What Is Form 8915

What Is Form 8915 - For example, one files form 3115 it one finds it more advantageous to begin to use the. Last year, taxpayers were permitted to. Solved•by intuit•594•updated january 17, 2023. The qualified 2020 disaster distributions for. Web a form that a company files with the irs to apply for a change in accounting method. Department of the treasury internal revenue service. Web 46 rows purpose of form. If that does not apply to. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. In prior tax years, form 8915.

Web 46 rows purpose of form. Department of the treasury internal revenue service. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Qualified 2020 disaster retirement plan distributions and repayments. If that does not apply to. For example, one files form 3115 it one finds it more advantageous to begin to use the. Solved•by intuit•594•updated january 17, 2023. Web generating form 8915 in proseries. The qualified 2020 disaster distributions for. You have a $35,000 excess repayment for 2022.

Solved•by intuit•594•updated january 17, 2023. Qualified 2020 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. Web a form that a company files with the irs to apply for a change in accounting method. Web generating form 8915 in proseries. You have a $35,000 excess repayment for 2022. Web updated january 13, 2023. For example, one files form 3115 it one finds it more advantageous to begin to use the. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Last year, taxpayers were permitted to.

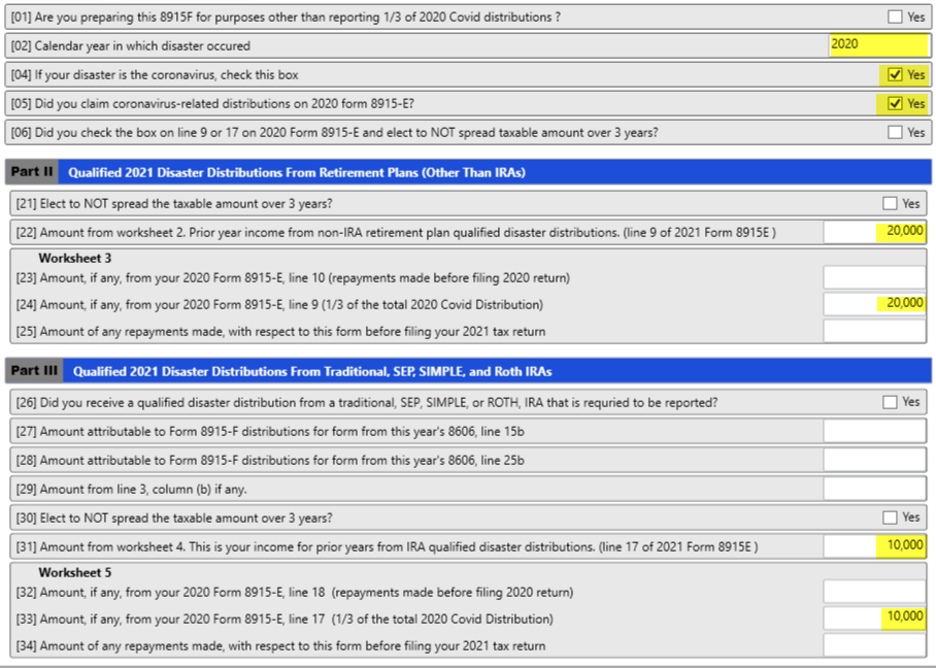

Basic 8915F Instructions for 2021 Taxware Systems

Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. If that does not apply to. In prior tax years, form 8915. Last year, taxpayers were permitted to. The qualified 2020 disaster distributions for.

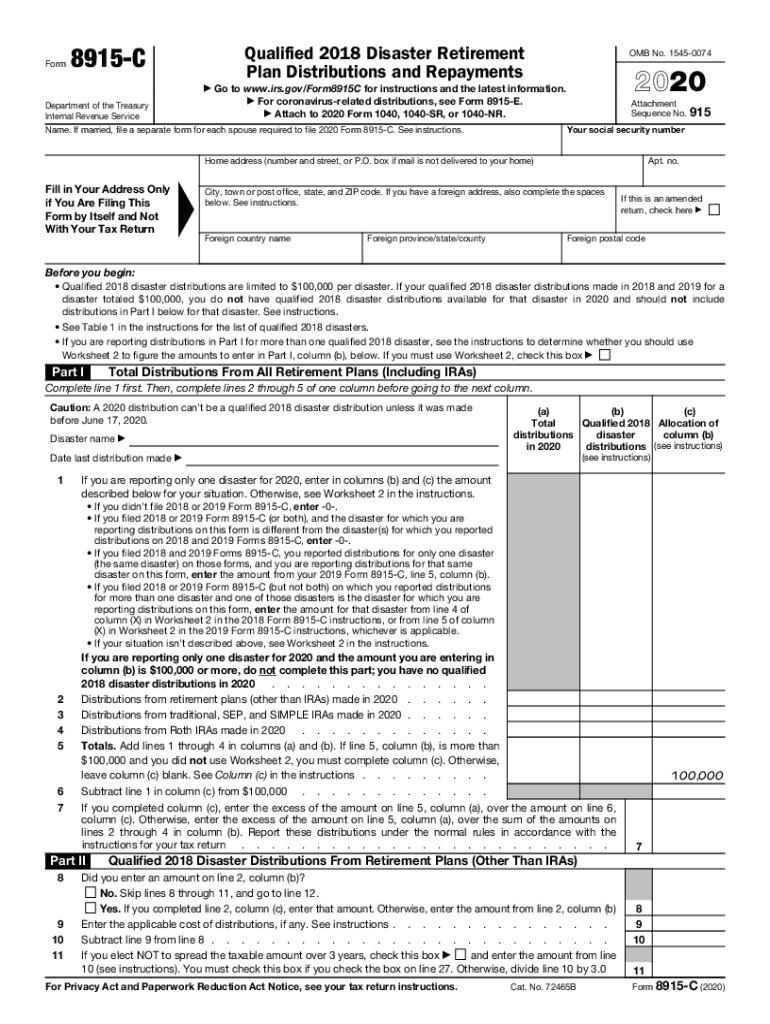

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

For example, one files form 3115 it one finds it more advantageous to begin to use the. In prior tax years, form 8915. You have a $35,000 excess repayment for 2022. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the..

