Where To Send Form 941 X

Where To Send Form 941 X - You can select one of these alternatives based on your preferences. Web business address specify the return you’re correcting by putting an “x” in the box next to form 941. At this time, the irs. Web if you’re in. Check off the box next to the quarter you’re correcting (e.g., april,. Where to mail form 941? Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Head to the process payroll forms tab. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Don't use an earlier revision to report taxes for 2023.

Check off the box next to the quarter you’re correcting (e.g., april,. The mailing address of your form 941. Web business address specify the return you’re correcting by putting an “x” in the box next to form 941. April, may, june read the separate instructions before completing this form. Don't use an earlier revision to report taxes for 2023. Web where to mail form 941 once you have filled out your form and written a check out to the “united states treasury,” be sure to include your ein (if you don’t already have one, you. Box 409101 ogden, ut 84409. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. You can select one of these alternatives based on your preferences. Where to mail form 941?

The mailing address of your form 941. Check off the box next to the quarter you’re correcting (e.g., april,. At this time, the irs. April, may, june read the separate instructions before completing this form. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Don't use an earlier revision to report taxes for 2023. Box 409101 ogden, ut 84409. Where to mail form 941? Web if you’re in. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs.

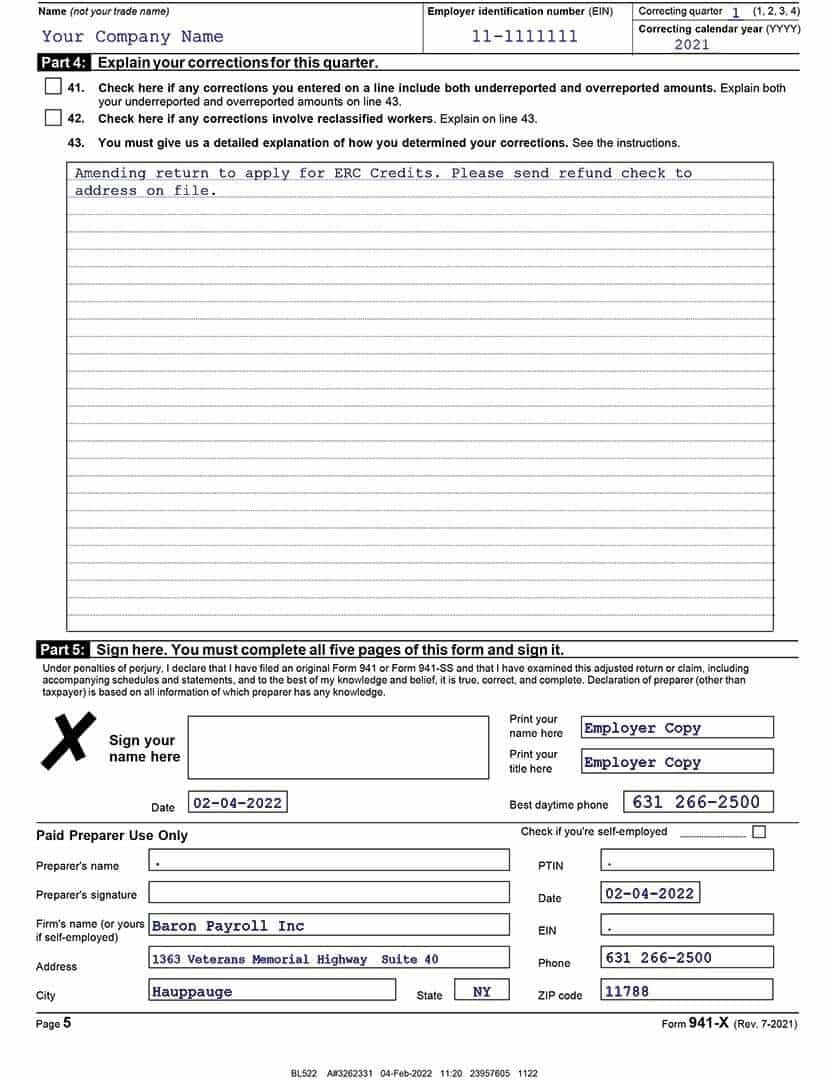

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Where to mail form 941? April, may, june read the separate instructions before completing this form. Box 409101 ogden, ut 84409. Check off the box next to the quarter you’re correcting (e.g., april,. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs.

