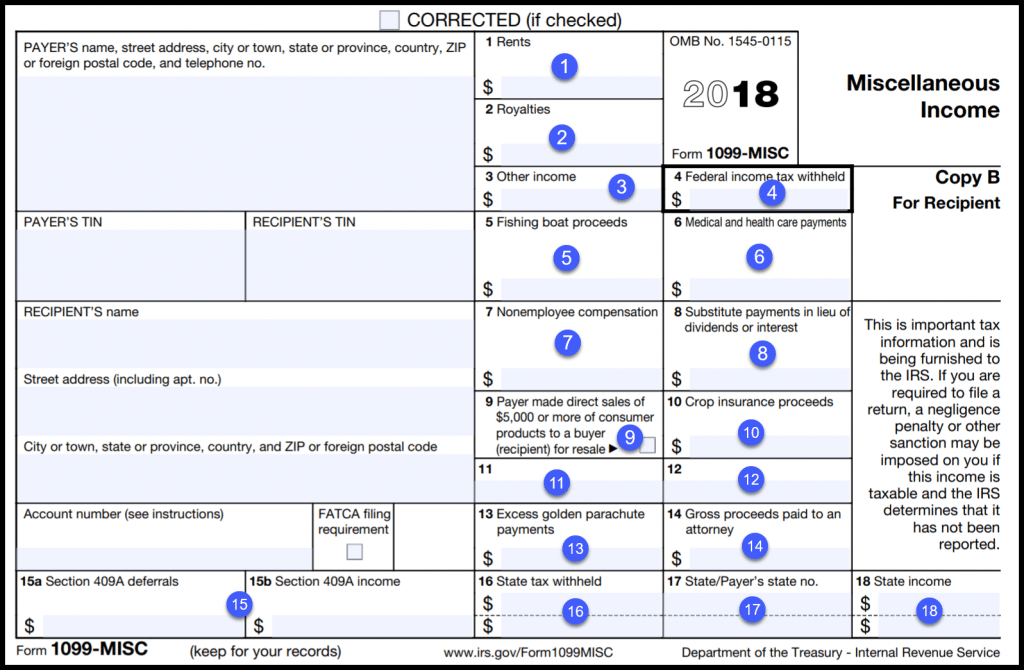

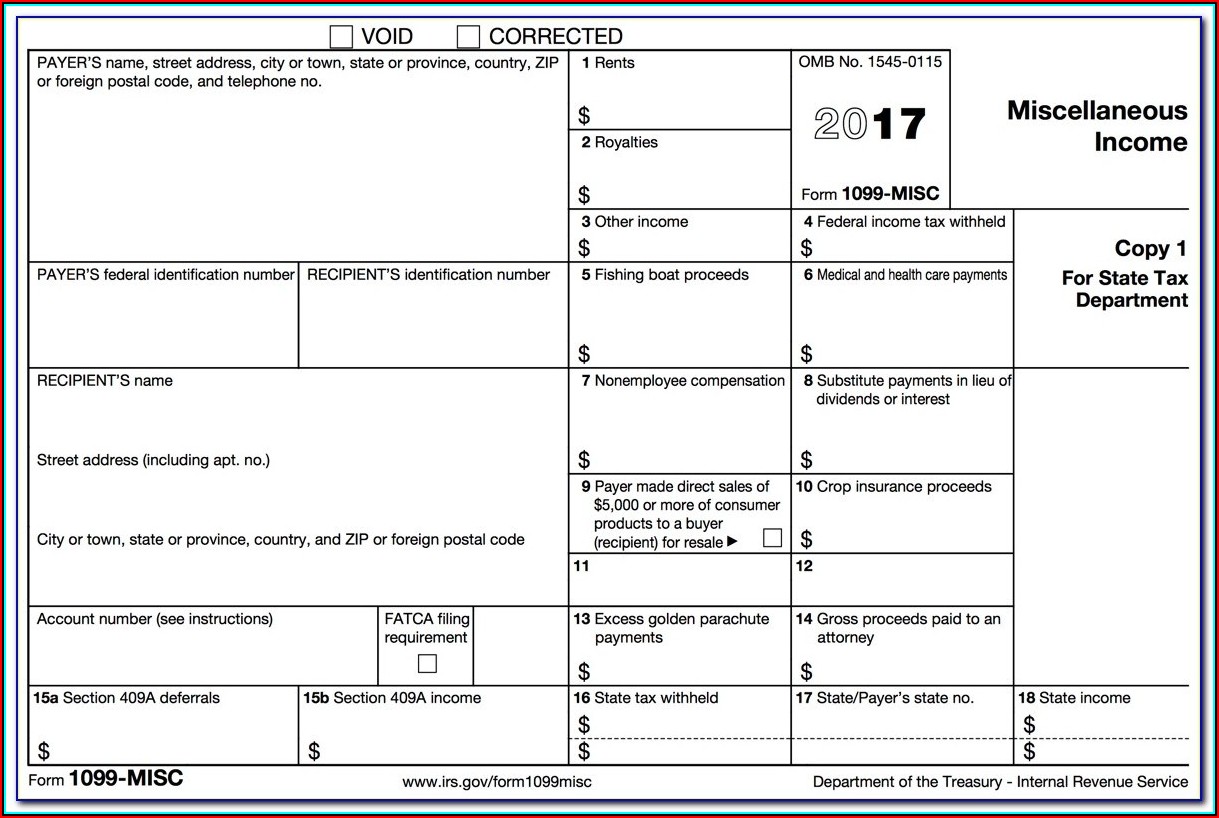

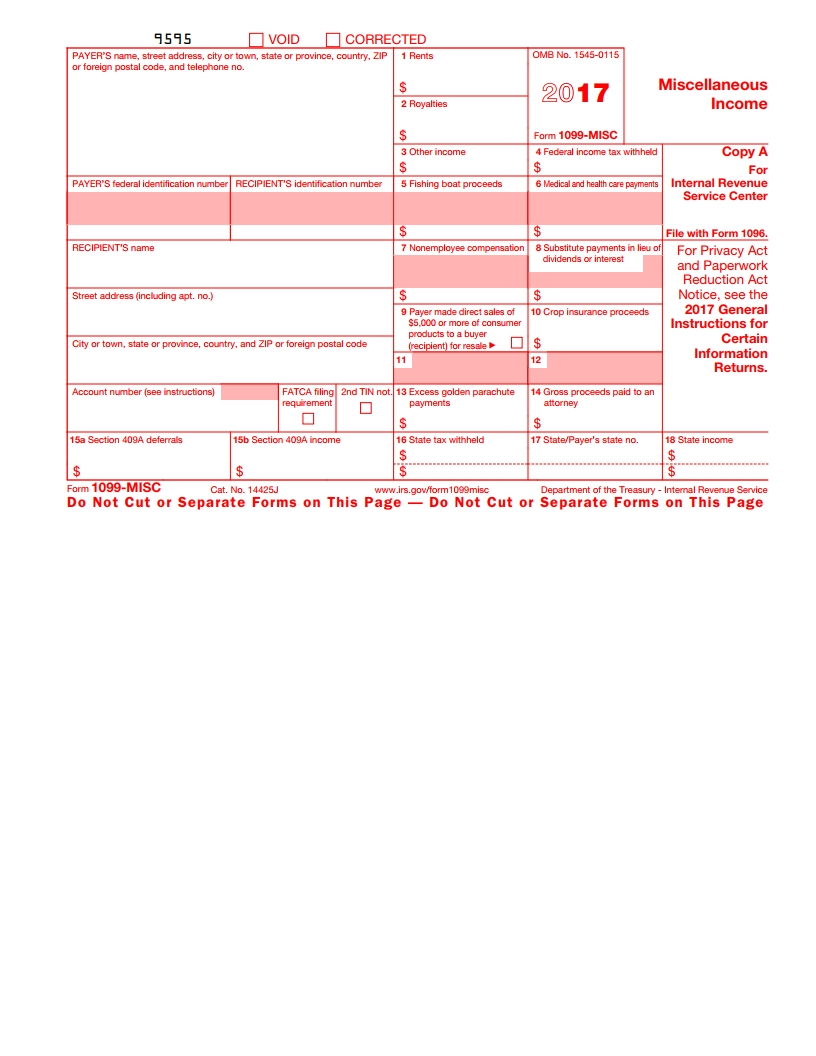

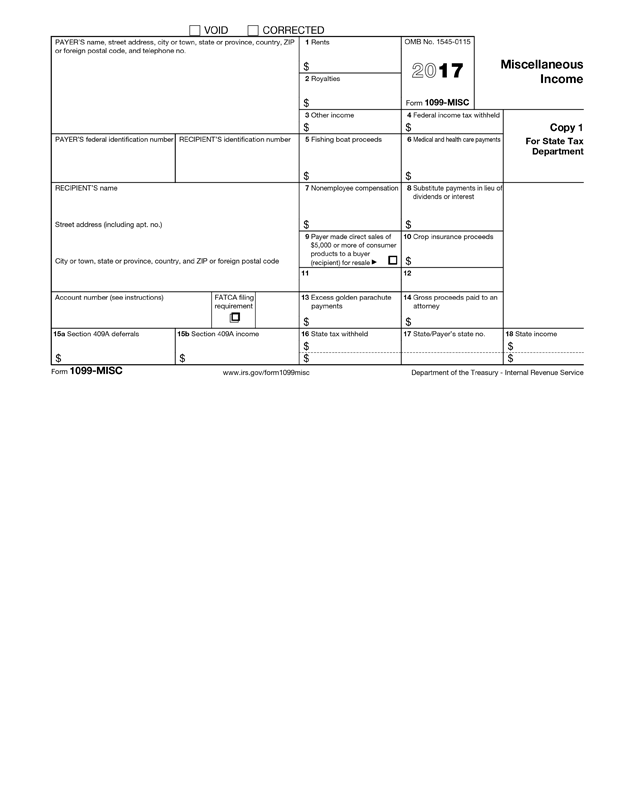

Blank 1099 Misc Form

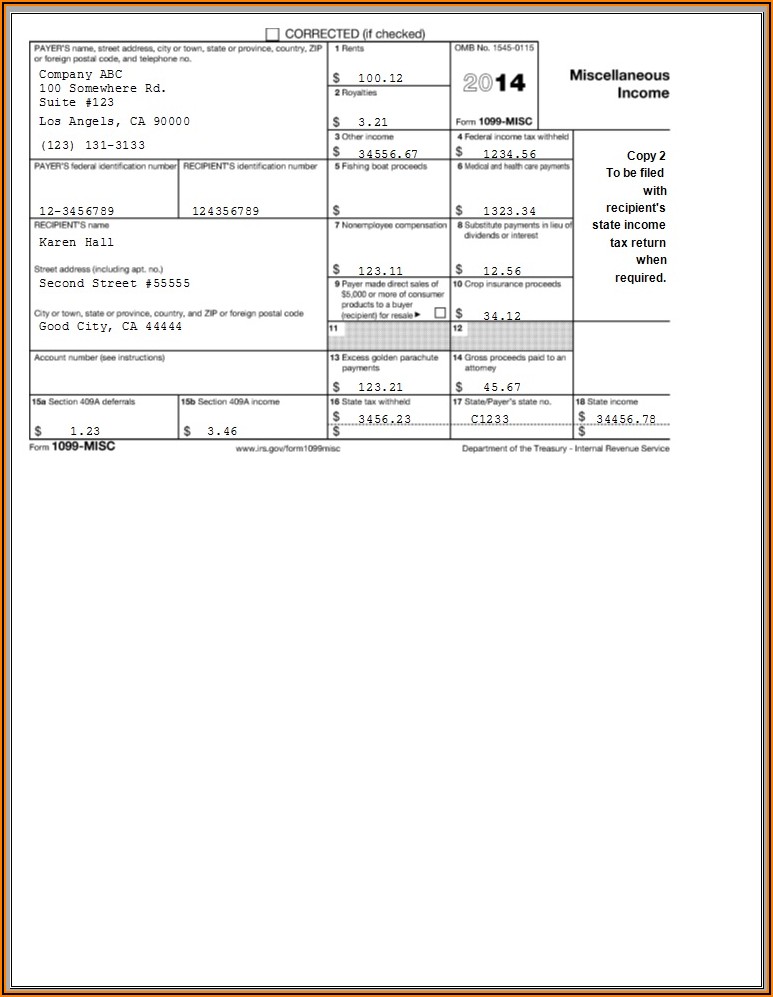

Blank 1099 Misc Form - Payments you make to businesses that sell physical products or goods — rather than provide services. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Both the forms and instructions will be updated as needed. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Cash paid from a notional principal contract made to an individual, partnership, or. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. Web instructions for recipient recipient’s taxpayer identification number (tin).

