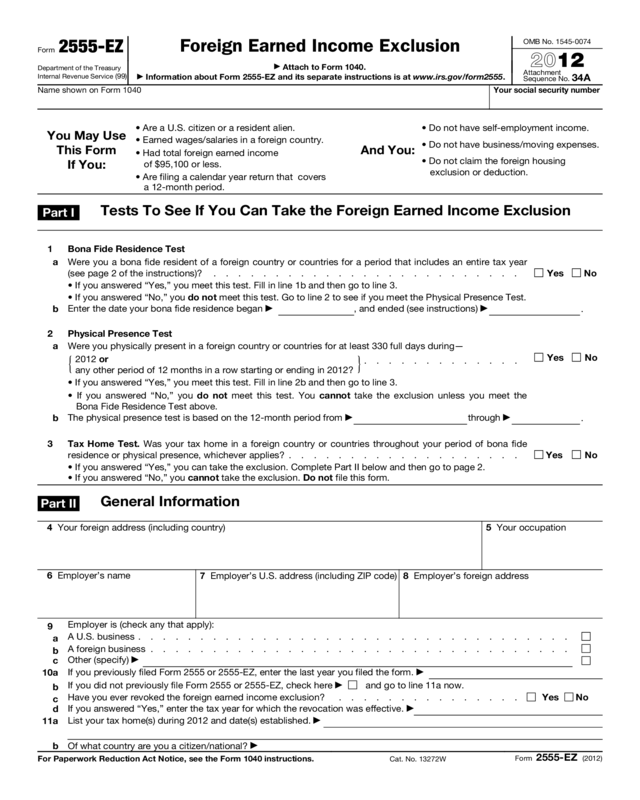

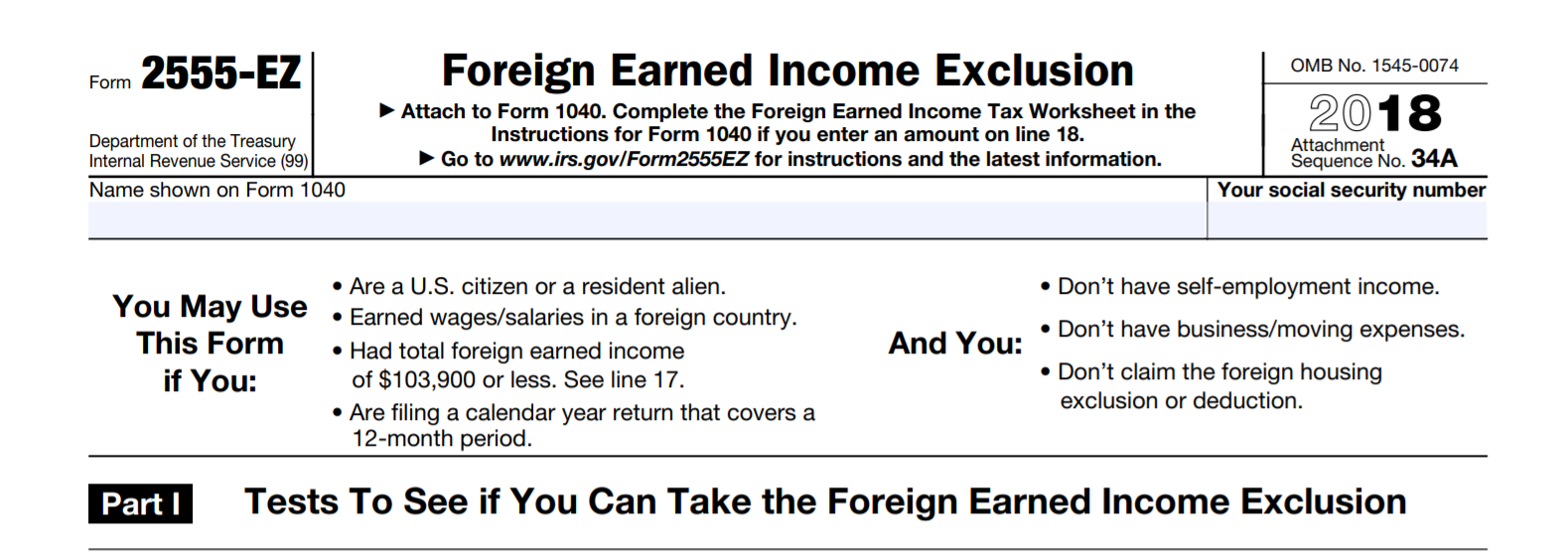

What Is Form 2555 Used For

What Is Form 2555 Used For - A guide for us expats katelynn minott, cpa & ceo published: One may file form 2555. June 24th, 2022 get to know the author uncle sam and american expats. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Web form 2555 can make an expat’s life a lot easier! Taxation of income earned in a foreign country. You cannot exclude or deduct more than the. Web foreign earned income exclusion (form 2555) u.s.

Go to www.irs.gov/form2555 for instructions and the latest. June 24th, 2022 get to know the author uncle sam and american expats. Who should use the foreign earned income exclusion? Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Web form 2555 can make an expat’s life a lot easier! A form that one files with the irs to claim a foreign earned income exclusion from u.s. It is used to claim the foreign earned income exclusion and/or the. The feie is ideal for people. A guide for us expats katelynn minott, cpa & ceo published: Web foreign earned income exclusion (form 2555) u.s.

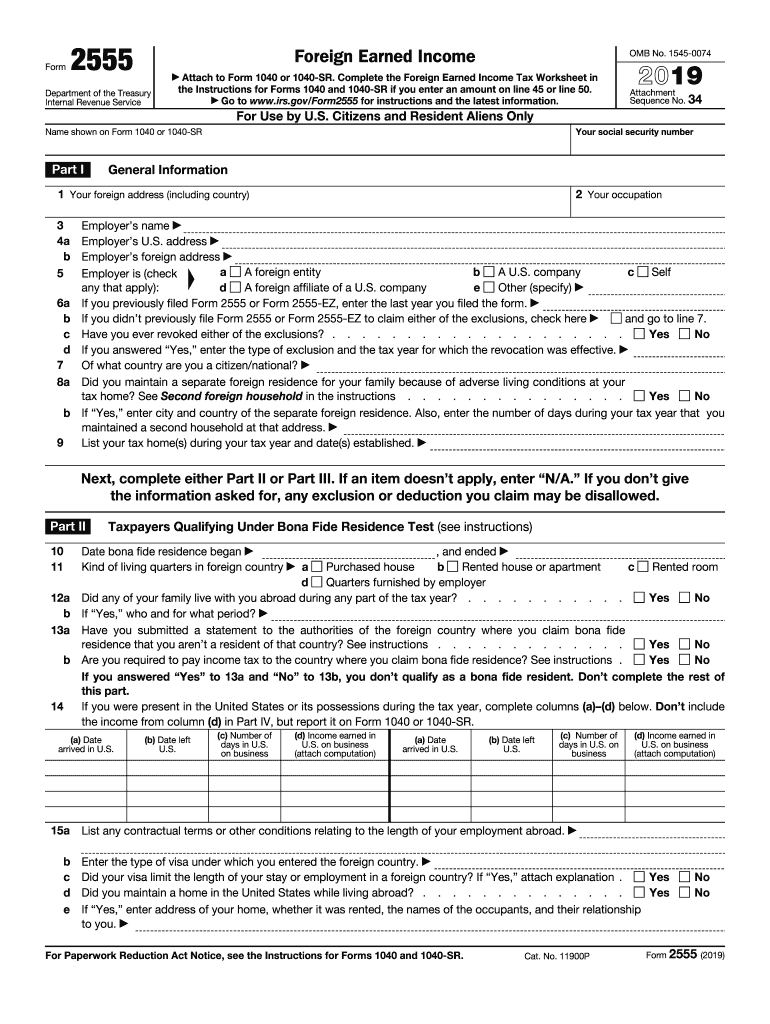

Web foreign earned income exclusion (form 2555) u.s. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. Download or email irs 2555 & more fillable forms, register and subscribe now! Web filing form 2555: What this means for most expats is that they can use the feie. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you. The feie is ideal for people. Go to www.irs.gov/form2555 for instructions and the latest. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from.

