Where To Send Form 56

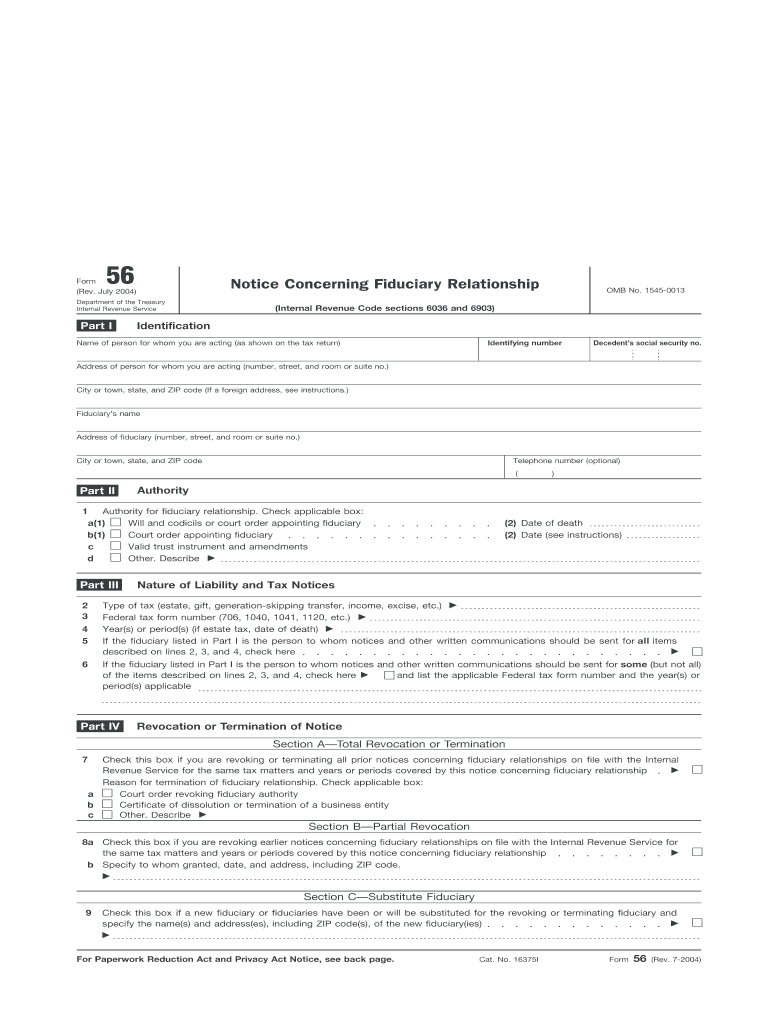

Where To Send Form 56 - If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. The fiduciary can directly mail irs form 56 to the irs departments in your state where the person for whom the judiciary acting is mandatory to file tax returns. Web notice of fiduciary relationship. In this part, you need to sign form 56 to complete it. Web form 56 and form 56 instructions can be found on the irs website. November 2022) department of the treasury internal revenue service. Web is it correct that form 56 should be mailed to the ogden address, or might the irs require i send it along with the gift tax return instead (department of the treasury / internal revenue service center / kansas city, mo. Specifically, receivers in receivership hearings or assignees for the benefit of creditors, should file form 56 within 10 days of meeting with the advisory group manager for the irs center with jurisdiction over the taxpayer. (internal revenue code sections 6036 and 6903) go to.

Web is it correct that form 56 should be mailed to the ogden address, or might the irs require i send it along with the gift tax return instead (department of the treasury / internal revenue service center / kansas city, mo. Web notice of fiduciary relationship. Form 56, notice concerning fiduciary relationship, is used for this purpose. In this part, you need to sign form 56 to complete it. You can also contact a tax professional such as a tax attorney or cpa to handle your form 56 filing. Web form name (current and previous year forms, instructions, and publications are provided on the. Web this is the relevant part: Form 56 can be mailed directly to the irs department in your state. (internal revenue code sections 6036 and 6903) go to. Where to mail irs form 56.

Web form name (current and previous year forms, instructions, and publications are provided on the. Provide notification to the irs of the creation or termination of a fiduciary relationship under section 6903. Web is it correct that form 56 should be mailed to the ogden address, or might the irs require i send it along with the gift tax return instead (department of the treasury / internal revenue service center / kansas city, mo. Where to send irs form 56? Specifically, receivers in receivership hearings or assignees for the benefit of creditors, should file form 56 within 10 days of meeting with the advisory group manager for the irs center with jurisdiction over the taxpayer. If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. Form 56 can be mailed directly to the irs department in your state. You may use form 56 to: Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of qualification under section 6036. November 2022) department of the treasury internal revenue service.

