What Is The Difference In Chapter 7 11 13

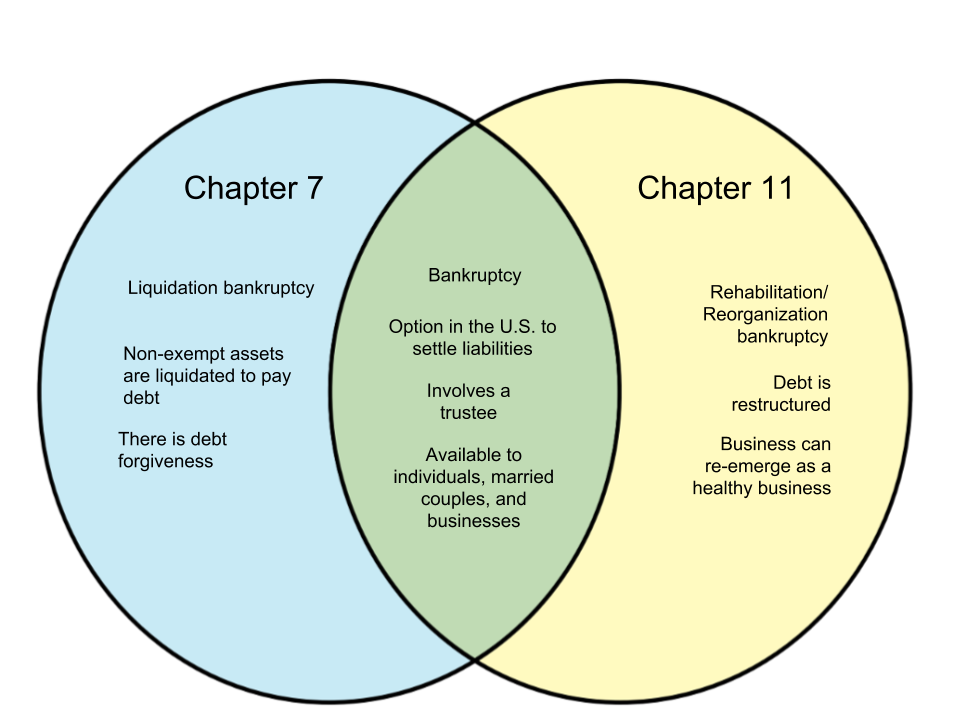

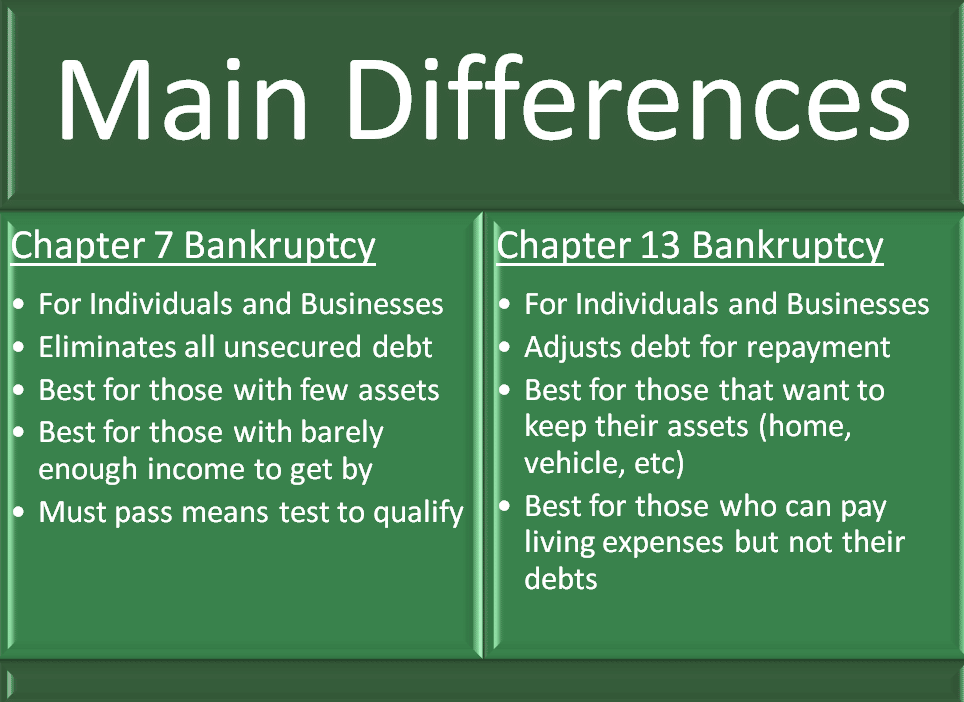

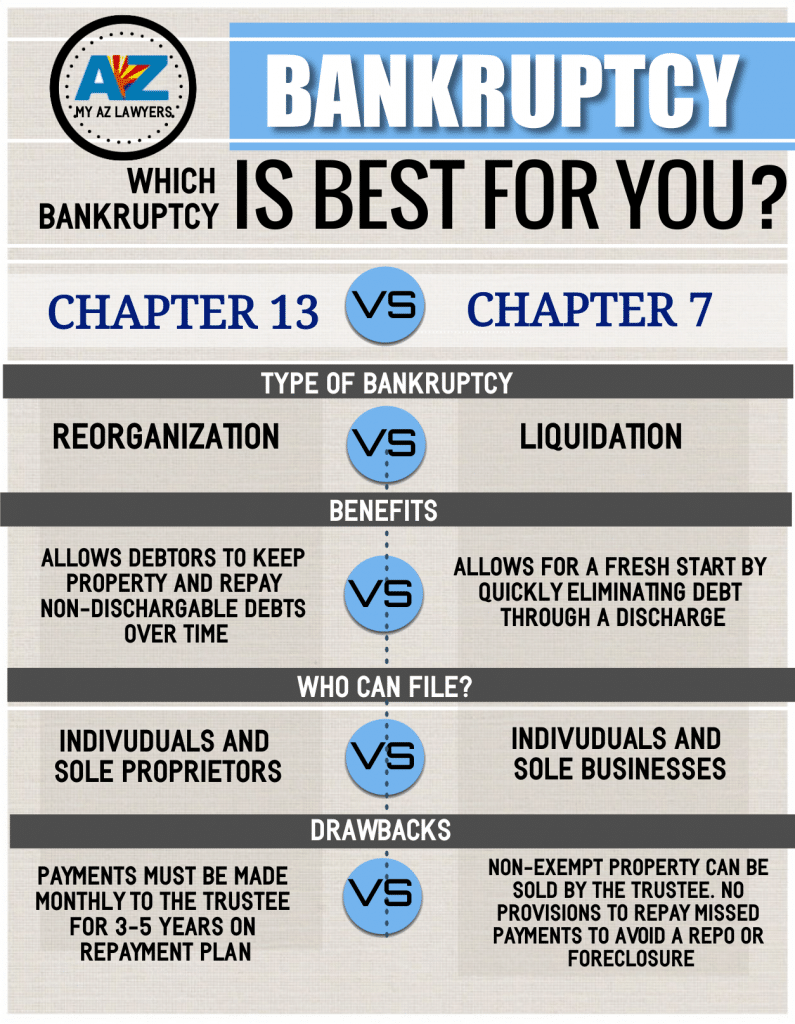

What Is The Difference In Chapter 7 11 13 - In contrast, chapter 13 is a debt restructuring option that can make it easier to manage your outstanding debts. Web chapter 7 is the type of bankruptcy that most people imagine when they think of bankruptcy: There are very few law firms that handle chapter 11. In mississippi, most consumer chapter 7 filings are what we call no asset cases because the debtor owns no. Chapter 7 bankruptcy is available to both businesses and individuals, while chapter 13. Web the key differences essentially amount to liquidation vs. Chapter 7 bankruptcy revolves around “liquidation”. Produced by michael simon johnson , rob szypko , asthaa chaturvedi and alex stern. Know the difference one involves liquidating assets, while the other reorganizes them by emily norris updated june 21, 2022 reviewed by. Chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an.

Those assets of a debtor that are not. Davis lin and michael benoist. Businesses or individuals are required to sell off their property so that they could repay their debts. Web a chapter 7 bankruptcy trustee can only liquidate nonexempt assets owned by the debtor. People in business or individuals can also seek relief in chapter 11.) chapter 13: Rarely businesses — sell their. This chapter of the u.s. Chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an. At the same time, chapter 13 does not provide the same level of debt relief like chapter 7. In mississippi, most consumer chapter 7 filings are what we call no asset cases because the debtor owns no.

Davis lin and michael benoist. Web budgeting & savings chapter 7 vs. Chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an. Web there are some notable differences between chapter 11 and chapter 13 bankruptcy, including eligibility, cost, and the amount of time required to complete the process. Businesses or individuals are required to sell off their property so that they could repay their debts. Web its principal chapters (7, 11, 12, 13 and 15) are briefly outlined below: Rarely businesses — sell their. Web chapter 7 requires you to sell property that isn’t exempt to pay off your debts. There are very few law firms that handle chapter 11. The chapter of the bankruptcy code providing for liquidation, ( i.e., the sale of a debtor's nonexempt property and the distribution of the proceeds to creditors.).

Personal Chapter 7 Bankruptcy versus Personal Chapter 13 Bankruptcy

Web what is the difference between chapters 7, 11, 12, & 13? Eastern time (it will be 6:04 p.m. Davis lin and michael benoist. Chapter 7 bankruptcy is available to both businesses and individuals, while chapter 13. Chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an.

