1099 Nanny Form

1099 Nanny Form - Complete, edit or print tax forms instantly. Forms for setting up as an employer 1. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion. Web the internal revenue service classifies nannies as household employees. Nanny & household tax and payroll service No, she is not a household employee. Web steps to create w2 for nanny. By renee booker if you employed a nanny to help care for your children during the year, you must report the income paid to her on the appropriate. As you probably already know, this is illegal. Get ready for tax season deadlines by completing any required tax forms today.

Get ready for tax season deadlines by completing any required tax forms today. By renee booker if you employed a nanny to help care for your children during the year, you must report the income paid to her on the appropriate. Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment. Web key takeaways if you control what work your nanny does and how they do it, the irs likely will consider them your employee. Therefore, families must report them by using a form w2. Web the internal revenue service classifies nannies as household employees. The social security administration offers online tools to employers. Web should you 1099 a nanny? As you probably already know, this is illegal. Nanny & household tax and payroll service

Get ready for tax season deadlines by completing any required tax forms today. Web the internal revenue service classifies nannies as household employees. Withheld federal taxes regardless of. Web 1 best answer. Nanny & household tax and payroll service As you probably already know, this is illegal. Web steps to create w2 for nanny. Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; Simply answer a few question to instantly download, print & share your form. Ad access irs tax forms.