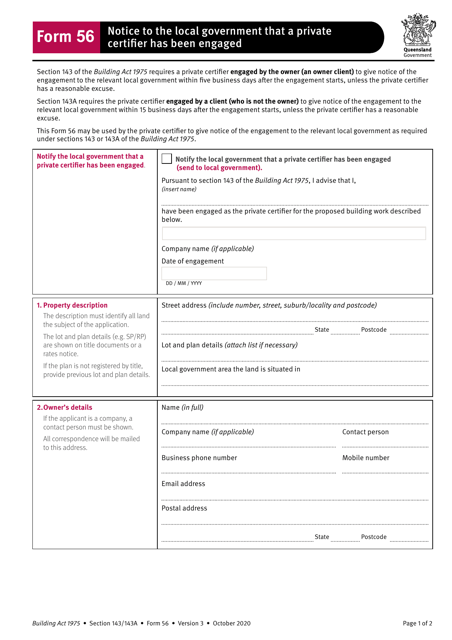

Form 56 Download Fillable PDF or Fill Online Notice to the Local

See the instructions for form 56 for filing requirements and other information. Web is it correct that form 56 should be mailed to the ogden address, or might the irs require i send it along with the gift tax return instead (department of the treasury / internal revenue service center / kansas city, mo. November 2022) department of the treasury.

Does Lululemon Accept Returns Without Receipts Tax

Web generally, the irs recommends filing form 56 when creating or terminating a fiduciary relationship. Web is it correct that form 56 should be mailed to the ogden address, or might the irs require i send it along with the gift tax return instead (department of the treasury / internal revenue service center / kansas city, mo. Form 56, notice.

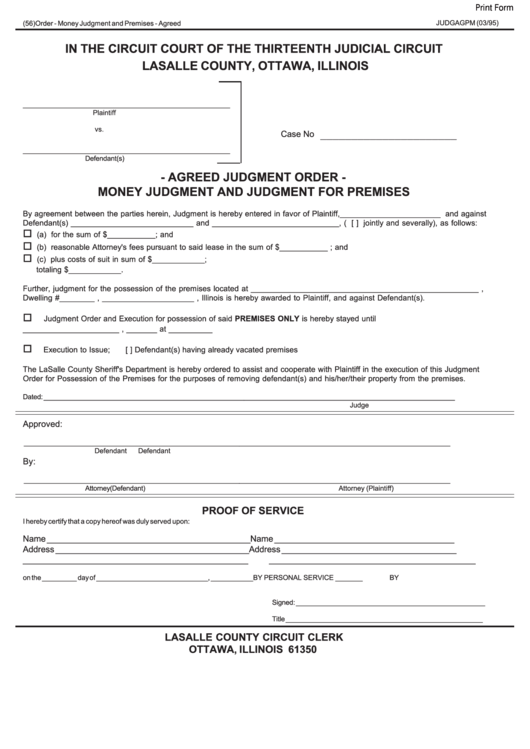

Fillable Form 56 Agreed Judgment For Money And Premises printable pdf

Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of qualification under section 6036. In this part, you need to sign form 56 to complete it. Form 56, notice concerning fiduciary relationship, is used for this purpose. You can also contact a tax professional such as a tax.

Form 4506T Instructions & Information about IRS Tax Form 4506T

You can also contact a tax professional such as a tax attorney or cpa to handle your form 56 filing. In this part, you need to sign form 56 to complete it. Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of qualification under section 6036. (internal revenue.

Irs Form 56 2006 Pdf Fill Out and Sign Printable PDF Template signNow

See the instructions for form 56 for filing requirements and other information. Form 56, notice concerning fiduciary relationship, is used for this purpose. Web form name (current and previous year forms, instructions, and publications are provided on the. Provide notification to the irs of the creation or termination of a fiduciary relationship under section 6903. Web go to the last.