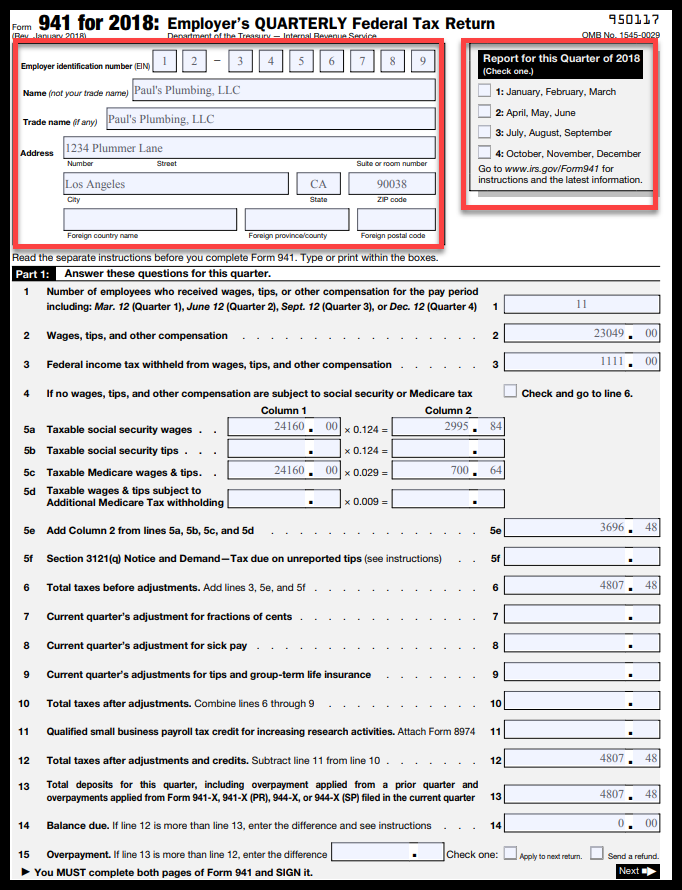

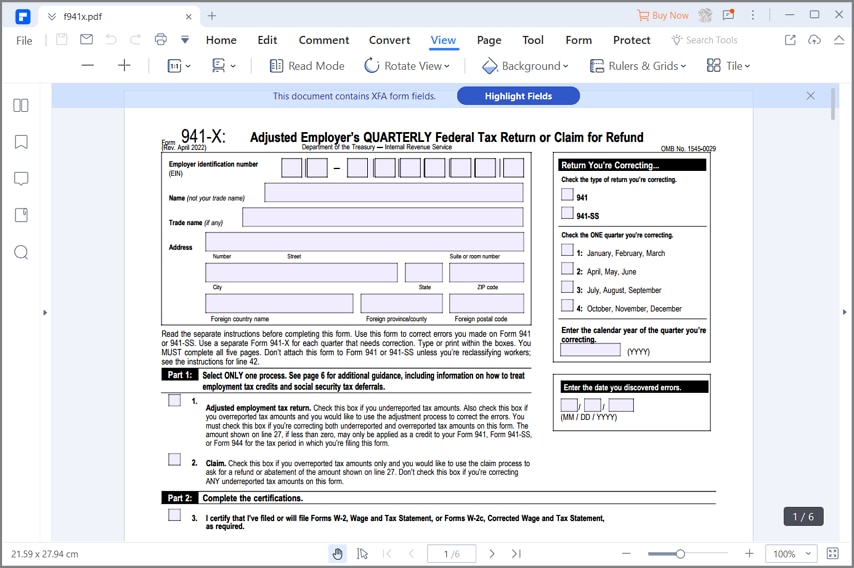

Form Bavar 2018 941 for 2018 Employer's QUARTERLY

If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Check off the box next to the quarter you’re correcting (e.g., april,. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Where to mail form 941? Web internal revenue service.