Breanna Tax Form 2555 Ez 2019

You cannot exclude or deduct more than the. Download or email irs 2555 & more fillable forms, register and subscribe now! It is used to claim the foreign earned income exclusion and/or the. Web form 2555 can make an expat’s life a lot easier! June 24th, 2022 get to know the author uncle sam and american expats.

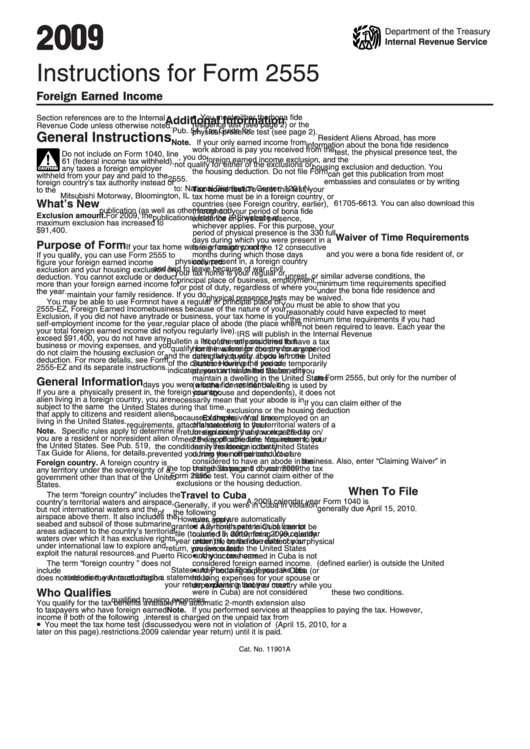

Instructions For Form 2555 Foreign Earned Internal Revenue

One may file form 2555. A form that one files with the irs to claim a foreign earned income exclusion from u.s. Web foreign earned income exclusion (form 2555) u.s. It is used to claim the foreign earned income exclusion and/or the. Go to www.irs.gov/form2555 for instructions and the.

2017 Form 2555 Edit, Fill, Sign Online Handypdf

A guide for us expats katelynn minott, cpa & ceo published: You cannot exclude or deduct more than the. What this means for most expats is that they can use the feie. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Go to www.irs.gov/form2555 for instructions and the latest.

