Where Do I Mail Form 1310 To The Irs

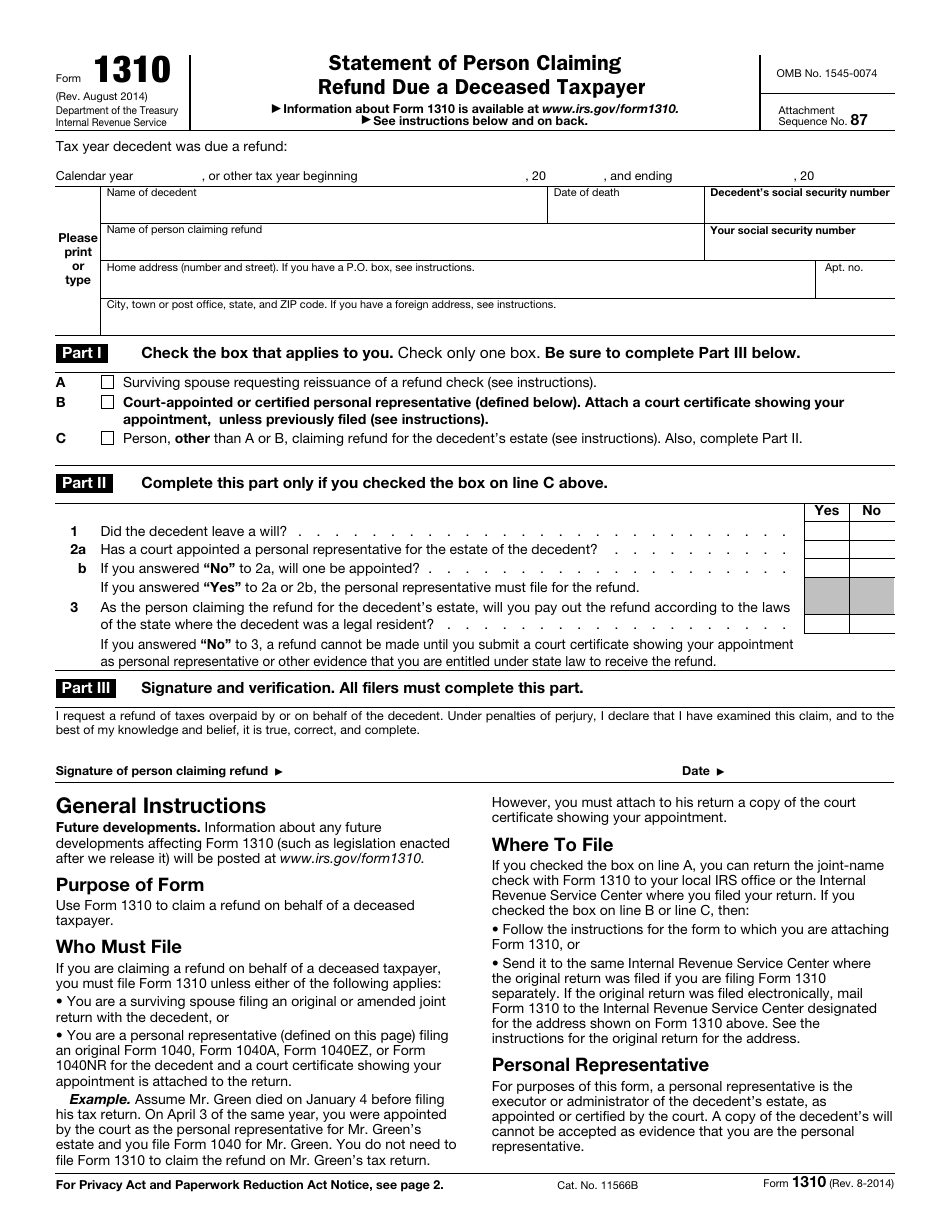

Where Do I Mail Form 1310 To The Irs - Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Also, find mailing addresses for other returns, including corporation,. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web the irs has set specific electronic filing guidelines for form 1310. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. If the taxpayer's ssn was not locked yet and. Now, a new letter purporting to be from the. Web up to $40 cash back do whatever you want with a form 1310 (rev. Web expert alumni i am sorry for your loss.