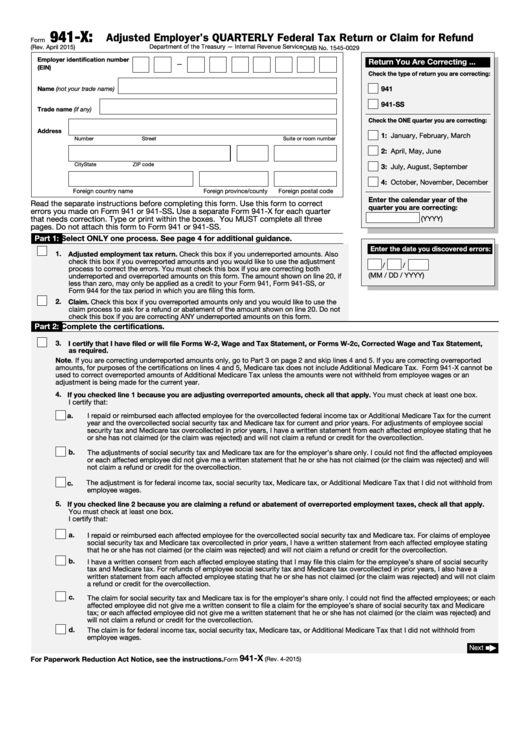

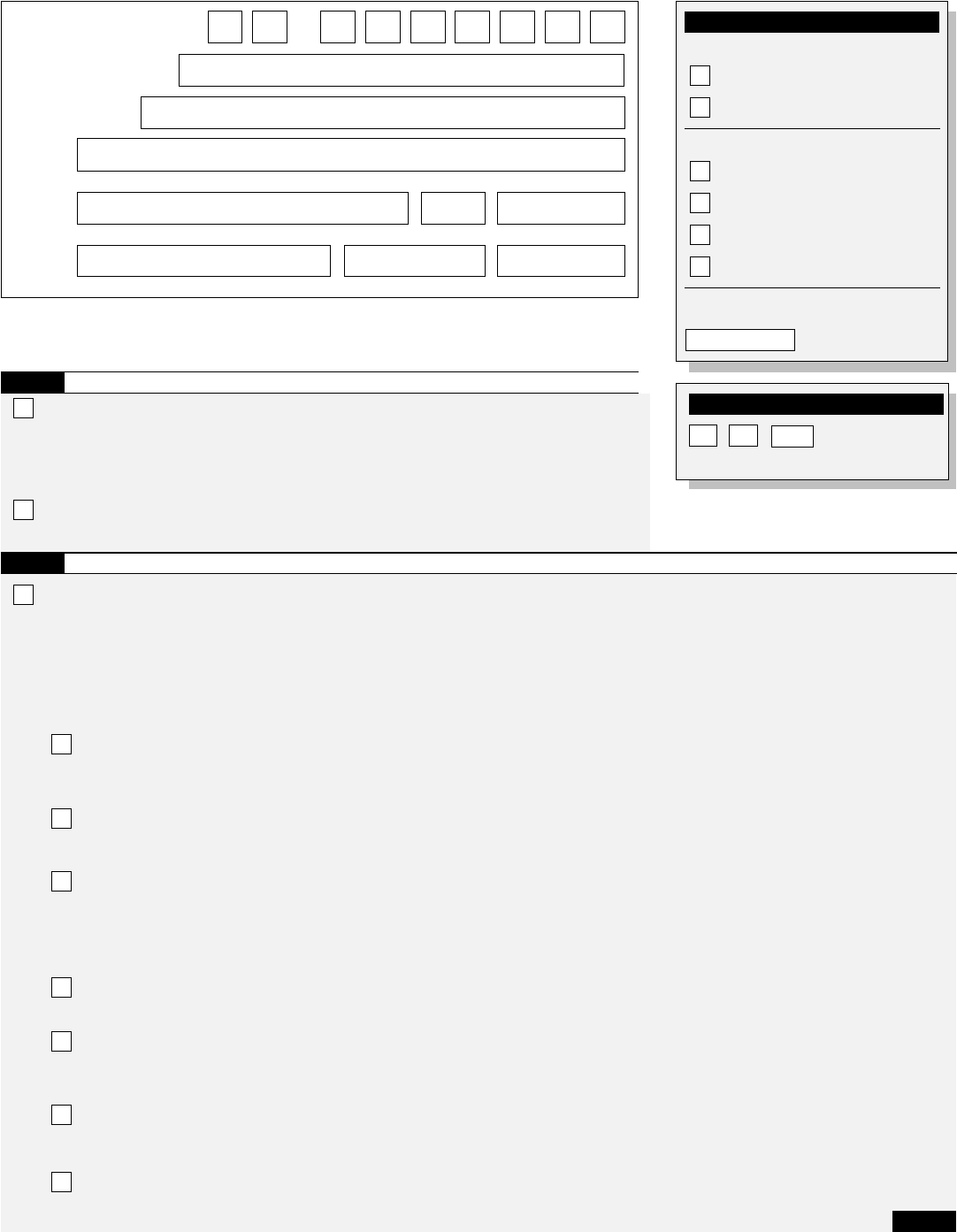

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

The mailing address of your form 941. You can select one of these alternatives based on your preferences. Don't use an earlier revision to report taxes for 2023. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. If you decide to paper file your form 941 return, you must.

What You Need to Know About Just Released IRS Form 941X Blog