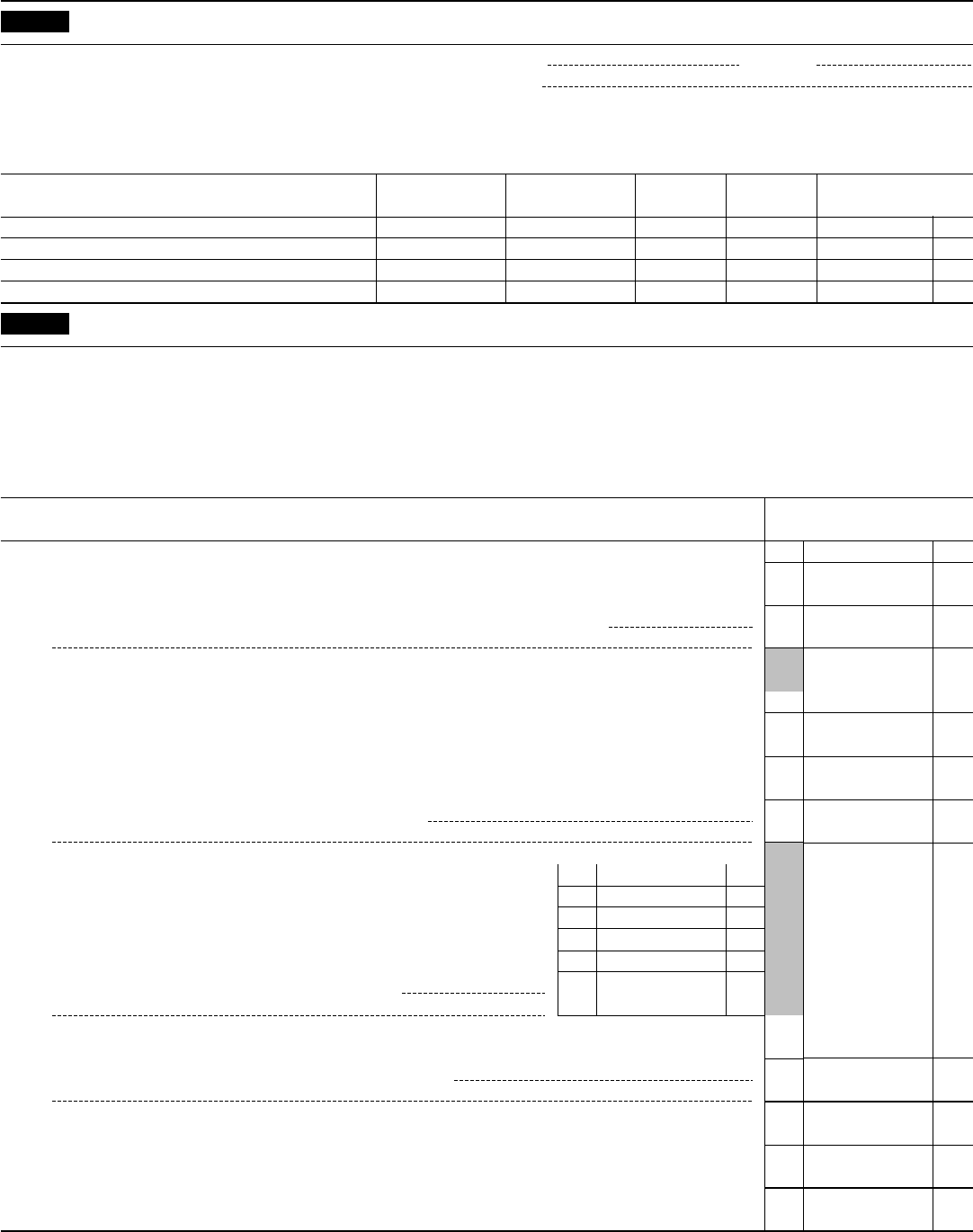

AF IMT Form 2555 Download Fillable PDF or Fill Online NAF Collection

Taxation of income earned in a foreign country. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The feie is ideal for people. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. A guide for us expats.

