Where Do I Send My W-4V Form For Social Security

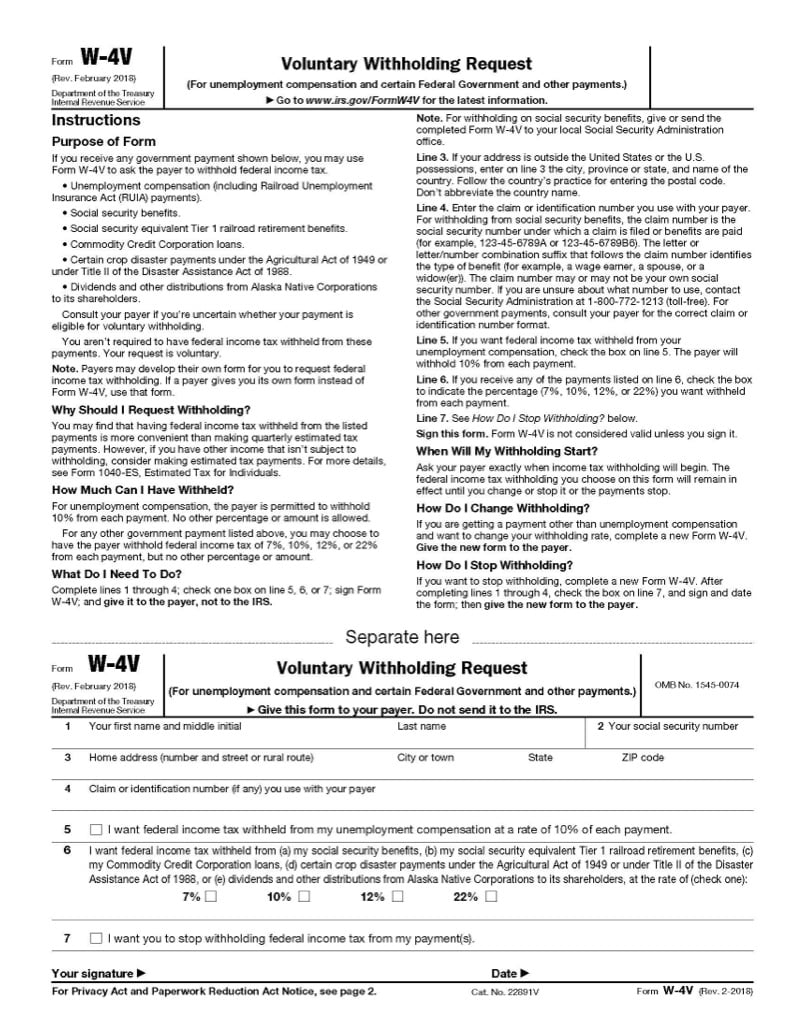

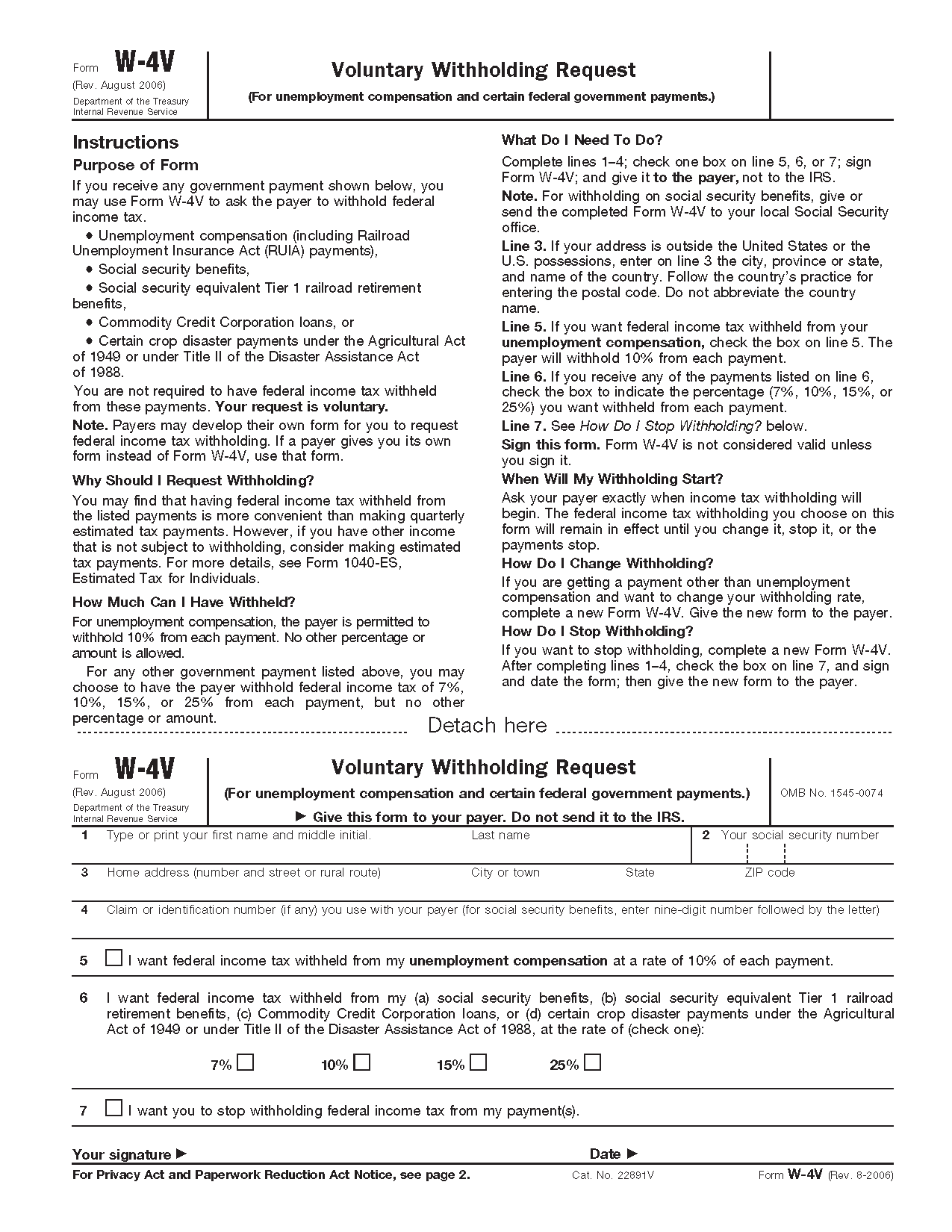

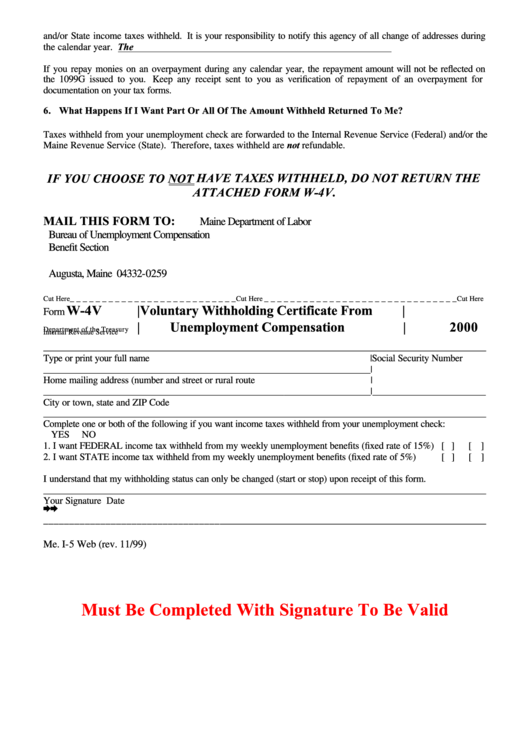

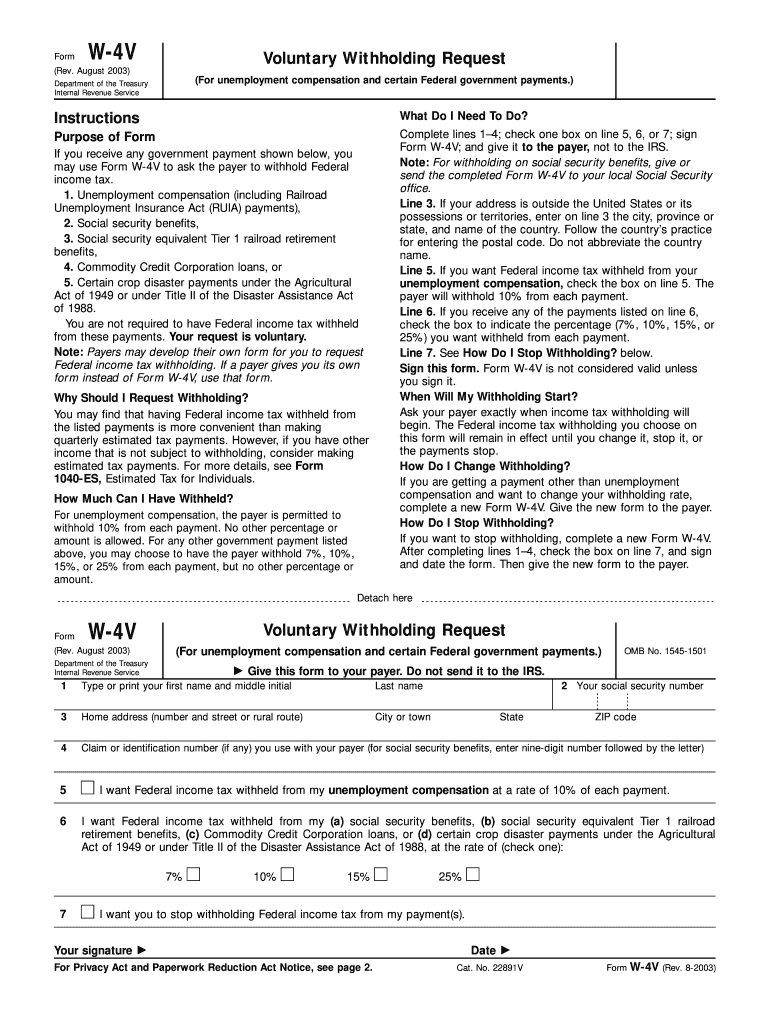

Where Do I Send My W-4V Form For Social Security - If you receive any government payment shown below, you may use this form to ask the payer to withhold. For line 3, if you live outside the u.s., add the city, state or. In order to have taxes withheld from your social security benefit, you must start by printing, completing and submitting an irs voluntary withholding. You can find the address of your local. Complete, sign and mail the form to your local social security office. Please do not send applications or documents needed to request a social security number or benefits to this address. Web complete lines 1 through 4; If your address is outside the united states or. Department of the treasury internal revenue service 'give this. And give it to the payer, not to the irs.

If your address is outside the. Please do not send applications or documents needed to request a social security number or benefits to this address. Complete, sign and mail the form to your local social security office. For line 3, if you live outside the u.s., add the city, state or. If your address is outside the. If you receive any government payment shown below, you may use this form to ask the payer to withhold. In order to have taxes withheld from your social security benefit, you must start by printing, completing and submitting an irs voluntary withholding. For line 3, if you live outside the u.s., add the city, state. Department of the treasury internal revenue service 'give this. Check one box on line 5, 6, or 7;

For withholding on social security benefits, give or send. Department of the treasury internal revenue service 'give this. If your address is outside the. For line 3, if you live outside the u.s., add the city, state. Web complete lines 1 through 4; In order to have taxes withheld from your social security benefit, you must start by printing, completing and submitting an irs voluntary withholding. You can find the address of your local. Complete, sign and mail the form to your local social security office. Check one box on line 5, 6, or 7; And give it to the payer, not to the irs.

