Where To Mail 433D Form

Where To Mail 433D Form - If you are requesting an initial installment agreement, i suggest you use form 9465 and. Web first, make sure you download a copy of the form. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. It asks for your name, address, social security or employee identification number, and your phone. Next, fill out the top section. If you lost the letter and you’re not sure where to send. By mail mail form 433. Check the address of the office depending on where you. Help videos short videos for a long list of topics. This video goes line by line on how to fill in and submit the form

If you lost the letter and you’re not sure where to send. Help videos short videos for a long list of topics. Electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay. By mail mail form 433. Then select the documents tab to combine, divide, lock or. Edit where do i mail my 433 f form. Web refer to file a notice of federal tax lien. Web up to $40 cash back 3. This video goes line by line on how to fill in and submit the form Web addresses for forms beginning with the number 1 form name (to obtain a copy of a form, instruction, or publication)address to mail form to irs:form 1040 (pr), self.

Web addresses for forms beginning with the number 1 form name (to obtain a copy of a form, instruction, or publication)address to mail form to irs:form 1040 (pr), self. If you are requesting an initial installment agreement, i suggest you use form 9465 and. Edit where do i mail my 433 f form. Then select the documents tab to combine, divide, lock or. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Replace text, adding objects, rearranging pages, and more. Electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay. You can download or print current or past. Next, fill out the top section. It asks for your name, address, social security or employee identification number, and your phone.

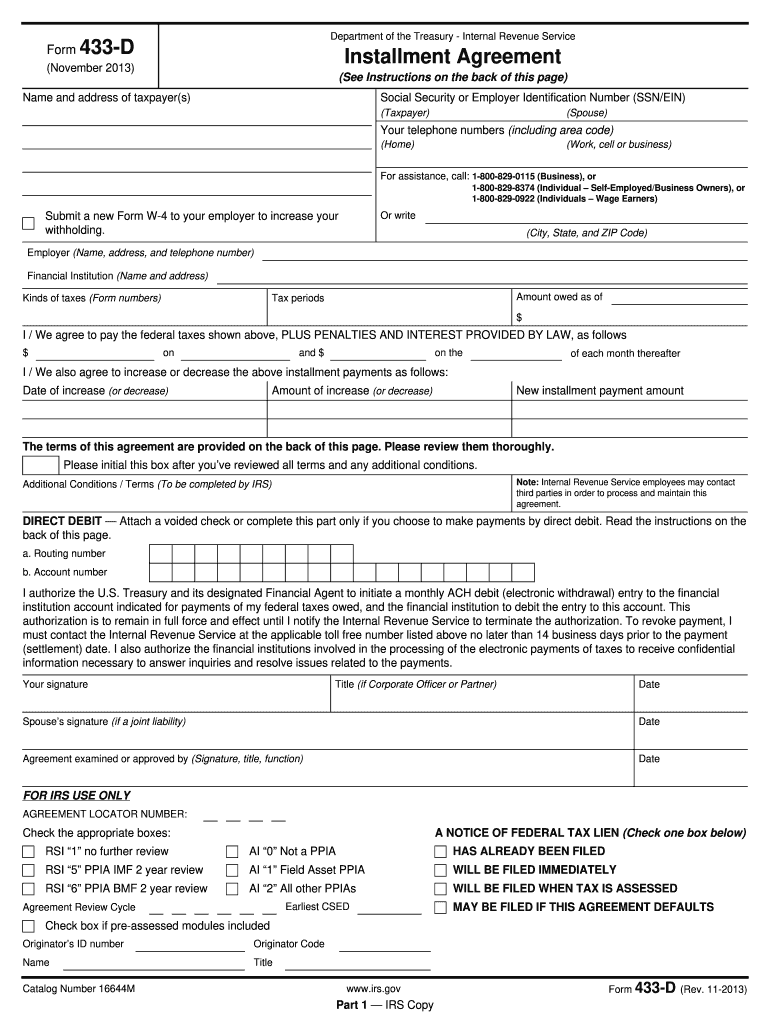

Where Do I Mail Irs Form 433 D To Form Resume Examples My3aXQ9aKw

If you are requesting an initial installment agreement, i suggest you use form 9465 and. You can download or print current or past. Web first, make sure you download a copy of the form. Electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay. Check the address of.

