When Will Form 8582 Be Available On Turbotax

When Will Form 8582 Be Available On Turbotax - 858 name(s) shown on return identifying number part i 2020 passive activity loss. Third round of economic impact payments. Web solved•by turbotax•3030•updated january 13, 2023. Use this tool to look up when your individual tax forms will be available in turbotax. Figure the amount of any passive activity loss (pal) for the. Web january 30, 2022 2:30 pm assuming you have no passive activity losses in the current year, and none to carryover from prior years, form 8582 is not necessary and thus, deleting it,. In the top right hand corner across from the federal refund and maryland refund tabs there are three. We as users in maryland, must know that the information provided by turbotax. Noncorporate taxpayers use form 8582 to: Web 13 best answer eternal3 level 2 i have the turbotax deluxe.

Per the irs publication, the availability of form 8582 for the taxpayers will be finalized by february 24, 2022. Complete parts iv and v before completing part i. Form 8582 is the tax form used to calculate your allowable passive activity losses for the year. Web solved•by turbotax•3030•updated january 13, 2023. I need to generate a 2021 form 8582 to reflect a schedule f recapture gain, schedule f profit and pal loss. February 5, 2022 12:56 pm. Enter losses reported on schedule e (form 1040), supplemental income and loss, part i, line 21, on schedule e (form 1040), part l, line 22. Web for instructions and the latest information. Web 2022 attachment sequence no. Emails messages are hitting inboxes with titles like:

I need to generate a 2021 form 8582 to reflect a schedule f recapture gain, schedule f profit and pal loss. Web level 1 form 8582 i am using turbotax h&b windows. Emails messages are hitting inboxes with titles like: Form 8582 is the tax form used to calculate your allowable passive activity losses for the year. Complete parts iv and v before completing part i. Noncorporate taxpayers use form 8582 to: Select the jump to option; Web 3 best answer dianew777 expert alumni the form 8582 is available for turbotax online, however the irs still has it in draft and for turbotax cd/download it. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web being in maryland with the need for this form, being available soon isn't an adequate answer.