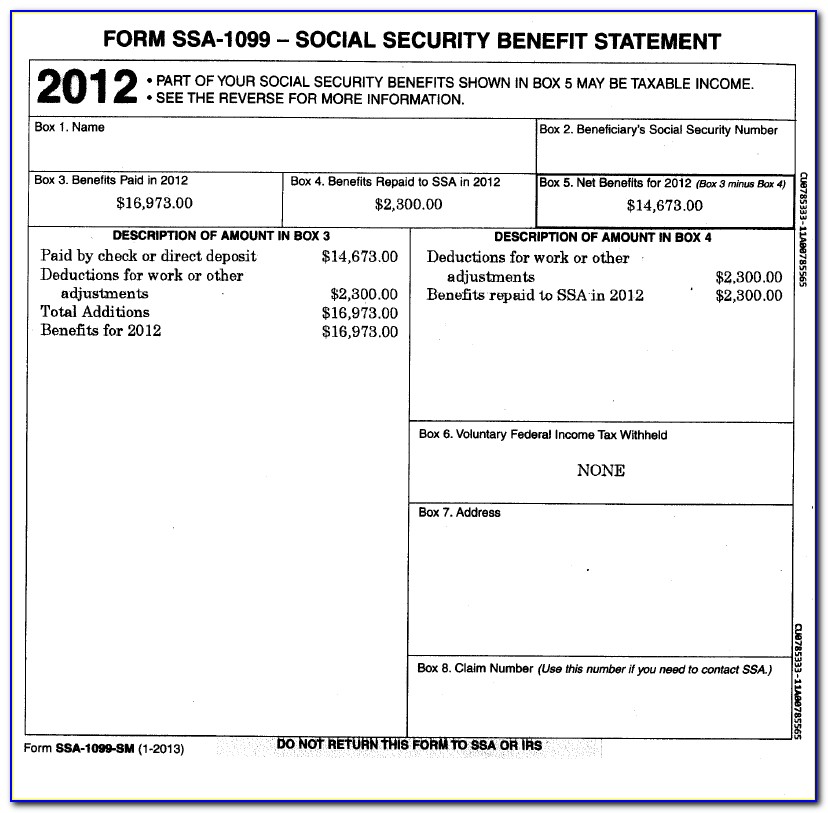

Social Security Benefits Form W 4v Form Resume Examples 12O8MYBkr8

If your address is outside the. Web complete lines 1 through 4; If you receive any government payment shown below, you may use this form to ask the payer to withhold. You can find the address of your local. Please do not send applications or documents needed to request a social security number or benefits to this address.

Form W4V IRS Tax Forms Jackson Hewitt

Department of the treasury internal revenue service 'give this. In order to have taxes withheld from your social security benefit, you must start by printing, completing and submitting an irs voluntary withholding. For withholding on social security benefits, give or send. For line 3, if you live outside the u.s., add the city, state or. If you receive any government.

