Who Qualifies For Form 8995

Who Qualifies For Form 8995 - •you have qbi, qualified reit dividends, or qualified ptp income or loss; Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web qualified business income for form 8995 it is aa qualified llc partnerships. Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. The deduction can be taken in addition to the.

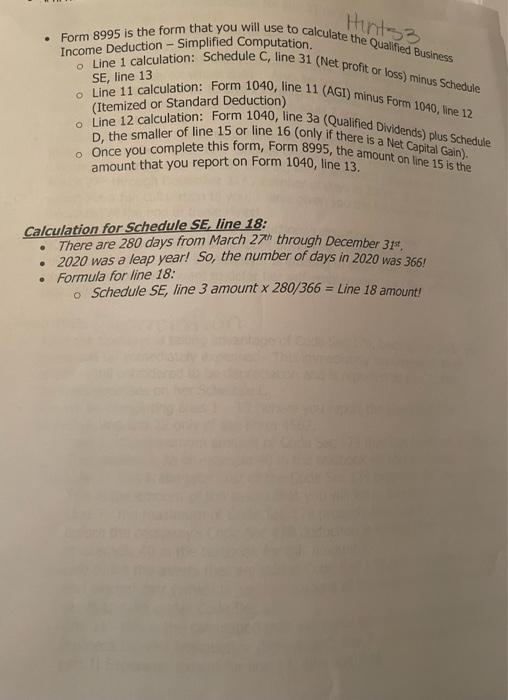

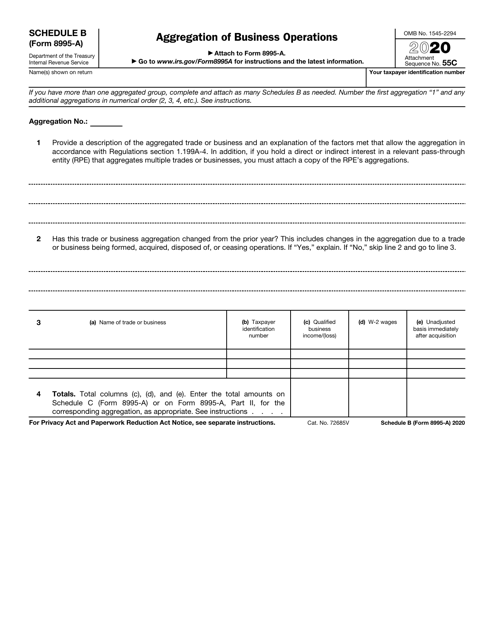

Web what is form 8995? Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. As with most tax issues, the. Web form 8995 is the simplified form and is used if all of the following are true: Web qualified business income for form 8995 it is aa qualified llc partnerships. My problem on turbotax is that unless you fill out a schedule c, which is not what is. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: •you have qbi, qualified reit dividends, or qualified ptp income or loss; Web steps to complete the federal form 8995 accurately.

Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. My problem on turbotax is that unless you fill out a schedule c, which is not what is. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. The deduction can be taken in addition to the. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. Web what is form 8995? As with most tax issues, the.

WHERE DO WE ENTER FORM 8995 QUALIFIED BUSINESS DEDUCTION LOSS

Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. •you have qbi, qualified reit dividends, or.

Total Stock Market Index Section 199A dividends this year Page 4

As with most tax issues, the. Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. Web form 8995 is the simplified form and is used if all of the following are true: You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web.