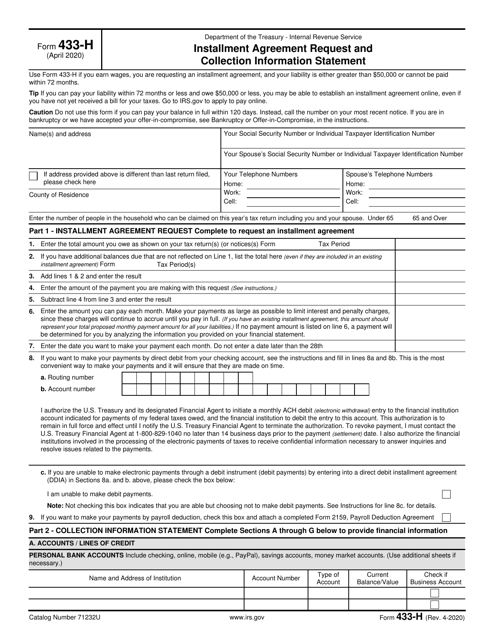

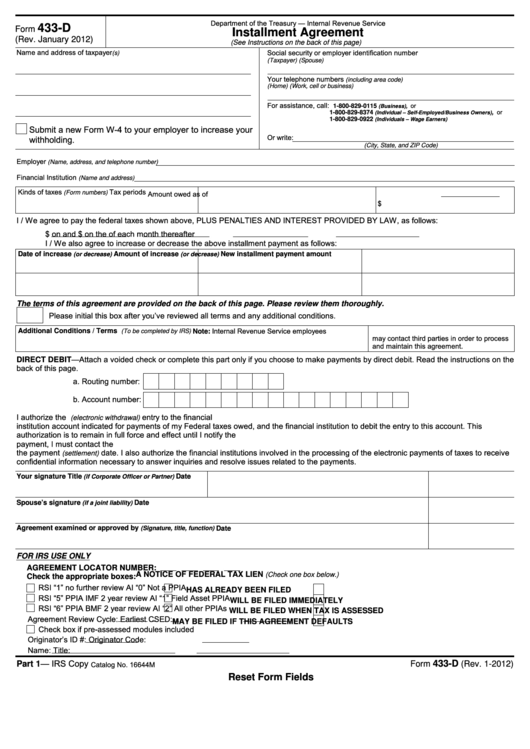

Form 433D YouTube

Replace text, adding objects, rearranging pages, and more. This video goes line by line on how to fill in and submit the form Check the address of the office depending on where you. Web addresses for forms beginning with the number 1 form name (to obtain a copy of a form, instruction, or publication)address to mail form to irs:form 1040.

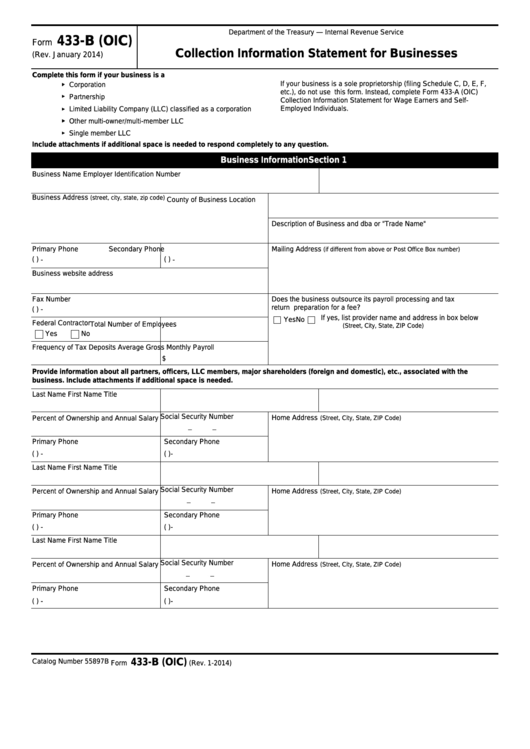

Top 7 Irs Form 433b Templates free to download in PDF format

Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Web first, make sure you download a copy of the form. Web refer to file a notice of federal tax lien. Edit where do i mail my 433 f form. Then select the documents tab to combine, divide, lock or.

Form 433d Edit, Fill, Sign Online Handypdf

Web up to $40 cash back 3. If you are requesting an initial installment agreement, i suggest you use form 9465 and. Next, fill out the top section. It asks for your name, address, social security or employee identification number, and your phone. Web first, make sure you download a copy of the form.