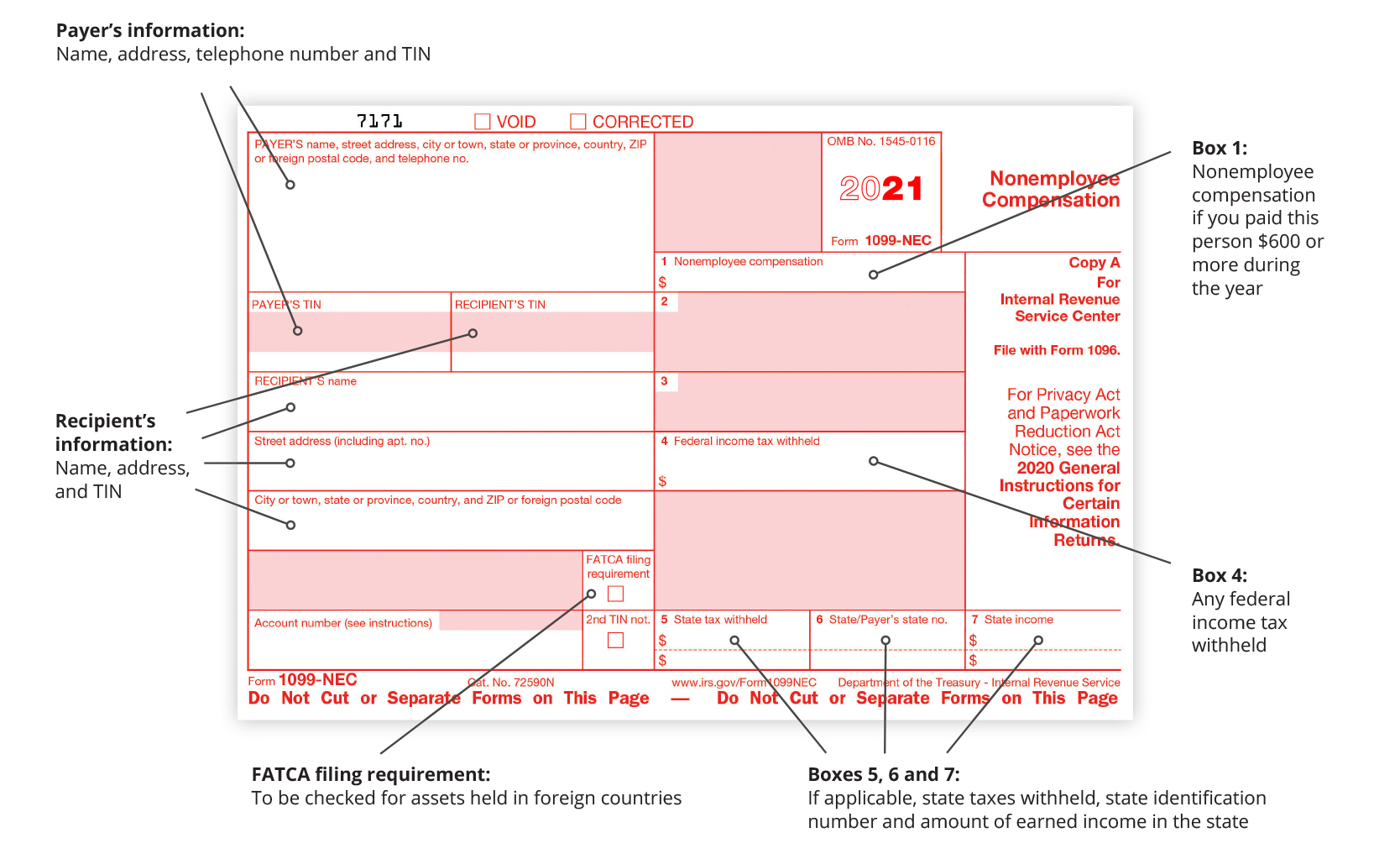

Form1099NEC

Simply answer a few question to instantly download, print & share your form. Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment. Web the taxpayer is neither a trained nurse nor therapist and doesn't provide such services to anyone other than her spouse. Nanny.

11 Common Misconceptions About Irs Form 11 Form Information Free

Web nanny taxes refer to the payroll taxes household employers are supposed to withhold and pay from a household employee's paycheck. By renee booker if you employed a nanny to help care for your children during the year, you must report the income paid to her on the appropriate. If you earn $2,600 or more during the calendar year, your.

Fillable Form 1099 Form Resume Examples xz20gvGVql

Nanny & household tax and payroll service Takes 5 minutes or less to complete. Complete, edit or print tax forms instantly. Web 1 best answer. Web should you 1099 a nanny?

