1099 Composite Form

1099 Composite Form - This includes the associated cost basis. Web your form 1099 composite may include the following internal revenue service (irs) forms: The irs compares reported income. Most often, multiple forms 1099. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. See how various types of irs form 1099 work. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. The document should contain three separate tax documents that you need to. At least $10 in royalties or broker. Go to www.irs.gov/freefile to see if you.

Web a 1099 composite is a consolidated statement listing the 1099s that have been issued by a financial institution to the taxpayer. Web what is a 1099 form? See how various types of irs form 1099 work. The irs compares reported income. Web if you have questions about the amounts reported on this form, contact the filer whose information is shown in the upper left corner on the front of this form. Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. Web your form 1099 composite may include the following internal revenue service (irs) forms: There is no need to report each mutual fund separately if schwab is reporting. Go to www.irs.gov/freefile to see if you. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that.

Go to www.irs.gov/freefile to see if you. At least $10 in royalties or broker. Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: Most often, multiple forms 1099. Web if you have questions about the amounts reported on this form, contact the filer whose information is shown in the upper left corner on the front of this form. Web your form 1099 composite may include the following internal revenue service (irs) forms: Web a composite has more than one type of 1099. Find out if you will receive 1099 forms from employers or. Web what is a 1099 form? The irs compares reported income.

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

There is no need to report each mutual fund separately if schwab is reporting. Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. Web charles schwab 1099 composite form just report it as it is reported to you by schwab; Web a composite has more than one.

