Workers Comp 1099 Form

Workers Comp 1099 Form - Workers' compensation is typically one of those legally. Web report wages, tips, and other compensation paid to an employee. Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. Ad success starts with the right supplies. This means that they are generally not covered by an employer’s workers’ compensation plan. From the latest tech to workspace faves, find just what you need at office depot®! Web 14 jun 2016 effect of workman’s compensation on taxability of social security benefits written by harold goedde | posted in 1040 tax calculator • 1099 • disability • social. Web workers' comp insurance for 1099 employees. I am an independent contractor, not an employee of the contractor. Ad covers contractors, truckers, consultants, personal services, cleaning services, & more.

Web 1099 workers are independent contractors, not employees. Web workers' comp insurance for 1099 employees. State laws don’t require employers to provide workers’ comp insurance for 1099 contractors. Ad covers contractors, truckers, consultants, personal services, cleaning services, & more. Millions of forms created with formswift, try free today! I am an independent contractor, not an employee of the contractor. The tax rate for medicare is 1.45 percent each for. Ad success starts with the right supplies. Web 14 jun 2016 effect of workman’s compensation on taxability of social security benefits written by harold goedde | posted in 1040 tax calculator • 1099 • disability • social. Workers' compensation is typically one of those legally.

Web 14 jun 2016 effect of workman’s compensation on taxability of social security benefits written by harold goedde | posted in 1040 tax calculator • 1099 • disability • social. Millions of forms created with formswift, try free today! Web workers' comp insurance for 1099 employees. What about workers' compensation insurance — do you have to include a 1099? Web report wages, tips, and other compensation paid to an employee. Report the employee's income and social security taxes withheld and other information. This means that they are generally not covered by an employer’s workers’ compensation plan. I am an independent contractor, not an employee of the contractor. Web how do taxes apply to a 1099 employee? Ad success starts with the right supplies.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web how do taxes apply to a 1099 employee? Workers' compensation is typically one of those legally. Ad covers contractors, truckers, consultants, personal services, cleaning services, & more. What about workers' compensation insurance — do you have to include a 1099? I am an independent contractor, not an employee of the contractor.

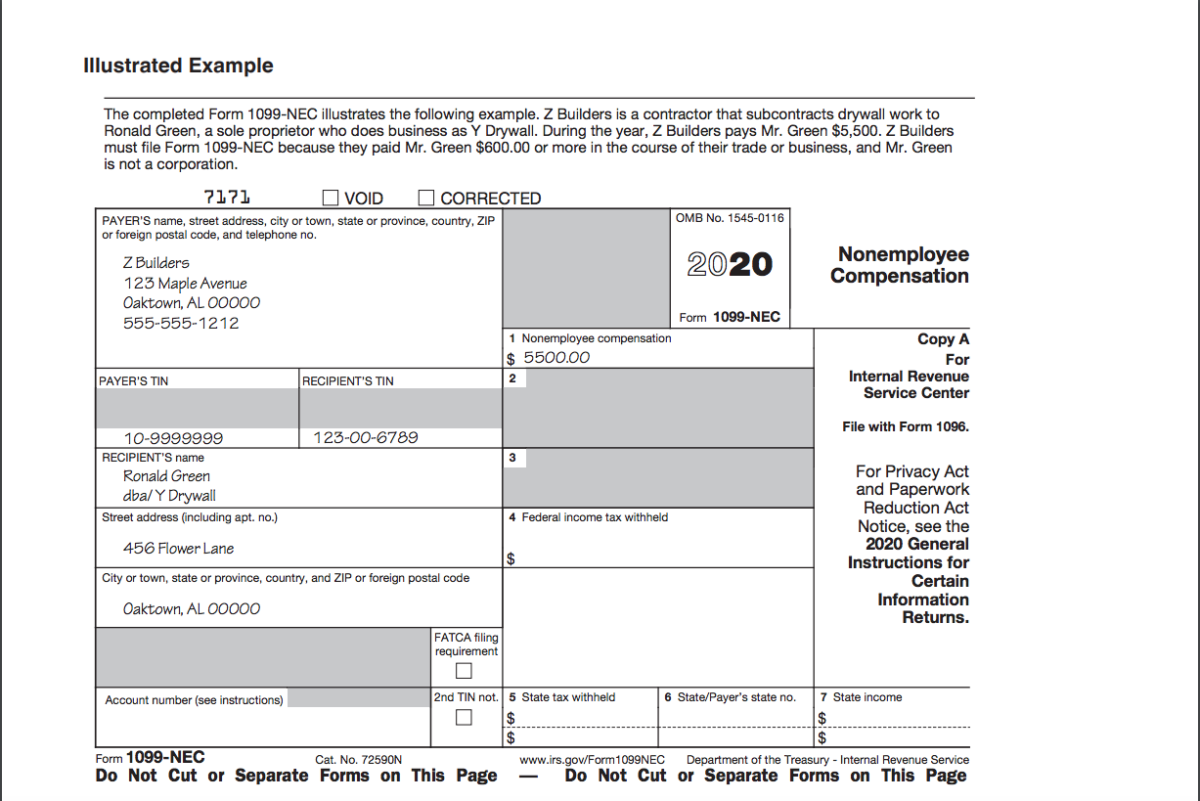

Introducing the New 1099NEC for Reporting Nonemployee Compensation

Web how do taxes apply to a 1099 employee? Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. Ad covers contractors, truckers, consultants, personal services, cleaning services, & more. Web if you received your workers compensation under a workers' compensation act or.

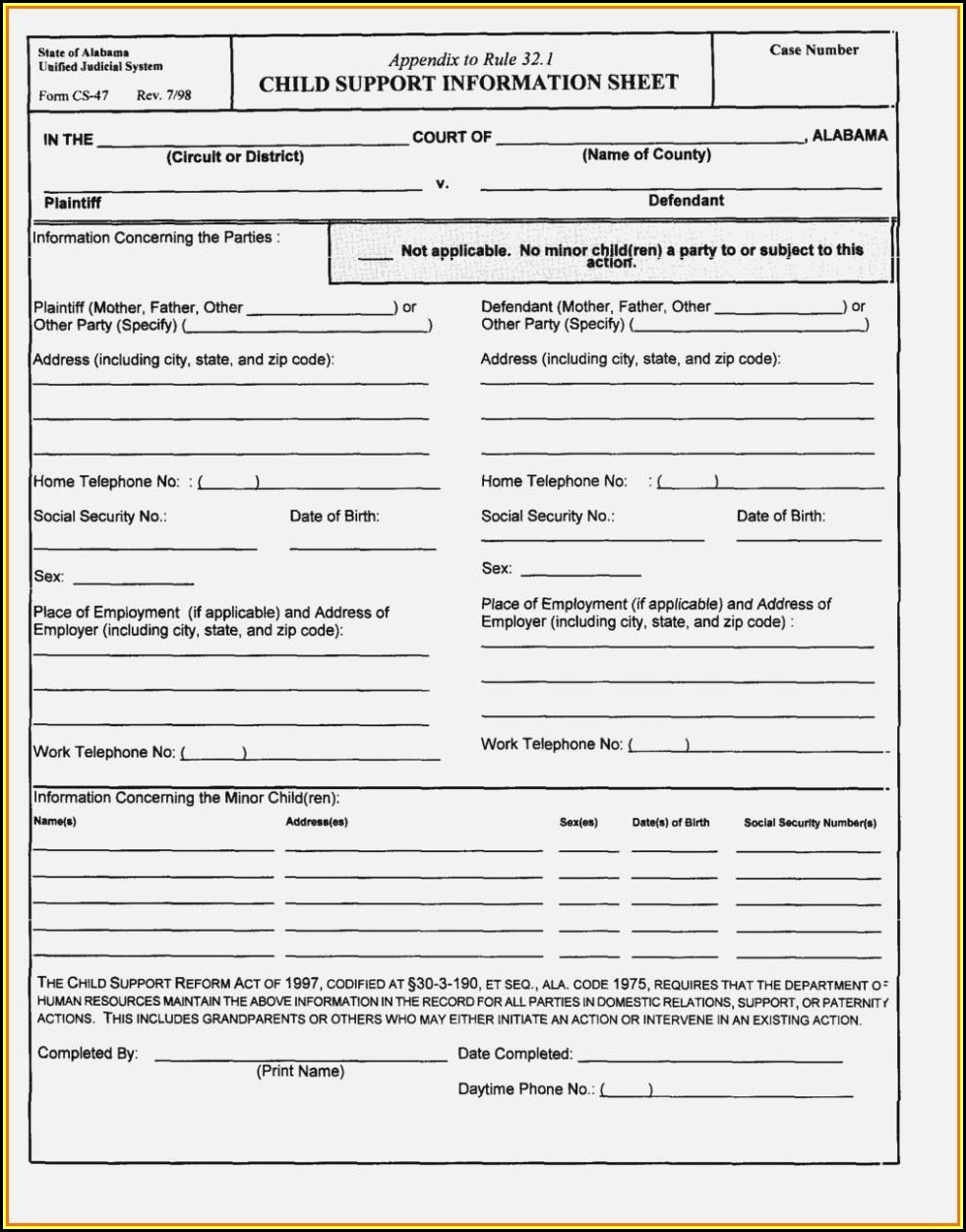

Workmans Comp Exemption Form Form Resume Examples l6YNb0yY3z

Ad success starts with the right supplies. Millions of forms created with formswift, try free today! Report the employee's income and social security taxes withheld and other information. I am an independent contractor, not an employee of the contractor. Find them all in one convenient place.

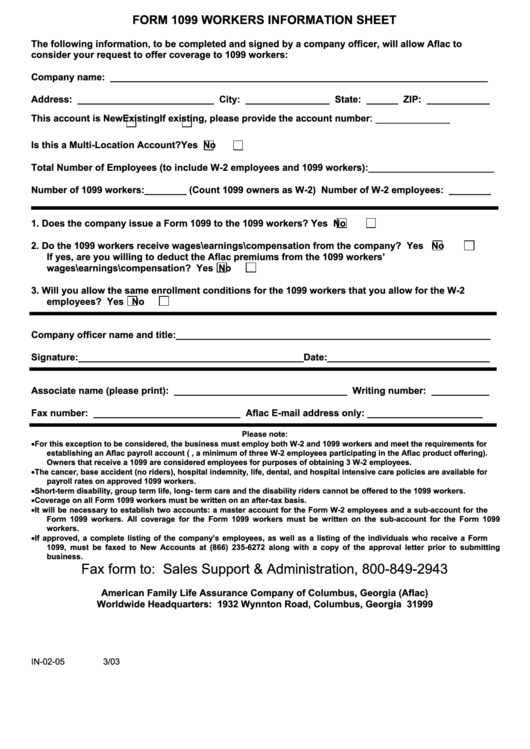

Form 1099 Workers Information Sheet printable pdf download

Workers' compensation is typically one of those legally. From the latest tech to workspace faves, find just what you need at office depot®! Find them all in one convenient place. What about workers' compensation insurance — do you have to include a 1099? Web if you received your workers compensation under a workers' compensation act or a statute in the.

Can I pay my employees a 1099 workers comp YouTube

I am an independent contractor, not an employee of the contractor. Web report wages, tips, and other compensation paid to an employee. State laws don’t require employers to provide workers’ comp insurance for 1099 contractors. Web if you received your workers compensation under a workers' compensation act or a statute in the nature of a workers' compensation act it is.

Fast Answers About 1099 Forms for Independent Workers Small Business

The tax rate for medicare is 1.45 percent each for. Web if you received your workers compensation under a workers' compensation act or a statute in the nature of a workers' compensation act it is not. Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts.

How To Get Form Ssa 1099 Ethel Hernandez's Templates

What about workers' compensation insurance — do you have to include a 1099? This means that they are generally not covered by an employer’s workers’ compensation plan. I am an independent contractor, not an employee of the contractor. From the latest tech to workspace faves, find just what you need at office depot®! Web 1 hour agoan unusual alliance of.

IRS Form 1099NEC Non Employee Compensation

Find them all in one convenient place. Ad success starts with the right supplies. I am an independent contractor, not an employee of the contractor. The tax rate for medicare is 1.45 percent each for. Workers' compensation is typically one of those legally.

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Web 14 jun 2016 effect of workman’s compensation on taxability of social security benefits written by harold goedde | posted in 1040 tax calculator • 1099 • disability • social. From the latest tech to workspace faves, find just what you need at office depot®! Millions of forms created with formswift, try free today! What about workers' compensation insurance —.

Free Printable 1099 Misc Forms Free Printable

Workers' compensation is typically one of those legally. Web report wages, tips, and other compensation paid to an employee. Web if you received your workers compensation under a workers' compensation act or a statute in the nature of a workers' compensation act it is not. I do not want workers compensation insurance and understand that i am not eligible for.

I Do Not Want Workers Compensation Insurance And Understand That I Am Not Eligible For Workers.

Web how do taxes apply to a 1099 employee? Millions of forms created with formswift, try free today! Web workers' comp insurance for 1099 employees. The tax rate for medicare is 1.45 percent each for.

I Am An Independent Contractor, Not An Employee Of The Contractor.

State laws don’t require employers to provide workers’ comp insurance for 1099 contractors. Ad success starts with the right supplies. Web 14 jun 2016 effect of workman’s compensation on taxability of social security benefits written by harold goedde | posted in 1040 tax calculator • 1099 • disability • social. Workers' compensation is typically one of those legally.

What About Workers' Compensation Insurance — Do You Have To Include A 1099?

Web report wages, tips, and other compensation paid to an employee. Find them all in one convenient place. Ad covers contractors, truckers, consultants, personal services, cleaning services, & more. From the latest tech to workspace faves, find just what you need at office depot®!

This Means That They Are Generally Not Covered By An Employer’s Workers’ Compensation Plan.

Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. Web if you received your workers compensation under a workers' compensation act or a statute in the nature of a workers' compensation act it is not. Report the employee's income and social security taxes withheld and other information. Ad covers contractors, truckers, consultants, personal services, cleaning services, & more.