What Is Form 8858

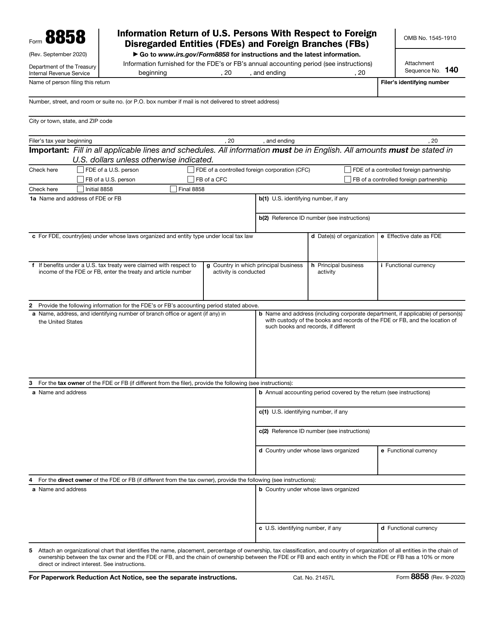

What Is Form 8858 - Web form 8858 is an information tax return submitted each year to the internal revenue service (irs) by qualifying u.s. Person that is a tax owner of an fde or operates an fb at any time during the u.s. Web what is form 8858? Web form 8858 is an informational tax form that’s purpose is to collect information and records on u.s. Taxpayer who owns a foreign business or an interest in a foreign business (corporation, partnership or. Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs), is one of a. However, instead of grades, this form is all about money. Web form 8858 filing requirements: Us taxes on foreign disregarded entities as an expat or u.s. Web form 8858 is due when your income tax return or information return is due, including extensions.

Turbotax premier online posted april 12, 2020 2:43 pm last updated april 12,. The four companies say they launched. Web form 8858 is a bit like a report card from the irs. Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. Web what is form 8858? Updates for owners and operators of foreign entities. Web form 8858 is an informational tax form that’s purpose is to collect information and records on u.s. The 8858 form is used by us persons who operate a foreign branch (fb) or own a foreign disregarded entity (fde). Ad download or email irs 8858 & more fillable forms, register and subscribe now! Us taxes on foreign disregarded entities as an expat or u.s.

Web what is form 8858? Persons with respect to foreign disregarded entities (fdes). Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs), is one of a. The four companies say they launched. Web what is form 8858? However, instead of grades, this form is all about money. Turbotax premier online posted april 12, 2020 2:43 pm last updated april 12,. Signnow allows users to edit, sign, fill and share all type of documents online. Taxpayer who owns a foreign business or an interest in a foreign business (corporation, partnership or. Web fdes or fbs, must file form 8858 and schedule m (form 8858).

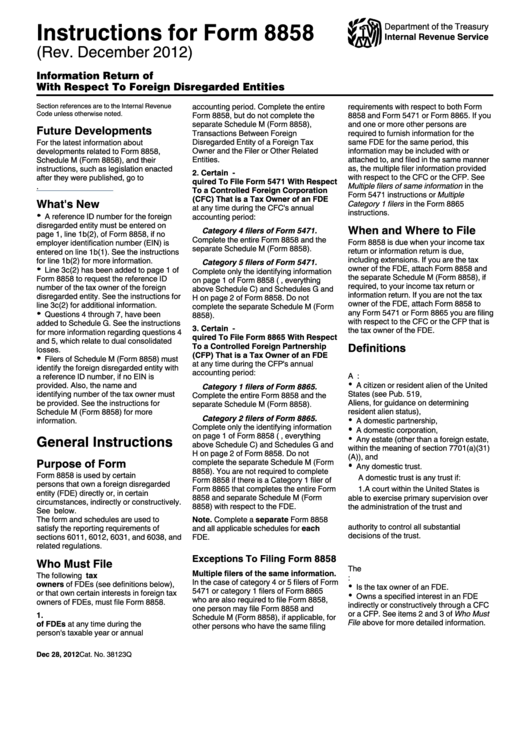

Instructions For Form 8858 Information Return Of U.s. Persons With

Web form 8858 filing requirements: Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs), is one of a. Web what is form 8858? Persons who own a foreign disregarded entity. Web what is form 8858?

