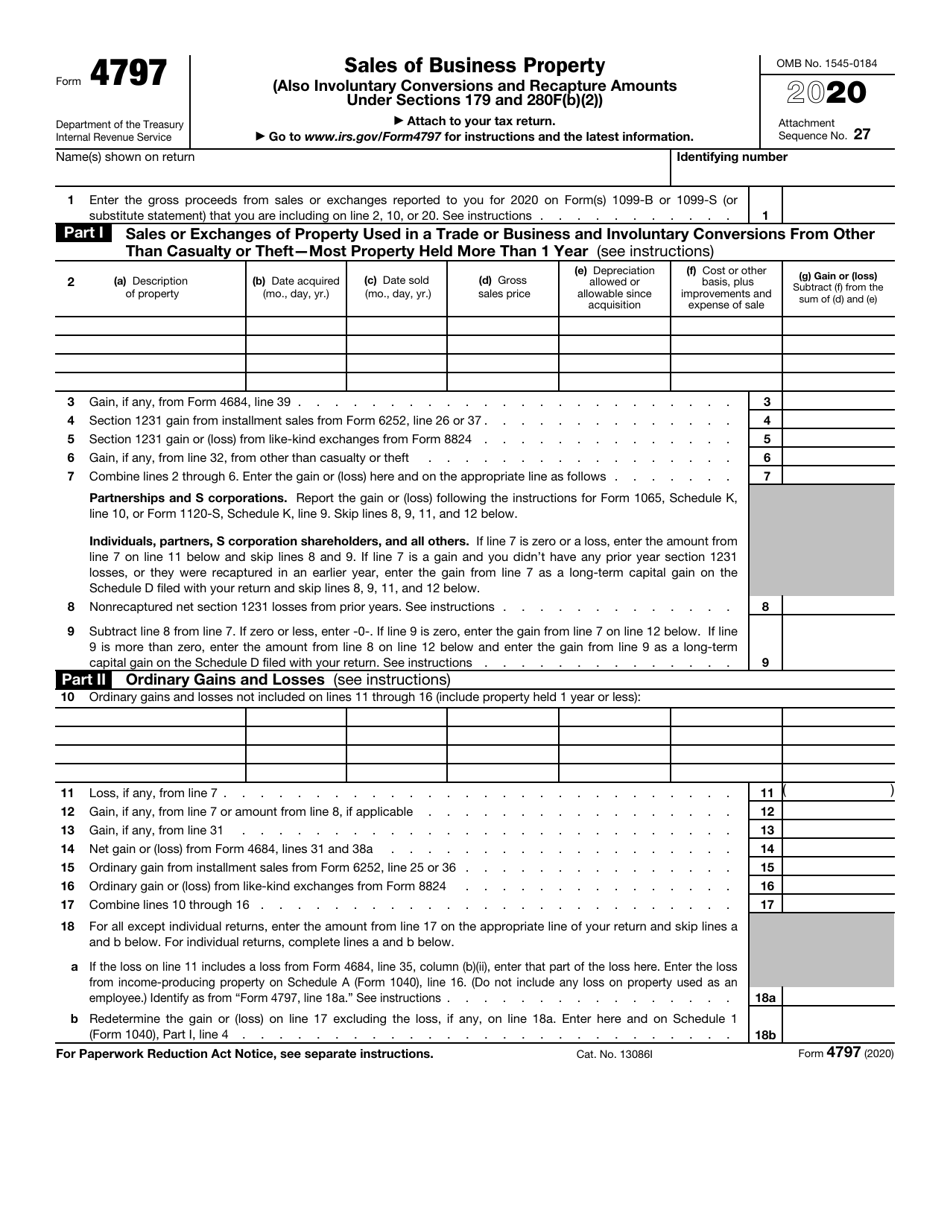

What Is Form 4797

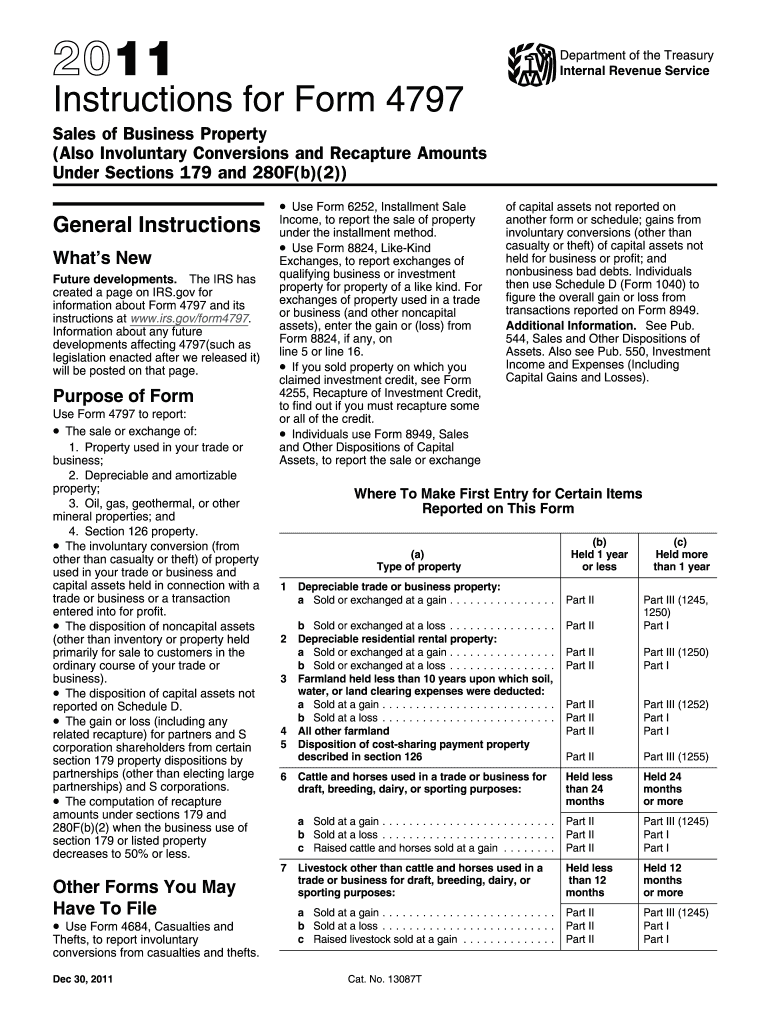

What Is Form 4797 - Web form 4797 is a tax form distributed by the internal revenue service (irs). Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources. Web put simply, irs form 4797 is a tax form that’s used specifically for reporting the gains or losses made from the sale or exchange of certain kinds of business property or assets. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. If line 7 is a gain and you didn’t have any prior year section Web if line 7 is zero or a loss, enter the amount from line 7 on line 11 below and skip lines 8 and 9. Form 4797 is used to report gains made from the sale or exchange of business property, including property used. This is different from property that was used in a business, which might be the case if you are utilizing an asset or property for personal and business use. Form 4797 is used when selling property that was used as a business.

