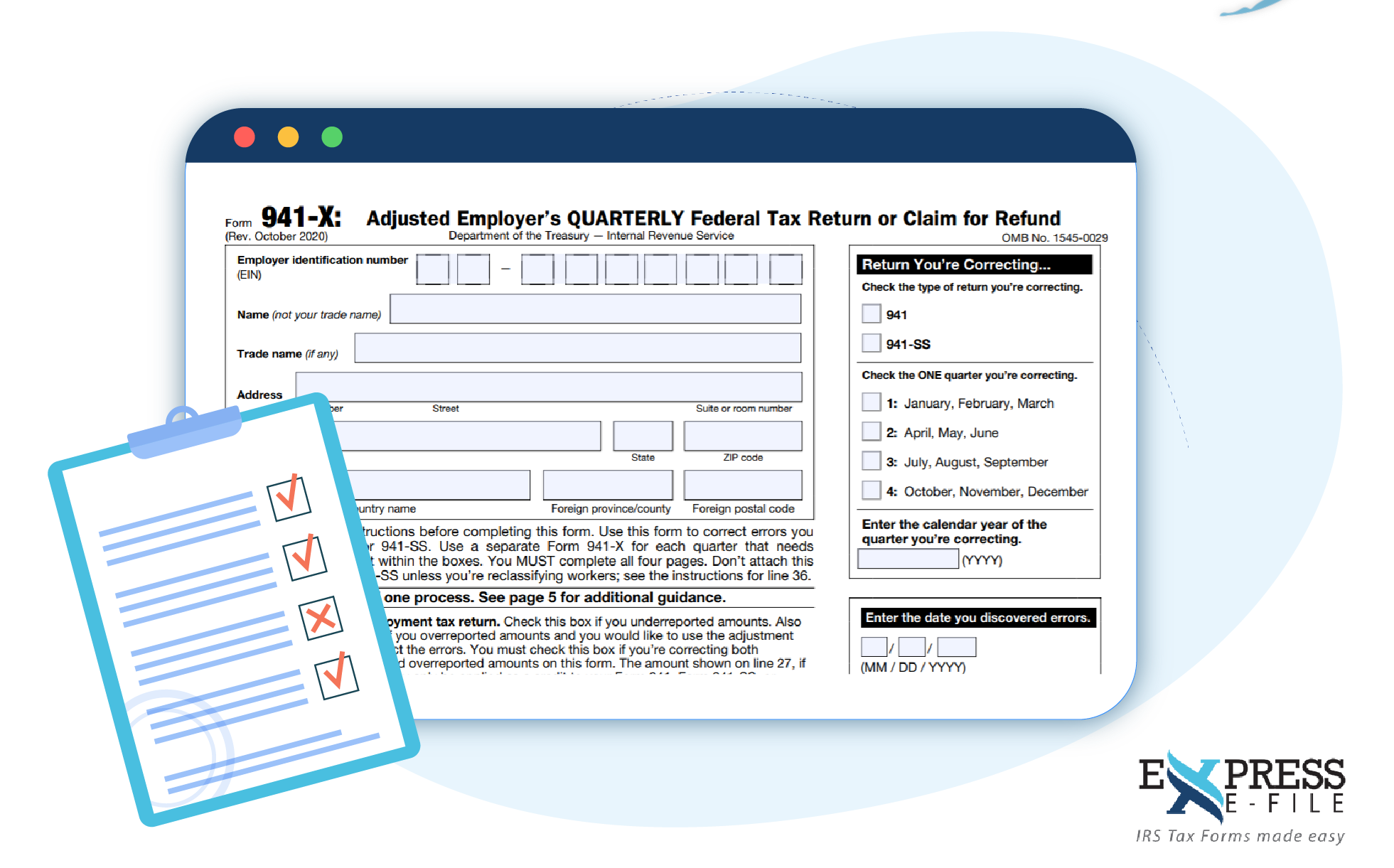

What Is A 941 X Form

What Is A 941 X Form - Web overview you must file irs form 941 if you operate a business and have employees working for you. Certain employers whose annual payroll tax and withholding. Web understanding tax credits and their impact on form 941. Form 941 is used by employers. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. File 941 x for employee retention credit is it possible to file both an erc and a. Ad access irs tax forms. Filing deadlines are in april, july, october and january. Employers use this form to report. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability.