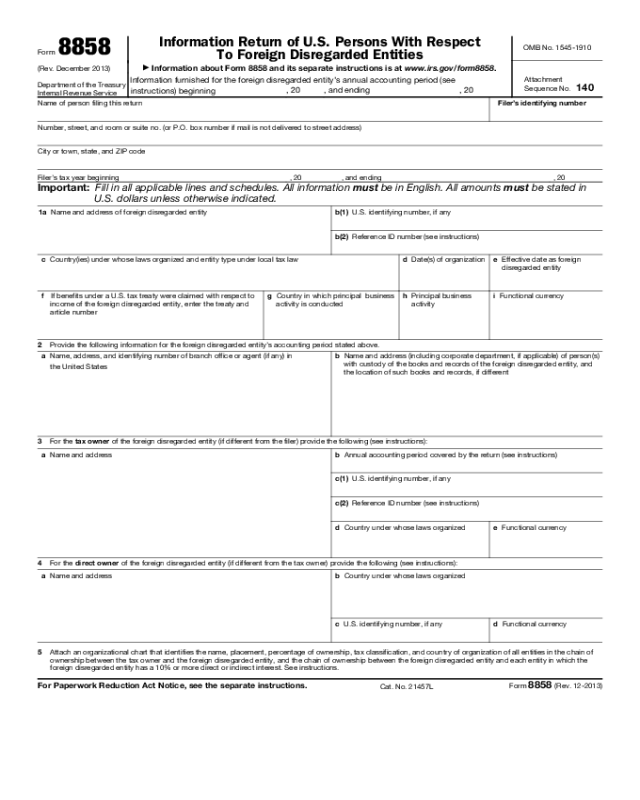

Form 8858 (Schedule M) Transactions between Foreign Disregarded

Signnow allows users to edit, sign, fill and share all type of documents online. The irs requires us taxpayers who are owners of foreign disregarded entities to file form 8858, information return of us persons with. Web anthropic, google, microsoft and openai team up to establish best practices but critics argue they want to avoid regulation. Persons with respect to.