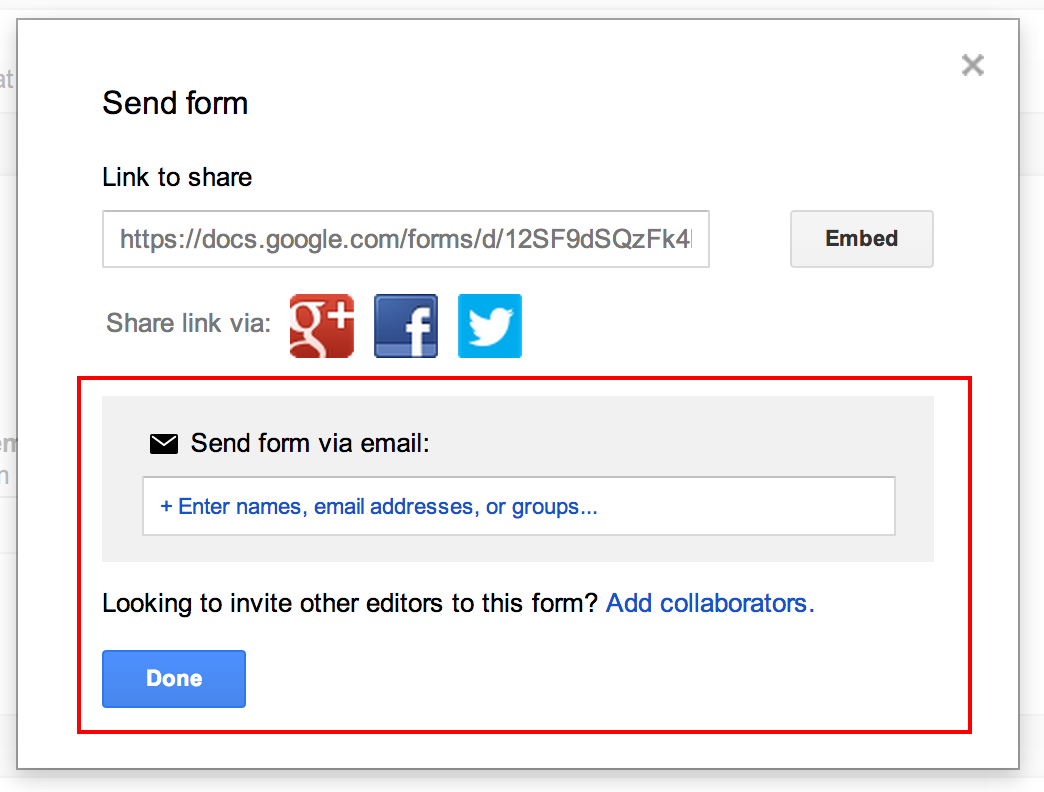

Email Google Form Daily Coding Forest

Web go to the last part of irs form 56 part iv (signature). Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of qualification under section 6036. Specifically, receivers in receivership hearings or assignees for the benefit of creditors, should file form 56 within 10 days of meeting.

Formulario 56 del IRS Community Tax

File form 56 with the internal revenue service center where the person for whom you are acting is required to file tax returns. Web go to the last part of irs form 56 part iv (signature). Web is it correct that form 56 should be mailed to the ogden address, or might the irs require i send it along with.

Form 56 Notice Concerning Fiduciary Relationship (2012) Free Download

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903.

IRS Form 56'nın Amacı Temeller 2021

(internal revenue code sections 6036 and 6903) go to. Web this is the relevant part: Form 56 can be mailed directly to the irs department in your state. Where to send irs form 56? Generally, you should file form 56 when you create (or terminate) a fiduciary relationship.

Top 7 Irs Form 56 Templates free to download in PDF format

Web form 56 and form 56 instructions can be found on the irs website. If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. Form 56, notice concerning fiduciary relationship, is used for this purpose. (internal revenue code sections 6036 and 6903) go to. In this part,.

Where To Mail Irs Form 56.

Web notice of fiduciary relationship. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web is it correct that form 56 should be mailed to the ogden address, or might the irs require i send it along with the gift tax return instead (department of the treasury / internal revenue service center / kansas city, mo. Specifically, receivers in receivership hearings or assignees for the benefit of creditors, should file form 56 within 10 days of meeting with the advisory group manager for the irs center with jurisdiction over the taxpayer.

See The Instructions For Form 56 For Filing Requirements And Other Information.

Web go to the last part of irs form 56 part iv (signature). Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of qualification under section 6036. For example, if you are acting as fiduciary for an individual, a decedent’s estate, or a trust, you may file form 56. Web form 56 and form 56 instructions can be found on the irs website.

You Can Also Contact A Tax Professional Such As A Tax Attorney Or Cpa To Handle Your Form 56 Filing.

In this part, you need to sign form 56 to complete it. (internal revenue code sections 6036 and 6903) go to. File form 56 with the internal revenue service center where the person for whom you are acting is required to file tax returns. If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this.

Form 56, Notice Concerning Fiduciary Relationship, Is Used For This Purpose.

Form 56 can be mailed directly to the irs department in your state. Web generally, the irs recommends filing form 56 when creating or terminating a fiduciary relationship. Web this is the relevant part: The fiduciary can directly mail irs form 56 to the irs departments in your state where the person for whom the judiciary acting is mandatory to file tax returns.