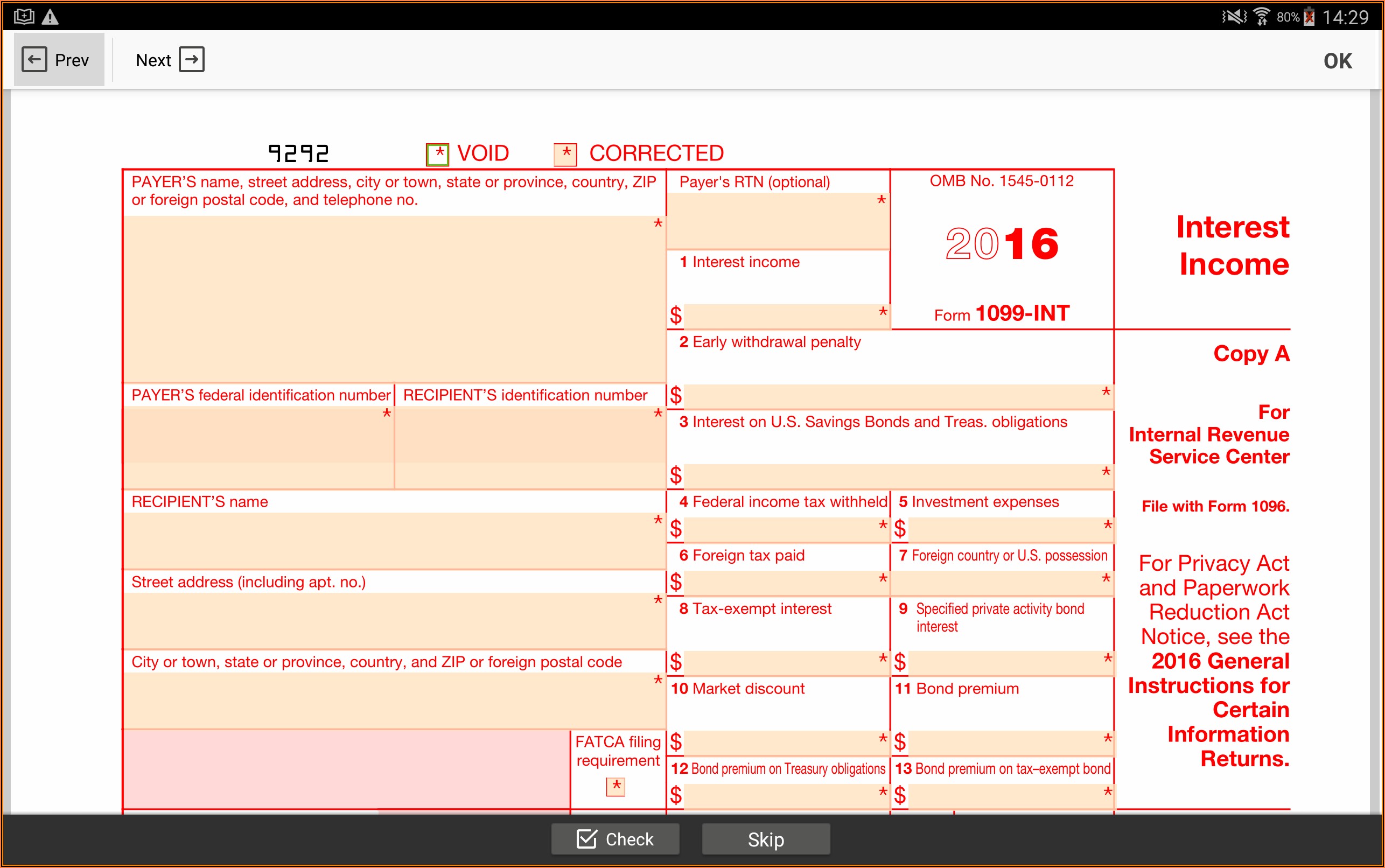

Form 1099INT Interest , Recipient's State Copy 2

If you earn $2,600 or more during the calendar year, your employer has until january 31st of the following year to send you. Web here are the 10 nanny tax forms every household employer will need. Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; Web steps to create w2 for nanny. No,.