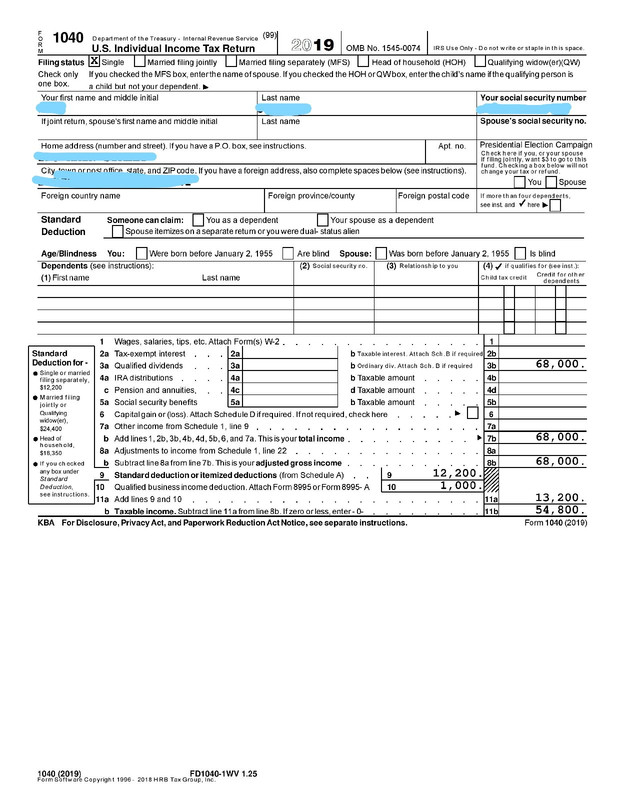

Solved All listed forms will be used with an AGI check

The deduction can be taken in addition to the. Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. My problem on turbotax is that unless you fill out a schedule c, which is not what is. Web what is form 8995? Web • if you own,.

Solved Please help me with this 2019 tax return. All

As with most tax issues, the. •you have qbi, qualified reit dividends, or qualified ptp income or loss; You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web form 8995 is the simplified form and is used if all of the following are true: Web what is form 8995?

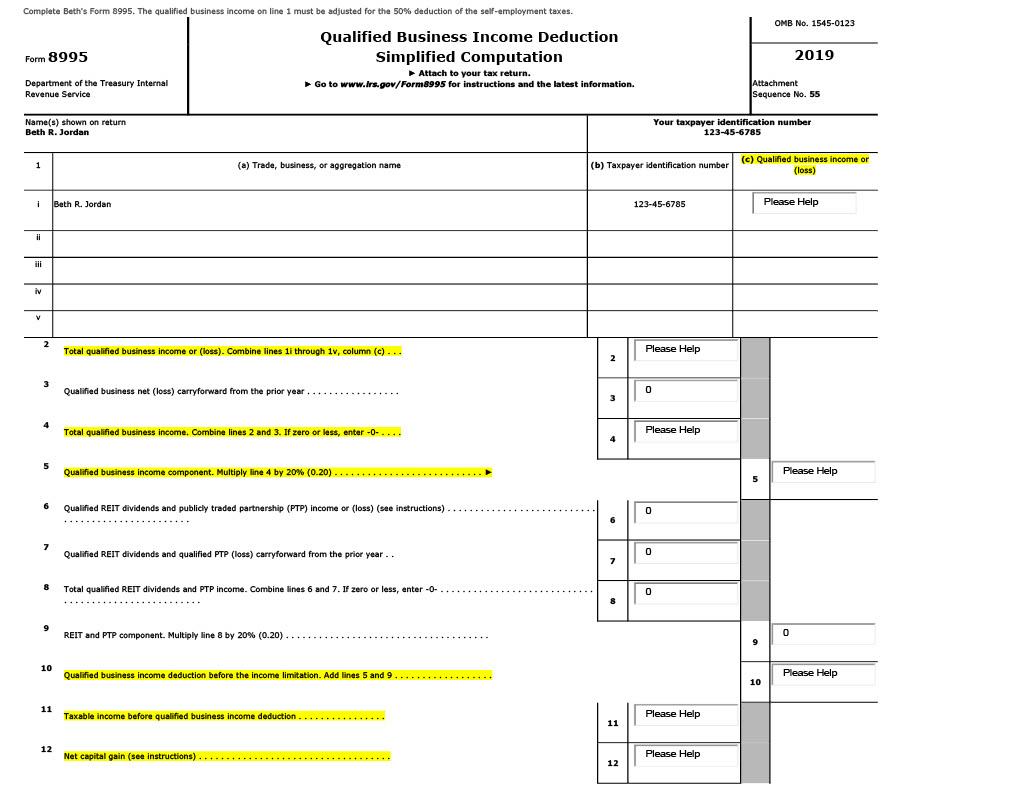

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

•you have qbi, qualified reit dividends, or qualified ptp income or loss; Web qualified business income for form 8995 it is aa qualified llc partnerships. As with most tax issues, the. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. Web • if you own, are a.

Here is my ranking of the Batman the ride rides at various parks with

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. Web qualified business income for form 8995 it is aa qualified llc.

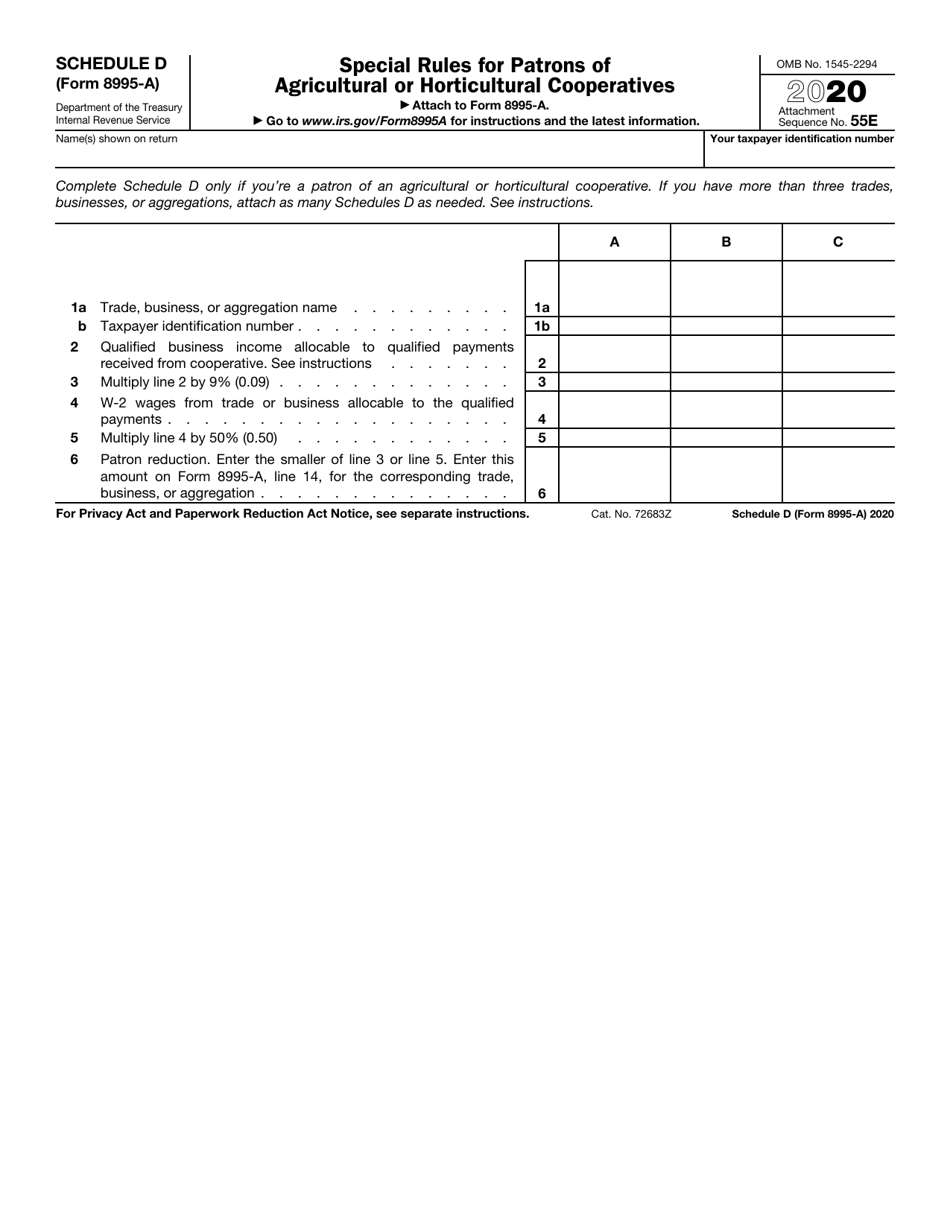

IRS Form 8995A Schedule D Download Fillable PDF or Fill Online Special

Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. Web what is form 8995? Web form 8995 is the simplified form and is used if all of the following are true: The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web qualified.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

The deduction can be taken in addition to the. Web form 8995 is the simplified form and is used if all of the following are true: Web what is form 8995? My problem on turbotax is that unless you fill out a schedule c, which is not what is. Before proceeding with the essential details, let me remind you that.

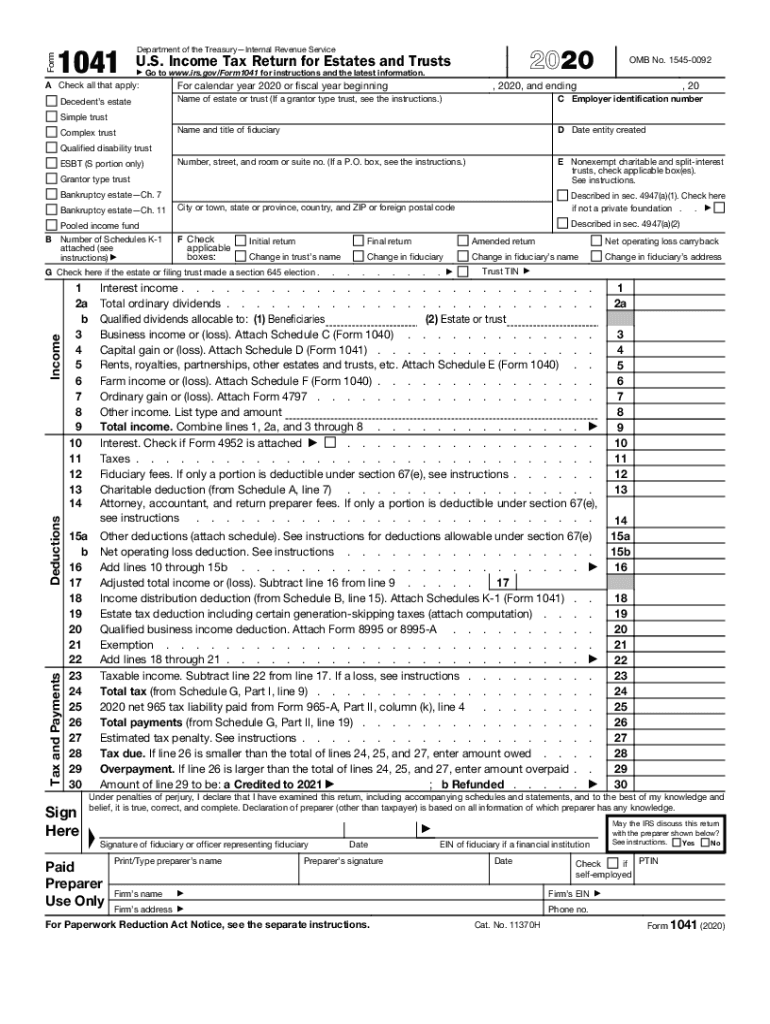

IRS 1041 20202021 Fill out Tax Template Online US Legal Forms

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web form 8995 is the simplified form and is used if all of the following are true: Web individuals and eligible estates and trusts that have qbi use form 8995.

We Tax Services PLLC Facebook

Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. The deduction can be taken in addition to the. My problem on turbotax is that unless you fill out a schedule c, which is not what is. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web qualified.

Web The Qualified Business Income Deduction (Qbi) Deduction Is Worth Up To 20% Of Qualified Net Business Income.

Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. My problem on turbotax is that unless you fill out a schedule c, which is not what is. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for.

Web Individuals And Eligible Estates And Trusts That Have Qbi Use Form 8995 To Figure The Qbi Deduction If:

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web what is form 8995? Web steps to complete the federal form 8995 accurately. You have qbi, qualified reit dividends, or qualified ptp income or loss (all.

The Deduction Can Be Taken In Addition To The.

As with most tax issues, the. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. Web qualified business income for form 8995 it is aa qualified llc partnerships. •you have qbi, qualified reit dividends, or qualified ptp income or loss;