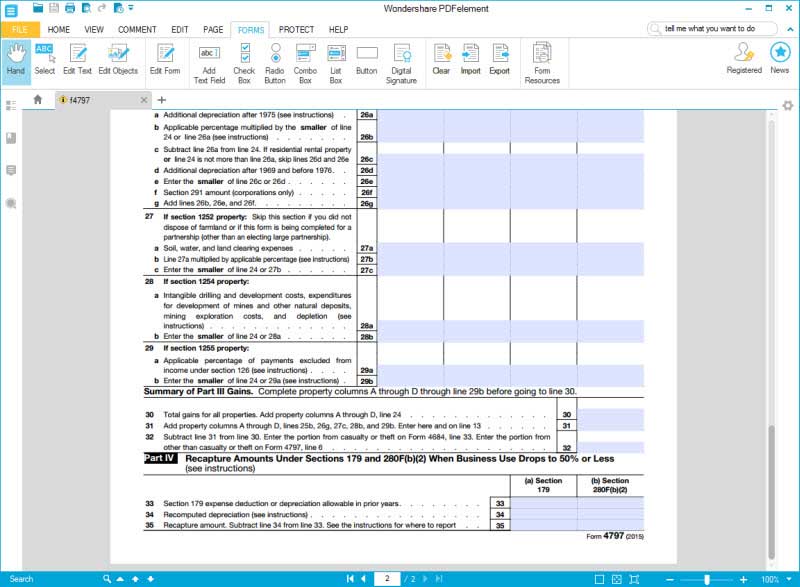

Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application. Web put simply, irs form 4797 is a tax form that’s used specifically for reporting the gains or losses made from the sale or exchange of certain kinds of business property or assets. Your best solution to fill out irs form 4797 Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. If line 7 is a gain and you didn’t have any prior year section See the instructions for lines 1b and 1c. Web form 4797 is a tax form distributed by the internal revenue service (irs). This might include any property used to generate rental income or even a house used as a business but could also extend to property used for agricultural, extractive, or industrial purposes. This is different from property that was used in a business, which might be the case if you are utilizing an asset or property for personal and business use. For example, your personal vehicle is used periodically for business trips.

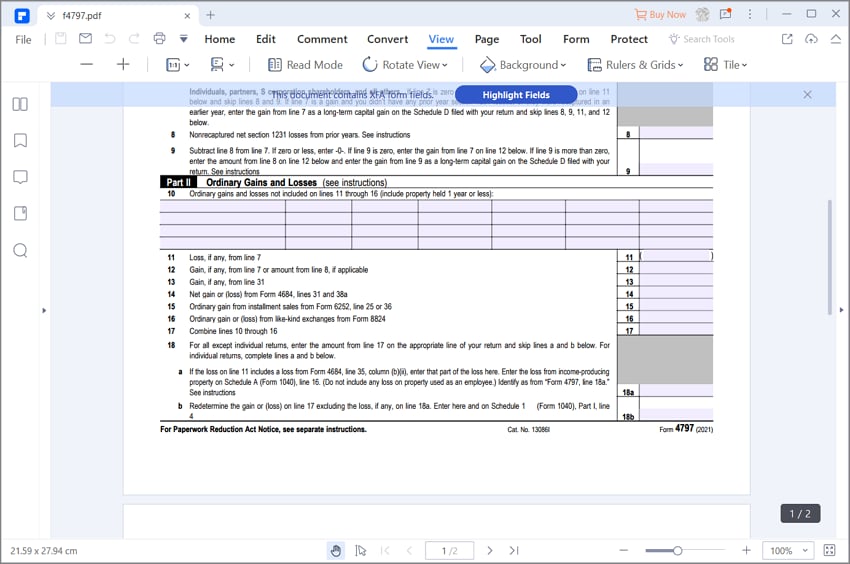

See the instructions for lines 1b and 1c. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web what is form 4797? For example, your personal vehicle is used periodically for business trips. If line 7 is a gain and you didn’t have any prior year section Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Form 4797 is used when selling property that was used as a business. Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application. Web if line 7 is zero or a loss, enter the amount from line 7 on line 11 below and skip lines 8 and 9. Nonrecapture net §1231 losses from prior years.

Ir's Form 4797 Instructions Fill Out and Sign Printable PDF Template

Your best solution to fill out irs form 4797 This might include any property used to generate rental income or even a house used as a business but could also extend to property used for agricultural, extractive, or industrial purposes. Form 4797 is used when selling property that was used as a business. Nonrecapture net §1231 losses from prior years..