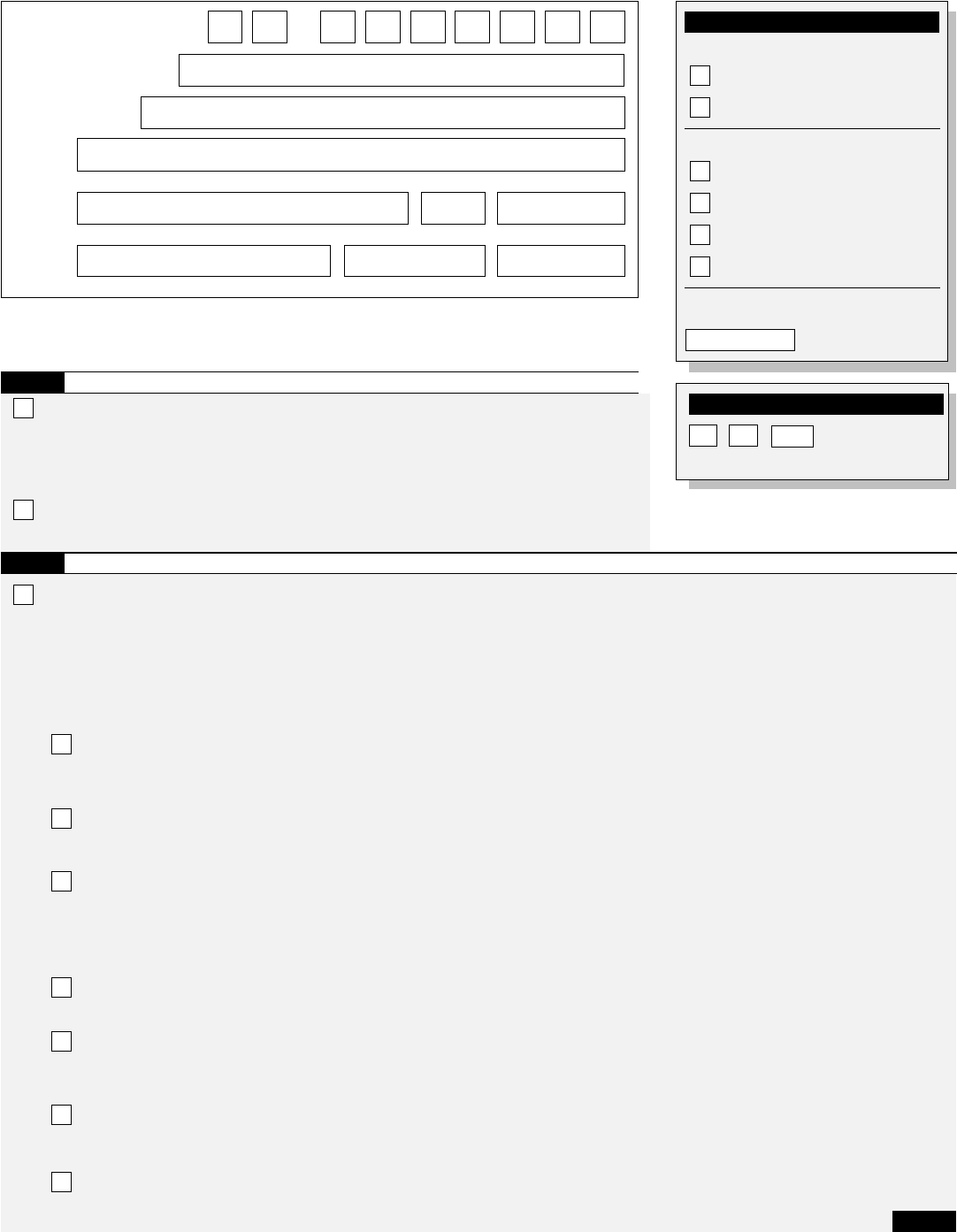

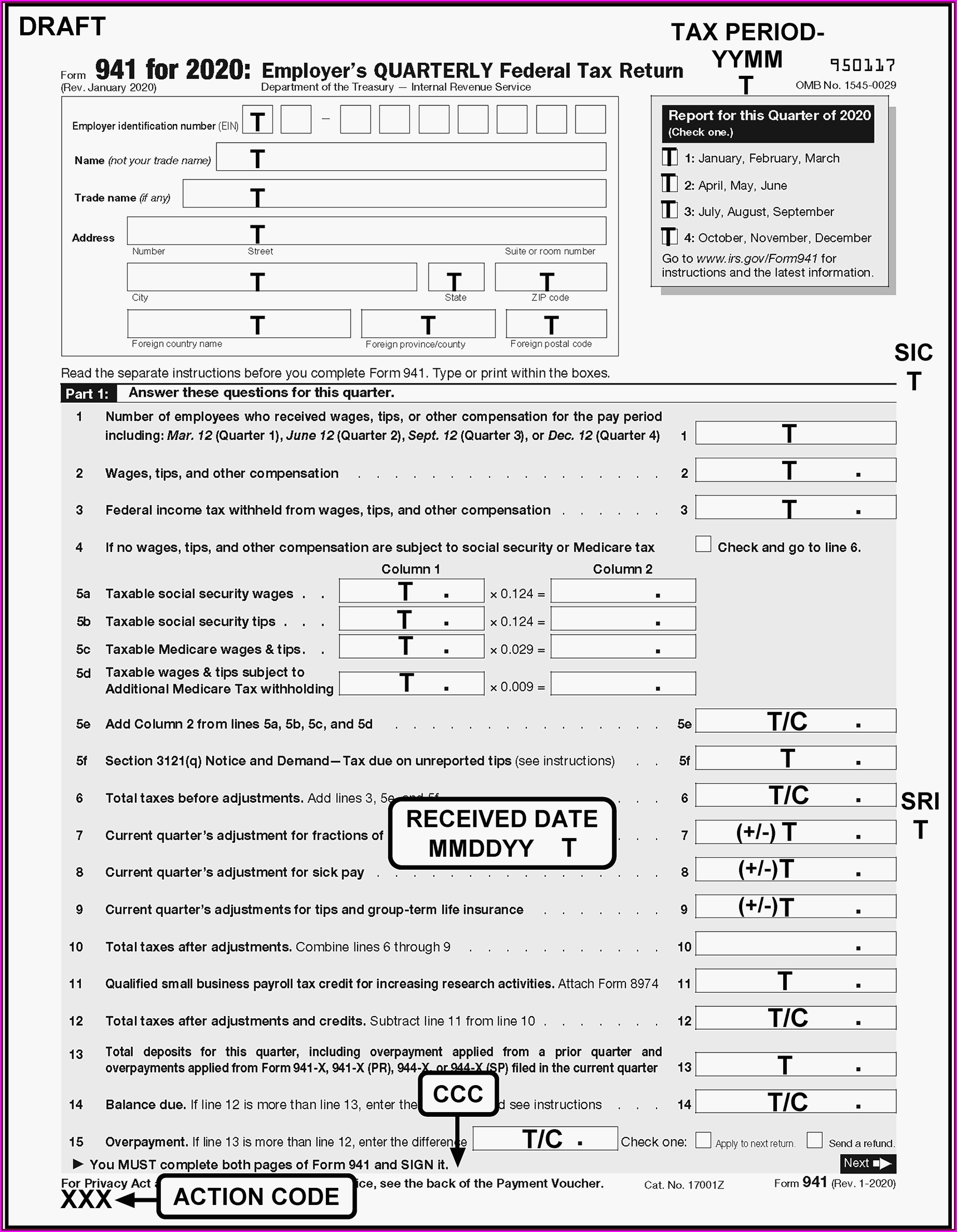

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web understanding tax credits and their impact on form 941. Ad access irs tax forms. Certain employers whose annual payroll tax and withholding. Web overview you must file irs form 941 if you operate a business and have employees working for you. Employers use this form to report. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Filing deadlines are in april, july, october and january. Get ready for tax season deadlines by completing any required tax forms today. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,.