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Both the forms and instructions will be updated as needed. Web instructions for recipient recipient’s taxpayer identification number (tin). Cash paid from a notional principal contract made to an individual, partnership, or. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Payments you make to businesses that sell physical products or goods — rather than provide services.

However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. Web instructions for recipient recipient’s taxpayer identification number (tin). Payments you make to businesses that sell physical products or goods — rather than provide services. Cash paid from a notional principal contract made to an individual, partnership, or. Both the forms and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).

IRS Form 1099 Reporting for Small Business Owners

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Cash paid from a notional principal contract made to an individual, partnership, or. Both the forms and.

1099 Misc Blank Form 2019 Form Resume Examples 76YGKqy0Yo

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Both the forms and instructions will be updated as needed. Nor are they required for payments to a c corporation or an s corporation unless the payment.

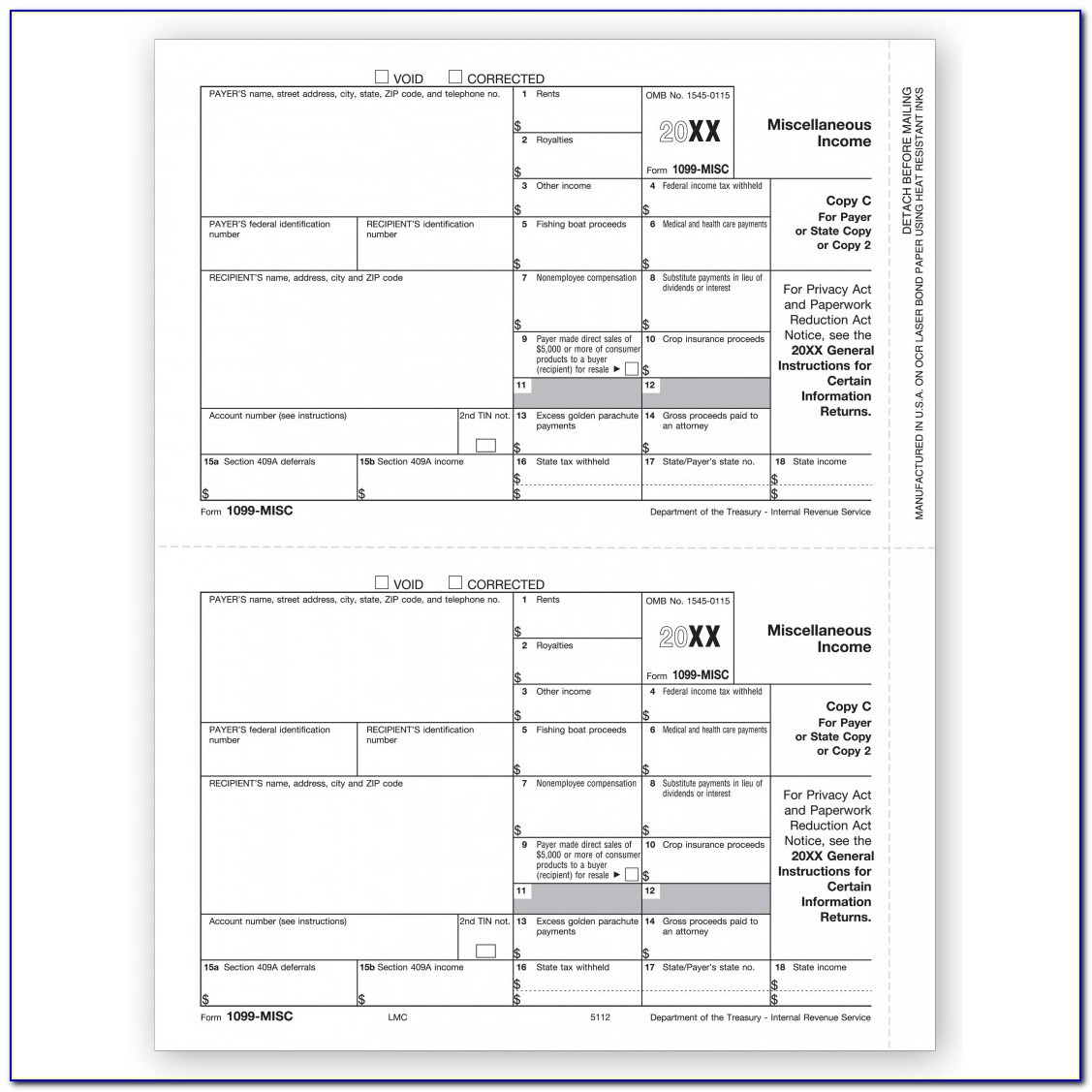

Free Printable 1099 Misc Forms Free Printable

However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Web instructions for recipient recipient’s taxpayer identification number (tin). Payments you make to businesses that sell physical products or goods — rather than provide services. Cash paid from a notional principal contract made to an individual, partnership, or. Both the forms.

1099 Misc Fillable Form Free amulette

Both the forms and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Cash paid from a notional principal contract.