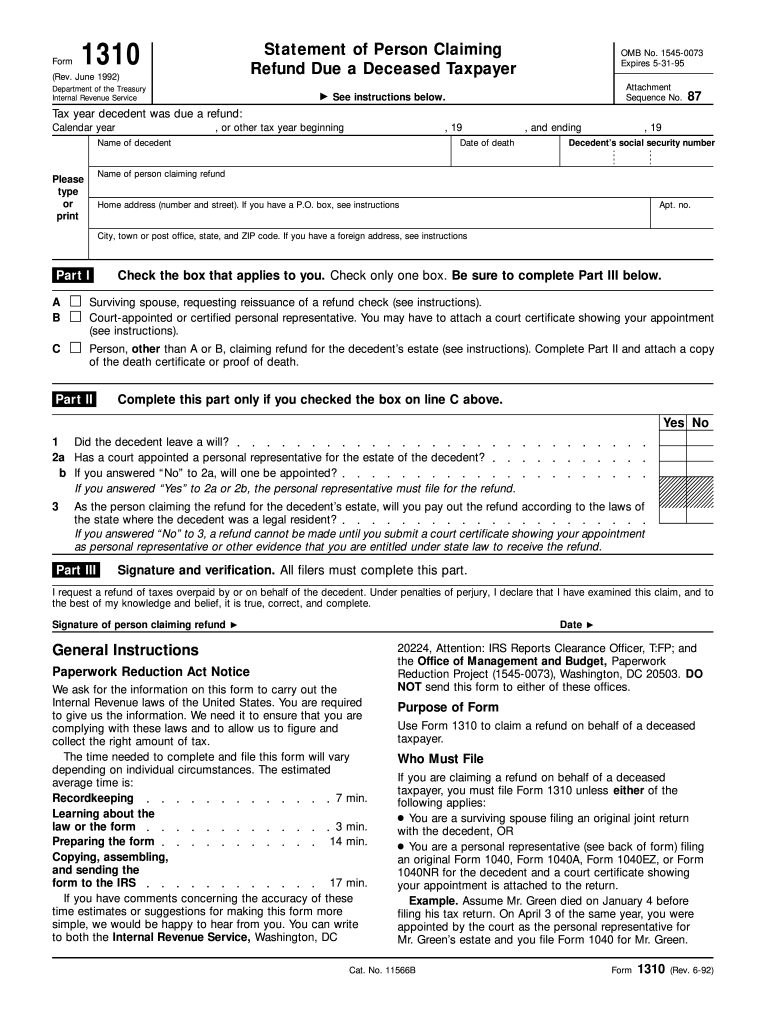

Calendar year , or other tax year beginning , 19 , and ending , 19 part i. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Web 1 day agofor years, the irs has warned about scammers using phone calls, text messages, emails and even social media. If the original return was filed electronically, mail. Web search by state and form number the mailing address to file paper individual tax returns and payments. Web where do i mail form 1310? Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Read the blog to know about the form. Web up to $40 cash back do whatever you want with a form 1310 (rev. Web the irs has set specific electronic filing guidelines for form 1310.

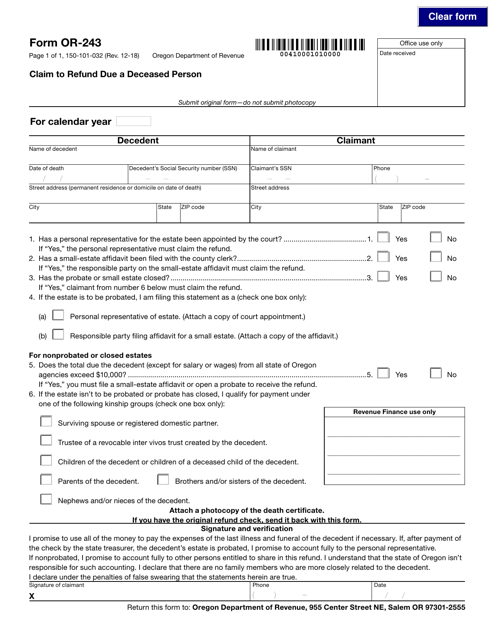

You can prepare the form and then mail it in to the same irs service center as the decedent's. Person, other than a or b, claiming a refund for the decedent’s estate. Read the blog to know about the form. Web 1 day agofor years, the irs has warned about scammers using phone calls, text messages, emails and even social media. Web up to $40 cash back do whatever you want with a form 1310 (rev. December 2021) department of the treasury internal revenue service go omb no. Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and error. If you aren’t the surviving. Also, complete part ii and mail it to irs with.