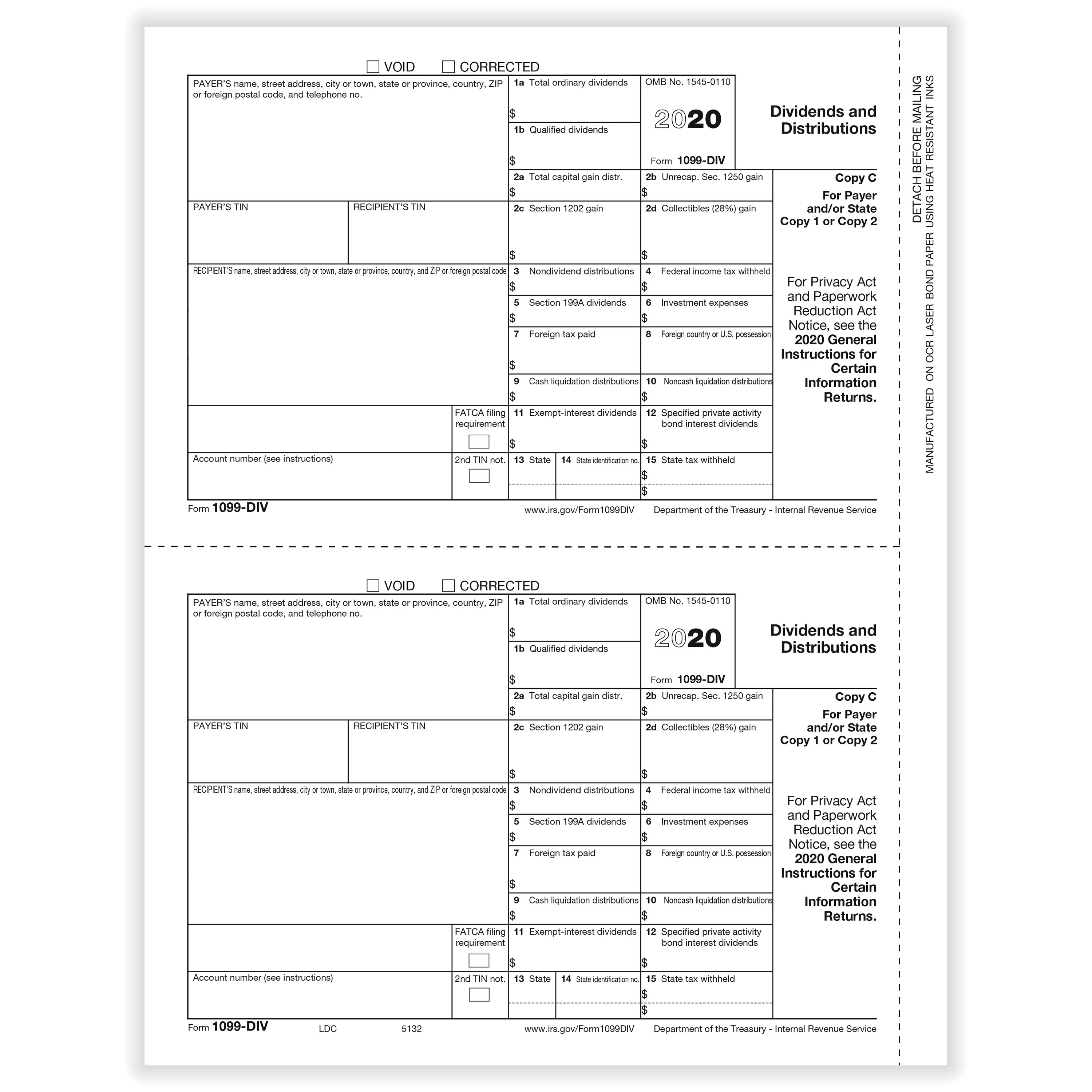

Form 1099DIV, Dividends and Distributions, State Copy 1

Please see this answer from richardg. The document should contain three separate tax documents that you need to. Web a 1099 composite is a consolidated statement listing the 1099s that have been issued by a financial institution to the taxpayer. Web your form 1099 composite may include the following internal revenue service (irs) forms: Web the composite 1099 form is.