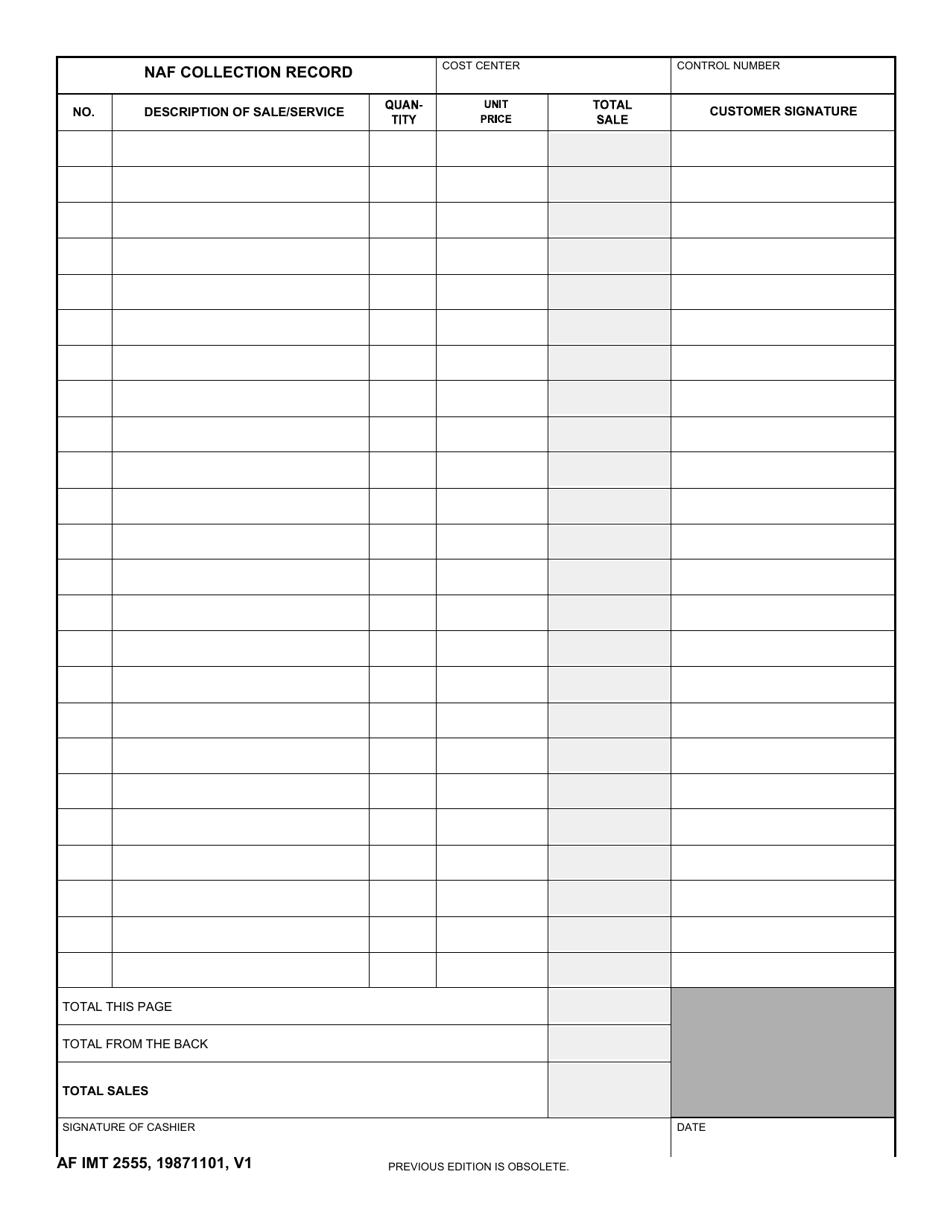

2019 Form IRS 2555 Fill Online, Printable, Fillable, Blank pdfFiller

One may file form 2555. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. A form that one files with the irs to claim a foreign.

Form 2555 Foreign Earned (2014) Free Download

Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you. Citizens and resident aliens who live and work abroad may be able to exclude.

Ssurvivor Example Of Form 2555 Filled Out

Go to www.irs.gov/form2555 for instructions and the latest. A form that one files with the irs to claim a foreign earned income exclusion from u.s. June 24th, 2022 get to know the author uncle sam and american expats. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction..

Form 2555 Instructions and Tips for US Expat Tax Payers YouTube

Web form 2555 can make an expat’s life a lot easier! Expats use to claim the foreign earned income. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you. What this means for most expats is that they can use the feie. A form that one files with the irs to claim a.

Form 2555Ez Edit, Fill, Sign Online Handypdf

One may file form 2555. It is used to claim the foreign earned income exclusion and/or the. Go to www.irs.gov/form2555 for instructions and the latest. Taxation of income earned in a foreign country. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you.

Form 2555 EZ SDG Accountant

Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Taxation of income earned in a foreign country. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web form 2555 is a tax form that must be filed by nonresident aliens.

Form 2555 (Foreign Earned Income Exclusion) Calculates The Amount Of Foreign Earned Income And/Or Foreign Housing You.

Expats use to claim the foreign earned income. Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Web foreign earned income exclusion (form 2555) u.s.

You Cannot Exclude Or Deduct More Than The.

A guide for us expats katelynn minott, cpa & ceo published: Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their. June 24th, 2022 get to know the author uncle sam and american expats.

Complete, Edit Or Print Tax Forms Instantly.

A form that one files with the irs to claim a foreign earned income exclusion from u.s. Who should use the foreign earned income exclusion? It is used to claim the foreign earned income exclusion and/or the. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

What This Means For Most Expats Is That They Can Use The Feie.

Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Go to www.irs.gov/form2555 for instructions and the. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Go to www.irs.gov/form2555 for instructions and the.