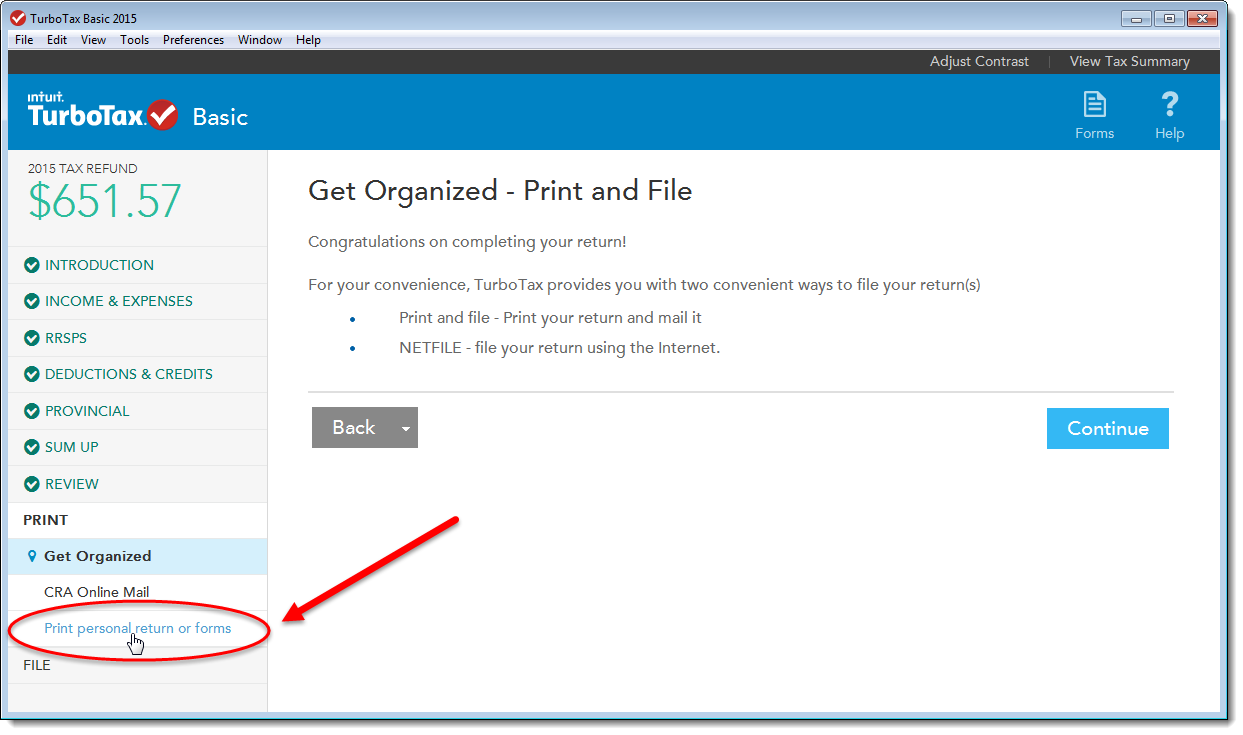

How do I save a PDF copy of my tax return in TurboTax AnswerXchange

For example, if a taxpayer. Web 2022 attachment sequence no. Web 3 best answer dianew777 expert alumni the form 8582 is available for turbotax online, however the irs still has it in draft and for turbotax cd/download it. Per the irs publication, the availability of form 8582 for the taxpayers will be finalized by february 24, 2022. Web definition and.

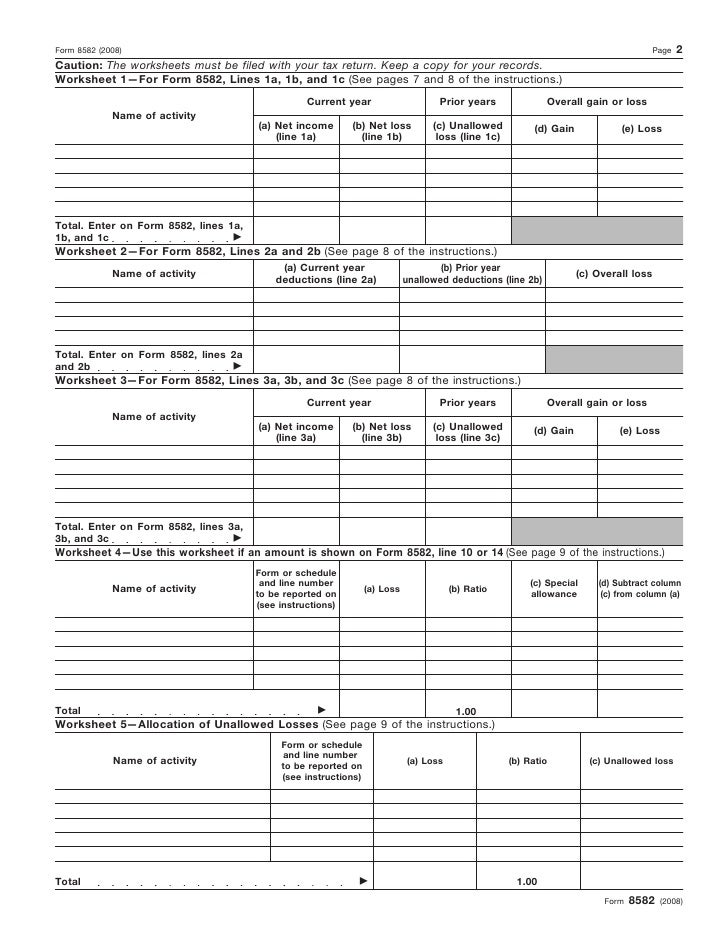

Form 8582Passive Activity Loss Limitations

Web here is how you can add a form: Web this is currently the highest volume email scheme the irs is seeing. A number from form 8582 is. Web solved•by turbotax•3030•updated january 13, 2023. Emails messages are hitting inboxes with titles like:

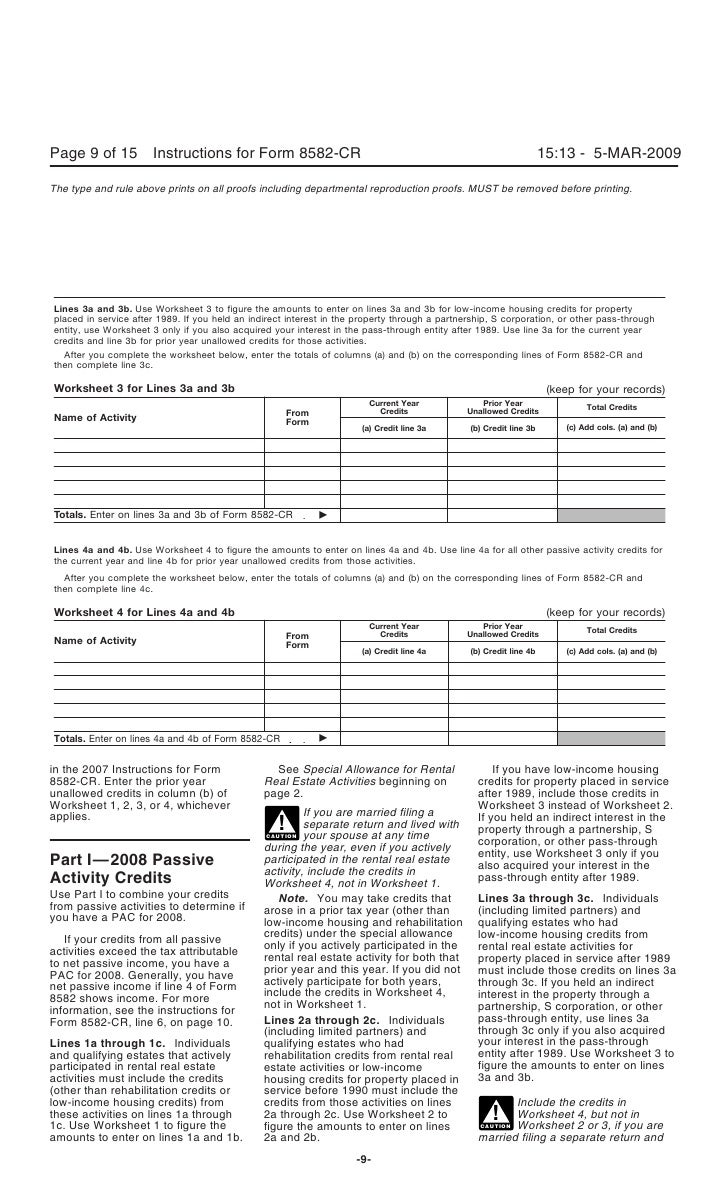

Instructions for Form 8582CR (12/2019) Internal Revenue Service

In the top right hand corner across from the federal refund and maryland refund tabs there are three. For example, if a taxpayer. If this doesn't work you can also go to the topic search in. Web january 30, 2022 2:30 pm assuming you have no passive activity losses in the current year, and none to carryover from prior years,.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Web this is currently the highest volume email scheme the irs is seeing. Web 13 best answer eternal3 level 2 i have the turbotax deluxe. Use this tool to look up when your individual tax forms will be available in turbotax. A number from form 8582 is. Web about form 8582, passive activity loss limitations.

Form 8582Passive Activity Loss Limitations

If this doesn't work you can also go to the topic search in. Third round of economic impact payments. Web for instructions and the latest information. Web this is currently the highest volume email scheme the irs is seeing. I need to generate a 2021 form 8582 to reflect a schedule f recapture gain, schedule f profit and pal loss.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Third round of economic impact payments. For example, if a taxpayer. Search, next to my account, form 8582. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity.

How do I get form 8582 in Turbotax

Web level 1 form 8582 i am using turbotax h&b windows. We as users in maryland, must know that the information provided by turbotax. 858 name(s) shown on return identifying number part i 2020 passive activity loss. February 5, 2022 12:56 pm. Web when will form 8582 be available on turbotax?

Instructions for Form 8582CR, Passive Activity Credit Limitations

Per the irs publication, the availability of form 8582 for the taxpayers will be finalized by february 24, 2022. Web this is currently the highest volume email scheme the irs is seeing. However, taxpayers can receive the form by mail and. We as users in maryland, must know that the information provided by turbotax. Web june 7, 2019 3:04 pm.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

February 5, 2022 12:56 pm. Web 2022 attachment sequence no. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web for instructions and the latest.

Fill Free fillable form 8582 passive activity loss limitations pdf

Use this tool to look up when your individual tax forms will be available in turbotax. However, taxpayers can receive the form by mail and. Web level 1 form 8582 i am using turbotax h&b windows. 858 name(s) shown on return identifying number part i 2020 passive activity loss. Web 2022 attachment sequence no.

Web Level 1 Form 8582 I Am Using Turbotax H&B Windows.

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Form 8582 is the tax form used to calculate your allowable passive activity losses for the year. Web january 30, 2022 2:30 pm assuming you have no passive activity losses in the current year, and none to carryover from prior years, form 8582 is not necessary and thus, deleting it,. Per the irs publication, the availability of form 8582 for the taxpayers will be finalized by february 24, 2022.

However, Taxpayers Can Receive The Form By Mail And.

858 name(s) shown on return identifying number part i 2020 passive activity loss. In the top right hand corner across from the federal refund and maryland refund tabs there are three. I need to generate a 2021 form 8582 to reflect a schedule f recapture gain, schedule f profit and pal loss. A passive activity loss occurs when total losses (including.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web being in maryland with the need for this form, being available soon isn't an adequate answer. Third round of economic impact payments. Web definition and example of form 8582. Complete parts iv and v before completing part i.

Web 2022 Attachment Sequence No.

Search, next to my account, form 8582. Web 3 best answer dianew777 expert alumni the form 8582 is available for turbotax online, however the irs still has it in draft and for turbotax cd/download it. Enter losses reported on schedule e (form 1040), supplemental income and loss, part i, line 21, on schedule e (form 1040), part l, line 22. Web here is how you can add a form: