Wisconsin Homestead Credit Form

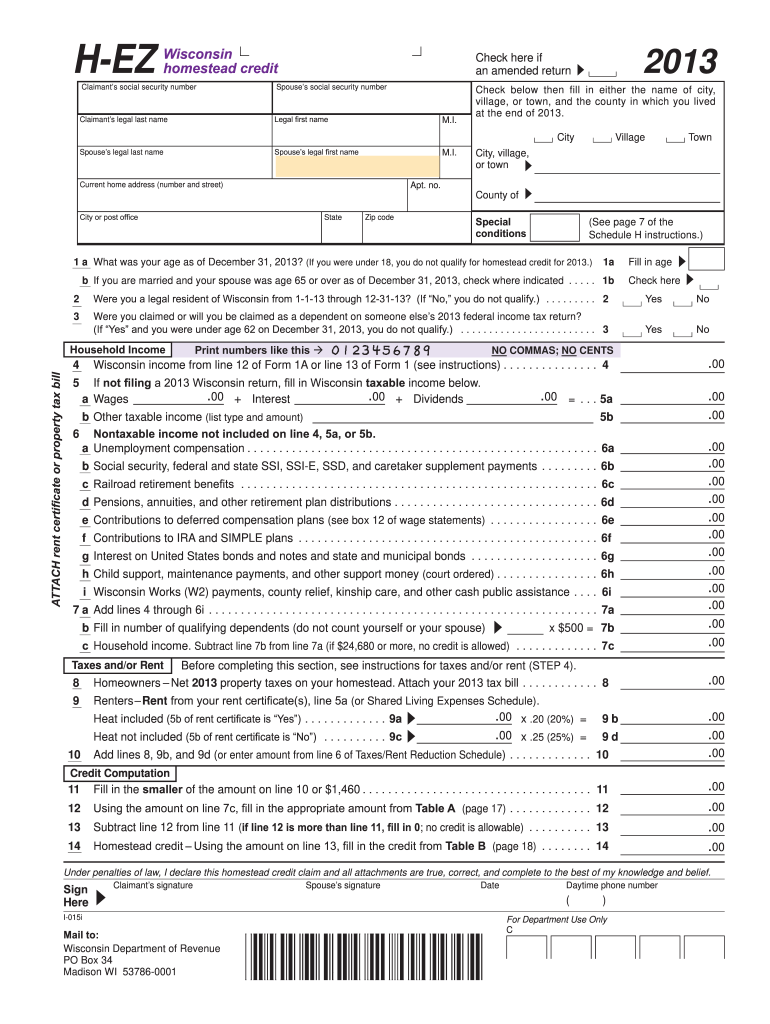

Wisconsin Homestead Credit Form - Web wisconsin homestead credit you may be eligible for a maximum tax credit of up to $1,160 if you were a wisconsin resident for all of 2021, owned or rented a dwelling, and. For a claimant with household income greater than the income threshold ($8,060). Show details we are not affiliated with. Web 92 votes what makes the 2022 wi homestead credit legally valid? Web h‑ez wisconsin homestead credit 2022 an amended return check below then fill in either the name of the city, village, or town, and the county in which you lived at the end of. If filing a wisconsin income tax return, fill in the credit amount on line 30 of form 1. The rent certificate is a tax form that your landlord needs to complete and sign. Web homestead tax credit = property taxes x 80% = $1,460 x 80% = $1,168* example b: Web click on new document and choose the file importing option: What is the deadline for filing my 2019 homestead.

Web fact sheet 1116 revenue.wi.gov the homestead credit program is designed to soften the impact of property taxes and rent on persons with lower incomes. Use fill to complete blank online wisconsin. Complete, edit or print tax forms instantly. Web 92 votes what makes the 2022 wi homestead credit legally valid? Web wisconsin homestead credit rent certificate form rent certificate pdf form content report error it appears you don't have a pdf plugin for this browser. Web h‑ez wisconsin homestead credit 2022 an amended return check below then fill in either the name of the city, village, or town, and the county in which you lived at the end of. Web the homestead credit is a state of wisconsin tax benefit for renters and homeowners with low or moderate incomes. Web wisconsin — homestead credit claim (easy form) download this form print this form it appears you don't have a pdf plugin for this browser. Upload wisconsin homestead credit form 2021 from your device, the cloud, or a protected link. Please use the link below to.

It includes information about the home you rent and. If filing a wisconsin income tax return, fill in the credit amount on line 30 of form 1. Complete, edit or print tax forms instantly. Web wisconsin homestead credit you may be eligible for a maximum tax credit of up to $1,160 if you were a wisconsin resident for all of 2021, owned or rented a dwelling, and. Web how do i claim homestead credit? • you owned or rented your home in 2022 • you were a legal resident of wisconsin from january 1 through december 31,. It is designed to lessen the impact of rent. Web to print your return to obtain the forms to mail for your homestead credit: Web wisconsin homestead credit rent certificate form rent certificate pdf form content report error it appears you don't have a pdf plugin for this browser. Web 92 votes what makes the 2022 wi homestead credit legally valid?

Wisconsin Form Homestead Credit Fill Out and Sign Printable PDF

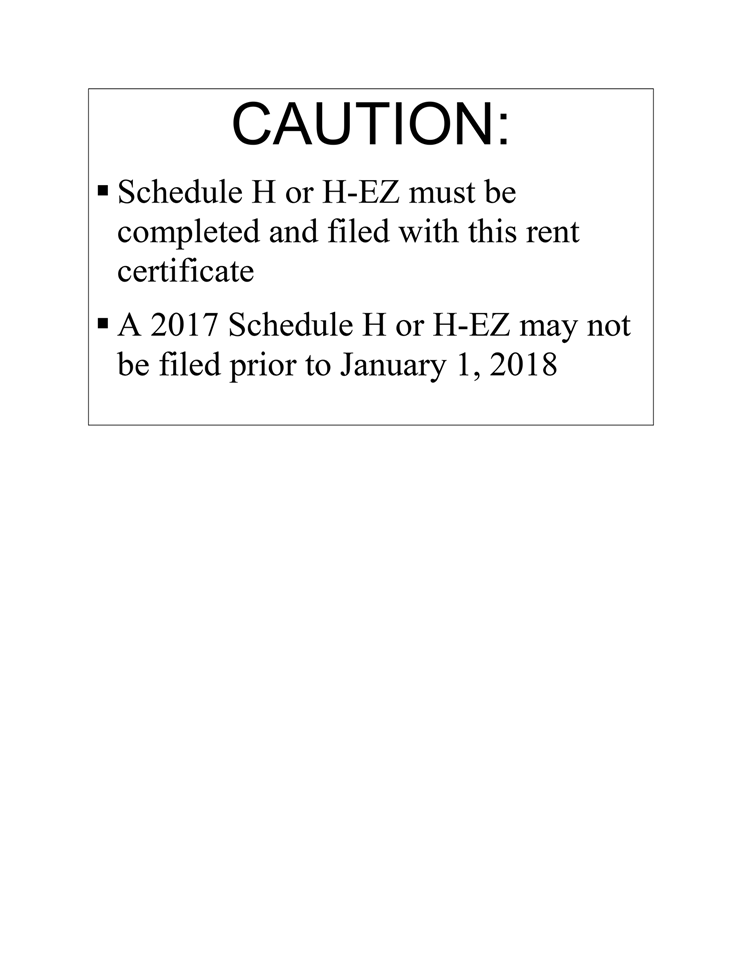

Web to print your return to obtain the forms to mail for your homestead credit: Web 92 votes what makes the 2022 wi homestead credit legally valid? • you owned or rented your home in 2022 • you were a legal resident of wisconsin from january 1 through december 31,. Web if you rent your home, attach a rent certificate..

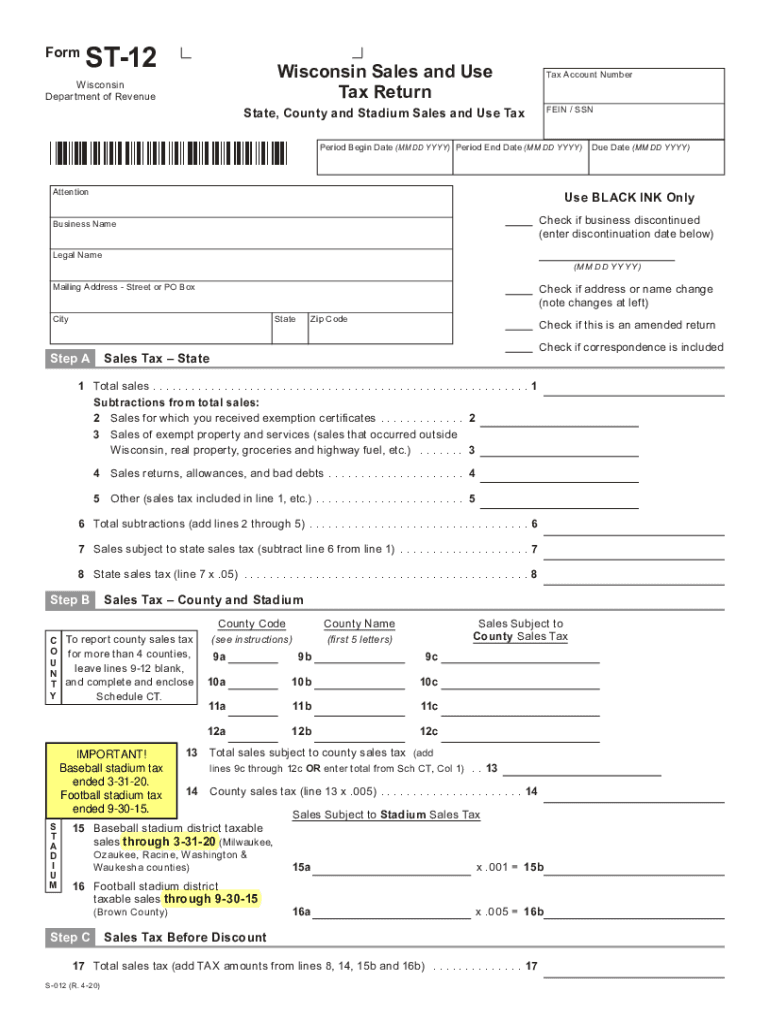

20202022 Form WI DoR ST12 Fill Online, Printable, Fillable, Blank

It is designed to lessen the impact of rent. Web forms required for wisconsin state homestead credit community discussions taxes state tax filing sph01 new member forms required for wisconsin. Web to print your return to obtain the forms to mail for your homestead credit: It includes information about the home you rent and. If filing a wisconsin income tax.

Wisconsin Rent Certificate EZ Landlord Forms

Web wisconsin homestead credit rent certificate form rent certificate pdf form content report error it appears you don't have a pdf plugin for this browser. Web h‑ez wisconsin homestead credit 2022 an amended return check below then fill in either the name of the city, village, or town, and the county in which you lived at the end of. Hez.

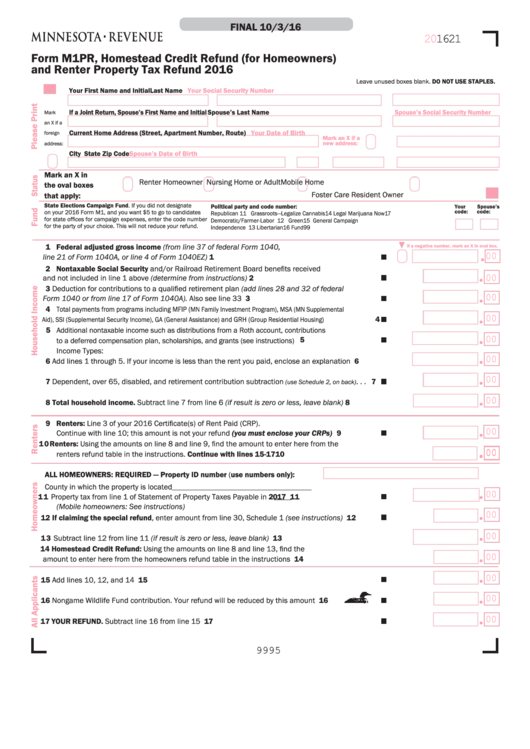

Form M1pr, Homestead Credit Refund (For Homeowners) printable pdf download

The rent certificate is a tax form that your landlord needs to complete and sign. Wisconsin schedule h allows qualifying homeowners or renters who pay property taxes. What is the deadline for filing my 2019 homestead. Web if you rent your home, attach a rent certificate. Use fill to complete blank online wisconsin.

20132021 Form WI Rent Certificate Fill Online, Printable, Fillable

Hez wisconsin homestead credit check here (wisconsin) form. Web forms required for wisconsin state homestead credit community discussions taxes state tax filing sph01 new member forms required for wisconsin. Web fact sheet 1116 revenue.wi.gov the homestead credit program is designed to soften the impact of property taxes and rent on persons with lower incomes. Web to print your return to.

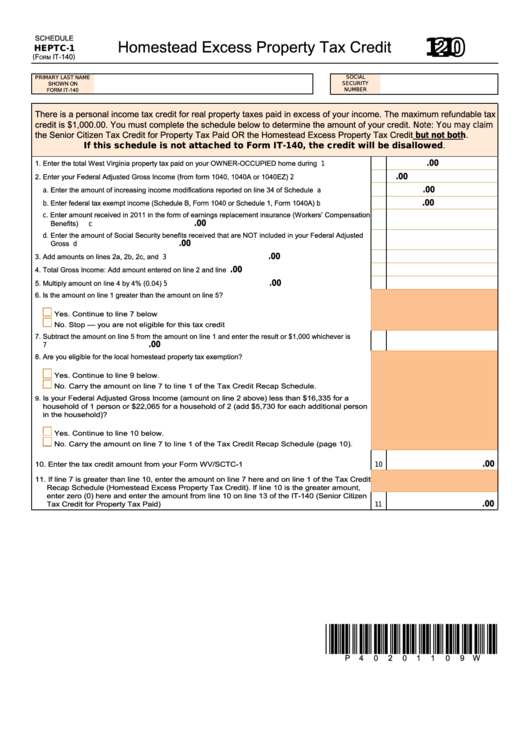

Schedule Heptc1 (Form It140) Homestead Excess Property Tax Credit

Web the homestead credit is a state of wisconsin tax benefit for renters and homeowners with low or moderate incomes. Web fact sheet 1116 revenue.wi.gov the homestead credit program is designed to soften the impact of property taxes and rent on persons with lower incomes. Web if you rent your home, attach a rent certificate. If filing a wisconsin income.

Fill Free fillable Form I015 Wisconsin homestead credit form 2019

Please use the link below to. Web wisconsin homestead credit rent certificate form rent certificate pdf form content report error it appears you don't have a pdf plugin for this browser. Web wisconsin — homestead credit claim (easy form) download this form print this form it appears you don't have a pdf plugin for this browser. Complete, edit or print.

Understanding Wisconsin Homestead Credit for Landlords and Property

Web h‑ez wisconsin homestead credit 2022 an amended return check below then fill in either the name of the city, village, or town, and the county in which you lived at the end of. Upload wisconsin homestead credit form 2021 from your device, the cloud, or a protected link. Show details we are not affiliated with. • you owned or.

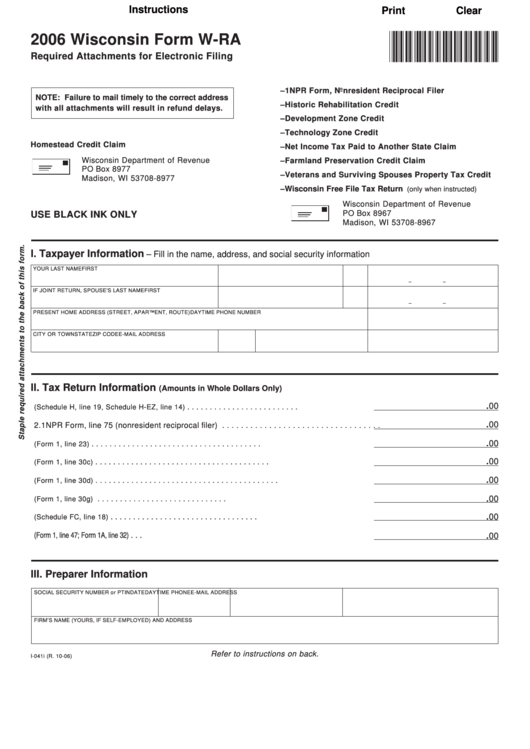

Fillable Form WRa Homestead Credit Claim 2006 Wisconsin Department

Upload wisconsin homestead credit form 2021 from your device, the cloud, or a protected link. Use fill to complete blank online wisconsin. Complete, edit or print tax forms instantly. Web forms required for wisconsin state homestead credit community discussions taxes state tax filing sph01 new member forms required for wisconsin. Web more about the wisconsin schedule h individual income tax.

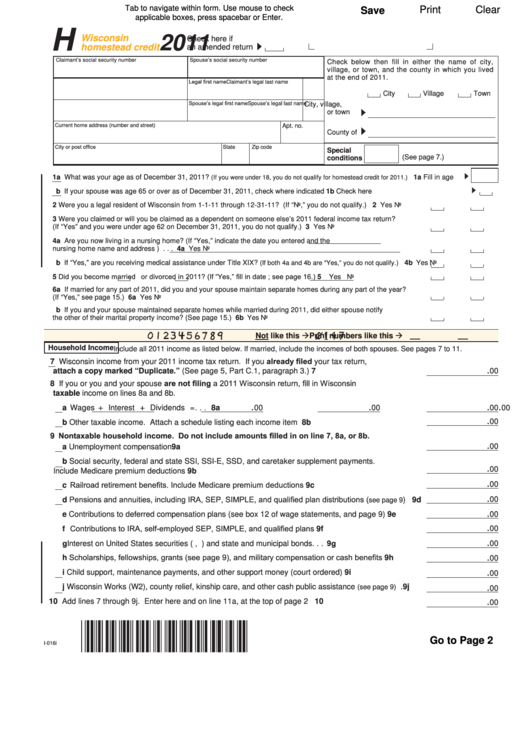

Fillable Form H Wisconsin Homestead Credit 2011 printable pdf download

For a claimant with household income greater than the income threshold ($8,060). Web click on new document and choose the file importing option: Upload wisconsin homestead credit form 2021 from your device, the cloud, or a protected link. Web the homestead credit is a state of wisconsin tax benefit for renters and homeowners with low or moderate incomes. What is.

Web Wisconsin — Homestead Credit Claim (Easy Form) Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web fill online, printable, fillable, blank form 2021: Web if you rent your home, attach a rent certificate.

If Filing A Wisconsin Income Tax Return, Fill In The Credit Amount On Line 30 Of Form 1.

Web homestead tax credit = property taxes x 80% = $1,460 x 80% = $1,168* example b: Please use the link below to. Wisconsin schedule h allows qualifying homeowners or renters who pay property taxes. It is designed to lessen the impact of rent.

For A Claimant With Household Income Greater Than The Income Threshold ($8,060).

Show details we are not affiliated with. Web how do i claim homestead credit? Web click on new document and choose the file importing option: Use fill to complete blank online wisconsin.

Complete, Edit Or Print Tax Forms Instantly.

The rent certificate is a tax form that your landlord needs to complete and sign. Web more about the wisconsin schedule h individual income tax tax credit ty 2022. What is the deadline for filing my 2019 homestead. It includes information about the home you rent and.