Chapter 7 or Chapter 13 Bankruptcy What’s the Difference? Freedom

| western district of michigan | united states bankruptcy court. There are very few law firms that handle chapter 11. This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable.

The Differences Between Chapters 7, 11 and 13 Bankruptcy

However, a survey done by the american bankruptcy institute in 2018 showed that if you file exemption paperwork properly, 93% of. Davis lin and michael benoist. In contrast, chapter 13 is a debt restructuring option that can make it easier to manage your outstanding debts. A business may liquidate through the bankruptcy process by filing a petition under either chapter.

Chapter 7 vs Chapter 13 Bankruptcy [Infographic]

This chapter of the u.s. This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities. Web a chapter 7 bankruptcy trustee can only liquidate nonexempt assets owned by the debtor. Web its principal chapters (7, 11, 12, 13 and 15) are briefly outlined below: Web what is.

45+ Difference Between Chapter 7 And Chapter 11

Web the key differences essentially amount to liquidation vs. There are very few law firms that handle chapter 11. Highlights from liverpool’s win against newcastle in the premier league. Web a chapter 7 bankruptcy trustee can only liquidate nonexempt assets owned by the debtor. The lander is in an elliptical orbit of the moon.

Infographic Chapter 7 vs. Chapter 13 BankruptcyWeaver Bankruptcy Law Firm

At the same time, chapter 13 does not provide the same level of debt relief like chapter 7. In chapter 7 asset cases, the debtor's. However, a survey done by the american bankruptcy institute in 2018 showed that if you file exemption paperwork properly, 93% of. The lander is in an elliptical orbit of the moon. Often called the liquidation.

Chapter 13 Bankruptcy Avondale Bankruptcy Attorneys

A business may liquidate through the bankruptcy process by filing a petition under either chapter 7 or chapter 11. This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities. In contrast, chapter 13 is a debt restructuring option that can make it easier to manage your outstanding.

32+ How Does Bankruptcy Chapter 7 Work FaizulLawerence

If a chapter 7 bankruptcy is filed, corporations, partnerships, and llcs cannot use chapter 13 to reorganize and must cease business operations. Know the difference one involves liquidating assets, while the other reorganizes them by emily norris updated june 21, 2022 reviewed by. Web what is the difference between chapters 7, 11, 12, & 13? Web its principal chapters (7,.

Chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an. Chapter 7 bankruptcy revolves around “liquidation”. Web what is the difference between chapter 7, 11, 12 & 13 cases? Web chapter 7 is the type of bankruptcy that most people imagine when they think of bankruptcy: A business may liquidate through the.

Chapter 7, 11, & 13 Bankruptcy; What Are the Differences? Weiner Law

In chapter 7 asset cases, the debtor's. Chapter 7 bankruptcy is available to both businesses and individuals, while chapter 13. Highlights from liverpool’s win against newcastle in the premier league. The lander is in an elliptical orbit of the moon. This chapter of the u.s.

Web Chapter 11 Is The Chapter Usually Used By Large Businesses To Reorganize Their Debts And Continue To Stay Afloat While They Reorganize Their Debts.

Web the key differences essentially amount to liquidation vs. In contrast, chapter 13 is a debt restructuring option that can make it easier to manage your outstanding debts. Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. Know the difference one involves liquidating assets, while the other reorganizes them by emily norris updated june 21, 2022 reviewed by.

Often Called The Liquidation Chapter, Chapter 7 Is Used By Individuals, Partnerships, Or Corporations Who Are Unable To Repair Their Financial Situation.

This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities. Produced by michael simon johnson , rob szypko , asthaa chaturvedi and alex stern. Those assets of a debtor that are not. Web chapter 7 requires you to sell property that isn’t exempt to pay off your debts.

Eastern Time (It Will Be 6:04 P.m.

In mississippi, most consumer chapter 7 filings are what we call no asset cases because the debtor owns no. Web what is the difference between chapters 7, 11, 12, & 13? However, a survey done by the american bankruptcy institute in 2018 showed that if you file exemption paperwork properly, 93% of. Web its principal chapters (7, 11, 12, 13 and 15) are briefly outlined below:

A Reorganization And Restructuring Of Debt.

Web the critical difference is that chapter 7 revolves around the liquidation of assets to repay debts. Davis lin and michael benoist. People in business or individuals can also seek relief in chapter 11.) chapter 13: There are very few law firms that handle chapter 11.

![Chapter 7 vs Chapter 13 Bankruptcy [Infographic]](https://infographicjournal.com/wp-content/uploads/2020/07/Chapter-7-13-Comparison.jpg)