IRS Form 1310 How to Fill it Right

Web expert alumni i am sorry for your loss. Read the blog to know about the form. Web search by state and form number the mailing address to file paper individual tax returns and payments. Web send it to the same internal revenue service center where the original return was filed if you are filing form 1310 separately. Web 1310.

IRS Form 1310 Claiming a Refund for a Deceased Person YouTube

You can prepare the form and then mail it in to the same irs service center as the decedent's. Web where do i mail form 1310? Web search by state and form number the mailing address to file paper individual tax returns and payments. Web click on c in part i of form 1310 where it asks. Web the irs.

Irs Form 1310 Printable Master of Documents

Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: Web do you want to fill out irs form 1310 to claim the federal tax refund on the behalf of a deceased family member? Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

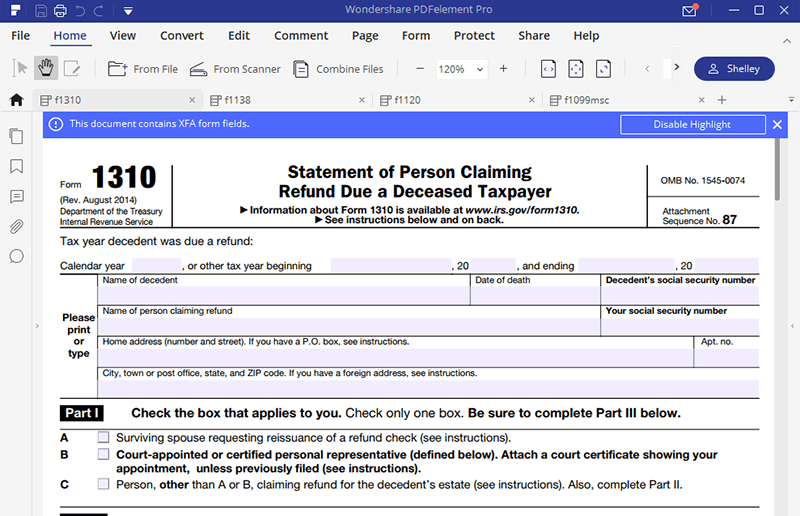

If the original return was filed electronically, mail. Securely download your document with other editable. Read the blog to know about the form. If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and error. Web send it to the same internal revenue service center where the original return was filed.

If IRS Letter arrives in the mail? WXC Corporation

Web up to $40 cash back do whatever you want with a form 1310 (rev. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web where do i mail form 1310? If the taxpayer's ssn was not locked yet.

Where Do I Mail Medicare Form Cms 1763 Form Resume Examples G28BAjpr3g

Web the irs has set specific electronic filing guidelines for form 1310. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: Securely download your document with other editable. Now, a new letter purporting to be from the.

Form 1310 Definition

If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Also, complete part ii and mail it to irs.

IRS Form 1310 Download Fillable PDF or Fill Online Statement of Person

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web search by state and form number the mailing address to file paper individual tax returns and payments. Web click on c in part i of form 1310 where it.

Manage Documents Using Our Document Editor For IRS Form 1310

Web expert alumni i am sorry for your loss. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: You can.

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Securely download your document with other editable. December 2021) department of the treasury internal revenue service go omb no. Web if a refund is due to the decedent, it may.

December 2021) Department Of The Treasury Internal Revenue Service Go Omb No.

Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: Calendar year , or other tax year beginning , 19 , and ending , 19 part i. If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web where do i mail form 1310?

You Can Prepare The Form And Then Mail It In To The Same Irs Service Center As The Decedent's.

Person, other than a or b, claiming a refund for the decedent’s estate. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web search by state and form number the mailing address to file paper individual tax returns and payments. Read the blog to know about the form.

Fill, Sign, Print And Send Online Instantly.

Web send it to the same internal revenue service center where the original return was filed if you are filing form 1310 separately. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. Web up to $40 cash back do whatever you want with a form 1310 (rev. If the taxpayer's ssn was not locked yet and.

Securely Download Your Document With Other Editable.

Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Web the irs has set specific electronic filing guidelines for form 1310. Also, complete part ii and mail it to irs with. Web do you want to fill out irs form 1310 to claim the federal tax refund on the behalf of a deceased family member?

:max_bytes(150000):strip_icc()/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)