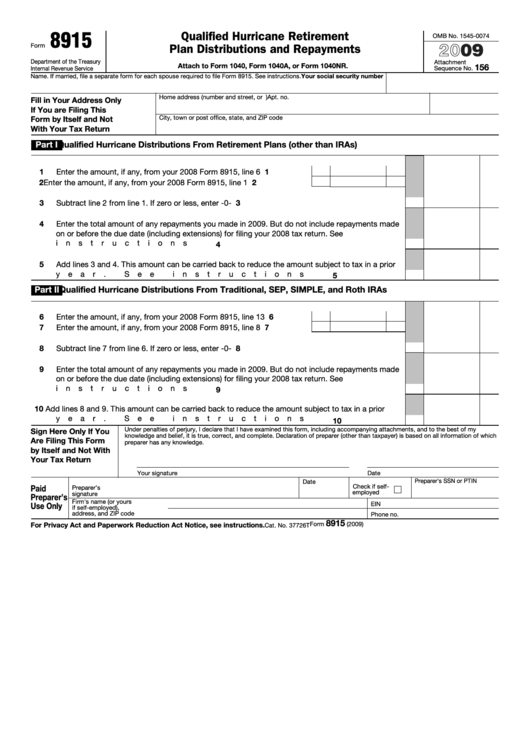

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Last year, taxpayers were permitted to. If that does not apply to. Web 46 rows purpose of form. Web updated january 13, 2023. Qualified 2020 disaster retirement plan distributions and repayments.

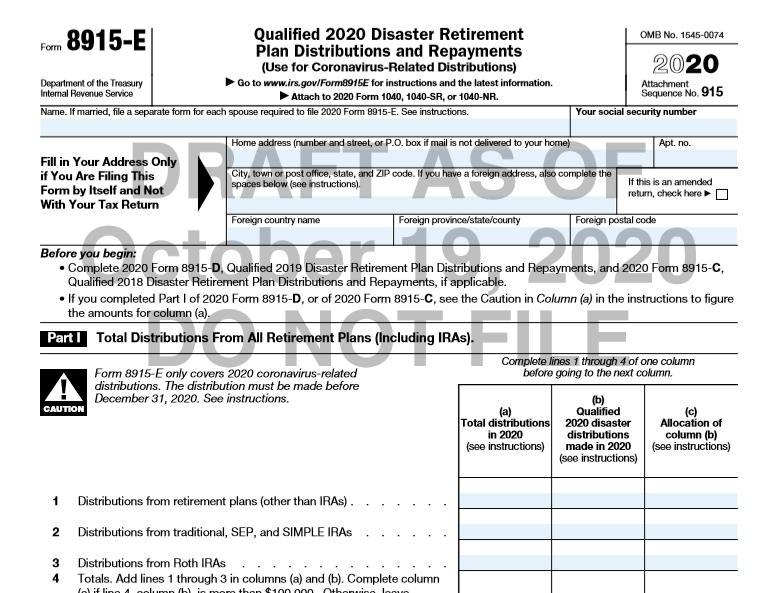

Fill Free fillable Form 8915E Plan Distributions and Repayments

You have a $35,000 excess repayment for 2022. Web updated january 13, 2023. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Web generating form 8915 in proseries. For example, one files form 3115 it one finds it more advantageous.

Use Form 8915E to report, repay COVIDrelated retirement account

For example, one files form 3115 it one finds it more advantageous to begin to use the. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Web a form that a company files with the irs to apply for a.

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

Web 46 rows purpose of form. Web generating form 8915 in proseries. Web updated january 13, 2023. Web a form that a company files with the irs to apply for a change in accounting method. You have a $35,000 excess repayment for 2022.

Tax Newsletter December 2020 Basics & Beyond

Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Web a form that a company files with the irs to apply for a change in accounting method. Web generating form 8915 in proseries. Solved•by intuit•594•updated january 17, 2023. The qualified.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

If that does not apply to. Last year, taxpayers were permitted to. The qualified 2020 disaster distributions for. Qualified 2020 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service.

Re When will form 8915E 2020 be available in tur... Page 19

The qualified 2020 disaster distributions for. Web 46 rows purpose of form. Web generating form 8915 in proseries. Solved•by intuit•594•updated january 17, 2023. In prior tax years, form 8915.

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

Solved•by intuit•594•updated january 17, 2023. You have a $35,000 excess repayment for 2022. The qualified 2020 disaster distributions for. For example, one files form 3115 it one finds it more advantageous to begin to use the. In prior tax years, form 8915.

You Have A $35,000 Excess Repayment For 2022.

Web a form that a company files with the irs to apply for a change in accounting method. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. If that does not apply to. Web 46 rows purpose of form.

Qualified 2020 Disaster Retirement Plan Distributions And Repayments.

The qualified 2020 disaster distributions for. In prior tax years, form 8915. For example, one files form 3115 it one finds it more advantageous to begin to use the. Solved•by intuit•594•updated january 17, 2023.

Department Of The Treasury Internal Revenue Service.

Web updated january 13, 2023. Web generating form 8915 in proseries. Last year, taxpayers were permitted to.