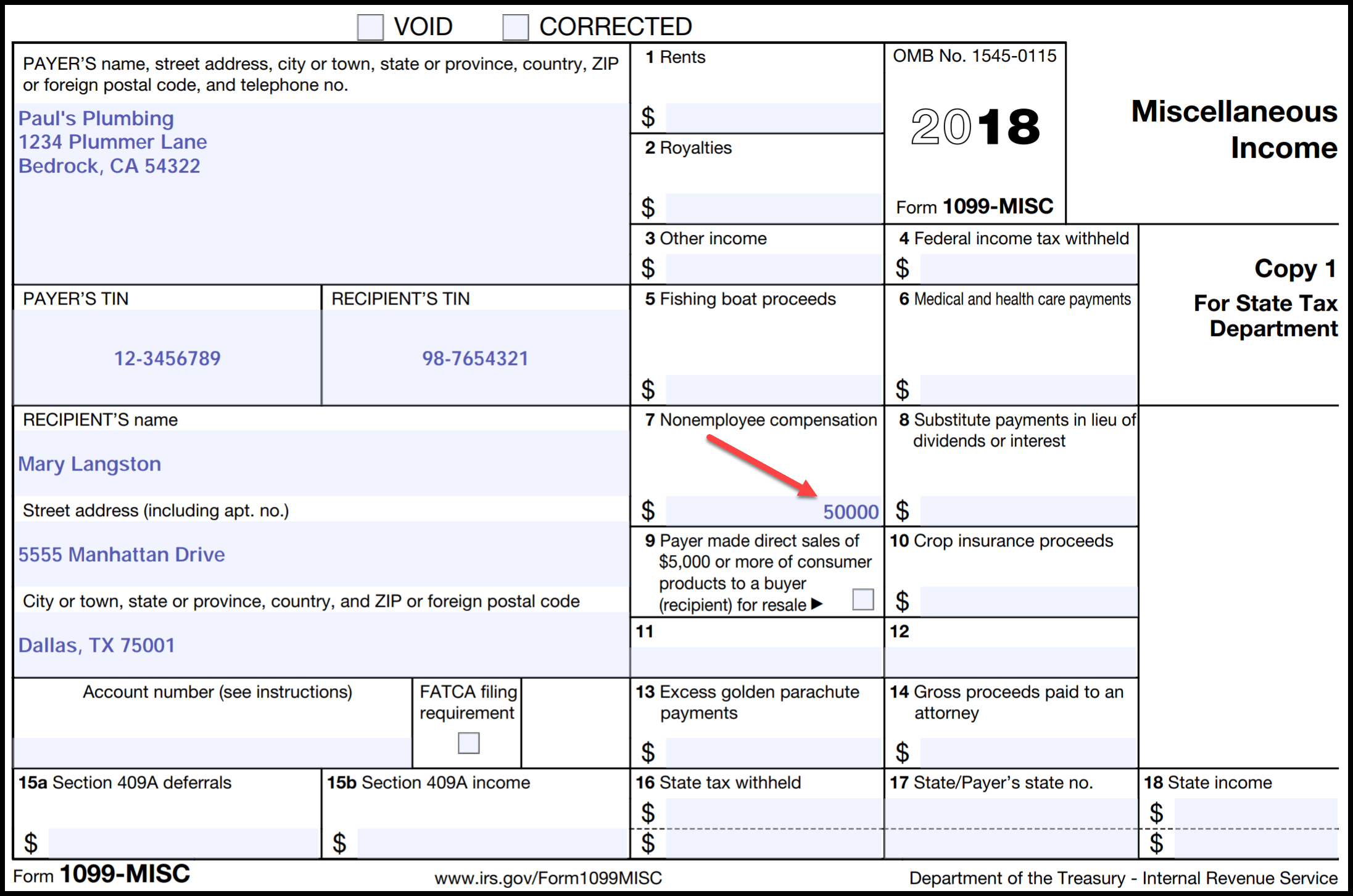

What is a 1099Misc Form? Financial Strategy Center

The social security administration offers online tools to employers. When you hire someone to work in your. As you probably already know, this is illegal. Ad access irs tax forms. Web here are the 10 nanny tax forms every household employer will need.

25 ++ sample completed 1099 misc form 2020 325140How to fill in 1099

Takes 5 minutes or less to complete. We will explain why you must use a. Nanny & household tax and payroll service Withheld federal taxes regardless of. Web the taxpayer is neither a trained nurse nor therapist and doesn't provide such services to anyone other than her spouse.

Form 1099 Misc Fillable Universal Network

The social security administration offers online tools to employers. Nanny & household tax and payroll service Web the taxpayer is neither a trained nurse nor therapist and doesn't provide such services to anyone other than her spouse. When you hire someone to work in your. For 2020, the annual wage.

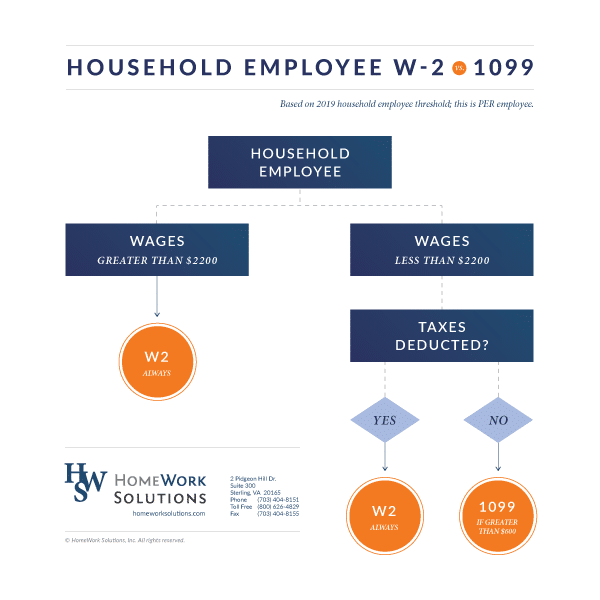

13 Form Nanny Understanding The Background Of 13 Form Nanny AH

Takes 5 minutes or less to complete. Withheld federal taxes regardless of. Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; Nanny & household tax and payroll service Ad care.com® homepay℠ can help you manage your nanny taxes.

13 Form Nanny Understanding The Background Of 13 Form Nanny AH

Web here are the 10 nanny tax forms every household employer will need. Nanny & household tax and payroll service Takes 5 minutes or less to complete. By renee booker if you employed a nanny to help care for your children during the year, you must report the income paid to her on the appropriate. Therefore, families must report them.

Free Nanny Contract — Nanny Counsel Nanny, Nanny tax, Nanny contract

The social security administration offers online tools to employers. Complete, edit or print tax forms instantly. We will explain why you must use a. Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment. Web should you 1099 a nanny?

Web Here Are The 10 Nanny Tax Forms Every Household Employer Will Need.

Ad care.com® homepay℠ can help you manage your nanny taxes. Get ready for tax season deadlines by completing any required tax forms today. Simply answer a few question to instantly download, print & share your form. Web the employer says they will give you a 1099.

Web Steps To Create W2 For Nanny.

Web the internal revenue service classifies nannies as household employees. Web key takeaways if you control what work your nanny does and how they do it, the irs likely will consider them your employee. Nanny & household tax and payroll service Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or;

Web Nanny Taxes Refer To The Payroll Taxes Household Employers Are Supposed To Withhold And Pay From A Household Employee's Paycheck.

Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment. Takes 5 minutes or less to complete. For 2020, the annual wage. Web 1 best answer.

No, She Is Not A Household Employee.

If you earn $2,600 or more during the calendar year, your employer has until january 31st of the following year to send you. Forms for setting up as an employer 1. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion. Web the taxpayer is neither a trained nurse nor therapist and doesn't provide such services to anyone other than her spouse.