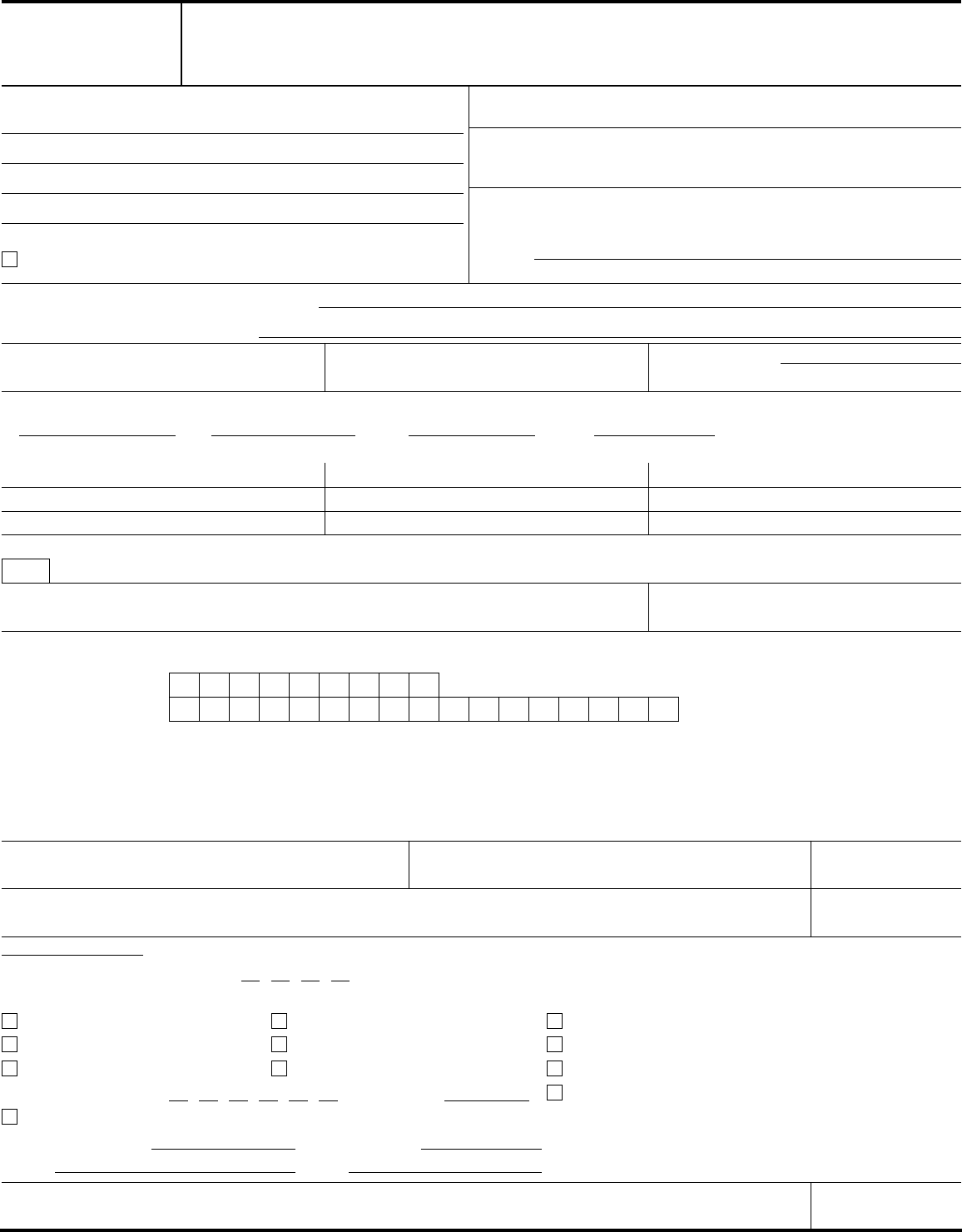

Form 433H Download Fillable PDF or Fill Online Installment Agreement

Web first, make sure you download a copy of the form. By mail mail form 433. Help videos short videos for a long list of topics. If you lost the letter and you’re not sure where to send. Electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay.

Irs Installment Agreement Form 433 D Mailing Address Form Resume

Replace text, adding objects, rearranging pages, and more. Help videos short videos for a long list of topics. Web addresses for forms beginning with the number 1 form name (to obtain a copy of a form, instruction, or publication)address to mail form to irs:form 1040 (pr), self. Next, fill out the top section. Web refer to file a notice of.

Domestic Mail Manual S912 Certified Mail

This video goes line by line on how to fill in and submit the form If you are requesting an initial installment agreement, i suggest you use form 9465 and. Edit where do i mail my 433 f form. You can download or print current or past. Web addresses for forms beginning with the number 1 form name (to obtain.