Form 4797 Sales of Business Property Definition

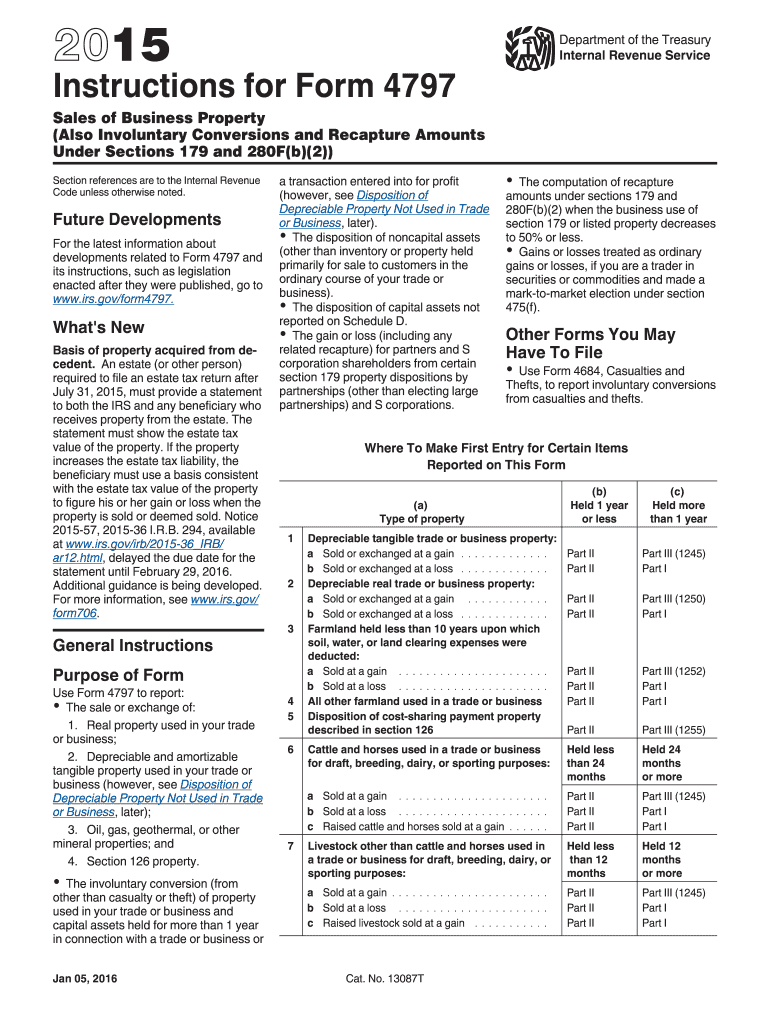

The irs form 4797 is used to report, real property used in your trade or business, depreciable and amortizable tangible property used in your trade or business and many other similar properties. Your best solution to fill out irs form 4797 Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. For.

IRS Form 4797 Download Fillable PDF or Fill Online Sales of Business

Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Web form 4797 is a tax form distributed by the internal revenue service (irs). Income from part iii, line 32. Form 4797 is used to report gains made from the sale or exchange of.

TURBOTAX InvestorVillage

If line 7 is a gain and you didn’t have any prior year section For example, your personal vehicle is used periodically for business trips. Form 4797 is used to report gains made from the sale or exchange of business property, including property used. Nonrecapture net §1231 losses from prior years. Web put simply, irs form 4797 is a tax.

Form 4797 Fill Out and Sign Printable PDF Template signNow

Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application. For example, your personal vehicle is used periodically for business trips. Web put simply, irs.

IRS Form 4797 Guide for How to Fill in IRS Form 4797

Income from part iii, line 32. Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application. This is different from property that was used in a business, which might be the case if you are utilizing an asset or property for personal and business use. Web form 4797 is a tax.

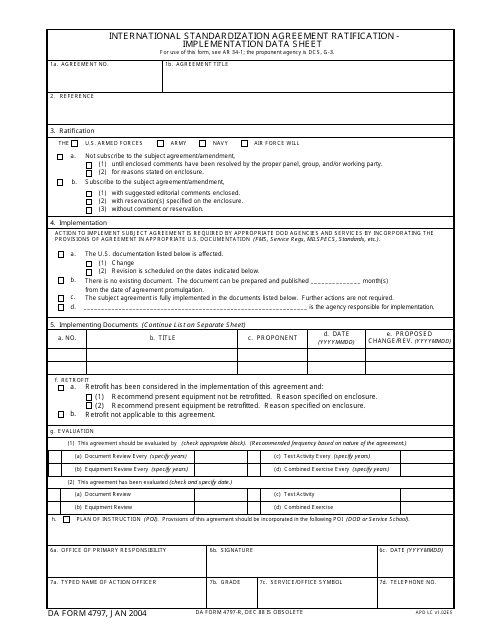

DA Form 4797 Download Fillable PDF, International Standardization

See the instructions for lines 1b and 1c. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Form 4797 is used to report gains made from the sale or exchange of business property, including property used. Web the irs form 4797 is a.