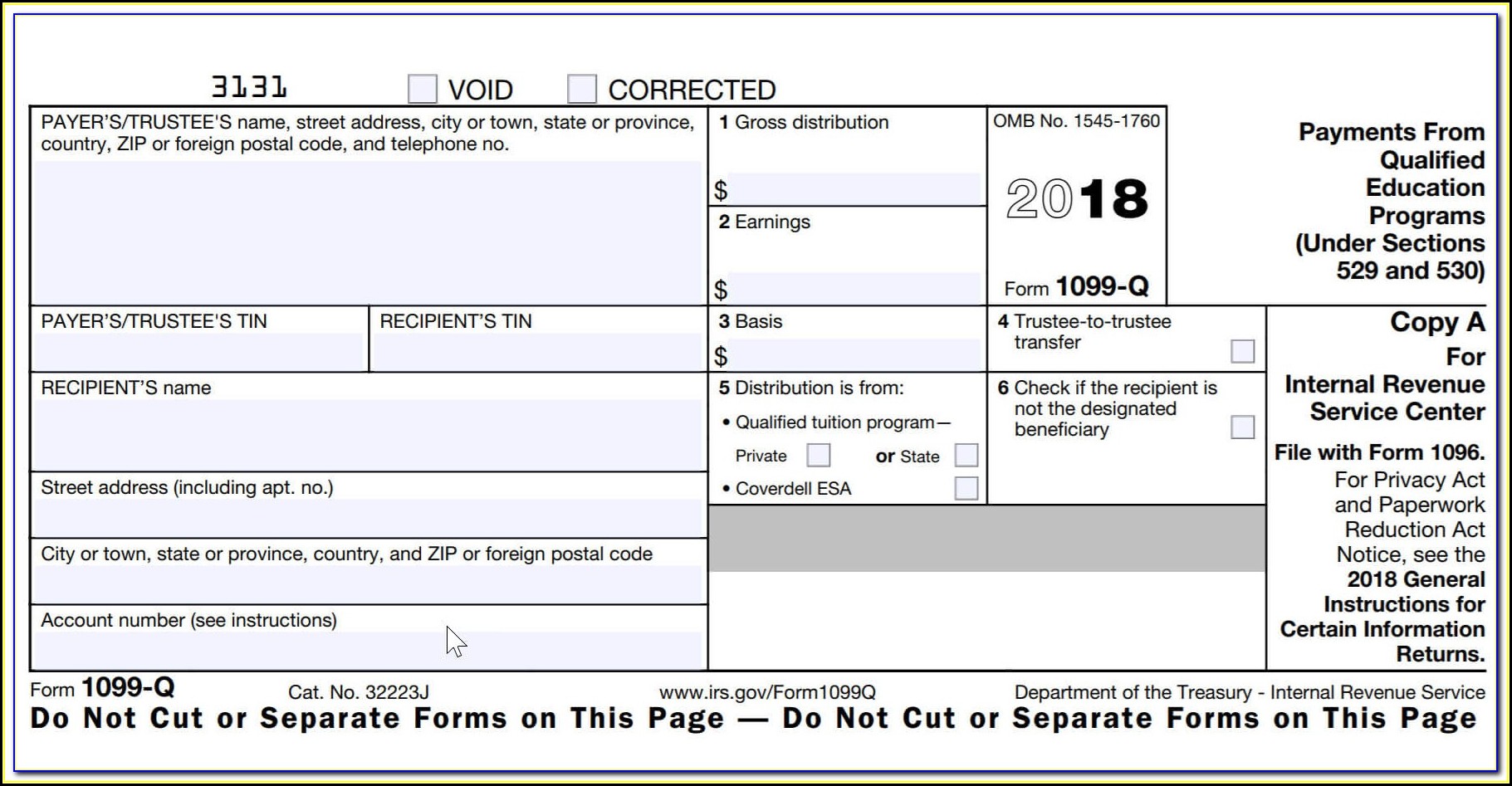

Blank W2 Form 2016 Form Resume Examples yKVBbg7VMB

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Payments you make to businesses that sell physical products or goods — rather than provide services. However,.

6 mustknow basics form 1099MISC for independent contractors Bonsai

Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. Cash paid from a notional principal contract made to an individual, partnership, or. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. However, this form recently changed, and it no longer includes.

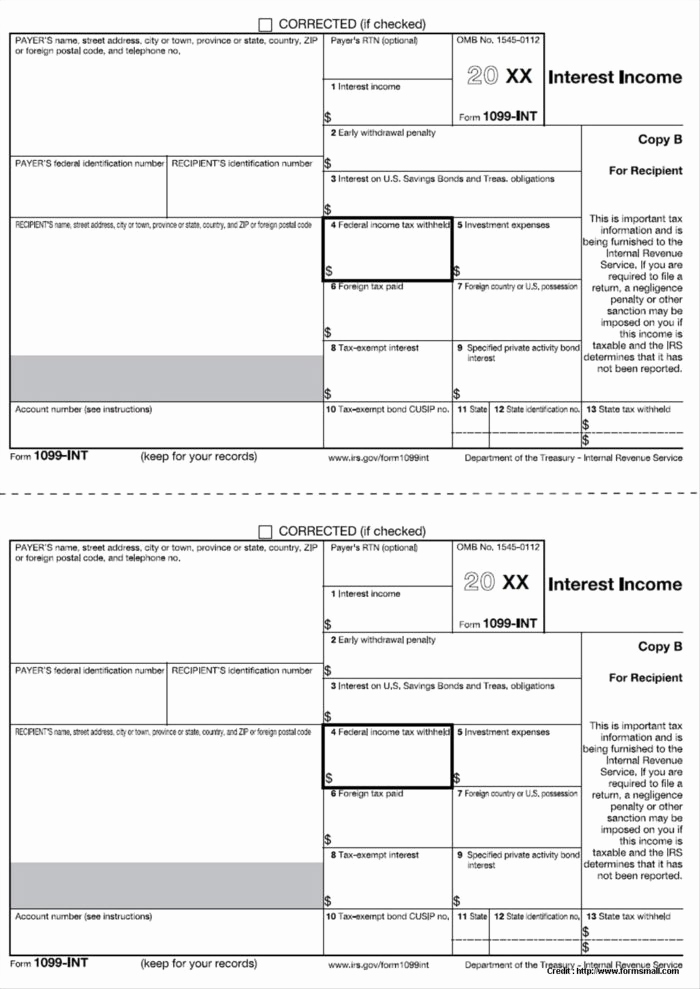

Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

Web instructions for recipient recipient’s taxpayer identification number (tin). However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Both the forms and.

1099MISC Form Template Create and Fill Online

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. Nor are they required for payments to a.

Performing 1099 YearEnd Reporting

Payments you make to businesses that sell physical products or goods — rather than provide services. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services. Both the forms and instructions will be updated as needed. However, this form recently changed, and it.

However, This Form Recently Changed, And It No Longer Includes Nonemployee Compensation The Way It Did In The Past.

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Both the forms and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Nor are they required for payments to a c corporation or an s corporation unless the payment is for medical or health care payments or legal services.

Web Instructions For Recipient Recipient’s Taxpayer Identification Number (Tin).

Cash paid from a notional principal contract made to an individual, partnership, or. Payments you make to businesses that sell physical products or goods — rather than provide services.