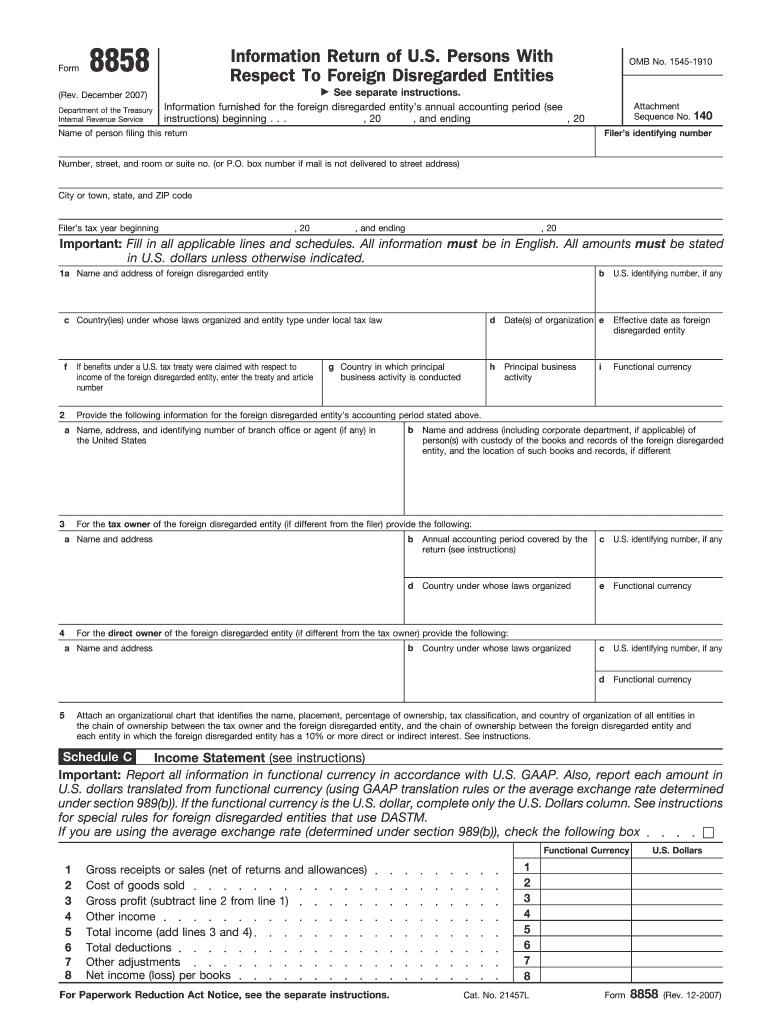

Form 8858 instructions 2010

Turbotax premier online posted april 12, 2020 2:43 pm last updated april 12,. Web what is form 8858? Updates for owners and operators of foreign entities. Web form 8858 filing requirements: Web what is form 8858?

Form 8858 instructions 2010

Should i file a form 8858 when i have a foreign rental property? Web fdes or fbs, must file form 8858 and schedule m (form 8858). Updates for owners and operators of foreign entities. Persons with respect to foreign disregarded entities. Web form 8858 is a bit like a report card from the irs.

Do I Need to File Form 8858 on My Expat Tax Return?

This form is less common than. Turbotax premier online posted april 12, 2020 2:43 pm last updated april 12,. Persons with respect to foreign disregarded. However, instead of grades, this form is all about money. Who’s required to fill out.

Form 8858 Edit, Fill, Sign Online Handypdf

Web what is form 8858? Form 8858 is a disclosure form for united states taxpayers who have formed a business entity outside of the u.s. Persons with respect to foreign disregarded entities. Ad download or email irs 8858 & more fillable forms, register and subscribe now! Web form 8858 is a bit like a report card from the irs.

Understanding Foreign Disregarded Entities & Form 8858

Web anthropic, google, microsoft and openai team up to establish best practices but critics argue they want to avoid regulation. If you are the tax owner of the fde or operate an fb, attach form 8858 and. In a significant change to previous us international tax reporting. Us taxes on foreign disregarded entities as an expat or u.s. Taxpayer who.

Form 8858 Practical Info On What You Need to Know

Web form 8858 is a bit like a report card from the irs. Web anthropic, google, microsoft and openai team up to establish best practices but critics argue they want to avoid regulation. Web what is form 8858? Persons with respect to foreign disregarded entities. In a significant change to previous us international tax reporting.

IRS Form 8858 Download Fillable PDF or Fill Online Information Return

Persons with respect to foreign disregarded entities (fdes). If you are the tax owner of the fde or operate an fb, attach form 8858 and. Persons with respect to foreign disregarded. Web what is form 8858? Should i file a form 8858 when i have a foreign rental property?

Form 8858 Fill Out and Sign Printable PDF Template signNow

Persons with respect to foreign disregarded entities. September 2021) department of the treasury internal revenue service. Persons with respect to foreign disregarded. Should i file a form 8858 when i have a foreign rental property? Web form 8858 is an information tax return submitted each year to the internal revenue service (irs) by qualifying u.s.

Taxpayer Who Owns A Foreign Business Or An Interest In A Foreign Business (Corporation, Partnership Or.

However, instead of grades, this form is all about money. Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs), is one of a. Persons with respect to foreign disregarded entities (fdes). Web form 8858 is a bit like a report card from the irs.

Web What Is The 8858 Form?

Web what is form 8858? Persons with respect to foreign disregarded entities. Person that is a tax owner of an fde or operates an fb at any time during the u.s. Web fdes or fbs, must file form 8858 and schedule m (form 8858).

Persons With Respect To Foreign Disregarded Entities (Fdes).

Should i file a form 8858 when i have a foreign rental property? Web form 8858 is due when your income tax return or information return is due, including extensions. Web anthropic, google, microsoft and openai team up to establish best practices but critics argue they want to avoid regulation. This form is less common than.

September 2021) Department Of The Treasury Internal Revenue Service.

Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. Form 8858 is a disclosure form for united states taxpayers who have formed a business entity outside of the u.s. Web what is form 8858? Persons who own a foreign disregarded entity.