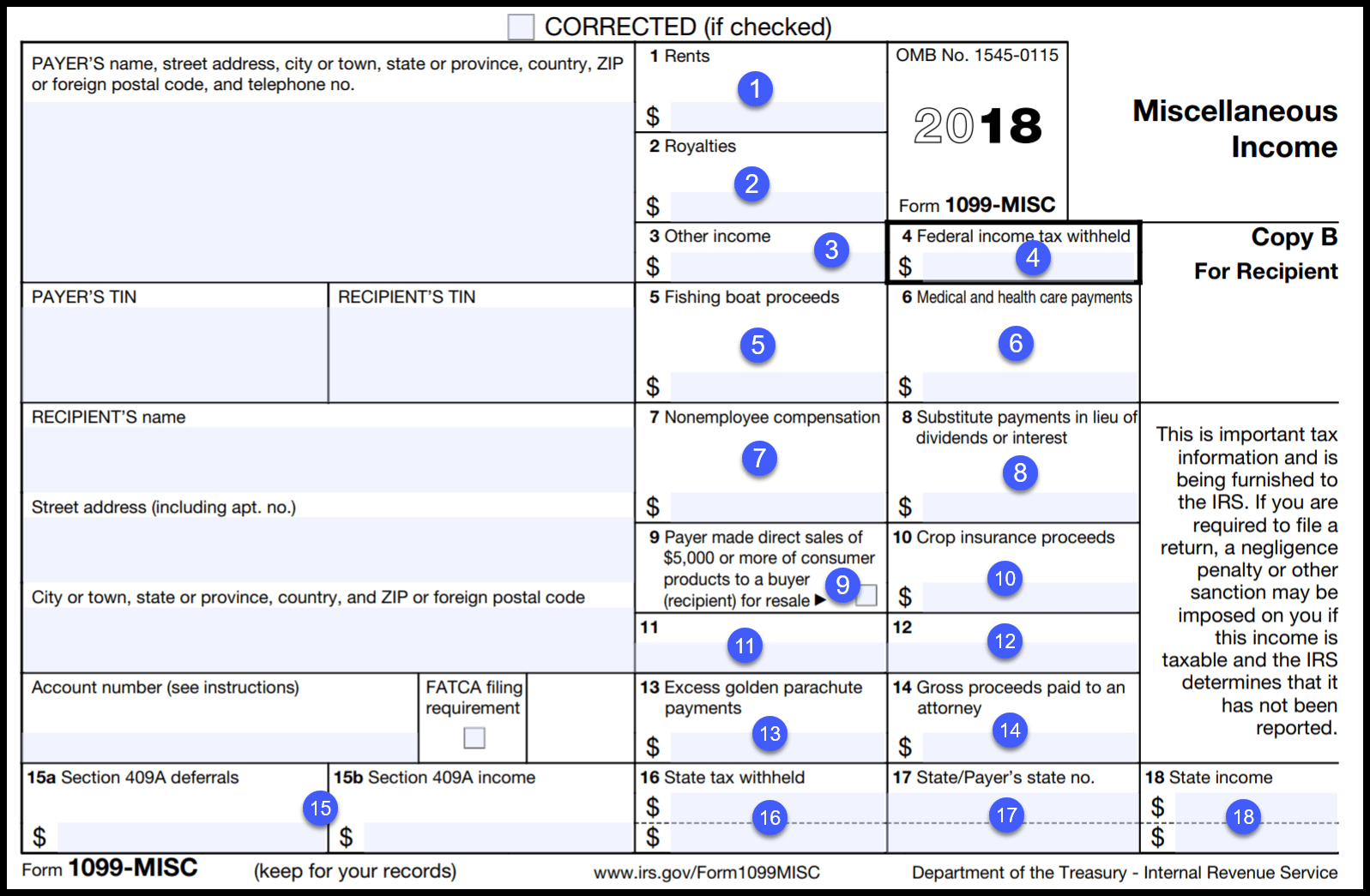

Form 1099

This includes the associated cost basis. Web a composite has more than one type of 1099. Web if you have questions about the amounts reported on this form, contact the filer whose information is shown in the upper left corner on the front of this form. Web your form 1099 composite may include the following internal revenue service (irs) forms:.

1099DIV Payer and State Copies Formstax

See how various types of irs form 1099 work. The document should contain three separate tax documents that you need to report: Web a 1099 composite is a consolidated statement listing the 1099s that have been issued by a financial institution to the taxpayer. The irs compares reported income. Web charles schwab 1099 composite form just report it as it.

IRS Form 1099 Reporting for Small Business Owners

This includes the associated cost basis. Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite: Web what is a 1099 form? Please see this answer from richardg. Web charles schwab 1099 composite form just report it as it is reported to you by schwab;

united states Why no 1099 for short term capital gains from stocks

Web a composite has more than one type of 1099. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. Those will be mailed no later than the. The irs compares reported income. Web if you have questions about the amounts reported on this form, contact the filer whose information is.

What You Should Know About Form1099 Real Guest Bloggers

This includes the associated cost basis. Web a composite has more than one type of 1099. There is no need to report each mutual fund separately if schwab is reporting. Web charles schwab 1099 composite form just report it as it is reported to you by schwab; Web how do i enter information from a 1099 composite?

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

Web a 1099 composite is a consolidated statement listing the 1099s that have been issued by a financial institution to the taxpayer. There is no need to report each mutual fund separately if schwab is reporting. Web if you have questions about the amounts reported on this form, contact the filer whose information is shown in the upper left corner.

1099INT A Quick Guide to This Key Tax Form The Motley Fool

The irs compares reported income. This includes the associated cost basis. The document should contain three separate tax documents that you need to report: Most often, multiple forms 1099. Web a composite has more than one type of 1099.

united states Why no 1099 for short term capital gains from stocks

Web learn what a 1099 irs tax form is, and the different types of 1099 forms with the experts at h&r block. The document should contain three separate tax documents that you need to report: Most often, multiple forms 1099. Go to www.irs.gov/freefile to see if you. Web charles schwab 1099 composite form just report it as it is reported.

Web The Composite 1099 Form Is A Consolidation Of Various Forms 1099 And Summarizes Relevant Account Information For The Past Year.

The document should contain three separate tax documents that you need to report: There is no need to report each mutual fund separately if schwab is reporting. Web how do i enter information from a 1099 composite? Go to www.irs.gov/freefile to see if you.

Those Will Be Mailed No Later Than The.

There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. Web a 1099 composite is a consolidated statement listing the 1099s that have been issued by a financial institution to the taxpayer. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web if you have questions about the amounts reported on this form, contact the filer whose information is shown in the upper left corner on the front of this form.

Web Learn What A 1099 Irs Tax Form Is, And The Different Types Of 1099 Forms With The Experts At H&R Block.

Web what is a 1099 form? This includes the associated cost basis. At least $10 in royalties or broker. Web your form 1099 composite may include the following internal revenue service (irs) forms:

Web A 1099 Form Is A Tax Record That An Entity Or Person — Not Your Employer — Gave Or Paid You Money.

Web what is a 1099 form? The irs compares reported income. The document should contain three separate tax documents that you need to. Web the primary forms of income you'll need to include in your tax filing are contained in the following three sections of your 1099 composite:

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)