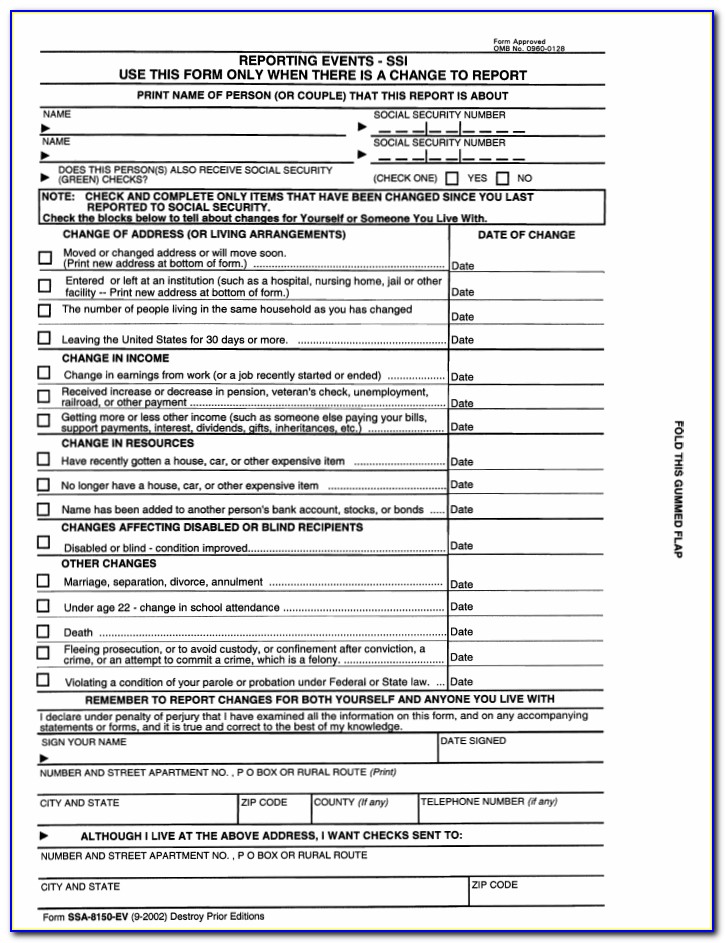

Social Security Form Ssa 521 Form Resume Examples bX5anK8OwW

If your address is outside the united states or. For line 3, if you live outside the u.s., add the city, state. Department of the treasury internal revenue service 'give this. If your address is outside the. You can find the address of your local.

Social Security Medicare Form Cms 1763 Form Resume Examples wRYPwQW394

Department of the treasury internal revenue service 'give this. Please do not send applications or documents needed to request a social security number or benefits to this address. Web complete lines 1 through 4; If your address is outside the. Complete, sign and mail the form to your local social security office.

