Wr 30 Form Nj

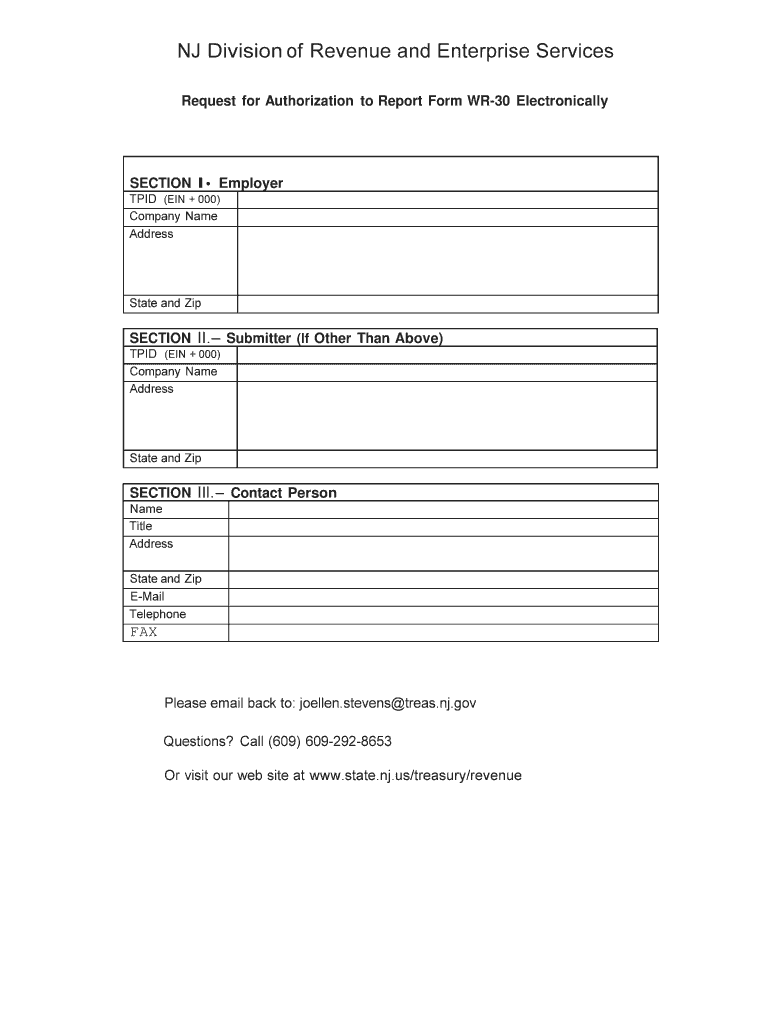

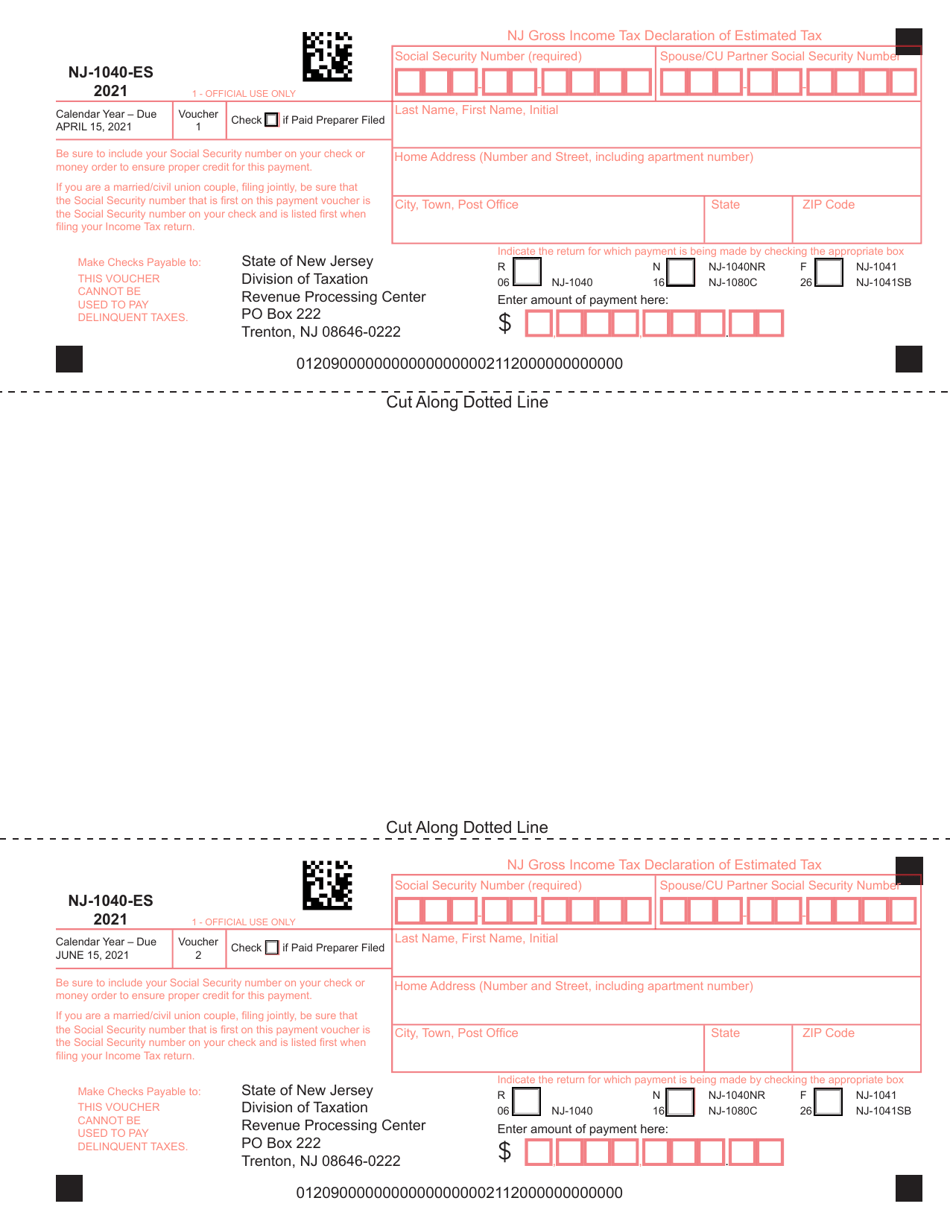

Wr 30 Form Nj - Web employer payroll tax electronic filing and reporting options. You may file the forms online here. Web companies must get approval from the new jersey division of revenue if they develop: Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Nj division of revenue and. Use this option to fill in and electronically file the following form (s): Penalties range from $5.00 to $25.00 per employee record error. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following.

Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Penalties range from $5.00 to $25.00 per employee record error. Nj division of revenue and. Web companies must get approval from the new jersey division of revenue if they develop: Web employer payroll tax electronic filing and reporting options. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. You may file the forms online here. Use this option to fill in and electronically file the following form (s):

You may file the forms online here. Web companies must get approval from the new jersey division of revenue if they develop: This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Nj division of revenue and. Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): Penalties range from $5.00 to $25.00 per employee record error.

New Jersey Wr 30 Form Fill Online, Printable, Fillable, Blank pdfFiller

This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): Web companies must get approval from the new jersey division of revenue if they develop: Nj.

NJ MVCTransferring Vehicle Ownership Form Fill Out and Sign Printable

Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Web employer payroll tax electronic filing and reporting options. Nj division of revenue and. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Use this option to fill in and electronically file the.

Nj Wr 30 Form Fill Out and Sign Printable PDF Template signNow

Penalties range from $5.00 to $25.00 per employee record error. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Use this option to fill in and electronically file the following form (s): Web.

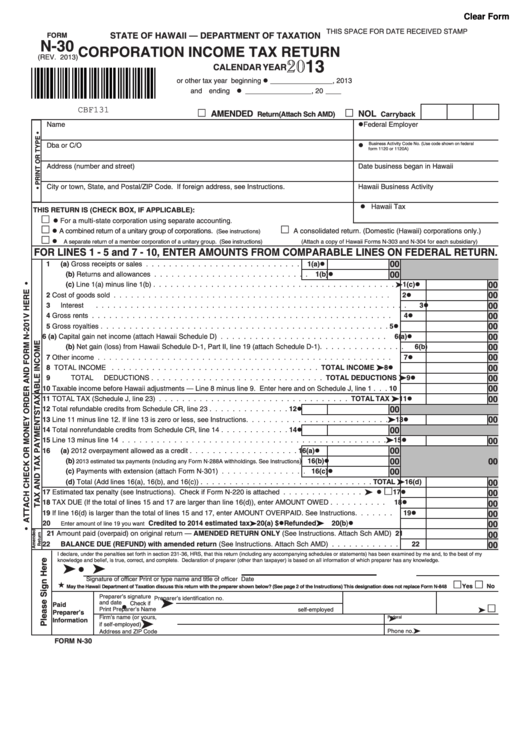

Fillable Form N30 Corporation Tax Return 2013 printable pdf

You may file the forms online here. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Use this option to fill in and electronically file the following form (s): Web employer payroll tax electronic filing and reporting options. Web companies must get approval from the new jersey division of revenue if they develop:

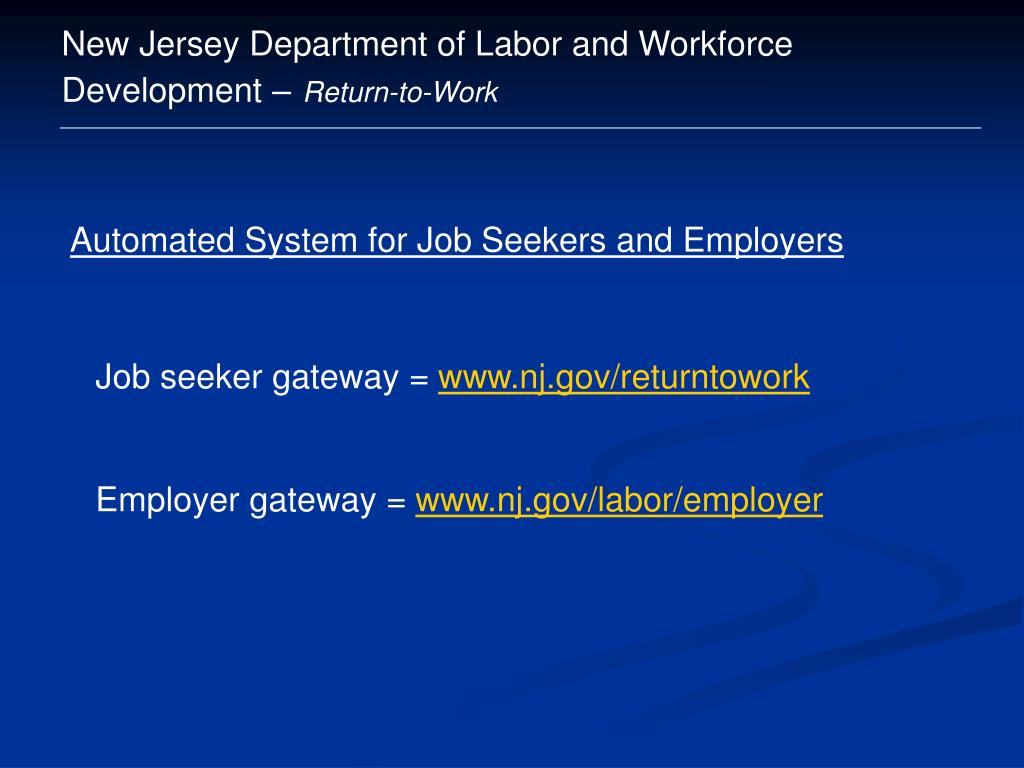

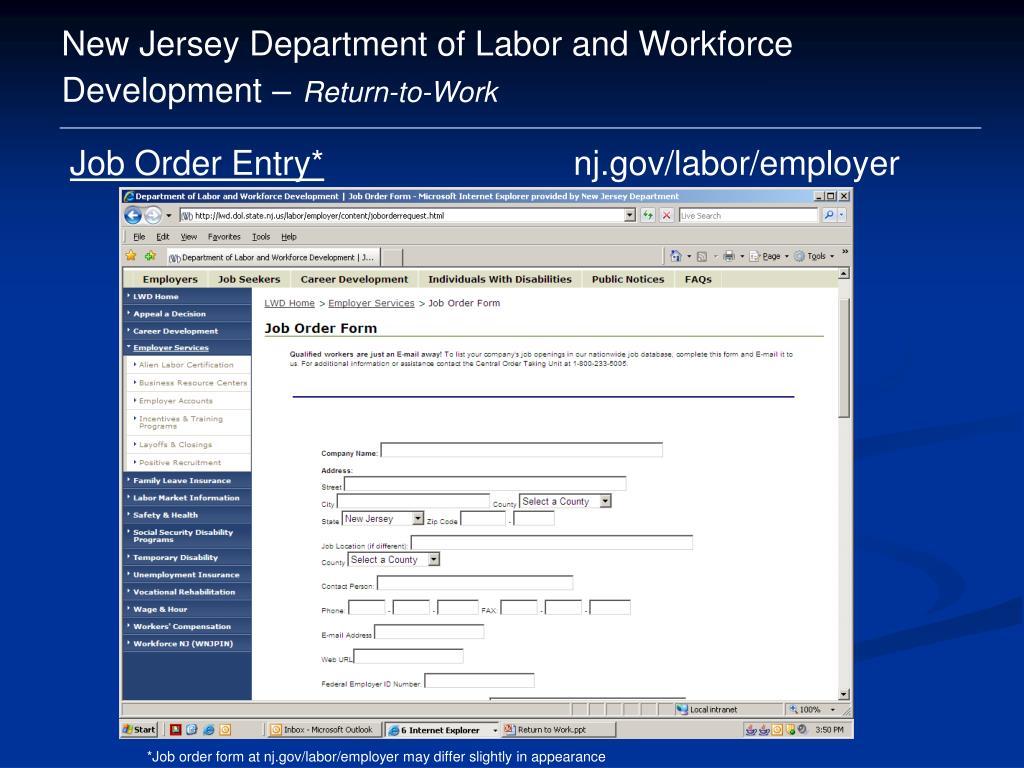

PPT New Jersey Department of Labor and Workforce Development Return

Nj division of revenue and. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web employer payroll tax electronic filing and reporting options. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Penalties range from $5.00 to $25.00 per employee record error.

Form Nj 165 Download Fillable Pdf Or Fill Online Employee S Certificate

Nj division of revenue and. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web employer payroll tax electronic filing and reporting options. Web companies must get approval from the new jersey division of revenue if they develop: Penalties range from $5.00 to $25.00 per employee record.

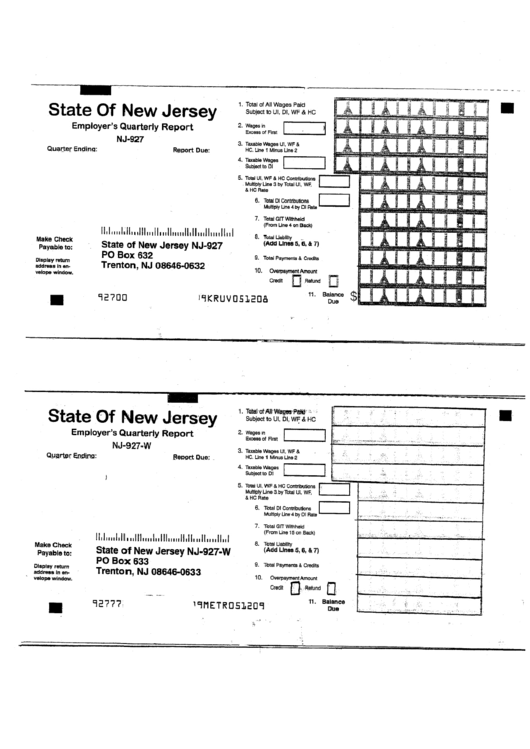

Form Nj927 Employer'S Quarterly Report Form printable pdf download

Nj division of revenue and. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): You may file the forms online here.

NWBreaks Largent Blue Jersey Razz 7/1/2017 YouTube

Web companies must get approval from the new jersey division of revenue if they develop: Web employer payroll tax electronic filing and reporting options. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Use this option to fill in and electronically file the following form (s): Nj division of revenue and.

2008 Playoff Absolute Memorabilia War Room WR30 Matt Ryan /250

Penalties range from $5.00 to $25.00 per employee record error. Use this option to fill in and electronically file the following form (s): This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web employer payroll tax electronic filing and reporting options. Web companies must get approval from.

PPT New Jersey Department of Labor and Workforce Development Return

You may file the forms online here. Nj division of revenue and. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Web employer payroll tax electronic filing and reporting options. Web companies must get approval from the new jersey division of revenue if they develop:

Nj Division Of Revenue And.

Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: You may file the forms online here. Penalties range from $5.00 to $25.00 per employee record error. Web employer payroll tax electronic filing and reporting options.

Use This Option To Fill In And Electronically File The Following Form (S):

Web companies must get approval from the new jersey division of revenue if they develop: This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following.