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Don't use an earlier revision to report taxes for 2023. Box 409101 ogden, ut 84409. Web internal revenue service p.o.

Create and Download Form 941 X Fillable and Printable 2022 941X

If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; At this time, the irs. Web if you’re in. Box 409101 ogden, ut 84409.

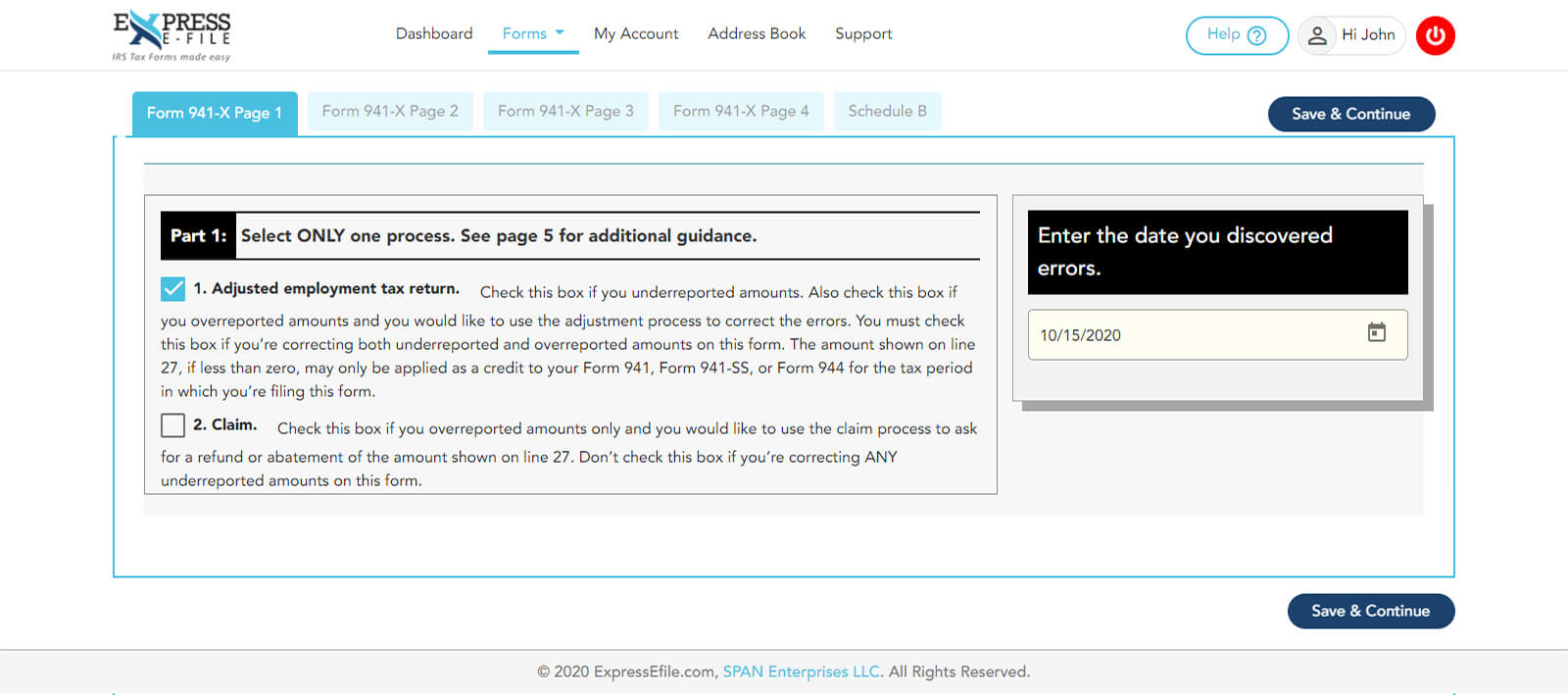

How to Complete & Download Form 941X (Amended Form 941)?