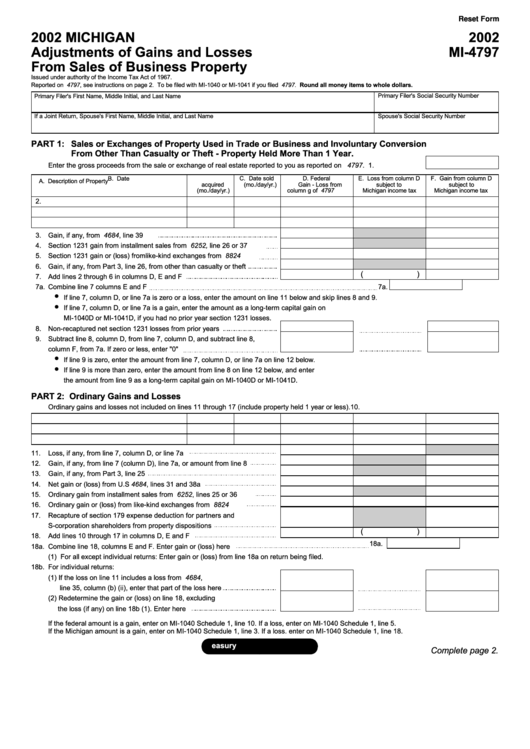

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

Your best solution to fill out irs form 4797 Web sale of a portion of a macrs asset. Form 4797 is used when selling property that was used as a business. Income from part iii, line 32. Web form 4797 is a tax form distributed by the internal revenue service (irs).

irs form 4797 Fill Online, Printable, Fillable Blank

Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. For example, your personal vehicle is used periodically for business trips. Web form 4797 is a tax form distributed by the internal revenue service (irs). If line 7 is a gain and you didn’t have any prior year section Web form 4797.

IRS Form 4797 Guide for How to Fill in IRS Form 4797

Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. This is different from property that was used in a business, which might be the case if you are utilizing an asset or property for personal and business use. See the instructions for lines.

Web Information About Form 4797, Sales Of Business Property, Including Recent Updates, Related Forms And Instructions On How To File.

Web put simply, irs form 4797 is a tax form that’s used specifically for reporting the gains or losses made from the sale or exchange of certain kinds of business property or assets. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Form 4797 is used to report gains made from the sale or exchange of business property, including property used. Involuntary conversion of a portion of a macrs asset other than from a casualty or theft.

Your Best Solution To Fill Out Irs Form 4797

Form 4797 is used when selling property that was used as a business. For example, your personal vehicle is used periodically for business trips. The irs form 4797 is used to report, real property used in your trade or business, depreciable and amortizable tangible property used in your trade or business and many other similar properties. Web the irs form 4797 is a pdf form which can be filled using a pdf form filler application.

This Is Different From Property That Was Used In A Business, Which Might Be The Case If You Are Utilizing An Asset Or Property For Personal And Business Use.

Web form 4797 is a tax form distributed by the internal revenue service (irs). Nonrecapture net §1231 losses from prior years. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web if line 7 is zero or a loss, enter the amount from line 7 on line 11 below and skip lines 8 and 9.

This Might Include Any Property Used To Generate Rental Income Or Even A House Used As A Business But Could Also Extend To Property Used For Agricultural, Extractive, Or Industrial Purposes.

Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources. Web sale of a portion of a macrs asset. If line 7 is a gain and you didn’t have any prior year section See the instructions for lines 1b and 1c.

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)