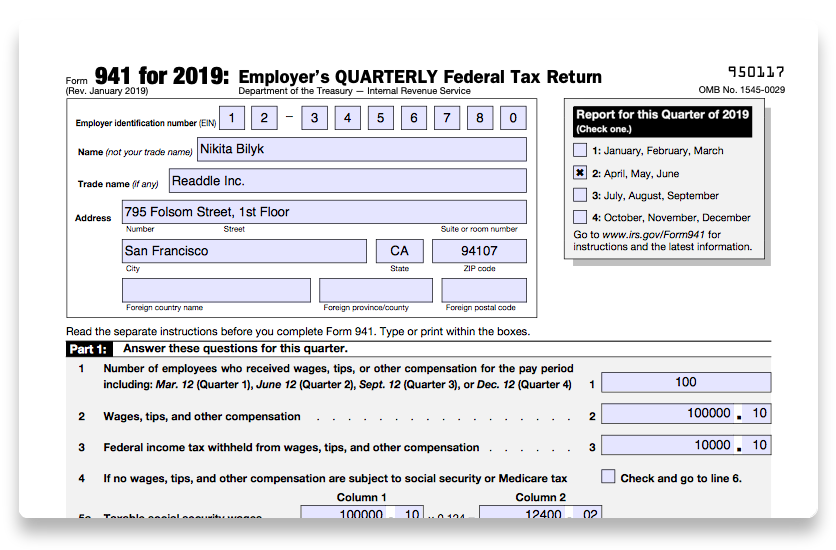

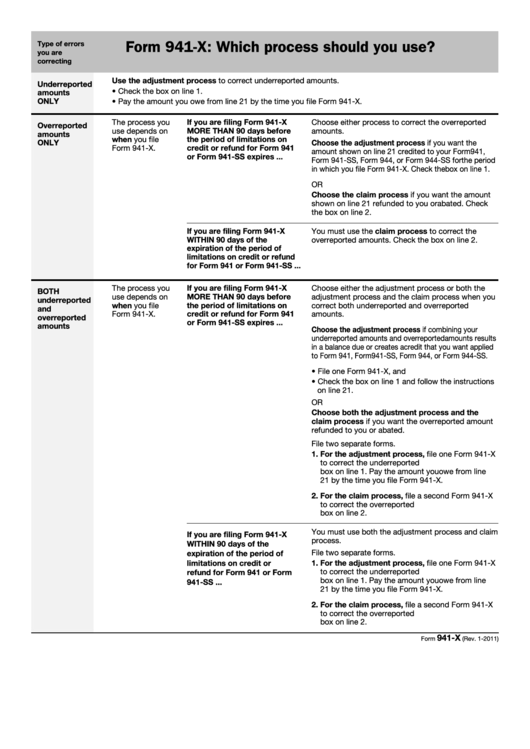

If you find an error on a. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. If you have figured out. The sum of line 30 and line 31 multiplied by the credit. Filing deadlines are in april, july, october and january. Web understanding tax credits and their impact on form 941. File 941 x for employee retention credit is it possible to file both an erc and a. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Employers use this form to report.