April, may, june read the separate instructions before completing this form. You can select one of these alternatives based on your preferences. Don't use an earlier revision to report taxes for 2023. Web where to mail form 941 once you have filled out your form and written a check out to the “united states treasury,” be sure to include your.

Form 941X Edit, Fill, Sign Online Handypdf

Where to mail form 941? It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. If you decide to paper file your form 941 return, you must mail a copy of the return to the irs. The mailing address of your form 941. You can select one of these alternatives.

IRS Form 941X Learn How to Fill it Easily

Where to mail form 941? Web internal revenue service p.o. Web if you’re in. Head to the process payroll forms tab. Don't use an earlier revision to report taxes for 2023.

Irs Form W4V Printable / IRS Releases New Draft Form W4 To Help

Don't use an earlier revision to report taxes for 2023. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Check off the box next to the quarter you’re correcting (e.g., april,. Where to mail form 941? Web business address specify the return you’re correcting by putting an “x” in.

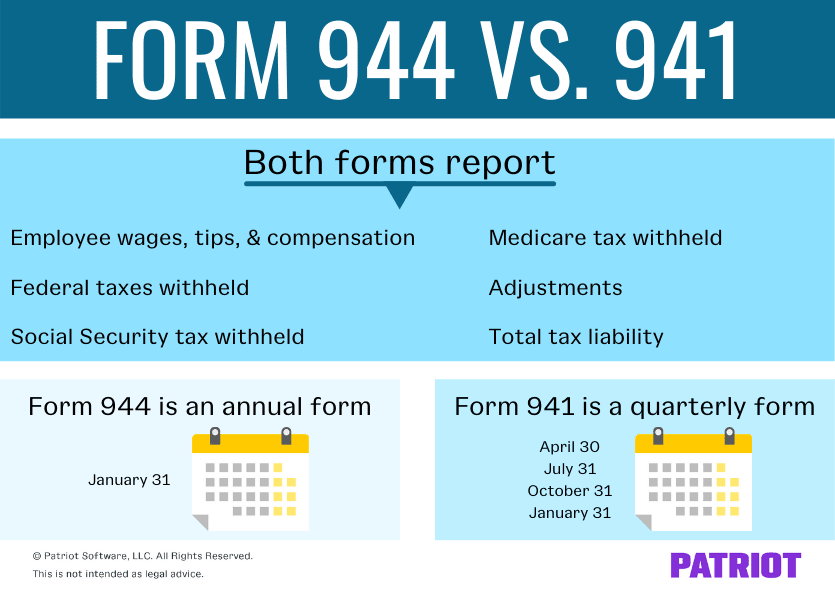

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

April, may, june read the separate instructions before completing this form. The mailing address of your form 941. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. At this time, the irs. Web internal revenue service p.o.

If You Decide To Paper File Your Form 941 Return, You Must Mail A Copy Of The Return To The Irs.

Box 409101 ogden, ut 84409. Web where to mail form 941 once you have filled out your form and written a check out to the “united states treasury,” be sure to include your ein (if you don’t already have one, you. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web internal revenue service p.o.

At This Time, The Irs.

Head to the process payroll forms tab. Where to mail form 941? Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web if you’re in.

The Mailing Address Of Your Form 941.

It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Check off the box next to the quarter you’re correcting (e.g., april,. You can select one of these alternatives based on your preferences. April, may, june read the separate instructions before completing this form.

Don't Use An Earlier Revision To Report Taxes For 2023.

Web business address specify the return you’re correcting by putting an “x” in the box next to form 941. Alabama, alaska, arizona, arkansas, california, colorado, hawaii, idaho, iowa, kansas,.