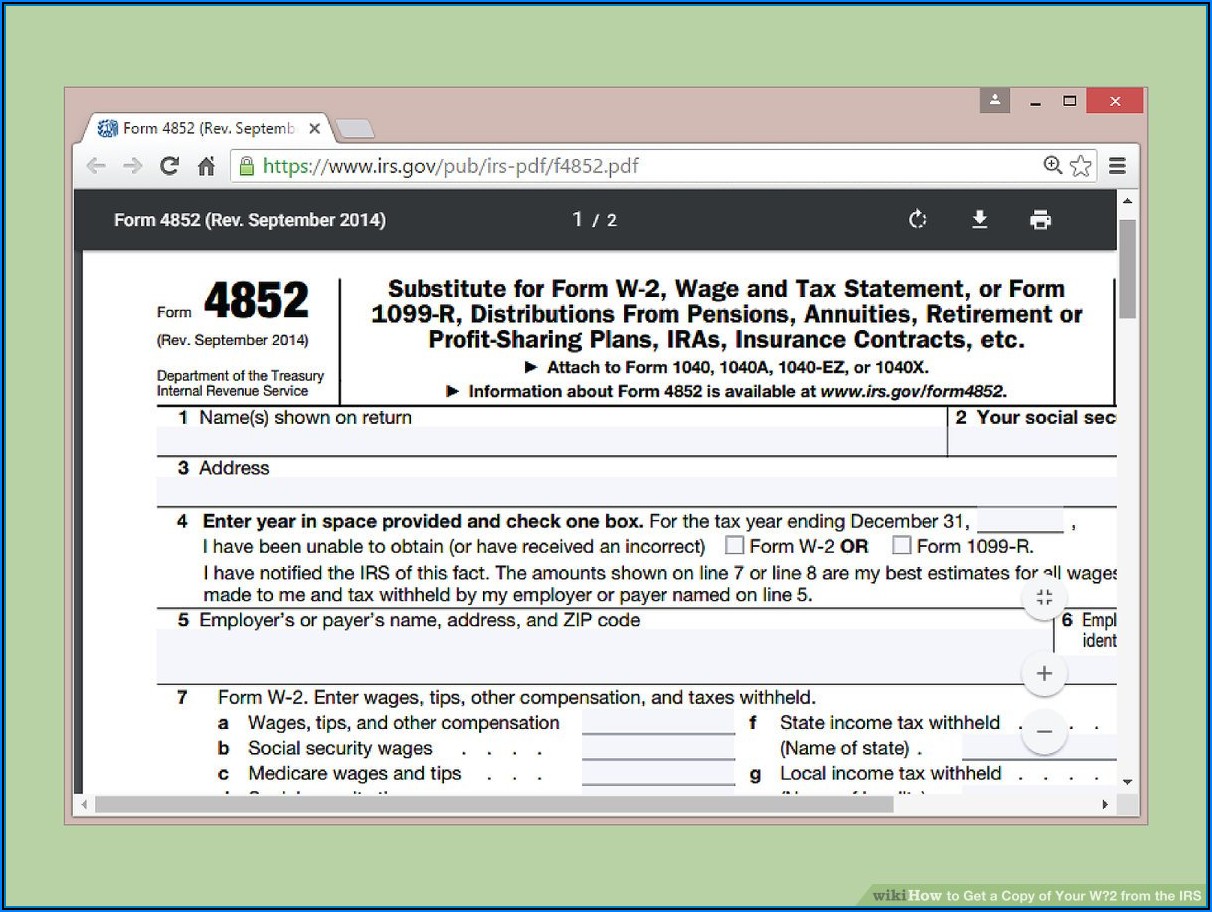

Taxes From A To Z 2020 V Is For Voluntary Withholding Taxgirl · Tax

Check one box on line 5, 6, or 7; If you receive any government payment shown below, you may use this form to ask the payer to withhold. If your address is outside the united states or. You can find the address of your local. Web complete lines 1 through 4;

Form W 4v 20202022 Fill and Sign Printable Template Online US

For line 3, if you live outside the u.s., add the city, state. You can find the address of your local. For withholding on social security benefits, give or send. If your address is outside the united states or. Department of the treasury internal revenue service 'give this.

W 4V Form SSA Printable 2022 W4 Form

Web complete lines 1 through 4; If your address is outside the united states or. Complete, sign and mail the form to your local social security office. Please do not send applications or documents needed to request a social security number or benefits to this address. And give it to the payer, not to the irs.

Irs Form W4V Printable Irs Form W4V Printable Ssa 21 2018 Fill

Department of the treasury internal revenue service 'give this. You can find the address of your local. For line 3, if you live outside the u.s., add the city, state or. Please do not send applications or documents needed to request a social security number or benefits to this address. And give it to the payer, not to the irs.

Form W4v Voluntary Withholding Certificate From Unemployment

For line 3, if you live outside the u.s., add the city, state or. If your address is outside the. In order to have taxes withheld from your social security benefit, you must start by printing, completing and submitting an irs voluntary withholding. For withholding on social security benefits, give or send. You can find the address of your local.

IRS W4V 2003 Fill out Tax Template Online US Legal Forms

If your address is outside the united states or. If you receive any government payment shown below, you may use this form to ask the payer to withhold. Complete, sign and mail the form to your local social security office. Department of the treasury internal revenue service 'give this. For line 3, if you live outside the u.s., add the.

If Your Address Is Outside The United States Or.

Web complete lines 1 through 4; For withholding on social security benefits, give or send. For line 3, if you live outside the u.s., add the city, state or. Check one box on line 5, 6, or 7;

And Give It To The Payer, Not To The Irs.

If your address is outside the. If you receive any government payment shown below, you may use this form to ask the payer to withhold. If your address is outside the. Department of the treasury internal revenue service 'give this.

For Line 3, If You Live Outside The U.s., Add The City, State.

You can find the address of your local. In order to have taxes withheld from your social security benefit, you must start by printing, completing and submitting an irs voluntary withholding. Complete, sign and mail the form to your local social security office. Please do not send applications or documents needed to request a social security number or benefits to this address.