Irs Form 433 D Fill Out and Sign Printable PDF Template signNow

It asks for your name, address, social security or employee identification number, and your phone. Web refer to file a notice of federal tax lien. If you are requesting an initial installment agreement, i suggest you use form 9465 and. Web up to $40 cash back 3. You can download or print current or past.

Fillable Form 433D Installment Agreement printable pdf download

If you are requesting an initial installment agreement, i suggest you use form 9465 and. Help videos short videos for a long list of topics. Check the address of the office depending on where you. Web addresses for forms beginning with the number 1 form name (to obtain a copy of a form, instruction, or publication)address to mail form to.

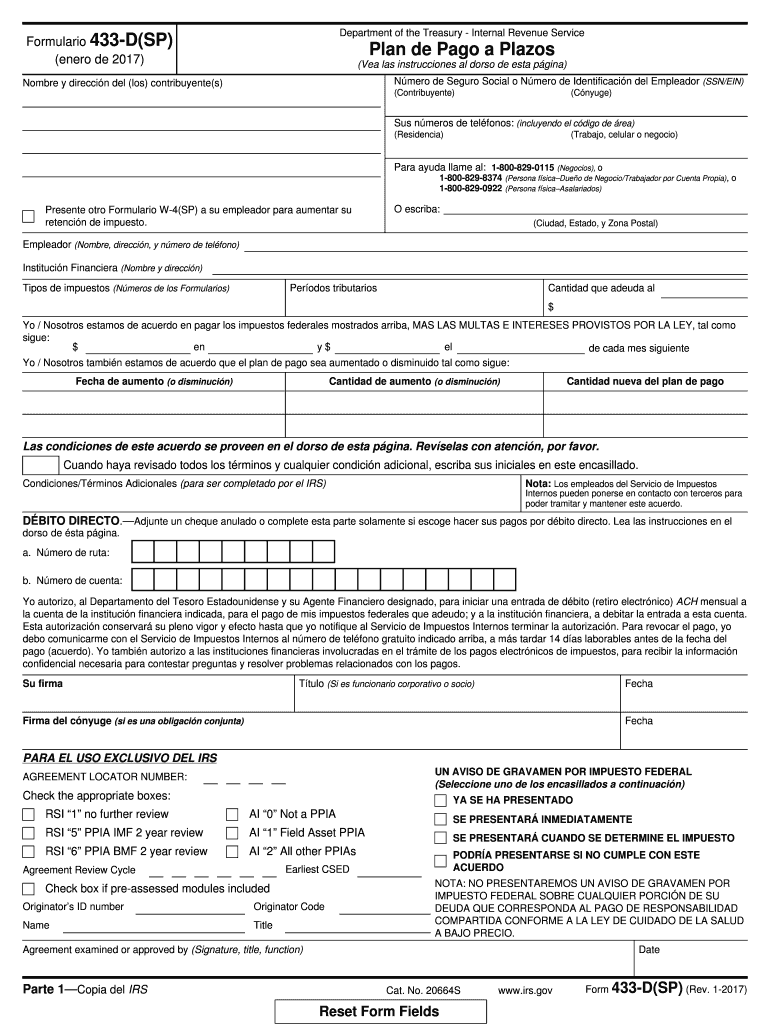

2017 Form IRS 433D (SP) Fill Online, Printable, Fillable, Blank

You can download or print current or past. Help videos short videos for a long list of topics. Web first, make sure you download a copy of the form. Check the address of the office depending on where you. If you are requesting an initial installment agreement, i suggest you use form 9465 and.

Web Watch Videos To Learn About Everything Turbotax — From Tax Forms And Credits To Installation And Printing.

Help videos short videos for a long list of topics. If you lost the letter and you’re not sure where to send. Web refer to file a notice of federal tax lien. Web first, make sure you download a copy of the form.

Check The Address Of The Office Depending On Where You.

You can download or print current or past. By mail mail form 433. Web up to $40 cash back 3. Replace text, adding objects, rearranging pages, and more.

Each Taxpayer Must Choose The Correct Office Based On Where They Live And How They Typically.

Web addresses for forms beginning with the number 1 form name (to obtain a copy of a form, instruction, or publication)address to mail form to irs:form 1040 (pr), self. Next, fill out the top section. Then select the documents tab to combine, divide, lock or. If you are requesting an initial installment agreement, i suggest you use form 9465 and.

Electronically There’s Not A Way To Submit This Form Electronically, But You Can View And Pay Your Balance By Going To Irs.gov/Directpay.

It asks for your name, address, social security or employee identification number, and your phone. Edit where do i mail my 433 f form. This video goes line by line on how to fill in and submit the form