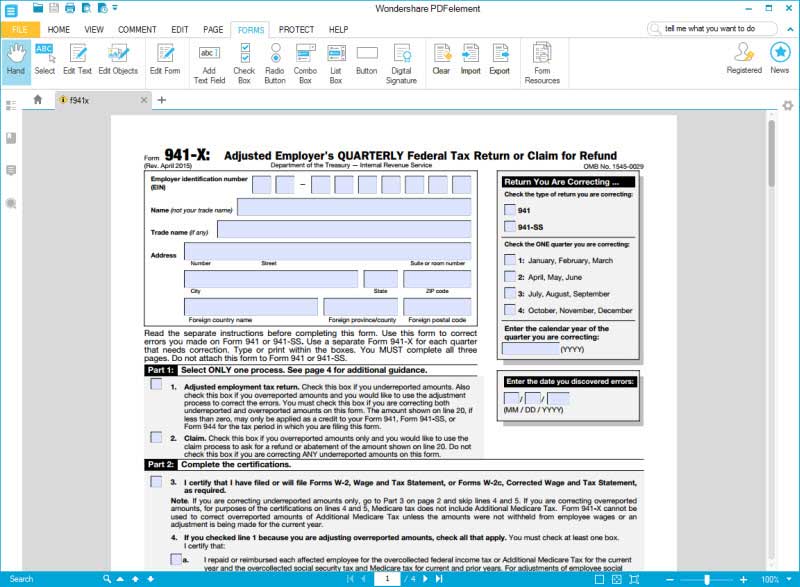

Form 941X Edit, Fill, Sign Online Handypdf

Employers use this form to report. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Form 941 is used by employers. Complete, edit or print tax forms instantly.

Form 941 X Fill Out and Sign Printable PDF Template signNow

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Filing deadlines are in april, july, october and january. The sum of line 30 and line 31 multiplied by the credit. Get ready for tax season deadlines by completing any required tax forms today. July 2020) adjusted employer’s quarterly.

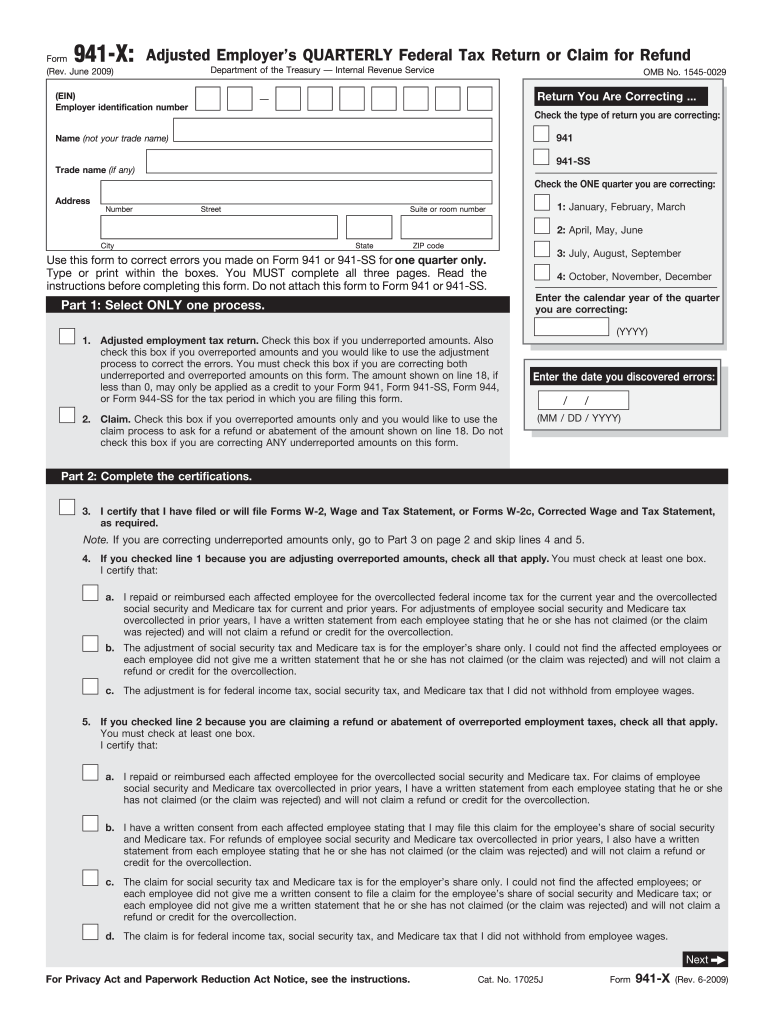

How to fill out IRS Form 941 2019 PDF Expert

If you are located in. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Complete, edit or print tax forms instantly. Ad access irs tax forms. Complete, edit or print tax forms instantly.

IRS Form 941X Learn How to Fill it Easily

Web understanding tax credits and their impact on form 941. The sum of line 30 and line 31 multiplied by the credit. Complete, edit or print tax forms instantly. Web overview you must file irs form 941 if you operate a business and have employees working for you. Employers use this form to report.

Form 941 X mailing address Fill online, Printable, Fillable Blank

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Ad get ready for tax season deadlines by completing any required tax forms today. Filing deadlines are in april, july, october and january. Certain employers.

What You Need to Know About Just Released IRS Form 941X Blog

Ad access irs tax forms. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Ad get ready for tax season deadlines by completing any required tax forms today. Certain employers whose annual payroll tax and withholding. Form 941 is used by employers.

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

Certain employers whose annual payroll tax and withholding. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. The sum of line 30 and line 31 multiplied by the credit. If you are located in.

IRS Form 941X Complete & Print 941X for 2021

Web overview you must file irs form 941 if you operate a business and have employees working for you. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web hub taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the.

Instructions For Form 941X Adjusted Employer'S Quarterly Federal Tax

The sum of line 30 and line 31 multiplied by the credit. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Certain employers whose annual payroll tax and withholding. Web hub taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. If you have figured.

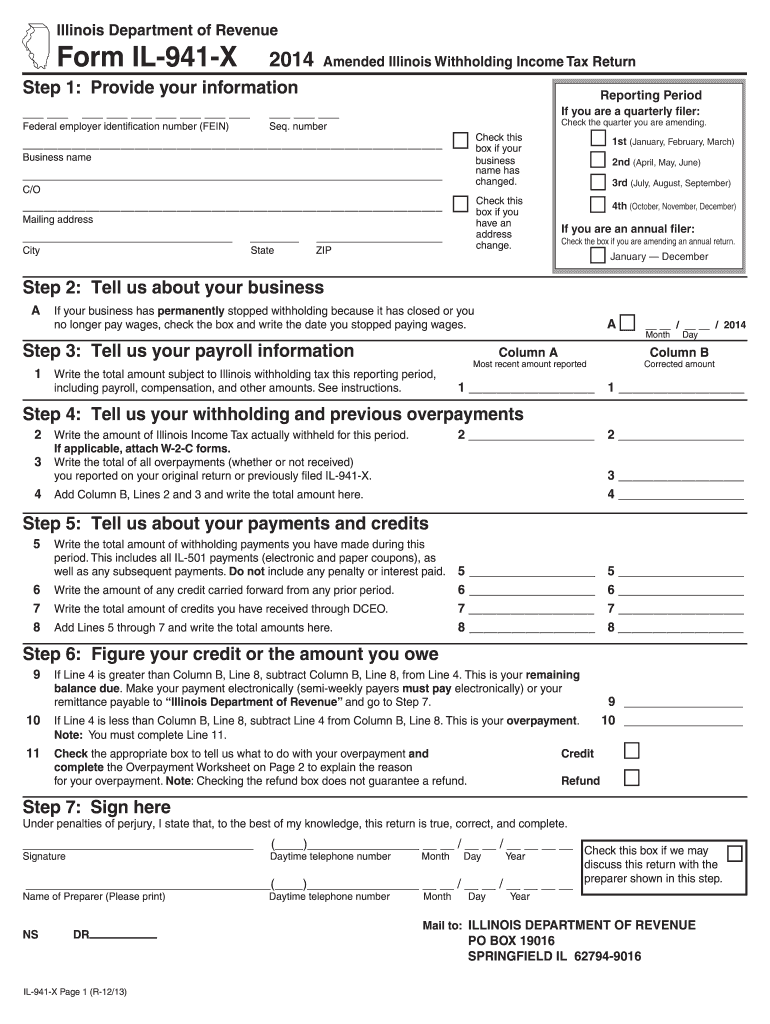

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Certain employers whose annual payroll tax and withholding. Web understanding tax credits and their impact on form 941. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Ad.

Certain Employers Whose Annual Payroll Tax And Withholding.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Filing deadlines are in april, july, october and january. If you find an error on a.

If You Are Located In.

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Complete, edit or print tax forms instantly. The sum of line 30 and line 31 multiplied by the credit. File 941 x for employee retention credit is it possible to file both an erc and a.

Form 941 Is Used By Employers.

Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. If you have figured out.

Connecticut, Delaware, District Of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine,.

Ad get ready for tax season deadlines by completing any required tax forms today. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employers use this form to report. Ad access irs tax forms.